UK Top Hotel Chain Data Scraping to Analyze Property Distribution and Market Saturation

The report delivers data-driven insights into UK hotel chain distribution, regional saturation, growth strategies, and performance dynamics.

Introduction

The United Kingdom hotel industry is undergoing a strategic recalibration in 2026, shaped by post-pandemic travel normalization, domestic tourism resilience, and renewed international visitation. Rather than rapid property proliferation, growth is increasingly defined by optimized location coverage, brand segmentation, and performance-led portfolio management across urban, regional, and leisure-driven markets.

To accurately map these developments, this research applies insights derived from UK Top hotel chain data scraping, enabling structured visibility into branded hotel distribution, regional concentration, and competitive saturation across the country. Through the use of a Real-Time Hotel Data Scraping API, market participants can continuously monitor hotel openings, refurbishments, closures, and brand transitions as they occur.

As investors, travel platforms, and hospitality consultants increasingly Extract hotel chains United Kingdom data for strategic planning, location intelligence has become a core pillar of market evaluation. This report analyzes hotel chain activity across the UK to deliver future-focused insights into geographic dominance, operational scale, and competitive positioning for 2026.

The analysis covers branded hotel presence across more than 320 UK cities and towns, tracking over 3,800 properties operated by 10 major hotel chains. The research emphasizes regional concentration patterns, metro dominance, brand mix, and data-backed intelligence supporting long-term decision-making.

3,800+

Hotels Tracked

10+

Hotel Chains

320+

Cities & Towns

Covered

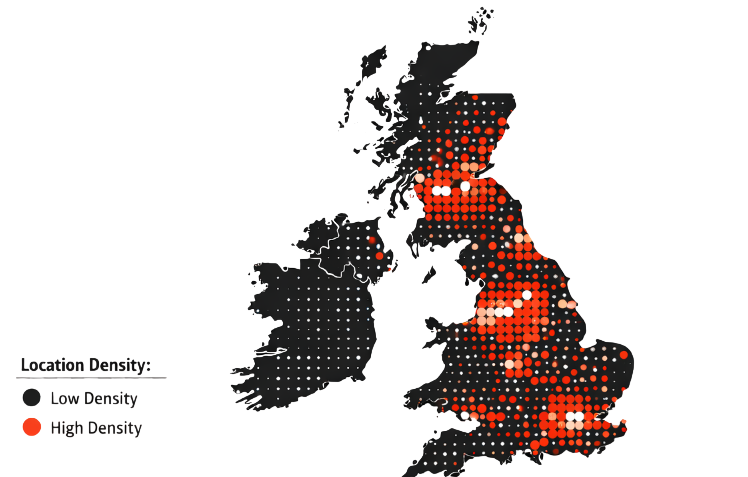

Top Regions by Number of Branded Hotels

Regions with the Highest Concentration of Hotel Chains in the UK

GREATER LONDON

820+

Driven by international tourism, financial services, conferences, and year-round leisure demand across Central London, Heathrow corridors, and Canary Wharf.

NORTH WEST ENGLAND

460+

Manchester and Liverpool anchor growth through sports tourism, cultural events, and expanding regional business travel.

SOUTH EAST ENGLAND

410+

Oxford, Reading, and coastal leisure hubs benefit from education, technology clusters, and short-stay domestic travel.

SCOTLAND

380+

Edinburgh and Glasgow lead with festival tourism, heritage travel, and strong international inflows.

WALES

160+

Belfast drives urban growth through infrastructure investment and rising tourism visibility.

What are the largest hotel chains in the United Kingdom in 2026?

Based on aggregated property distribution and geographic coverage, Premier Inn, Travelodge, and IHG Hotels & Resorts remain the largest hotel chains operating in the UK in 2026. Their dominance is driven by nationwide coverage, standardized formats, and strong positioning across both metropolitan and secondary markets.

Premier Inn

PROPERTIES

Regions

4

Cities

300+

Largest hotel chain across all UK regions, operating in 300+ cities nationwide

Travelodge

PROPERTIES

Regions

4

Cities

280+

Leading economy hotel chain with nationwide coverage across all UK regions and 280+ cities

IHG Hotels & Resorts

PROPERTIES

Regions

4

Cities

190+

Multi-brand hotel group operating across all UK regions with presence in 190+ cities

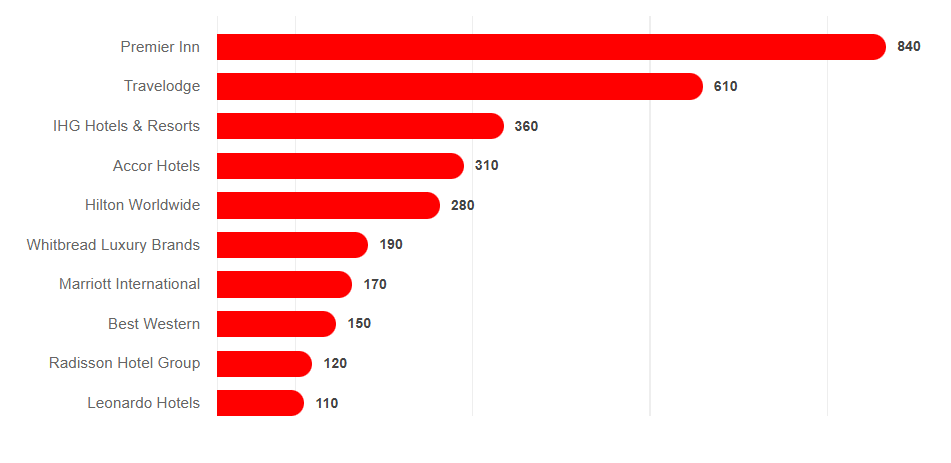

Top 10 Hotel Chains in the United Kingdom by Property Count and Geographic Presence – 2026

This table presents a structured comparison of leading UK hotel chains by total properties, national coverage, and city-level penetration. The table supports chain-level benchmarking and competitive analysis. Insights from this table indicate that economy and mid-scale chains dominate by volume, while premium brands maintain focused footprints in high-yield urban markets. These findings are supported by performance indicators derived from the Hotel Guest Review Dataset, highlighting demand stability across branded segments.

| Hotel Chain | Total Properties | Availability (No. of Regions) | Availability (No. of Cities) | Download Dataset |

|---|---|---|---|---|

| Premier Inn | 840 | 4 regions | 300+ cities | Download |

| Travelodge | 610 | 4 regions | 280+ cities | Download |

| IHG Hotels & Resorts | 360 | 4 regions | 190+ cities | Download |

| Accor Hotels | 310 | 4 regions | 170+ cities | Download |

| Hilton Worldwide | 280 | 4 regions | 160+ cities | Download |

| Whitbread Luxury Brands | 190 | 4 regions | 110+ cities | Download |

| Marriott International | 170 | 4 regions | 95+ cities | Download |

| Best Western | 150 | 4 regions | 120+ cities | Download |

| Radisson Hotel Group | 120 | 4 regions | 85+ cities | Download |

| Leonardo Hotels | 110 | 4 regions | 80+ cities | Download |

Top 10 Hotel Chains in the United Kingdom – 2026

In 2026, the United Kingdom hotel industry reflects a balanced mix of economy, mid-scale, and premium chains serving diverse traveler segments across England, Scotland, Wales, and Northern Ireland. Premier Inn and Travelodge lead in total property count, leveraging standardized formats and dense nationwide coverage, while IHG, Accor, and Hilton expand multi-segment and premium offerings across major metropolitan and regional business markets.

Economy and mid-scale brands dominate secondary cities, commuter belts, and roadside locations throughout England and the devolved nations, while premium and lifestyle-focused brands concentrate on London, Edinburgh, Manchester, and key leisure destinations. Insights derived from a Hotel chain data scraping API UK highlight Best Western, Radisson, and Leonardo Hotels as important contributors to regional coverage, business travel, and leisure-driven stays.

This configuration provides nationwide hotel access across corporate hubs, transit corridors, regional centers, and tourism-focused destinations throughout the United Kingdom.

Chain-Level Market Insights

Premier Inn

Economy / Mid-ScalePremier Inn leads the UK hotel market with over 840 properties, benefiting from standardized room formats, pricing consistency, and high visibility across transport-linked locations.

Travelodge

EconomyTravelodge operates more than 610 hotels nationwide, with strong representation in commuter towns, suburban commercial zones, and city-edge locations.

IHG Hotels & Resorts

Multi-SegmentIHG maintains a balanced UK presence across Holiday Inn, Holiday Inn Express, Crowne Plaza, and InterContinental brands.

Accor Hotels

Economy to PremiumAccor continues selective expansion through ibis, Novotel, and Mercure brands, aligning with urban regeneration and lifestyle travel demand.

Hilton Worldwide

PremiumHilton focuses on full-service and extended-stay properties across major UK metros, emphasizing brand experience and loyalty-driven demand.

Whitbread Luxury Brands

Premium / UpscaleWhitbread Luxury Brands focus on high-end hospitality experiences through carefully positioned upscale properties, emphasizing design-led stays and experiential travel in major UK cities.

Marriott International

Luxury / PremiumMarriott International maintains a selective UK footprint, concentrating on premium, lifestyle, and luxury brands across major metropolitan and leisure destinations.

Best Western

Economy / Mid-ScaleBest Western operates a flexible brand model across regional towns, suburban markets, and roadside locations, supporting independent operators while ensuring nationwide coverage.

Radisson Hotel Group

Upper Mid-ScaleRadisson focuses on business-centric and upper mid-scale hotels across regional commercial hubs, airport corridors, and secondary UK cities.

Leonardo Hotels

Mid-ScaleLeonardo Hotels continues measured expansion across urban UK markets, targeting centrally located properties that serve both business and leisure travelers.

Advantages of Chain-Focused Hotel Location Data

Our Strategic datasets derived from Hotel Data Scraping Services deliver actionable intelligence for hospitality stakeholders across the UK market. By applying Hotel chain locations data scraping UK, organizations can unlock multiple operational and investment advantages.

- High-Impact Market Identification: City-level distribution analysis helps uncover underserved regions, saturation thresholds, and expansion-ready locations.

- Revenue and Pricing Optimization: Location intelligence aligned with demand signals enables dynamic pricing adjustments and yield optimization.

- Expansion and Portfolio Planning: Insights into regional density and competitor overlap support informed franchising, acquisition, and rebranding decisions.

- Demand Pattern Tracking: Shifts in leisure, business, and event-driven travel are monitored to guide marketing and resource allocation.

- Competitive Intelligence Enhancement: Performance benchmarking supports stronger positioning across crowded urban and regional markets.

Dataset Structure and Field Coverage

This research is supported by a structured UK hotel chain location dataset designed for scalable analysis and integration into decision systems.

| Field Name | Description |

|---|---|

| Property Identity | Hotel name, brand affiliation, and chain classification |

| Address & Geo-Coordinates | Full address, city, region, postcode, latitude, and longitude |

| Room Inventory & Utilization | Total rooms, occupancy trends, and historical demand |

| Rate Structure & Pricing | Seasonal pricing, average rates, and competitive benchmarks |

| Guest Sentiment & Ratings | Aggregated reviews and satisfaction scores |

| Market Intelligence Metrics | Location performance, competitor density, and growth potential |

These structured fields support deeper Hotel Data Intelligence workflows across analytics, forecasting, and investment modeling.

Insights and Analysis

The UK hotel market in 2026 reflects a balanced structure where economy and mid-scale brands lead in numerical scale, while premium operators concentrate on revenue optimization and experiential differentiation. Continuous monitoring through Hotel chain market intelligence scraping enables operators to adapt rapidly to demand volatility, pricing shifts, and competitive movement.

Secondary cities benefit from regeneration and infrastructure investment, while London remains the central anchor for international travel and premium hospitality performance.

Conclusion

As competition intensifies in 2026, data-driven decision-making has become indispensable for the UK hospitality sector. Leveraging a Hotel chain data Scraping API UK provides continuous visibility into property-level changes, brand expansion, and market saturation trends.

Ongoing UK hotel chain location tracking enables stakeholders to refine expansion strategies, optimize portfolios, and manage risk across diverse regions. When combined with pricing intelligence from the Hotel Room Price Trends Dataset, organizations gain a comprehensive understanding of both location performance and revenue dynamics.

Together, these insights empower investors, hotel operators, and travel platforms to identify opportunities, anticipate market shifts, and sustain competitive advantage across the United Kingdom hotel landscape.