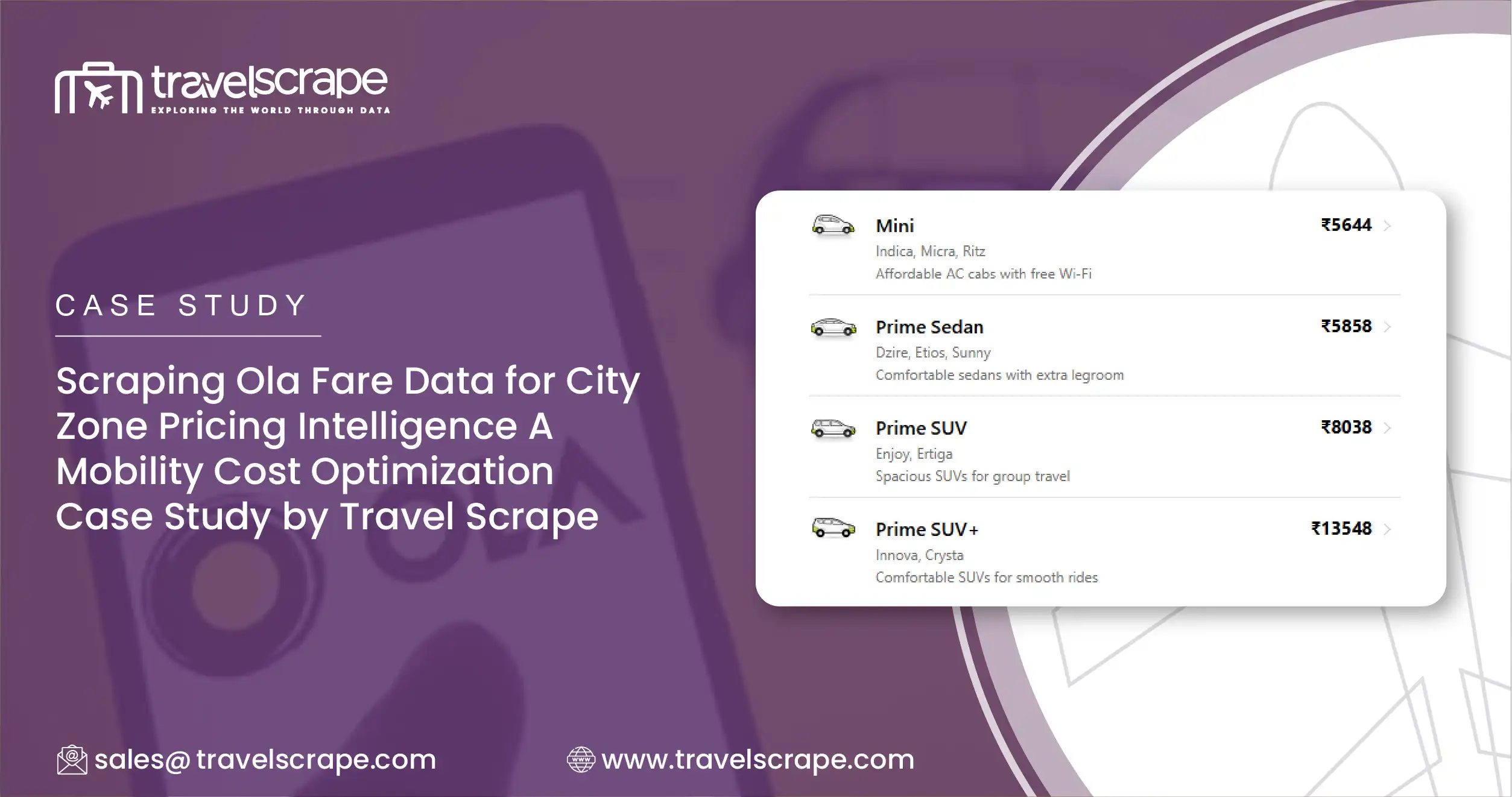

Scraping Ola Fare Data for City Zone Pricing Intelligence A Mobility Cost Optimization Case Study by Travel Scrape

Introduction

In India’s fast-growing urban economy, employee mobility and last-mile logistics costs are rising rapidly. For D2C brands, logistics firms, and enterprise operations teams, cab travel is no longer an occasional expense. It is a recurring, city-dependent operational cost that directly impacts margins.

Cab aggregators follow dynamic pricing models that vary sharply by city, zone, time of day, and demand conditions. Yet most companies still rely on static assumptions, reimbursement caps, or vendor-provided averages that do not reflect real-world pricing behaviour.

This case study explains how Travel Scrape helped an India-based D2C logistics firm build a city zone-wise cab fare intelligence system by scraping structured fare data from Ola. The outcome was a clear understanding of airport premiums, CBD vs residential fare gaps, and peak pricing volatility across Tier-1 and Tier-2 cities.

Business Challenge

The client was a fast-scaling D2C logistics firm with operations across multiple Indian cities. Their workforce depended heavily on cab travel for:

- Employee commute reimbursements

- Airport transfers

- Intra-city operational travel

- Vendor and warehouse coordination

As operations expanded, mobility costs began to show unpredictable spikes.

Core Problems Faced

1. Inconsistent Airport Pricing Across Cities

Airport transfers accounted for a disproportionate share of total cab expenses. However, the firm lacked clarity on:

- Whether higher airport costs were structural or temporary

- How airport premiums differed city by city

- Which cities had unusually high surge behaviour

2. No Visibility Into Zone-Based Fare Gaps

The firm could not reliably answer questions such as:

- How much more expensive is CBD travel compared to residential areas?

- Are residential routes stable enough to standardize reimbursement?

- Do Tier-2 cities actually offer predictable pricing?

3. Poor Cost Forecasting

Without granular data, finance teams relied on historical averages, leading to:

- Budget overruns during peak seasons

- Underestimated costs in Tier-1 metros

- Weak negotiating position with mobility vendors

The client needed zone-level pricing intelligence, not generic city averages.

Why Zone-Based Pricing Matters in India

Indian cities are highly fragmented in terms of traffic density, infrastructure quality, and demand patterns.

- A 10 km ride in a CBD can cost more than a 20 km suburban ride

- Airport routes often include tolls, highway premiums, and surge multipliers

- Peak hours vary significantly by city and zone

Travel Scrape recommended a zone-based route matrix approach to capture these realities accurately.

Solution by Travel Scrape

Travel Scrape designed and executed a structured Ola fare data scraping framework focused on repeatability, comparability, and business usability.

Instead of collecting random rides, the solution standardized fare collection around defined city zones and route types.

Zone-Based Route Matrix Design

Each city was divided into three practical mobility zones:

- Airport

- Central Business District (CBD)

- Residential / Peripheral Areas

Using these zones, Travel Scrape created a consistent route matrix applicable across cities.

Route Types Tracked

- Airport ↔ CBD

- CBD ↔ Residential

- Residential ↔ Residential

This ensured that pricing behaviour could be compared within a city and across cities without distortion.

City Coverage

The dataset covered a mix of Tier-1 and Tier-2 Indian cities, including:

- Bengaluru

- Mumbai

- Delhi NCR

- Pune

- Hyderabad

- Chennai

- Ahmedabad

- Jaipur

- Indore

This mix allowed the client to benchmark mature metros against emerging operational hubs.

Data Collection Methodology

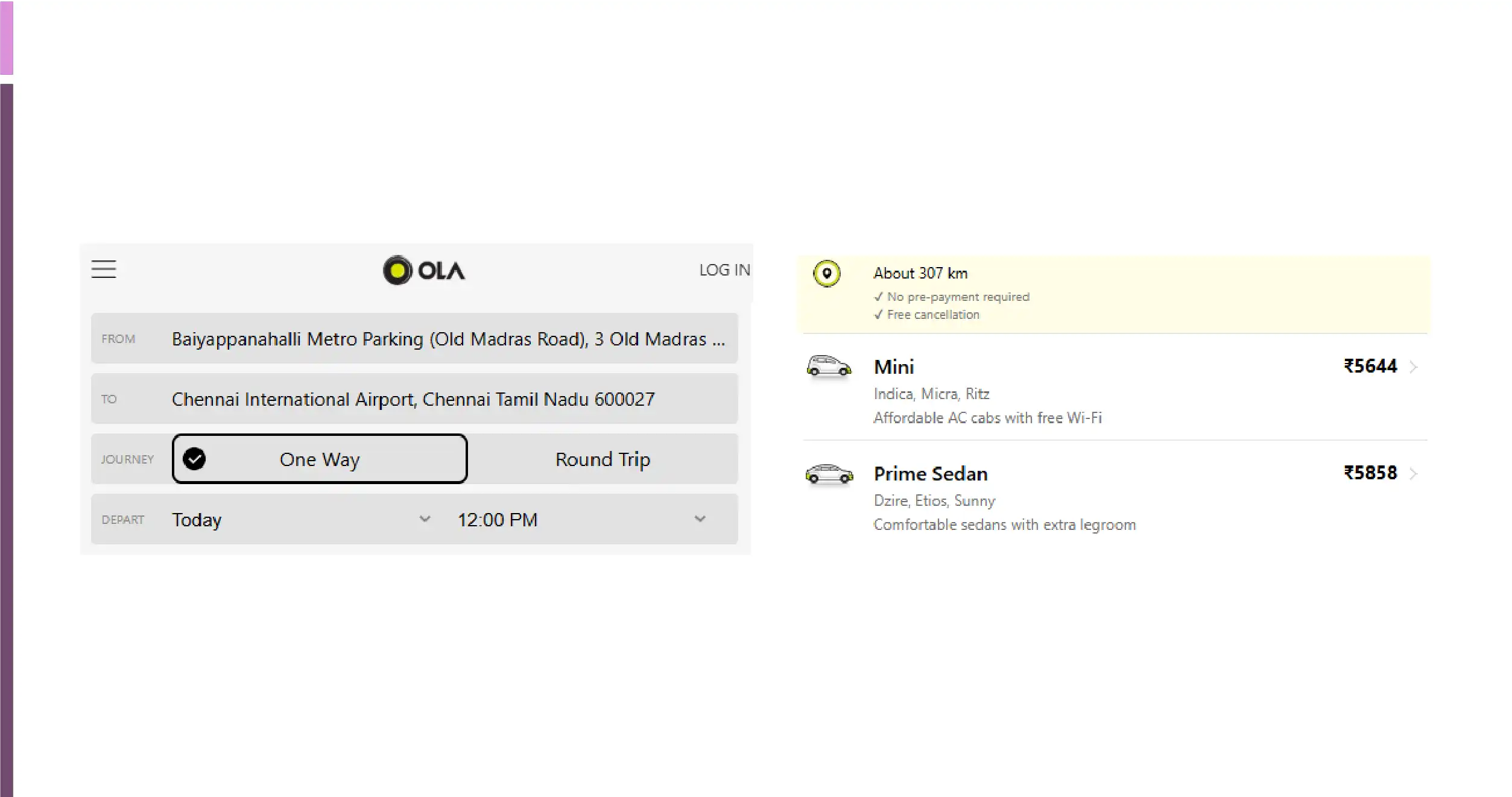

Travel Scrape implemented automated fare extraction with strict consistency controls.

Frequency and Timing

- Multiple fare captures per day

- Coverage across:

- Morning peak

- Midday

- Evening peak

- Late-night off-peak

- Weekdays and weekends included

Data Attributes Captured

For each fare quote, the following fields were extracted:

- City

- Route type

- Pickup zone

- Drop-off zone

- Distance (km)

- Estimated fare (INR)

- Peak or off-peak flag

- Timestamp

This structure ensured the data was finance-ready and analytics-ready.

Sample Data Snapshot

Below is a simplified example of the dataset delivered.

| City | Route | Avg Fare (INR) | Peak Uplift % |

|---|---|---|---|

| Bengaluru | Airport → CBD | 1,120 | +38% |

| Pune | Airport → CBD | 720 | +22% |

| Hyderabad | CBD → Residential | 410 | +18% |

| Ahmedabad | Residential → Residential | 260 | +9% |

This format allowed the client to directly plug the data into internal dashboards and cost models.

Analytical Framework Applied

Travel Scrape supported the client with a clear analytical structure rather than just raw data.

Key Metrics Derived

- Average fare by route and city

- Peak uplift percentage

- Fare volatility index

- Zone-wise fare variance

- Tier-1 vs Tier-2 pricing differential

Key Insights Uncovered

1. Tier-1 Cities Showed Significantly Higher Peak Volatility

One of the clearest findings was the difference in peak behaviour between Tier-1 and Tier-2 cities.

- Tier-1 cities showed peak uplift ranging from 30% to 45%

- Tier-2 cities generally stayed below 20% uplift

- Evening peaks were consistently more expensive than morning peaks

This explained why budgets were regularly overshooting in metros like Bengaluru and Mumbai.

2. Airport Routes Carried a Structural Premium

Airport routes were not just occasionally expensive. They showed a persistent premium.

- Airport fares were consistently higher even during off-peak hours

- Premiums were driven by:

- Toll charges

- Longer deadhead distances

- Higher surge sensitivity

- The premium existed across all cities, not just metros

This insight allowed the client to treat airport travel as a separate cost category, rather than bundling it with general travel.

3. CBD vs Residential Fare Gaps Were City-Specific

CBD routes behaved very differently across cities.

- Bengaluru and Mumbai showed steep CBD premiums due to congestion

- Pune and Ahmedabad showed more balanced pricing

- CBD fares were more volatile than residential routes in all cities

This made it clear that one national reimbursement policy was inefficient.

4. Residential Routes Were the Most Predictable

Residential to residential routes emerged as the most stable segment.

- Lowest fare variance

- Minimal surge impact

- Predictable cost per kilometre

This allowed the client to confidently standardize internal benchmarks for day-to-day operational travel.

Business Impact

The insights delivered measurable operational and financial value.

1. Accurate Mobility Cost Forecasting

Finance teams used zone-wise averages instead of city-wide assumptions.

- Reduced budget variance

- Improved quarterly forecasting accuracy

- Better alignment between projected and actual spend

2. Improved City-Wise Operational Planning

Operations teams adjusted strategies based on data:

- Shifted certain functions to lower-volatility cities

- Optimized travel-heavy roles in Tier-2 locations

- Planned staffing with realistic mobility cost assumptions

3. Stronger Vendor Negotiations

The firm used Travel Scrape’s data as a negotiation tool.

- Demonstrated actual market pricing patterns

- Challenged vendor-provided averages

- Negotiated better corporate rates for airport travel

Data-backed discussions replaced anecdotal arguments.

Why Travel Scrape

Travel Scrape specializes in structured travel and mobility data extraction across India and global markets.

What sets Travel Scrape apart:

- Zone-level pricing intelligence

- High-frequency fare monitoring

- Clean, standardized datasets

- India-specific mobility expertise

- Enterprise-ready data delivery

Whether the use case is cost optimization, vendor negotiation, or strategic planning, Travel Scrape delivers decision-grade travel data.

Conclusion

Cab pricing in India is dynamic, fragmented, and highly city-dependent. Organizations that rely on averages or assumptions inevitably lose control over mobility costs.

This case study shows how Travel Scrape transformed Ola fare data into zone-wise pricing intelligence, enabling a D2C logistics firm to forecast costs accurately, plan operations smarter, and negotiate from a position of strength.

For enterprises managing large-scale urban mobility, zone-based fare intelligence is no longer optional. It is a critical input for sustainable growth.