How Does Scraping Costa Cruise Price Data Reveal Real-Time Fare Fluctuations and Deal Trends?

Introduction

Cruise pricing has become increasingly dynamic as operators respond to real-time demand, route performance, and inventory pressure. Costa Cruises, one of the most established cruise brands globally, actively adjusts fares across sail dates, itineraries, and cabin categories. These changes are rarely linear and often occur without public announcements. This is why businesses now rely on Scraping Costa Cruise Price Data to gain visibility into how fares actually move over time rather than relying on occasional manual checks.

At the same time, companies that Scrape Costa Cruise Tickets Price Data are able to monitor not just base prices, but also bundled inclusions, cabin-level variations, and short-lived discounts. Continuous Costa cruise fare monitoring transforms pricing from a guessing game into a measurable system, enabling data-driven booking strategies, deal forecasting, and competitive benchmarking.

Why Costa Cruise Pricing Is Difficult to Track Manually?

Costa Cruise pricing does not follow a simple seasonal or promotional model. Instead, fares fluctuate based on a combination of demand velocity, unsold inventory, route popularity, and sailing proximity. The same itinerary can show different prices for identical cabins depending on booking timing, regional portals, or added value components.

Manual tracking fails because prices may change multiple times per day, discounts may be embedded within packages, and promotions are often targeted rather than universal. Without automated data collection, these pricing signals are fragmented and impossible to analyze at scale.

How Costa Cruise Price Scraping Works in Practice?

Price scraping is not a one-time data pull; it is a structured, recurring process that captures pricing behavior across time. By collecting fare data daily or intraday, analysts can build a historical pricing layer that reveals intent rather than just outcomes.

Through structured scraping, the following pricing elements are captured and analyzed in detail:

- Sailing-level fare evolution: Each departure date is tracked independently, making it possible to compare how identical itineraries behave differently across the calendar.

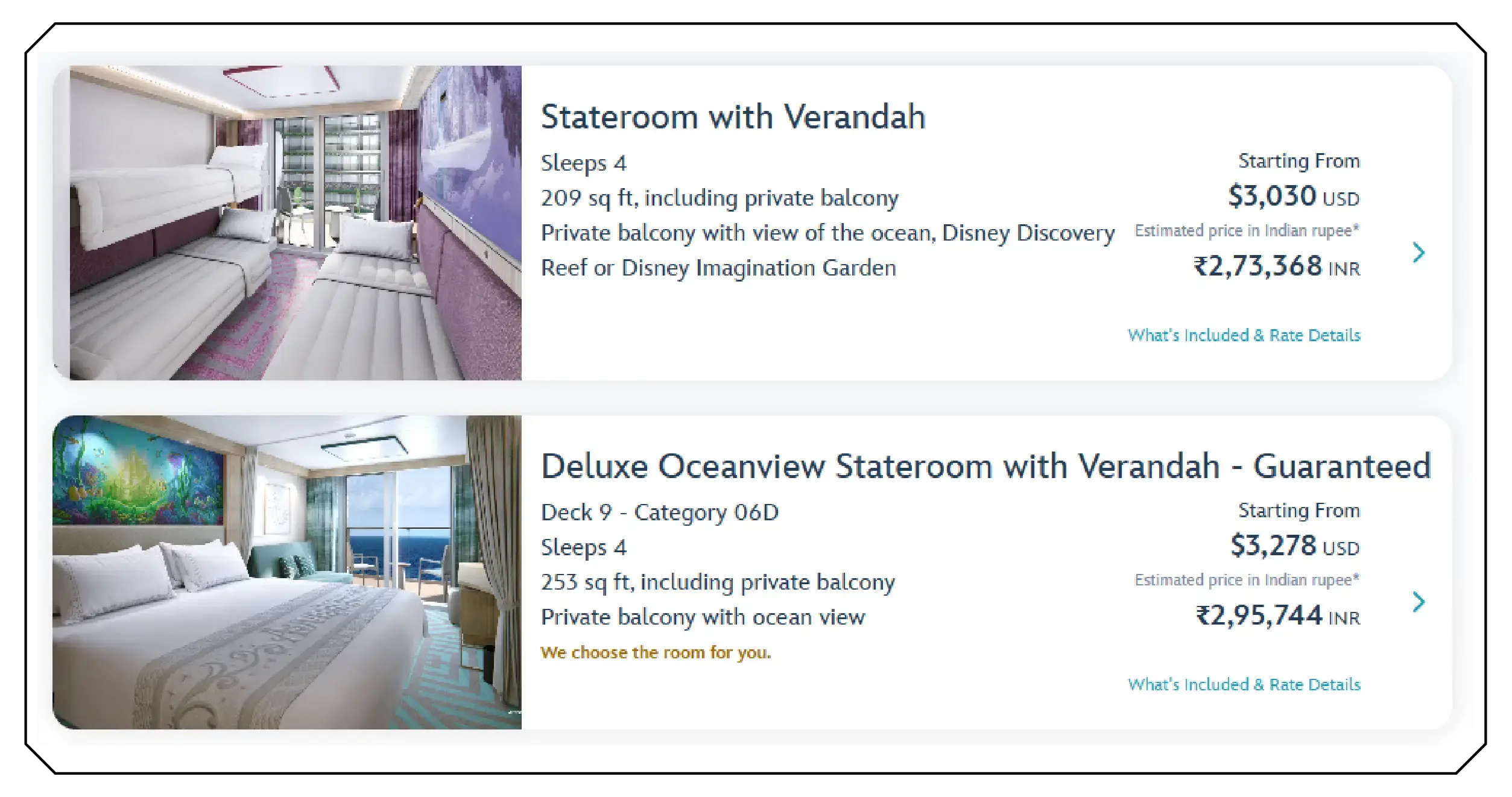

- Cabin-specific price behavior: Interior, ocean-view, balcony, and suite fares are monitored separately, revealing which cabin types receive early discounts versus last-minute reductions.

- Value packaging changes: Scraping detects when Costa adds onboard credits, beverage packages, or Wi-Fi instead of lowering base fares, preserving brand positioning.

- Time-based price movement: Continuous data collection shows how fares react to booking velocity and remaining inventory as departure approaches.

- Promotion versus real discount visibility: Analysts can distinguish between marketing labels and genuine net price reductions affecting traveler value.

This depth of visibility allows businesses that scrape pricing data to move beyond surface-level promotions and understand the mechanics behind Costa’s pricing decisions.

What Fare Change Data Reveals About Costa’s Pricing Strategy?

Once fare data is collected over weeks or months, patterns begin to emerge that are not visible through isolated observations. Fare changes are rarely random; they follow repeatable behavioral signals tied to inventory pressure and route-level demand.

Detailed analysis of scraped fare data reveals:

- Inventory pressure indicators: Multiple downward adjustments in a short window often signal unsold cabin surplus rather than seasonal discounting.

- Route sensitivity differences: Some itineraries maintain pricing discipline until late booking windows, while others soften earlier due to demand elasticity.

- Discount timing strategy: Costa generally avoids aggressive early discounts, reserving sharper reductions for final booking phases when occupancy targets are at risk.

- Brand-protective pricing behavior: Instead of lowering fares, Costa frequently enhances inclusions to stimulate demand without eroding perceived value.

- Competitive reaction patterns: Sudden fare changes often align with competitor pricing shifts on overlapping routes.

These insights form the foundation of Costa Cruise deal trend analysis, allowing analysts to anticipate when discounts are likely to emerge instead of reacting after deals go live.

Using Route Data to Contextualize Pricing Behavior

Fare data becomes significantly more powerful when combined with itinerary and route intelligence. Mapping prices against ports, distances, and regions reveals how geography influences Costa’s pricing decisions.

When paired with a Global Cruise Route Dataset, analysts can identify which destinations consistently rely on discounts and which sustain premium pricing. For example, short-haul Mediterranean cruises may show frequent price adjustments due to high competition, while limited-season Northern European routes often maintain stable fares longer.

This route-level context helps businesses prioritize inventory, target promotions, and align marketing strategies with real demand behavior rather than assumptions.

Understanding Value Beyond the Headline Price

Modern cruise pricing is not solely about lowering fares. In many cases, Costa adjusts perceived value without changing the base price. Scraped data reveals when added inclusions replace direct discounts, a tactic that protects margins while still driving conversions.

This deeper layer of insight defines Cruise Pricing Intelligence, as it evaluates total offer value rather than focusing only on visible price cuts. Understanding when value is added instead of discounted is critical for accurate benchmarking and revenue analysis.

Regional Pricing Behavior and Market Differentiation

Costa Cruises operates across multiple geographic markets, and pricing behavior varies significantly by region. European sailings often follow different discount rhythms compared to South American or Asian itineraries, reflecting regional booking habits and competitive pressure.

By applying Costa Cruise pricing intelligence, analysts can compare identical sailings across regional portals, revealing how currency, demand elasticity, and local competition influence fare structures. This insight is especially valuable for global travel platforms managing cross-market pricing strategies.

Structuring Scraped Data for Long-Term Intelligence

Raw pricing data has limited value without structure. Organizing fares by sail date, route, cabin type, and booking window enables advanced analytics and forecasting.

A well-maintained Costa Cruise ticket pricing dataset supports price elasticity modeling, trend forecasting, and historical benchmarking. Over time, this dataset becomes a strategic asset that informs marketing decisions, inventory planning, and deal timing optimization.

Business Impact Across the Cruise Ecosystem

Cruise price scraping benefits multiple stakeholders across the travel and analytics ecosystem. Travel agencies improve booking recommendations, OTAs enhance deal visibility, and intelligence providers model demand against capacity. Revenue teams also use this data to benchmark Costa’s behavior against competitors and identify pricing gaps.

The competitive advantage comes not from seeing prices, but from understanding how and why they move.

How Travel Scrape Can Help You?

1. Real-Time Price Monitoring

Real-Time Price Monitoring captures continuous fare changes across routes, cabins, and dates, helping you identify optimal booking windows, sudden discounts, and pricing anomalies faster reliably.

2. Historical Trend Analysis

Historical Trend Analysis builds structured datasets over time, enabling you to forecast pricing behavior, compare seasonal patterns, and predict future deal cycles accurately with confidence.

3. Route-Level Intelligence

Route-Level Intelligence links pricing with itineraries, destinations, and demand signals, helping you prioritize high-margin routes, optimize inventory strategies, and improve revenue planning decisions across markets.

4. Competitive Benchmarking

Competitive Benchmarking tracks competitor fares alongside yours, revealing pricing gaps, undercut risks, and positioning opportunities so you can adjust strategies proactively and confidently at scale.

5. Automation and Scalability

Automation and Scalability eliminate manual tracking, delivering clean, structured data feeds that integrate into dashboards, analytics models, and decision systems without operational overhead delays errors.

Conclusion

Costa Cruise pricing is intentionally fluid, designed to respond to demand signals, route performance, and inventory pressure. Without continuous monitoring, these movements remain reactive and fragmented. Data-driven analysis enables businesses to see beyond promotions and understand the logic behind fare changes.

Effective Costa Cruise discount & deal monitoring allows stakeholders to identify genuine value opportunities rather than headline offers. Continuous Tracking Costa Cruise fare changes data transforms volatility into predictability. When supported by enterprise-grade Cruise & Ferry Data Scraping Services, this approach delivers long-term strategic advantage in an increasingly competitive cruise market.

Ready to elevate your travel business with cutting-edge data insights? Scrape Aggregated Flight Fares to identify competitive rates and optimize your revenue strategies efficiently. Discover emerging opportunities with tools to Extract Travel Website Data, leveraging comprehensive data to forecast market shifts and enhance your service offerings. Real-Time Travel App Data Scraping Services helps stay ahead of competitors, gaining instant insights into bookings, promotions, and customer behavior across multiple platforms. Get in touch with Travel Scrape today to explore how our end-to-end data solutions can uncover new revenue streams, enhance your offerings, and strengthen your competitive edge in the travel market.