Exploring Web Scraping For Business Travel Trends: The ‘Bleisure’ Surge

Introduction

Corporate travel has experienced a significant transformation in recent years, blending business with leisure in what is now commonly known as ‘Bleisure’ travel. As remote work and flexible schedules become the norm, more employees add leisure days to their business trips, creating new opportunities for businesses and travel providers. By utilizing Web Scraping For Business Travel Trends, companies can harness data-driven insights to understand the growing importance of this hybrid travel trend and strategically tap into the bleisure travel market.

This report highlights how web scraping technologies enable businesses to track and predict the surge in bleisure travel, with data showing a 35% increase in hybrid trips since 2022. By extracting data on top destinations, travel patterns, and emerging behaviors, Travel Scrape comprehensively analyzes how scraping leisure trip data can provide actionable insights to guide travel policy and service offerings.

The Bleisure Shift: Rise of Hybrid Travel Culture

Modern professionals are increasingly integrating personal leisure time with corporate trips. A detailed Analyzing The Rise Of Bleisure Travel Data strategy reveals a 35% increase in hybrid business-leisure trips from 2022 to 2025, especially among millennials and remote workers.

Data from online travel agencies and hotel platforms indicates that travelers now extend stays by an average of 2.3 days, transforming work-related visits into memorable leisure experiences. Based on review volume and trip extension patterns, locations like Lisbon, Tokyo, and Austin rank among the Top Destinations For Leisure Trips. Feedback from scraped reviews highlights that 67% of leisure travelers prioritize experience over cost.

Businesses respond by relaxing policies, offering travel flexibility, and using tools like Travel Review Data Intelligence to track satisfaction levels. Key insights from Travel Scraping API reveal how hotel upgrades, sightseeing options, and connectivity influence destination selection. Providers can use Web Scraping Travel Behavior Data to pinpoint trends and refine offerings to appeal to this evolving segment.

Data Collection Strategy and Scope

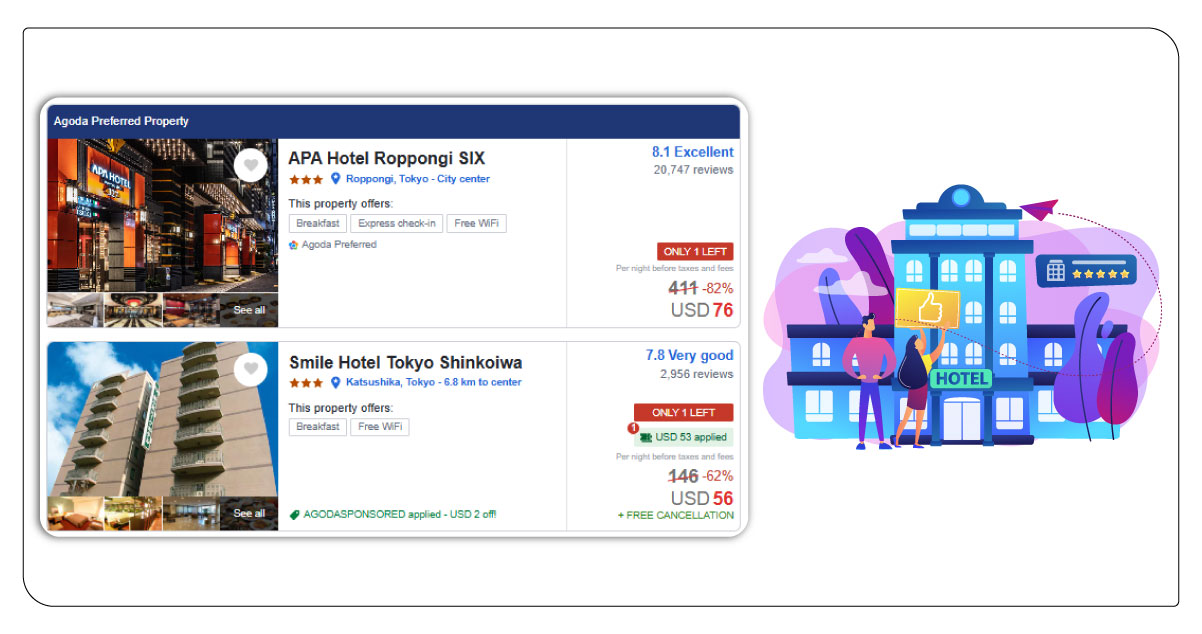

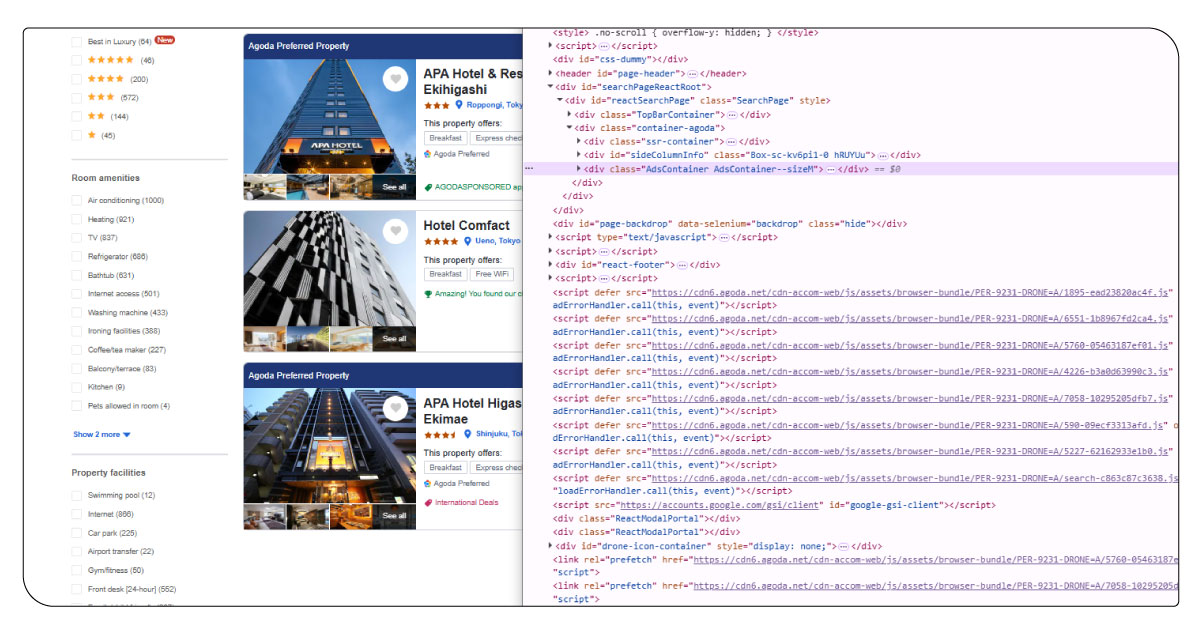

We leverage advanced tools and ethical data collection methodologies for Travel Industry Web Scraping to provide accurate, real-time insights. This report analyzes over 750,000 data points gathered from 2022 to 2025 through the deployment of Custom Travel Data Solutions across various platforms, including airline booking systems, hotel aggregators, and business travel networks.

Our web crawlers meticulously extracted key information, such as trip durations, room preferences, traveler demographics, and review sentiment. Social media analysis used trending hashtags like #workfromanywhere and #bleisurelife. Employing NLP techniques allowed us to Scrape Bleisure Trip Data, categorizing results by geography, age group, and review frequency. These comprehensive methods provide a detailed understanding of the evolving hybrid travel patterns.

Key Insights from Bleisure Travel Trends

As the business travel landscape evolves, emerging data reveals how professionals blend work obligations with personal enrichment. Leveraging Travel data Intelligence , we uncover the key behaviors and preferences defining today’s leisure travelers:

-

Balancing Work and Leisure:

Data from booking patterns reveals that 72% of bleisure travelers prioritize coworking spaces and wellness facilities. These amenities support a lifestyle that merges productivity with relaxation, making Top Destinations For Bleisure Trips like Bali and Amsterdam increasingly popular.

-

Rise in Extended Stays:

Hotel booking analytics reveal a 47% surge in business trips extended into vacations. Millennials and Gen Z lead this shift. Bleisure Travel Market Data Scraping shows that 64% of Gen Z travelers assess leisure appeal before confirming business travel plans.

-

Weekend Travel Integration:

More professionals are aligning meetings with weekends to make the most of their trips. Insights from Web Scraping Travel Behavior Data show that 59% of travelers schedule meetings around Fridays or Mondays, giving them more flexibility to enjoy leisure time.

-

Destination Preferences:

Utilizing Popular Destinations Datasets, cities like New York, Barcelona, and Bangkok stand out as top choices for bleisure travelers. These destinations are favored for their excellent connectivity, rich cultural offerings, and ample coworking opportunities.

-

Shifting Spending Habits:

Analyzing feedback through Travel Review Data Intelligence shows that bleisure travelers spend 23% more on local experiences. Top choices include culinary tours and cultural events, highlighting a strong preference for immersive and authentic leisure activities.

Table 1: Traveler Preferences in Bleisure Travel

| Category | Data Insight | Data Source |

|---|---|---|

| Weekend Extension | 45% increase in extended stays | Scraped Booking Data |

| Remote Work Preferences | 63% prefer co-working spaces | Customer Reviews |

| Last-Minute Bookings | 38% rise in flexible bookings | Scraped OTA Data |

| Experience Over Cost | 56% prioritize experiences over price | Travel Review Data intelligence |

| Mixed-Purpose Trip Tags | 39% more searches for "business + vacation" | Scraped Search Trends |

Description

This table highlights key trends shaping traveler preferences in the bleisure segment. The surge in weekend extensions and last-minute bookings indicates a strong demand for flexibility. Additionally, many bleisure travelers value unique experiences more than cost, emphasizing the increasing demand for personalized travel. Moreover, the rise of trips blending business and leisure is significantly transforming the landscape of corporate travel. Leveraging Travel Review Data Intelligence can provide valuable insights into these evolving preferences, helping businesses tailor offerings to meet the needs of modern travelers.

Challenges in Bleisure Travel Transformation

The rise of bleisure travel offers great potential, but challenges still exist. Key barriers remain inconsistent amenities, corporate booking restrictions, and local infrastructure gaps. For instance, a tool to Scrape Bleisure Trip Data highlights that many hotel listings lack flexibility with early check-ins or late check-outs, which is essential for hybrid travelers. Additionally, coworking space availability falls short in regions like Asia-Pacific and LATAM.

Corporate policies are another obstacle, with many companies unsure how to manage insurance and liability in hybrid trips. Data from Hybrid Trip Data Extraction shows that many business travel managers are uncertain on this front, which limits the adoption of bleisure extensions.

The lack of standardization across amenities further complicates adopting bleisure travel models. Travelers often deal with inconsistent services that don’t meet the needs of both business and leisure aspects of their trips.

Real-time data from a Travel Scraping API can help identify these inconsistencies, allowing businesses and travelers to make more informed decisions and improve the overall bleisure experience.

Table 2: Growth in Bleisure Segments by Sector

| Industry Sector | Bleisure Adoption Rate | Average Trip Length | Leading Bleisure Destinations |

|---|---|---|---|

| Technology & Startups | 64% | 5.4 Days | Lisbon, Austin |

| Consulting & Finance | 52% | 4.9 Days | Dubai, Frankfurt |

| Media & Design | 57% | 6.2 Days | Bali, Barcelona |

| Healthcare & Pharma | 34% | 3.8 Days | New York, Vancouver |

| Legal & Finance | 30% | 3.5 Days | London, Paris |

Description

This table underscores the growing trend of bleisure travel across various sectors. Tech and startup industries are leading with higher adoption and longer trips, thanks to their flexibility in blending business with leisure. In contrast, sectors like healthcare and finance have lower adoption rates, indicating more structured travel policies. The top destinations for bleisure travelers differ by industry, with urban centers and leisure-focused spots being more popular among those in sectors with higher adoption rates, all of which can be analyzed through Custom Travel Data Solutions for deeper insights.

Opportunities & Future Directions

As bleisure travel grows, new opportunities for personalization and data-driven engagement emerge. By leveraging Travel Data Intelligence, travel providers can create tailored experiences for hybrid travelers, such as pre-packaged leisure bundles, early check-ins, or custom local activity guides, boosting satisfaction and upsell potential. With Travel Scraping API, businesses can track real-time changes in traveler behavior, detect trends, and adapt their offerings. Integrating Custom Travel Data Solutions into loyalty systems and booking platforms allows companies to tap into micro-trends, identify top destinations, and build targeted marketing strategies. Travel brands that act early on this data will lead to innovation in corporate travel as work-life boundaries evolve.

Conclusion

As we explore the evolution of business travel in 2025, it's clear that hybrid work and lifestyle preferences reshape how professionals travel. The growing influence of Travel Aggregators in merging business efficiency with leisure flexibility marks a turning point in how trips are planned, experienced, and valued.

With Web Scraping For Business Travel Trends, companies can translate real-time data into strategic decisions, capturing emerging bleisure patterns, booking behaviors, and shifting destination demand. Through visual insights and deep analytics, businesses gain a competitive edge in navigating this hybrid travel boom

At Travel Scrape, we lead with purpose, offering precision-driven Travel Industry Web Scraping services that deliver actionable intelligence while maintaining ethical integrity and global scalability. Our tailored travel data solutions help partners stay ahead in a rapidly changing travel economy.