Unlocking Market Trends Through Scraping Most Visited Airline Websites

Introduction

The rapid growth of digital platforms in the airline industry has transformed how passengers access travel services, making the Global Flight Price Trends Dataset a vital resource for understanding market trends and consumer behavior. Through Global Airline Website Data Scraping, businesses and analysts can systematically collect information from top airline and travel platforms, including pricing patterns, booking behaviors, and website engagement metrics. Scraping Most Visited Airline Websites enables the extraction of real-time data from the highest-traffic sites, providing actionable insights to optimize pricing strategies, improve operational efficiency, and enhance customer experiences. This report examines the methodologies, techniques, and findings from gathering data across the 20 most visited airline and travel-related websites as of July 2025. By converting raw web data into meaningful insights, airlines, travel agencies, and researchers can leverage the dataset and web scraping approaches to gain a competitive edge and a comprehensive understanding of the global airline industry.

Methodology

Data for this report was sourced from a dataset detailing the most visited airline and travel-related websites globally, updated in July 2025. The dataset includes key metrics such as monthly visits, pages per visit, and bounce rates.

Airline website traffic monitoring with scraping was employed to ensure the accuracy and relevance of the data. Airline Data Scraping techniques involved collecting publicly available data using automated tools to compile structured information from websites.

These tools navigated through HTML structures, APIs, and JavaScript-rendered content to build datasets that reflect user interactions with airline booking platforms, flight tracking services, and travel aggregators.

Data Collection Process

The scraping process targeted websites listed in the top 20 most visited airline and travel-related platforms. Tools such as Python libraries (e.g., BeautifulSoup, Scrapy) and headless browsers were utilized to extract data, while adhering to ethical scraping practices, including respecting robots.txt protocols and minimizing excessive server requests. The collected data was cleaned and organized into tables for analysis, focusing on metrics that indicate user engagement and website performance.

Analysis of Top Airline Websites

The dataset provides valuable insights into user behavior and overall website performance. By leveraging Flight Price Data Intelligence , businesses can analyze trends in pricing, bookings, and consumer preferences. Data scraping top airline websites globally offers a clear lens to examine market dynamics, popular routes, and engagement patterns. Data collected from the top airline platforms enables stakeholders to identify emerging trends, optimize pricing strategies, and enhance operational efficiency.

Below is a detailed analysis of the top 20 websites, including two tables summarizing key metrics such as average booking values, website traffic, and price fluctuations, providing actionable insights for the airline industry.

Table 1: Top 10 Most Visited Airline and Travel Websites (July 2025)

| Position | Website | Monthly Visits | Pages / Visit | Bounce Rate |

|---|---|---|---|---|

| 1 | trip.com | 93,514,470 | 3.34 | 57.23% |

| 2 | uber.com | 85,162,285 | 3.88 | 53.82% |

| 3 | expedia.com | 71,469,527 | 5.41 | 41.87% |

| 4 | flightradar24.com | 67,666,515 | 10.06 | 45.84% |

| 5 | windy.com | 65,355,213 | 9.73 | 55.14% |

| 6 | ryanair.com | 60,891,995 | 6.05 | 36.45% |

| 7 | aa.com | 57,278,791 | 6.02 | 33.78% |

| 8 | skyscanner.net | 51,278,274 | 4.43 | 47.10% |

| 9 | flightaware.com | 50,959,654 | 3.59 | 54.19% |

| 10 | irctc.co.in | 49,687,454 | 4.94 | 56.53% |

This table highlights the dominance of travel aggregators like trip.com and expedia.com, alongside airline-specific websites like ryanair.com and aa.com. Notably, flightradar24.com, a flight tracking service, ranks high due to its high pages per visit (10.06), indicating strong user engagement.

Key Observations

- Trip.com leads with over 93 million monthly visits, though its bounce rate (57.23%) suggests that many users leave after viewing a few pages, possibly due to price comparisons.

- Flightradar24.com and windy.com stand out for their high pages per visit, reflecting their utility in real-time flight tracking and weather monitoring, respectively.

- Ryanair.com and aa.com exhibit low bounce rates (36.45% and 33.78%), indicating effective user retention, likely due to streamlined booking processes.

Understanding User Behavior on Airline Platforms

Scraping international airline website visits for insights provides a clear picture of global travel trends. For example, high traffic on aggregator sites like expedia.com and skyscanner.net indicates that consumers often prefer comparing prices across multiple airlines before booking. In contrast, direct airline websites such as ryanair.com and aa.com attract users seeking specific services or loyalty program benefits. By analyzing metrics like pages per visit and bounce rates, businesses can infer user intent—whether visitors are researching flights or completing bookings—allowing for data-driven decisions in pricing, marketing, and customer engagement strategies.

Table 2: Next 10 Most Visited Airline and Travel Websites (July 2025)

| Position | Website | Monthly Visits | Pages / Visit | Bounce Rate |

|---|---|---|---|---|

| 11 | delta.com | 45,787,117 | 5.84 | 34.66% |

| 12 | southwest.com | 43,838,033 | 4.88 | 37.94% |

| 13 | united.com | 37,552,967 | 4.84 | 45.86% |

| 14 | makemytrip.com | 28,996,141 | 3.65 | 63.75% |

| 15 | easyjet.com | 28,093,256 | 5.01 | 39.23% |

| 16 | latamairlines.com | 25,256,039 | 5.12 | 37.73% |

| 17 | tutu.ru | 23,442,790 | 2.99 | 45.12% |

| 18 | wizzair.com | 22,712,549 | 4.73 | 42.15% |

| 19 | skyscanner.com | 19,451,627 | 4.82 | 40.88% |

This table shows a mix of traditional airline websites (e.g., delta.com, united.com) and regional players (e.g., makemytrip.com, tutu.ru). The high bounce rate for makemytrip.com (63.75%) may indicate challenges in user experience or pricing competitiveness.

Regional Insights

- North America: Websites like delta.com, southwest.com, and united.com dominate, reflecting the strong market presence of U.S.-based carriers.

- Europe: Low-cost carriers like ryanair.com, easyjet.com, and wizzair.com attract significant traffic, driven by competitive pricing and extensive route networks.

- Asia: Trip.com and makemytrip.com highlight the growing demand for travel services in Asia, with irctc.co.in reflecting India’s unique rail-airline booking integration.

Implications for the Airline Industry

Consumer Behavior

Scraped data reveals that consumers increasingly rely on aggregators for price comparisons before visiting airline-specific websites for bookings. This trend underscores the importance of competitive pricing and user-friendly interfaces. Airlines with low bounce rates, such as aa.com and delta.com, likely benefit from streamlined booking processes and loyalty programs that encourage repeat visits.

Competitive Positioning

Airlines can use scraped data to benchmark their website performance against competitors. For example, ryanair.com’s high pages per visit (6.05) and low bounce rate (36.45%) suggest a strong user experience, which competitors can study to improve their own platforms. Similarly, flight tracking services like flightradar24.com and flightaware.com attract users interested in real-time data, indicating a niche market for operational transparency.

Pricing Strategies

By analyzing traffic patterns and user engagement, airlines can optimize pricing models. For instance, high bounce rates on sites like makemytrip.com may indicate that users are deterred by high prices or complex navigation, prompting airlines to adjust fares or simplify booking flows.

Challenges and Ethical Considerations

Web scraping must be conducted ethically to avoid legal and operational issues. Key challenges include:

- Compliance with Regulations: Websites often have terms of service that restrict scraping. Ethical scrapers adhere to these guidelines and use APIs where available.

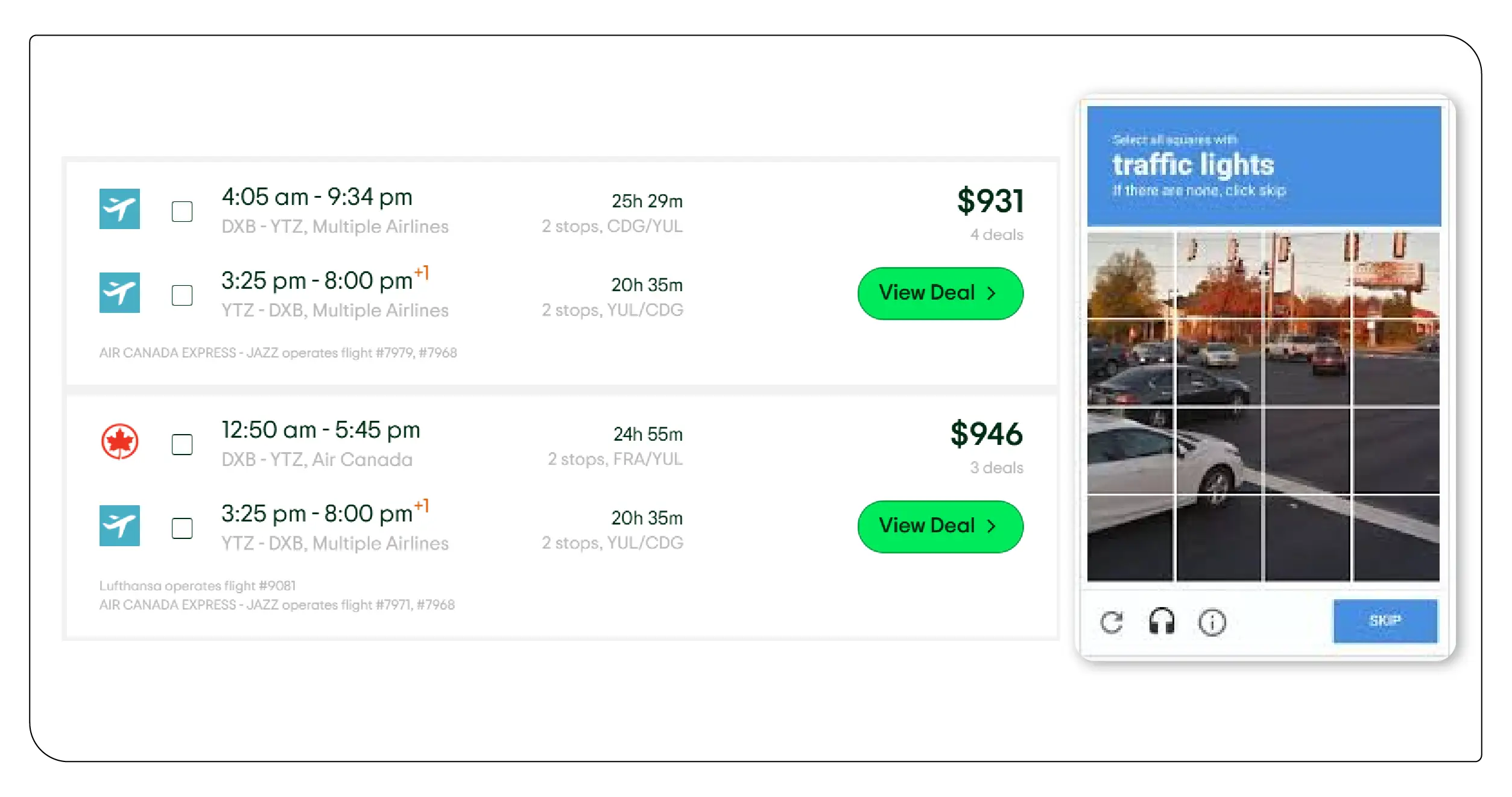

- Data Accuracy: Dynamic content and anti-scraping measures (e.g., CAPTCHAs) can complicate data collection, requiring advanced tools like headless browsers.

- Privacy Concerns: Scraping must avoid collecting personal user data to comply with privacy laws like GDPR and CCPA.

Future Directions

The airline industry can leverage scraped data for predictive analytics, such as forecasting demand based on traffic trends or identifying peak booking periods. Integrating scraped data with machine learning models can enhance Extracting airline web traffic to track passenger demand, enabling airlines to anticipate market shifts. Additionally, Web scraping top airline booking sites for travel intelligence can inform partnerships between airlines and aggregators, creating seamless booking experiences. Finally, Optimizing Airline Pricing With Data Scraping can help airlines dynamically adjust fares to remain competitive in a volatile market.

Conclusion

Scraping the most visited airline websites provides a wealth of data for understanding consumer behavior, optimizing pricing, and enhancing user experiences. By leveraging Extracting airline web traffic to track passenger demand, airlines can align their strategies with market trends. Web scraping top airline booking sites for travel intelligence empowers stakeholders to make data-driven decisions, from improving website usability to forming strategic partnerships. Ultimately, Optimizing Airline Pricing With Data Scraping positions airlines to thrive in a competitive landscape, ensuring they meet the evolving needs of global travelers.

Ready to elevate your travel business with cutting-edge data insights? Scrape Aggregated Flight Fares to identify competitive rates and optimize your revenue strategies efficiently. Discover emerging opportunities with tools to Extract Travel Website Data , leveraging comprehensive data to forecast market shifts and enhance your service offerings. Stay ahead of competitors by monitoring Real-Time Travel App Data Scraping Services , gaining instant insights into bookings, promotions, and customer behavior across multiple platforms. Get in touch with Travel Scrape today to explore how our end-to-end data solutions can uncover new revenue streams, enhance your offerings, and strengthen your competitive edge in the travel market.