How Can Hotel Location Data Scraping Reveal the Largest Hotel Chains in the US?

Introduction

The hospitality industry in the United States represents one of the most competitive and dynamic markets globally, with thousands of hotels spanning from luxury resorts to budget-friendly accommodations. Understanding major hotel chains' landscape and geographical distribution has become crucial for investors, competitors, and market analysts. Modern technology and Hotel Location Data Scraping techniques emerge as powerful tools that can unveil comprehensive insights about the largest hotel chains operating across America, their market penetration strategies, and competitive positioning.

Understanding the Hotel Industry Landscape Through Data

The American hotel industry encompasses numerous brands, from internationally recognized chains like Marriott, Hilton, and Choice Hotels to regional players that dominate specific markets. Traditional market research methods often fail to provide real-time, comprehensive data about hotel locations, pricing strategies, and market presence. This is where modern data extraction techniques utilizing Hotel Data Scraping become invaluable for businesses seeking competitive intelligence. Advanced data collection methods can gather extensive information about hotel properties, including their exact locations, brand affiliations, room inventories, pricing patterns, and seasonal availability trends. This data-driven approach clarifies how major hotel chains establish their footprint across different states, cities, and regions.

The complexity of the hotel market requires sophisticated data collection methods that can simultaneously process information from multiple sources. Modern techniques for Web Scraping Hotel Brands allow analysts to compile comprehensive databases that reveal market share, geographical clustering patterns, and competitive dynamics that would otherwise remain hidden.

The Power of Location-Based Intelligence

Location data is the foundation for understanding hotel chain dominance in the American market. By analyzing where major chains establish their properties, businesses can identify several key patterns:

- Market penetration strategies employed by different hotel brands.

- Geographic clustering around airports, business districts, and tourist destinations.

- Brand positioning in various market segments and price points.

- Expansion patterns and growth trajectories across different regions.

A comprehensive analysis of Hotel Market Data USA reveals fascinating insights about how chains like Marriott International have strategically positioned themselves in major metropolitan areas. At the same time, brands like La Quinta focus heavily on highway corridors and secondary markets. This geographic intelligence becomes crucial for understanding competitive advantages and market opportunities.

Dynamic information systems that provide Real-Time Hotel Inventory Data further enhance location-based analysis by showing where hotels are located and their operational capacity, occupancy patterns, and seasonal fluctuations. This real-time intelligence helps identify the most successful chains in different markets and periods.

Methodology Behind Effective Hotel Data Collection

Successful hotel chain analysis requires a multi-faceted approach to data collection that combines various sources and methodologies. The process typically involves several key components:

Primary Data Sources

- Official hotel chain websites and booking platforms

- Third-party reservation systems and Travel Aggregators

- Government tourism databases and licensing records

- Real estate and commercial property listings

Technical Implementation

Strategic decisions regarding Hotel Chain API vs. Scraping often depend on specific research requirements and data availability. While APIs provide structured access to specific datasets, web scraping offers more comprehensive coverage of publicly available information that might not be accessible through official channels.

Automated systems utilizing Hotel Footprint Data Scraper tools can systematically collect information about property locations, brand affiliations, room counts, amenities, and pricing structures. This automated approach ensures consistent data collection across thousands of properties while maintaining accuracy and timeliness.

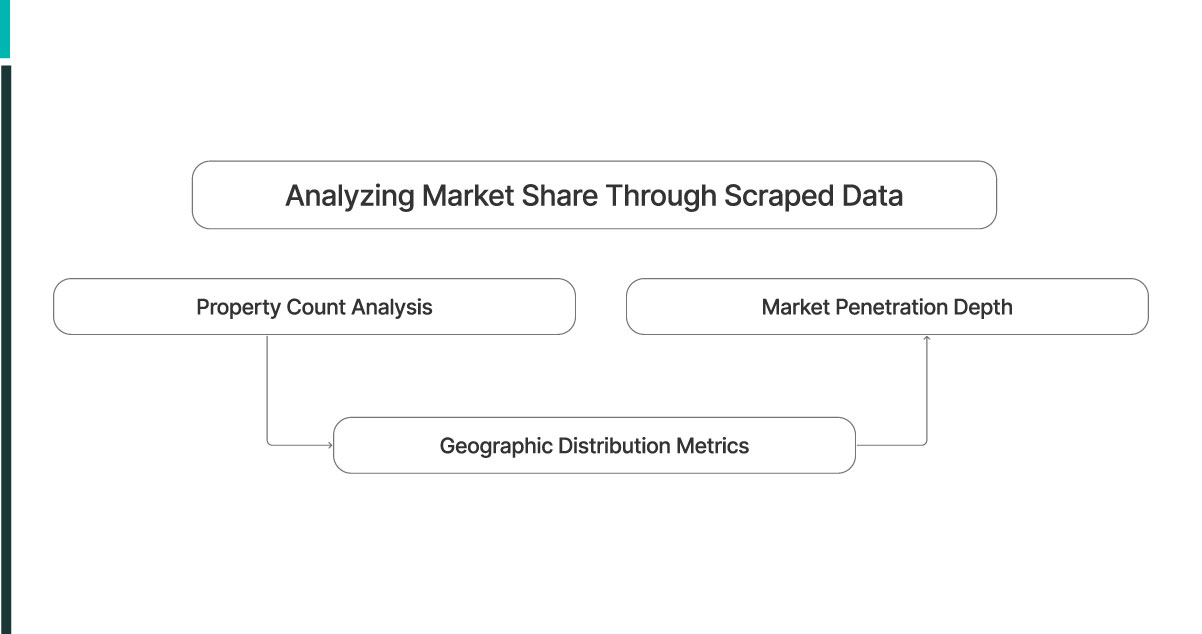

Analyzing Market Share Through Scraped Data

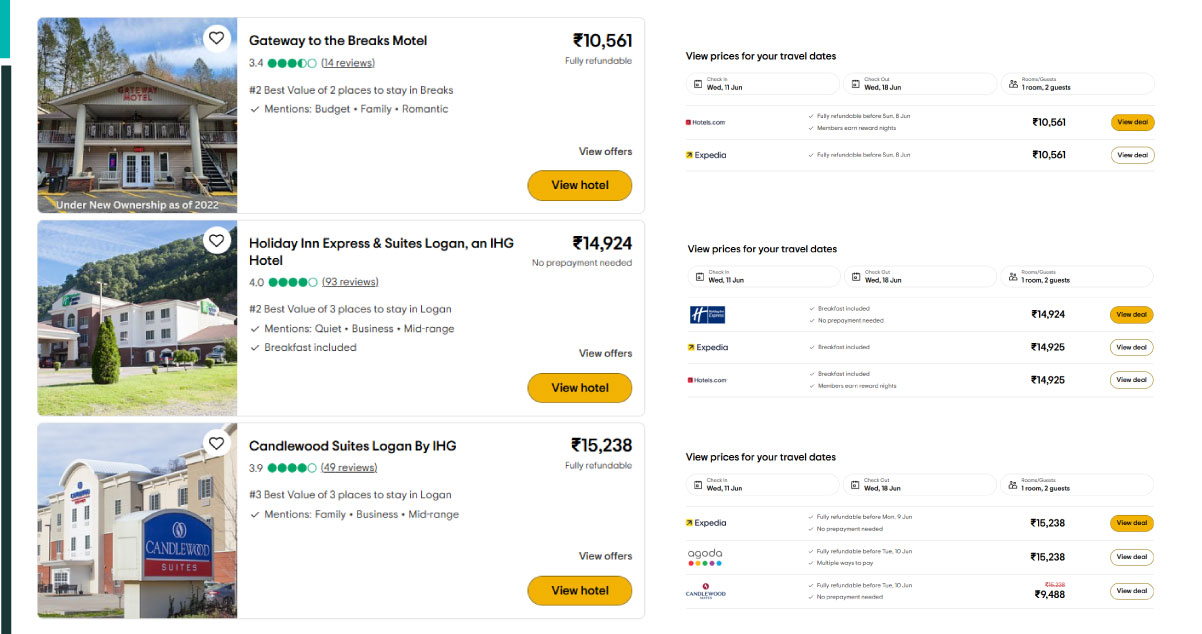

Once comprehensive location data is collected, analysts can begin identifying the largest hotel chains through various metrics:

1. Property Count Analysis

The most straightforward method involves counting the total number of properties each hotel chain operates. However, this approach must account for different ownership structures, including:

- Company-owned properties

- Franchised locations

- Management contracts

- Joint ventures and partnerships

2. Geographic Distribution Metrics

Advanced analytics utilizing Scraped Hotel Data For Market Intelligence reveals how chains distribute their properties across different markets.

Some key metrics include:

- State-by-state presence analysis

- Urban vs. suburban vs. rural distribution patterns

- Airport proximity and highway access points

- Tourist destination clustering

3. Market Penetration Depth

Beyond simple property counts, practical analysis examines how deeply chains penetrate specific markets through:

- Multiple brand presence in single locations

- Different price segment coverage

- Seasonal vs. year-round operations

Revenue and Capacity Indicators

While location data provides the foundation for market analysis, combining it with operational metrics creates a more complete picture of hotel chain dominance:

Advanced inventory analysis using Real-Time Hotel Inventory Data helps identify which chains control the most accommodation capacity, not just the highest number of properties. A chain with fewer but larger properties might serve more guests than competitors with many smaller hotels.

Market positioning strategies become clear through Hotel Room Price Trends Dataset analysis, which reveals how major chains position themselves across different market segments. This information helps identify:

- Premium positioning strategies

- Budget market penetration

- Mid-market competitive dynamics

- Seasonal pricing variations

Operational efficiency metrics utilizing Hotel Availability Forecast Datasets provide insights into operational efficiency and market demand patterns. High-performing chains often maintain better occupancy rates across their portfolio, indicating stronger brand recognition and operational excellence.

Technology Integration and API Considerations

Modern hotel chain analysis increasingly relies on sophisticated technology solutions that can efficiently process vast amounts of data. Businesses must carefully evaluate Hotel Chain API vs. Scraping approaches, as each involves several important considerations:

API Advantages

- Structured, reliable data formats

- Official vendor support and documentation

- Reduced technical complexity

- Built-in rate limiting and ethical guidelines

Web Scraping Benefits

- Access to publicly available data not provided through APIs

- Greater flexibility in data collection scope

- Cost-effectiveness for large-scale projects

- Independence from vendor restrictions

Advanced analytics platforms offering Custom Travel Data Solutions often combine both approaches, using available APIs and supplementing with web scraping for comprehensive coverage. This hybrid methodology ensures the most complete and accurate dataset possible.

Regional and Segment-Specific Analysis

The American hotel market exhibits significant regional variations that become apparent through comprehensive location data analysis:

1. Regional Market Leaders

Different hotel chains dominate various regions of the United States:

- Northeast corridor business hotel concentrations

- Southeast leisure and resort market patterns

- Western state highway and recreational area presence

- Midwest business travel and convention market focus

Advanced analytics using Hotel Data Intelligence reveals how chains specialize in different market segments:

- Luxury and upscale positioning

- Extended-stay and corporate housing

- Budget and economy accommodations

- Boutique and lifestyle brands

2. Urban vs. Suburban Strategies

Location data analysis shows distinct patterns in how chains approach different development environments. Some focus on downtown urban cores, while others target suburban business districts or highway interchange locations.

Competitive Intelligence and Market Opportunities

Comprehensive competitive intelligence through Web Scraping Hotel Brands provides insights that extend beyond simple market share analysis:

Modern analytics platforms utilizing Scraped Hotel Data For Market Intelligence help identify underserved markets where major chains have a limited presence, creating opportunities for new market entry strategies, acquisition target identification, partnership opportunities, and investment decision support.

Competitive Response Patterns

Historical location data reveals how chains respond to competitor moves, including:

- Market entry timing

- Strategic location selection

- Brand positioning responses

- Capacity expansion patterns

Future Trends and Predictive Analytics

Predictive modeling using Hotel Availability Forecast Datasets combined with historical location data enables predictive analysis of hotel chain expansion patterns:

Growth Trajectory Modeling: By analyzing historical expansion patterns, businesses can predict:

- Future market entry priorities

- Brand development strategies

- Geographic expansion timing

- Investment allocation patterns

Market Demand Forecasting: Advanced analytics platforms utilizing Travel Scraping API data help identify emerging travel patterns and destination popularity trends, which influence hotel chain strategic planning.

How Travel Scrape Can Help You?

We understand the complexity of gathering and transforming comprehensive hotel industry data into actionable business intelligence. Our specialized solutions utilizing Hotel Footprint Data Scraper technology provide comprehensive support through:

Data Collection Services

- Real-time hotel location data extraction across all major US markets

- Comprehensive brand affiliation mapping and property categorization

- Automated inventory tracking and capacity analysis

- Competitive positioning and market share intelligence

Custom Analytics Solutions

- Tailored Custom Travel Data Solutions designed for your specific research requirements

- Market entry feasibility studies and competitive landscape analysis

- Investment due diligence support with detailed property portfolios

- Geographic expansion planning and opportunity identification

Technology Integration

- Advanced Hotel Data Intelligence platforms with user-friendly dashboards.

- API integration capabilities for seamless data integration into existing systems.

- Real-time monitoring services for market changes and expansion activities.

- Our comprehensive Travel Scraping API ensures access to current information while maintaining compliance with data collection best practices.

Conclusion

Advanced data collection techniques, including Hotel Location Data Scraping have revolutionized how we understand and analyze the American hospitality industry's competitive landscape. By providing comprehensive, real-time data about hotel chain locations, market penetration, and operational metrics, these advanced data collection techniques enable businesses to make informed strategic decisions based on concrete market intelligence rather than assumptions or incomplete information.

The insights gained from systematic location data analysis extend far beyond simple property counts, revealing complex patterns of market segmentation, regional specialization, and competitive positioning that shape the industry's future direction. As Travel Aggregators and booking platforms continue to evolve, the importance of comprehensive data collection and analysis will only increase.

For businesses operating in or considering entry into the hospitality sector, leveraging comprehensive Travel Industry Web Scraping capabilities represents a critical competitive advantage. Contact Travel Scrape today to discover how our specialized data collection and analysis services can provide the market intelligence you need to succeed in this dynamic industry.