Scraping Grab Car & Bike Fare Data for Route-Wise Pricing Analysis Case Study by Travel Scrape

Introduction

Urban mobility platforms in Southeast Asia have evolved beyond simple ride booking apps. They now operate as complex, multi-modal ecosystems where cars, bikes, and other transport options compete for the same rider across different routes, time windows, and price sensitivities.

For mobility aggregators and city planners, understanding how consumers switch between car and bike rides is critical. Small pricing differences, time savings, or route characteristics can significantly impact ride demand and fleet utilization.

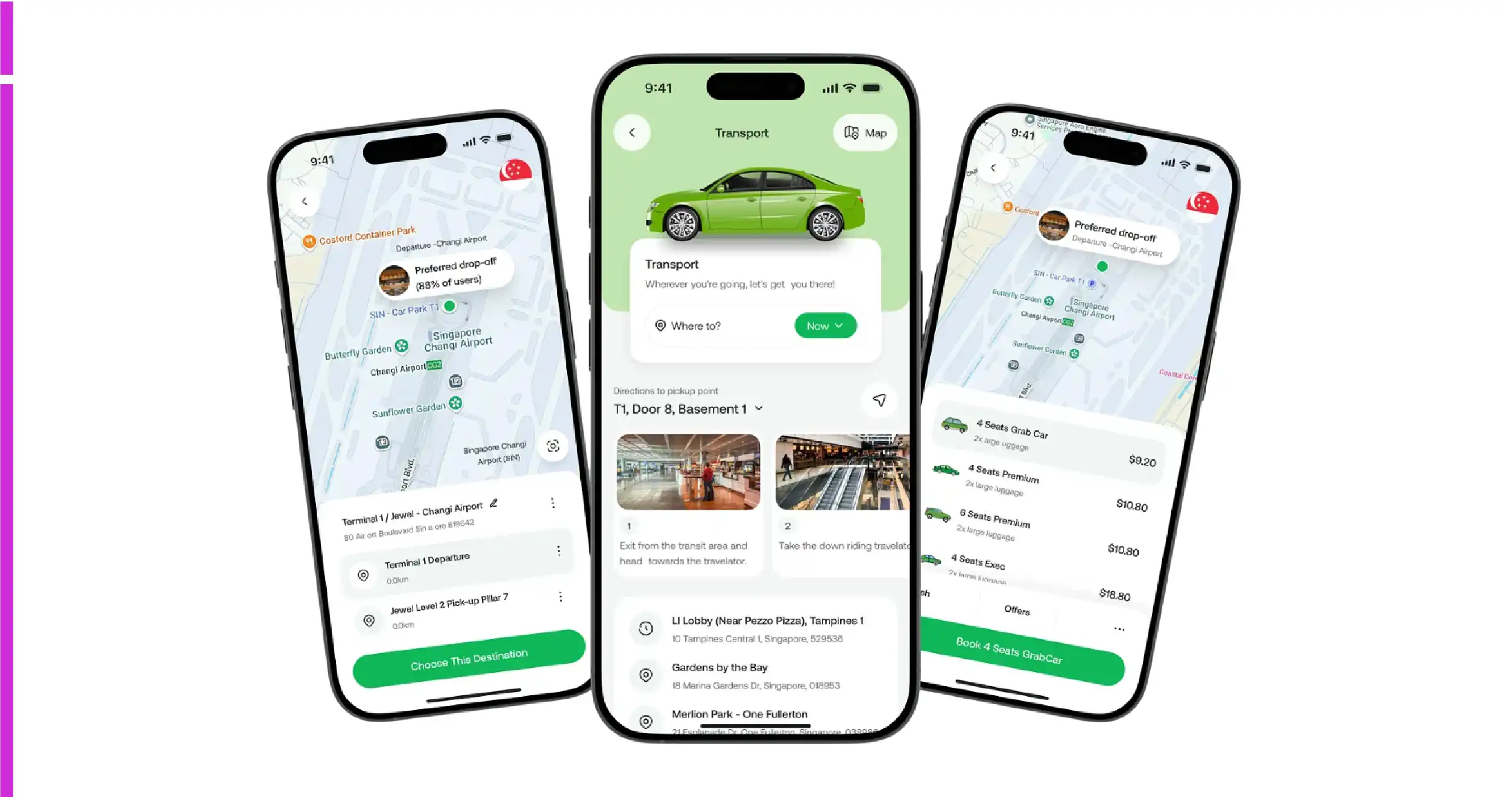

This case study explains how Travel Scrape helped a Southeast Asian mobility aggregator analyse route-wise pricing behaviour by scraping and structuring car and bike fare data from Grab. The outcome was a detailed pricing intelligence system that revealed mode preferences, time-price trade-offs, and actionable insights for product and planning decisions.

Business Challenge

The client operated a regional mobility aggregation platform covering multiple Southeast Asian cities. While they had access to high-level usage metrics, they lacked granular visibility into how riders chose between cars and bikes on specific routes.

Key challenges included:

- No route-level comparison between car and bike fares

- Limited understanding of airport versus CBD pricing behaviour

- Inability to quantify peak and off-peak fare differences by mode

- No structured view of time saved versus price paid

- Difficulty forecasting modal demand for city-level planning

Without this intelligence, decisions around fleet allocation, product mix, and partner strategy were largely assumption-based.

Objective

The client partnered with Travel Scrape to build a route-wise pricing intelligence framework with the following goals:

- Compare car and bike fares on identical routes

- Measure price differences across airport, CBD, and residential routes

- Track peak vs off-peak pricing behavior

- Analyze time saved versus fare paid

- Identify consistent switching patterns across cities

Scope of Data Collection

Travel Scrape designed a structured scraping framework to ensure clean, comparable data across cities and time windows.

Routes Covered

- CBD → Airport

- Airport → CBD

- CBD → Residential Zones

- Short intra-CBD routes

Ride Modes

- Grab Car

- Grab Bike

Time Segments

- Morning peak

- Midday off-peak

- Evening peak

- Late-night off-peak

Cities

- Major SEA metro cities with high ride density

- Tourist-heavy cities with strong airport demand

- Business hubs with dense CBD traffic

Data Points Captured

Each fare request was normalized to ensure accurate comparison between car and bike modes.

- Route start and end coordinates

- Ride mode (car or bike)

- Estimated fare

- Estimated travel time

- Surge or dynamic pricing indicator

- Time of day and day type

Sample Data Snapshot

| Route | Mode | Avg Fare (USD) | Estimated Time | Time Saved |

|---|---|---|---|---|

| CBD → Airport | Car | 18.40 | 42 min | — |

| CBD → Airport | Bike | 7.90 | 54 min | +12 min |

| CBD → CBD | Car | 6.20 | 18 min | — |

| CBD → CBD | Bike | 3.10 | 22 min | +4 min |

| Residential → CBD | Car | 9.80 | 30 min | — |

| Residential → CBD | Bike | 4.60 | 36 min | +6 min |

This structured dataset allowed the client to compare price and time trade-offs on identical routes.

Methodology Used by Travel Scrape

Route Normalization

Fixed pickup and drop points were defined for every route. This eliminated variability caused by different rider locations and ensured consistent comparisons.

Time-Window Sampling

Fare data was captured multiple times per day across weekdays and weekends to reflect real-world pricing dynamics.

Mode-to-Mode Matching

Car and bike fares were always captured within the same time window to prevent bias caused by sudden demand fluctuations.

Data Cleaning & Validation

Outliers caused by abnormal surges or technical errors were flagged and reviewed before analysis.

Key Insights

1. Bikes Dominated Short CBD Routes

Across all cities studied, bike rides consistently outperformed cars on short CBD routes.

- Bike fares were 45–60% lower than car fares

- Time difference was typically under 5 minutes

- Riders prioritized cost savings over minimal time loss

This made bikes the default choice for short urban trips.

2. Cars Remained Preferred for Airport Routes

Despite significantly higher fares, cars were strongly preferred on airport routes.

- Average car fares were 2–2.5x higher than bike fares

- Time savings ranged from 10 to 20 minutes

- Riders valued comfort, luggage space, and reliability

This behavior was consistent across both business and tourist cities.

3. Price-Time Tradeoffs Were Highly Consistent

One of the most valuable findings was consistency.

- When time saved exceeded 10 minutes, riders chose cars

- When time saved was under 5 minutes, bikes dominated

- These thresholds remained stable across cities

This allowed the client to model rider behavior with higher confidence.

4. Peak Pricing Affected Cars More Than Bikes

During peak hours:

- Car fares showed sharper surge behavior

- Bike fares increased marginally or remained stable

- Price gaps widened significantly during congestion

This created strong bike adoption during peak CBD traffic.

5. City Patterns Were Predictable, Not Random

While absolute fares differed city to city, relative behavior remained similar.

- CBD density increased bike preference

- Airport distance increased car preference

- Tourist cities showed higher willingness to pay for cars

This insight supported scalable expansion strategies.

Business Impact

Improved Product Mix Decisions

The client used Travel Scrape’s insights to adjust how car and bike options were presented in different zones and time windows.

- Bikes highlighted for short CBD routes

- Cars emphasized for airport and long routes

Data-Driven City Mobility Planning

Route-level demand forecasts helped the client:

- Plan driver onboarding by mode

- Anticipate peak-hour demand shifts

- Optimize supply distribution by zone

Modal Demand Forecasting

By combining pricing and time data, the client built predictive models to estimate:

- Mode switching under fare changes

- Impact of congestion on ride choice

- Sensitivity to surge pricing

Stronger Partner Negotiations

Clear evidence of route-wise performance allowed the client to negotiate better terms with fleet partners and operators.

Why Travel Scrape

Travel Scrape specializes in large-scale mobility and travel data extraction, offering:

- Route-based fare intelligence

- Multi-modal pricing comparison

- City-level mobility insights

- Clean, analysis-ready datasets

Our approach focuses on accuracy, repeatability, and real-world business relevance.

Conclusion

Understanding how riders choose between car and bike options requires more than average pricing data. It demands route-level, time-aware, and mode-specific intelligence.

Through systematic scraping and analysis of Grab car and bike fares, Travel Scrape enabled a mobility aggregator to uncover consistent behavioral patterns, improve product decisions, and plan smarter urban mobility strategies.

This case study demonstrates how structured mobility data can directly influence pricing, planning, and growth decisions across Southeast Asia.