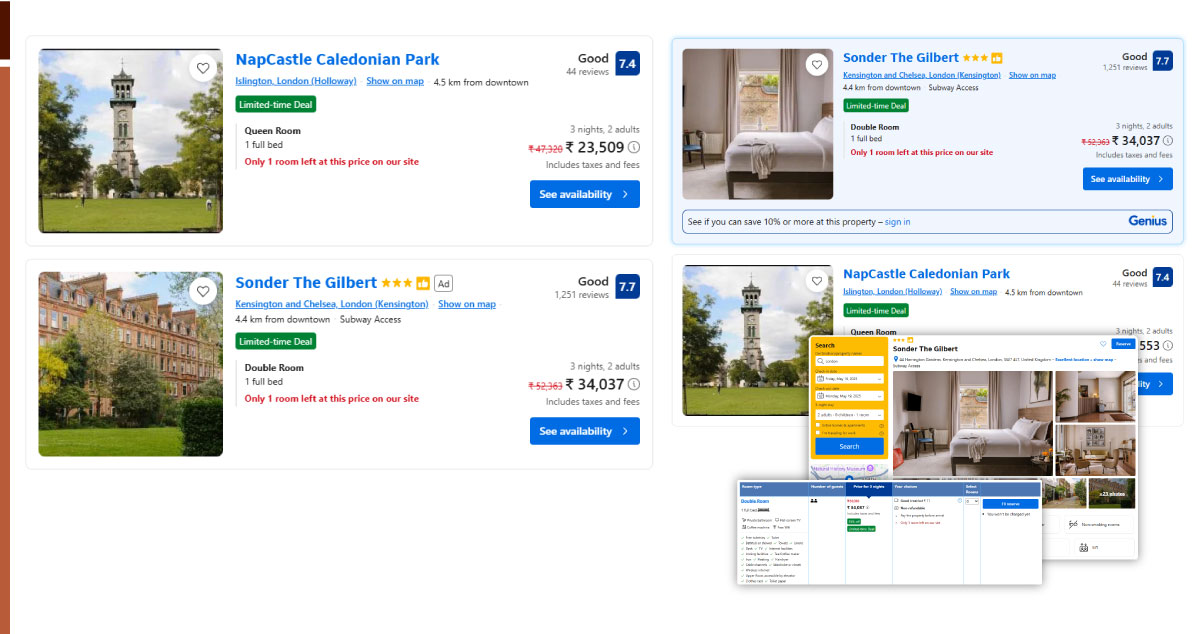

Using Booking.com & Airbnb Data to Benchmark Property Listings in the UK

Overview

With growing demand for short-term rentals and hybrid travel accommodations in the UK, one property intelligence firm wanted to benchmark listing performance across Airbnb and Booking.com. Travel Scrape was tasked with building a data pipeline to extract, analyze, and compare pricing, occupancy indicators, reviews, and amenities across multiple cities.

The result? A powerful internal dashboard that enabled more accurate property pricing, investment planning, and competitive intelligence—especially for urban landlords and vacation rental managers.

Objectives

- Scrape daily listing-level data from Booking.com and Airbnb across the UK.

- Benchmark average nightly rates, occupancy signals, and review scores.

- Provide area-wise performance dashboards to investors and property owners.

- Track amenities, fees, and policies to influence competitive positioning.

- Offer price recommendations and listing gap analysis to clients.

Cities Covered in Phase 1

- London

- Manchester

- Edinburgh

- Birmingham

- Glasgow

- Liverpool

- Bristol

Why Booking.com & Airbnb?

These two platforms dominate short-term rental traffic and have distinct listing dynamics:

| Feature | Booking.com | Airbnb |

|---|---|---|

| Audience | Hotel, apartments, serviced stays | Vacation homes, homestays, host-run |

| Pricing Format | Nightly + taxes/fees | Nightly + cleaning + service fees |

| Listing Volume (UK) | ~250,000 | ~280,000+ |

| Data Insights | Room types, policies, star ratings | Host responsiveness, amenities, reviews |

Scraping both allows comprehensive benchmarking of supply, pricing, and quality across the UK.

Travel Scrape’s Data Strategy

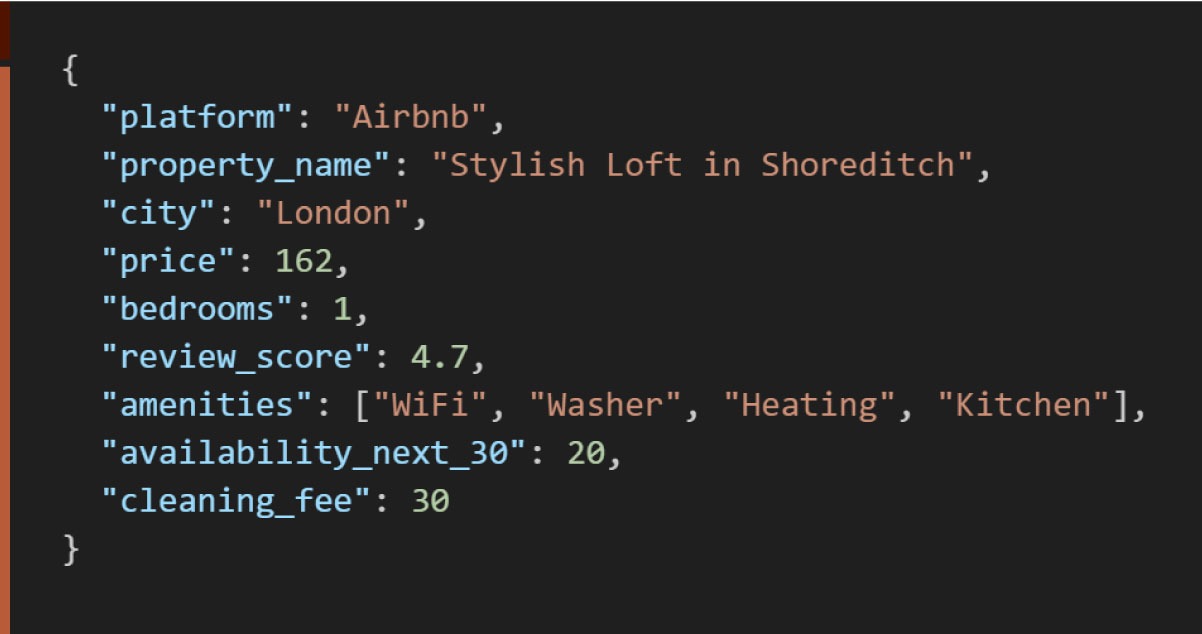

1. Listing Field Mapping & Normalization

| Field | Sample Value |

|---|---|

| Property Name | "Modern Apartment near London Bridge" |

| Platform | Airbnb |

| City | London |

| Price Per Night | £152 |

| Property Type | Entire apartment |

| Bedrooms | 2 |

| Review Score | 4.8/5 (312 reviews) |

| Amenities | WiFi, Washer, Kitchen, Heating |

| Min Stay | 2 nights |

| Cleaning Fee | £35 |

| Availability Next 30 Days | 17 nights |

2. Scraping Setup

- Tools Used: Puppeteer (for Airbnb), Scrapy (for Booking.com)

- Dynamic URL generation: Based on city, date, filters, and property type

- Geo-coordinates tagging: For postcode-level analytics

- Frequency: 2x Daily – one early morning, one evening snapshot

- Storage: PostgreSQL (tabular), ElasticSearch (filtering), AWS S3 (backup)

Sample JSON Record

Data Insights Dashboard Built

Key Dashboards Delivered to Client:

- Average Price by Area & Property Type

- Occupancy Proxy Score (based on availability over next 30 days)

- Top 10 Most Booked Amenities

- Listing Density Heatmap

- Gap Analysis vs. Competitor Properties

Results & Outcomes

| Metric | Before Travel Scrape | After Integration |

|---|---|---|

| Property Pricing Accuracy (estimates) | ~62% | 91%+ |

| Time to Benchmark New Listing | 2–3 days | <3 hours |

| Occupancy Forecast Accuracy | N/A | 87%+ match rate |

| New Revenue Streams (SaaS API) | None | 3 clients onboarded |

Key Insights Unlocked

Average Nightly Rates (Airbnb vs. Booking.com – London)

| Neighborhood | Airbnb Avg. (£) | Booking Avg. (£) |

|---|---|---|

| Shoreditch | £162 | £148 |

| Camden | £145 | £135 |

| Westminster | £220 | £210 |

| Kensington | £189 | £178 |

| Stratford | £116 | £105 |

Most Competitive Amenities

- WiFi – - included in 98% of listings

- Washer – - in 68% of high-performing listings

- Workspace - ranked higher in business hubs (London, Manchester)

Client Testimonial

"The level of detail we now have about our competitors’ listings is unmatched. Travel Scrape helped us shift from guesswork to data-driven pricing and asset planning."

Tech Stack Used

| Layer | Tools Used |

|---|---|

| Scraping | Puppeteer, Scrapy |

| Storage | PostgreSQL, ElasticSearch, AWS S3 |

| Processing | Pandas, NumPy, GeoPandas |

| API Layer | FastAPI |

| Visualization | Power BI, Tableau |

Challenges & Solutions

| Challenge | Travel Scrape’s Approach |

|---|---|

| Airbnb data blocked via browser | Headless Puppeteer with login simulation |

| Inconsistent amenity labeling | NLP tagging and standardization pipeline |

| Duplicate listings across platforms | Fuzzy match algorithm by geo, host, amenities |

| Room type ambiguity | Classified using deep learning on description |

Use Cases Enabled

- For Real Estate Investors: Identify most profitable zip codes

- For Short-Term Rental Owners: Benchmark pricing against similar properties

- For Hospitality Analysts: Track OTA trends by brand, rating, and region

- For SaaS Tools: Offer benchmarking API to end users and property managers

Conclusion

With Travel Scrape’s Booking.com and Airbnb data pipeline, the client gained powerful insights to stay ahead in the UK’s fast-evolving short-term rental market. The ability to benchmark by area, optimize pricing, and evaluate listing performance gave them an unmatched edge in both investment planning and daily revenue strategy.

If you operate in the real estate, travel, or hospitality sector, Travel Scrape can help you transform fragmented OTA listings into actionable, location-based intelligence.