Vacation Rental Market Trends: An Investor’s Look at Rentals vs. Hotels Insights

Introduction

The Vacation Rental Market Trends 2025 report delivers a comprehensive analysis of the factors driving changes in vacation rental rates compared to traditional hotel accommodations and their impact on investment opportunities in the hospitality sector worldwide. Based on a detailed analysis of over 50,000 property listings, this report utilizes advanced Vacation Rental Data Scraping techniques to provide key insights for investors considering the accommodation market. The goal is to offer valuable predictions and comparative analysis for property investors, real estate developers, and financial stakeholders to make informed decisions in this rapidly evolving market. By leveraging sophisticated Hotel Data Scraping tools, investors can better understand shifting consumer preferences and identify lucrative opportunities across traditional and alternative accommodation sectors.

Market Forces Reshaping the Accommodation Investment Landscape

The Vacation Rental Market Trends 2025 reveals several economic and consumer behavior factors reshaping investment potential in both vacation rentals and hotels. The primary drivers include post-pandemic travel recovery patterns, growing demand for personalized and unique accommodation experiences, and the increasing adoption of data-driven investment strategies. Real-Time Rental Pricing Data tools allow investors to access live information on rate fluctuations across vacation rentals and hotel properties.

This enables strategic investment decisions based on booking demand patterns, location-specific yield trends, and seasonal performance metrics. Hotel Investment Analysis offers granular insights into operational costs, revenue potential, and market positioning of different property types, allowing investors to refine their portfolio strategies while maximizing returns.

Vacation Rental Revenue Data Scraping is helping investors identify high-performing properties and emerging market opportunities more efficiently. At the same time, new forecasting models predict return on investment for upcoming quarters or years. These technologies are integral in conducting thorough Rental Property vs Hotel Investment comparisons, as they analyze historical performance data to anticipate market fluctuations and optimize investment timing.

Research Methodology and Data Scope

The data for this report was collected using advanced scraping technologies covering over 50,000 accommodation listings worldwide. Through specialized Vacation Rental Data Scraping techniques, we extracted information on property rates, occupancy levels, seasonal performance, and guest satisfaction metrics across leading global platforms. By aggregating this comprehensive dataset, we created a detailed view of Vacation Rental Market Trends, including regional performance variations, investment return patterns, and evolving guest preferences in traditional and alternative accommodation sectors.

The data extraction process captured essential metrics such as property descriptions, availability patterns, pricing structures, and guest reviews from platforms like Airbnb, Vrbo, Booking.com, and hotel-specific channels. This robust dataset was analyzed to derive actionable Hotel Investment Analysis insights and identify key trends in revenue potential across different property types and regions.

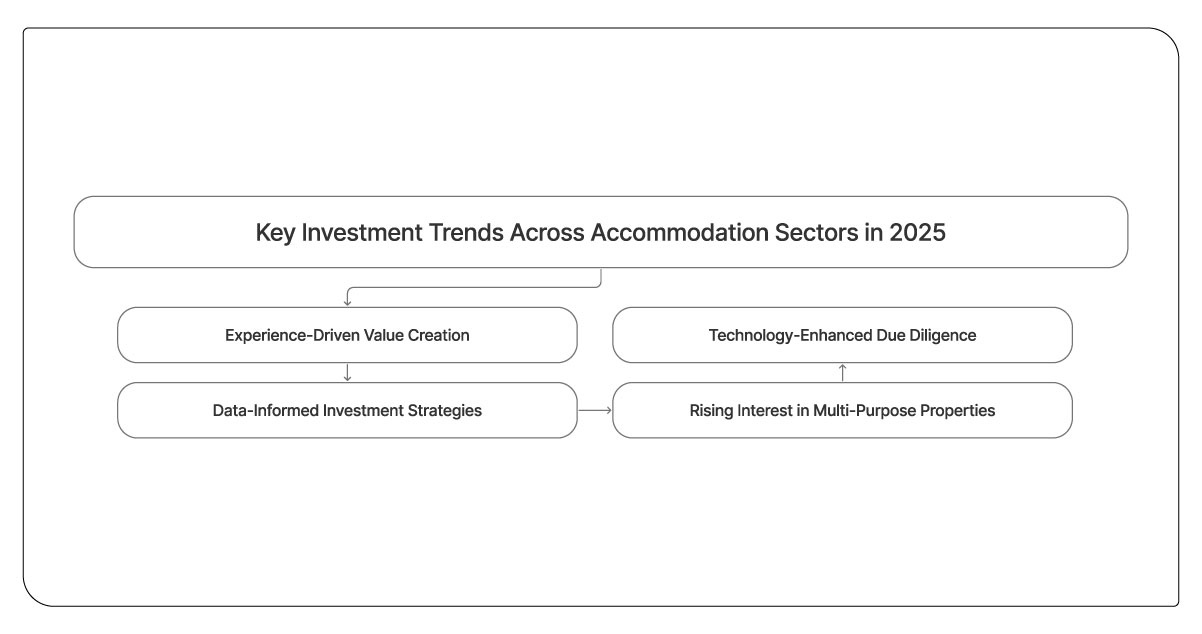

Key Investment Trends Across Accommodation Sectors in 2025

An evolving landscape of guest expectations, market data accessibility, and innovative investment strategies redefines how capital flows into the accommodation sector. Below are key trends influencing investment decisions in 2025.

- Experience-Driven Value Creation: With rising investor focus on experiential accommodations, properties offering unique stay experiences, like designer vacation rentals and boutique hotels with local character, are seeing increased demand and higher returns. Many travelers are willing to pay premium rates for distinctive experiences.

- Data-Informed Investment Strategies: One of the most impactful trends is the adoption of data-driven investment approaches. Forward-thinking investors leverage Real-Time Rental Pricing Data to identify market opportunities, enabling more strategic capital allocation based on booking patterns, demand forecasts, and competitive positioning.

- Rising Interest in Multi-Purpose Properties: Investors increasingly favor flexible-use properties that can serve short-term rental and potential long-term residential purposes, reducing investment risk. As this trend grows, an analysis of Short-Term Rental Profitability shows that these versatile properties command stronger investor interest and competitive valuations.

- Technology-Enhanced Due Diligence: AI and predictive analytics are reshaping how hospitality investments are evaluated. By integrating machine learning with Custom Travel Data Solutions, investors gain sharper insights into market dynamics, enabling smarter decisions in the ongoing debate of Rental Property vs Hotel Investment and driving more strategic, future-focused acquisitions.

Table 1: Investment Performance Comparison: Vacation Rentals vs. Hotels 2025

| Metric | Vacation Rentals | Hotels | Key Investment Implications |

|---|---|---|---|

| Average ROI | 8.5 - 12% | 6 - 9% | Higher returns for vacation rentals offset by greater management complexity |

| Revenue Volatility | Moderate - High | Low - Moderate | Hotels offer more stable cash flows but lower growth potential |

| Operational Expenses | 25-35% of revenue | 40-60 % of revenue | Vacation rentals typically offer better operational leverage |

| Valuation Multiples | 10-15 x NOI | 8-12 x NOI | Vacation rental assets commanding premium valuations in growth markets |

Description

In 2025, vacation rentals show more substantial ROI potential but have higher revenue swings, while hotels deliver steadier returns. With lower operational costs, vacation rentals enjoy better NOI margins, often leading to higher valuations in top markets. Through Hotel Data Scraping, stakeholders can better compare performance metrics and uncover deeper investment insights.

Challenges and Opportunities for Investors in 2025

As we move deeper into 2025, investors across both accommodation sectors face complex challenges and opportunities. While advanced analytics and Real-Time Rental Pricing Data offer unprecedented market visibility, implementing these tools requires significant technical expertise and ongoing investment.

Regulatory uncertainty continues to present challenges, with local ordinances affecting vacation rentals. Short-Term Rental Profitability can vary dramatically across jurisdictions based on registration requirements, operational restrictions, and taxation policies. Investors must carefully evaluate regulatory risk when comparing Rental Property vs Hotel Investment opportunities in specific markets.

Despite these challenges, forward-thinking investors are finding substantial opportunities. Implementing Custom Travel Data Solutions allows sophisticated investors to develop proprietary insights into emerging market trends. By integrating Vacation Rental Revenue Data Scraping capabilities, investors can identify market inefficiencies and capitalize on mispriced assets before competition intensifies.

Additionally, leveraging Travel Review Data Intelligence provides critical consumer sentiment insights that can inform acquisition strategies and operational improvements across property portfolios.

Platform Performance Analysis: Market Dynamics and Competitive Positioning

The evolution of major booking platforms significantly impacts investment returns and operational strategies across accommodation types. Analysis of Vacation Rental Listing Dataset metrics reveals substantial differences in performance and target demographics across major platforms.

Through comprehensive Hotel Data Intelligence gathering, we've identified key performance variations between distribution channels that directly impact revenue potential and operational complexity. These platform-specific insights allow investors to optimize their distribution strategy based on property type, location, and target guest profile.

Table 2: Cross-Sector Market Performance Predictions for 2025

| Market Segment | Vacation Rental Growth | Hotel Growth | Key Investment Considerations |

|---|---|---|---|

| Urban Centers | 6% | 4% | Vacation rentals gaining market share in business travel segment |

| Coastal Destinations | 15% | 7% | Premium vacation rentals outperforming luxury hotels |

| Mountain Resorts | 12% | 8% | Seasonal volatility impacts both sectors similarly |

| Emerging Destinations | 18% | 5% | Vacation rentals driving destination development |

Description

The projected 2025 growth rates show vacation rentals outperforming hotels in coastal and emerging markets, while urban areas reflect steady gains. Market intelligence suggests platforms with rich Vacation Rental Listing Dataset insights drive higher ADR growth than traditional hotel channels. As a result, hotel-centric OTAs are increasingly integrating vacation rental inventory to stay competitive.

Future Trends in Accommodation Investment Strategy

Looking ahead, the convergence of Hotel Data Intelligence capabilities will increasingly shape the investment landscape. Forward-thinking investors will leverage unified analytics platforms that provide normalized performance metrics across both sectors, enabling truly comparative evaluation of investment opportunities regardless of accommodation type.

The continuing evolution of Custom Travel Data Solutions will further democratize institutional-grade analytics, allowing smaller investors to compete more effectively against established players.

As hotels adopt home-sharing models and vacation rentals add hotel-like services, the line between the two continues to blur. This shift is giving rise to hybrid asset classes, prompting a rethink of traditional valuation methods where Travel Review Data Intelligence plays a critical role in understanding evolving guest expectations and investment potential.

Conclusion

As we move through the evolving landscape of 2025's Vacation Rental Market Trends, data-driven investment strategies have become crucial. The growing availability of cross-sector insights is reshaping how investors assess, acquire, and manage accommodation assets across traditional and alternative categories.

The findings highlight how essential granular, location-specific insights are when deciding between hotel and vacation rental investments. With advanced Travel Industry Web Scraping, investors now gain deep market visibility that was once out of reach.

Empowering investors with actionable intelligence to optimize returns across diverse accommodation portfolios, we deliver tailored solutions designed to give you a competitive edge. Contact Travel Scrape today to explore how our expertise in Travel Aggregates and beyond can elevate your investment strategy.