Extract IHCL Hotel chains locations in India – City-Level Granularity and Occupancy Hubs

The report analyzes IHCL hotel locations across India, providing insights on occupancy, pricing, city distribution, guest reviews, and strategic growth opportunities.

Introduction

India’s hospitality industry is rapidly evolving with data-driven insights guiding strategic decisions. One critical capability is to Extract IHCL Hotel chains locations in India, enabling analysis of hotel distribution, occupancy dynamics, pricing behavior, and guest sentiment. Through a Real-Time Hotel Data Scraping API, analysts and hotel businesses can optimize operations, marketing strategies, and expansion planning. Leveraging Tata Group hotel chain locations data scraping empowers stakeholders to access comprehensive datasets for competitive and operational intelligence.

With a presence spanning over 200 properties, IHCL includes iconic brands such as Taj Hotels, Vivanta, Ginger, SeleQtions, and luxury offerings like Taj Exotica and Taj Safaris. Using method to Extract API for Taj Hotels Chains India, businesses can extract real-time insights into occupancy, rate trends, and guest satisfaction metrics.

200+

Hotels

15+

Major Cities

18+

States Covered

Top States by Number of Hotels

Leading Indian states hosting IHCL hotels

Maharashtra

38+

Delhi NCR

32+

Karnataka

28+

Tamil Nadu

22+

Rajasthan

18+

Goa

14+

These states cover the highest concentration of IHCL properties, representing both business and leisure hotspots, ideal to Scrape IHCL hotel chains data in India.

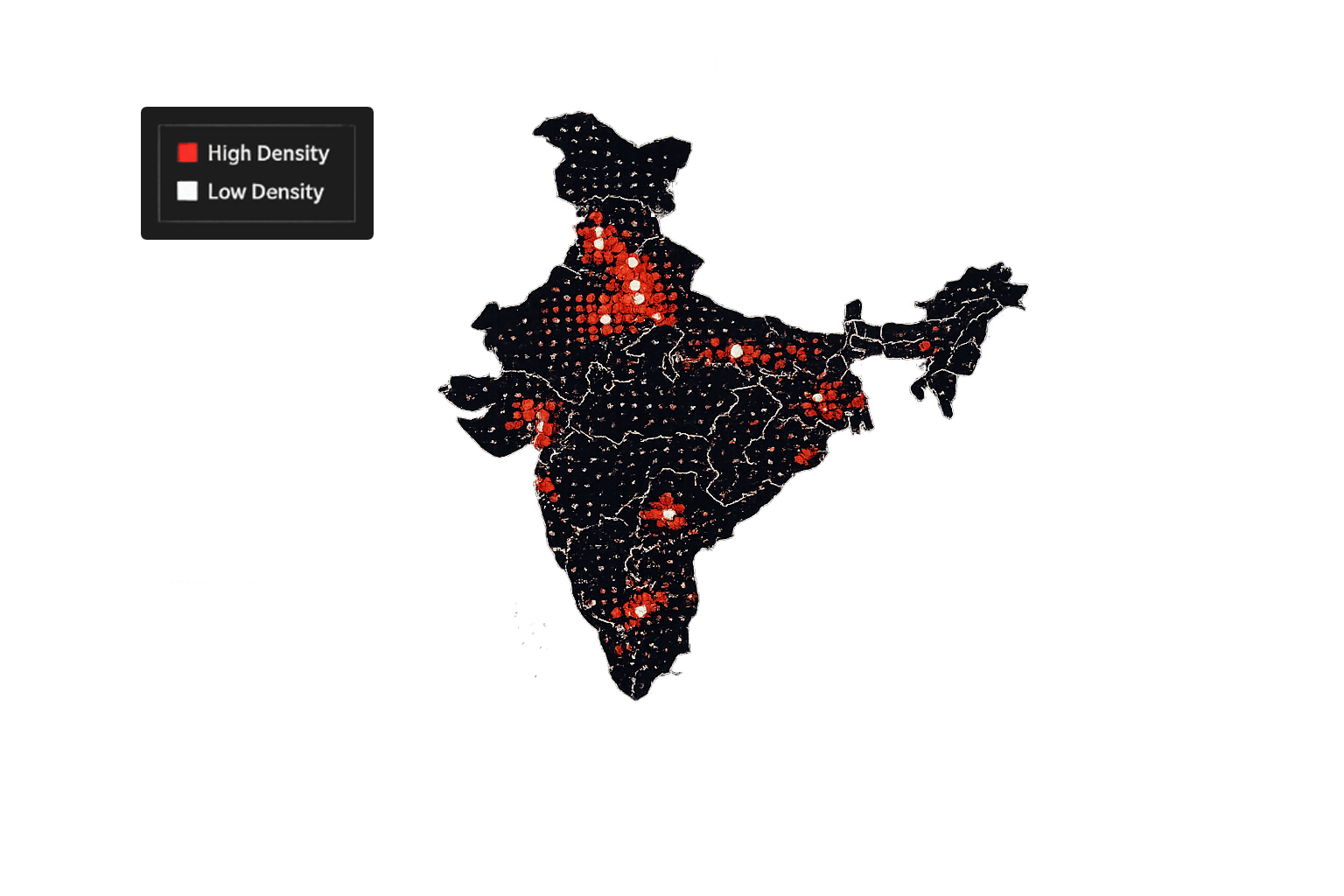

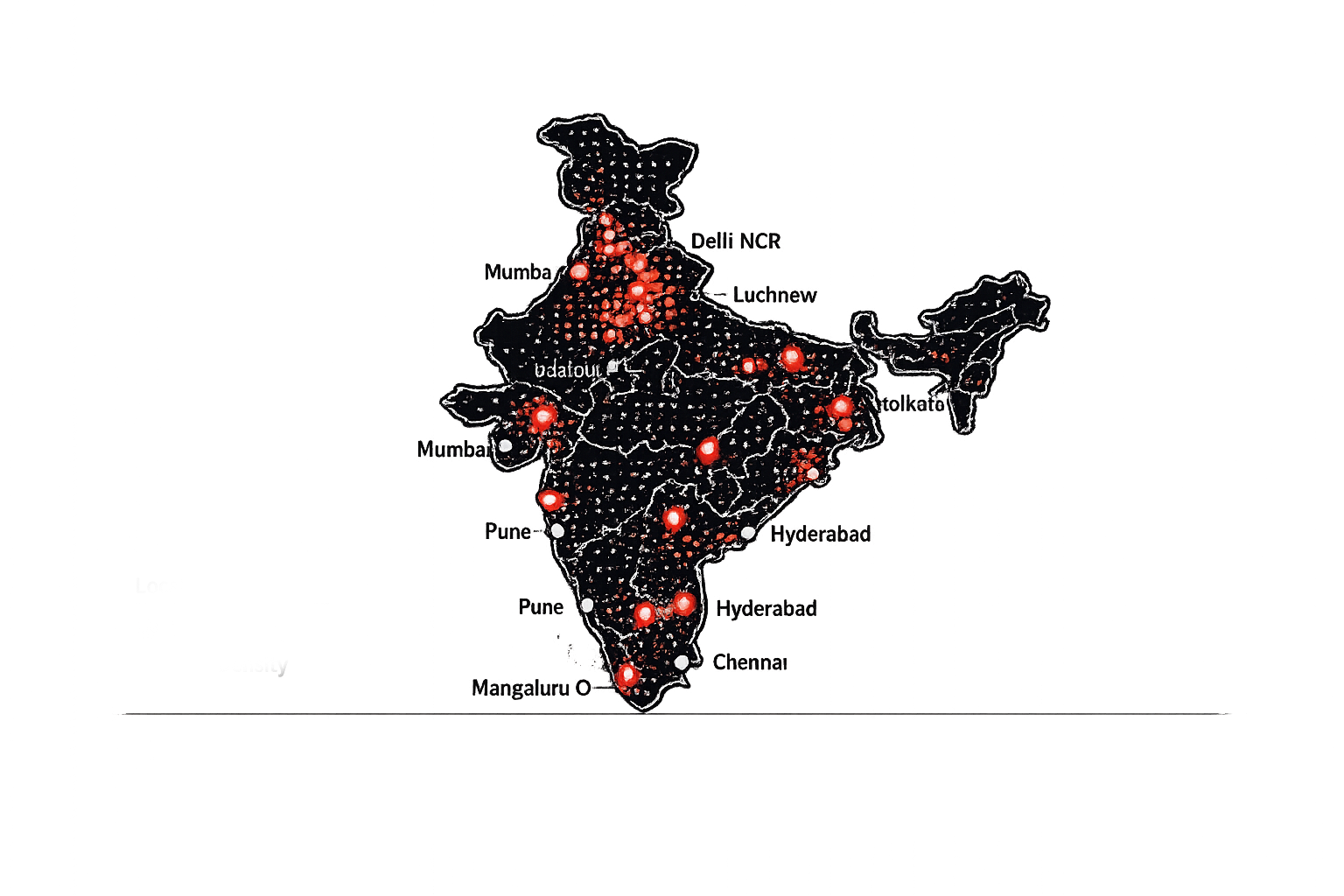

City Level Granularity

Total Cities Covered: 15+ major cities (Mumbai, Delhi NCR, Bengaluru, Chennai, Jaipur, Goa, Pune, Hyderabad, Kochi, Udaipur, Kolkata, Ahmedabad, Lucknow, Mangaluru, Coimbatore)

High Occupancy Hubs :

Top States with Most IHCL Hotels in India

Based on available data, the states with the highest number of IHCL properties include:

| Rank | State Name | Total Hotels | Key Cities |

|---|---|---|---|

| 01 | Maharashtra | 38+ | Mumbai, Pune, Nagpur |

| 02 | Delhi NCR | 32+ | New Delhi, Gurgaon, Noida |

| 03 | Karnataka | 28+ | Bengaluru, Mysuru, Mangaluru |

| 04 | Tamil Nadu | 22+ | Chennai, Coimbatore, Madurai |

| 05 | Rajasthan | 18+ | Jaipur, Udaipur, Jodhpur |

| 06 | Goa | 14+ | Panaji, Calangute, Baga |

These states host the majority of IHCL hotels and represent high-demand business and leisure destinations. This data is critical for Hotel Data Scraping Services aimed at competitive analysis, expansion planning, and market strategy optimization.

IHCL Hotels in Key Indian Cities

| Rank | City | Hotels | Avg Review | Star Rating | Starting Price (INR) |

|---|---|---|---|---|---|

| 01 | Mumbai | 19 | 8.6 | 4★–5★ | ₹9,500 |

| 02 | Delhi NCR | 16 | 8.4 | 4★–5★ | ₹8,800 |

| 03 | Bengaluru | 13 | 8.3 | 3★–5★ | ₹7,800 |

| 04 | Jaipur | 9 | 8.1 | 4★–5★ | ₹6,800 |

| 05 | Chennai | 7 | 8.0 | 3★–4★ | ₹6,200 |

City-level metrics help track guest satisfaction and occupancy trends through IHCL hotel chain locations dataset in India for benchmarking performance.

IHCL Hotels with High Occupancy Rates

| Rank | Hotel Name | City | Star Rating | Review Score | Total Rooms | Occupancy Rate (%) |

|---|---|---|---|---|---|---|

| 01 | Taj Mahal Tower | Mumbai | 5★ | 9.1 | 560 | 96% |

| 02 | Taj Lands End | Mumbai | 5★ | 8.9 | 555 | 94% |

| 03 | Vivanta Bengaluru | Bengaluru | 4★ | 8.5 | 310 | 92% |

| 04 | Taj Lake Palace | Udaipur | 5★ | 9.3 | 102 | 93% |

| 05 | Taj Exotica Goa | Goa | 5★ | 9.0 | 225 | 91% |

High-occupancy hotels provide actionable insights for Hotel Guest Review Dataset, revenue optimization, and strategic expansion.

Distribution of IHCL Hotels Across Major Indian Cities

| Rank | City | Number of Hotels | Total Rooms | Avg Review Score | Starting Price (INR) |

|---|---|---|---|---|---|

| 01 | Mumbai | 19 | 4,950 | 8.6 | 9,500 |

| 02 | Delhi NCR | 16 | 4,100 | 8.4 | 8,800 |

| 03 | Bengaluru | 13 | 3,200 | 8.3 | 7,800 |

| 04 | Jaipur | 9 | 1,650 | 8.1 | 6,800 |

| 05 | Chennai | 7 | 1,420 | 8.0 | 6,200 |

City-level distribution aids operational planning and Tata Group hotel chain data scraping India for occupancy, pricing, and service benchmarking.

Looking to Give Your Hotel Business an Edge?

“Leverage IHCL hotel location data to optimize operations, boost revenue, and uncover growth opportunities across India’s hospitality market.”

Advantages of IHCL Hotel Location Data Over Generic Datasets

Our IHCL-focused datasets deliver actionable intelligence, helping businesses in hospitality, investment, and strategic decision-making:

- Operational Strategy Optimization: IHCL datasets enable hotel managers to analyze regional occupancy trends, seasonal demand fluctuations, and guest preferences, allowing smarter staffing, resource allocation, and service delivery improvements across multiple properties.

- Competitive Market Intelligence: Extracted IHCL hotel data helps travel tech companies monitor competitor pricing, occupancy levels, and promotional offers, providing actionable insights to design effective marketing campaigns and optimize room rate strategies.

- Investment and Portfolio Planning: Investors and REITs can use IHCL property metrics, including room counts, average occupancy, and review performance, to evaluate potential acquisitions, forecast revenue, and assess long-term profitability for diversified portfolios.

- Urban and Leisure Expansion Insights: Real estate and expansion teams gain visibility into high-demand metropolitan, tourist, and leisure destinations, guiding location-specific property development, brand placement, and strategic city-level growth opportunities.

- Customer Experience and Service Benchmarking: Analyzing guest ratings, reviews, and feedback trends across IHCL properties allows hospitality firms to identify service gaps, improve guest satisfaction, and develop personalized experiences to boost brand loyalty.

| Field Name | Description |

|---|---|

| Property Name & Category | Specifies the hotel name and its IHCL brand such as Taj, Vivanta, Ginger, or SeleQtions. |

| Geographic Information | Includes city, state, full address, and GPS coordinates for location mapping. |

| Accommodation & Occupancy Metrics | Shows total rooms, occupancy trends, and booking patterns. |

| Pricing Details | Captures average room rates, seasonal pricing, and dynamic rate fluctuations. |

| Guest Experience Data | Provides review scores, total reviews, and guest feedback for service insights. |

Insights and Analysis

Strategic City Presence

IHCL properties concentrate in Mumbai, Delhi NCR, Bengaluru, Chennai, Jaipur, and Goa to maximize brand visibility and guest occupancy.

Portfolio Diversification

IHCL spans mid-tier to ultra-luxury, addressing business, leisure, and luxury travel segments.

Dynamic Revenue Management

Using Hotel Room Price Trends Dataset, hotels can adjust pricing based on seasonal demand, events, and occupancy shifts.

Competitive Intelligence

Access to Tata Group datasets supports market benchmarking, competitor tracking, and identifying underserved regions.

Guest-Centric Insights

Analysis from Hotel Guest Review Dataset informs service enhancements, improving satisfaction and long-term loyalty.

Conclusion

Leveraging IHCL Hotel chains locations data scraping API provides detailed insights into hotel occupancy, pricing patterns, and city-level distribution across India. Integration with Tata Group hotel chain API data scraping enables real-time monitoring, predictive analysis, and improved operational planning. Using the Hotel Room Price Trends Dataset, hotels can optimize revenue management and adjust pricing strategies based on demand fluctuations.

Key hospitality hubs include Maharashtra, Delhi NCR, Karnataka, and Tamil Nadu, where IHCL properties lead in occupancy, revenue generation, and brand visibility. Data-driven insights support smarter investment decisions, enhanced guest experiences, and sustainable growth across the entire IHCL network.