Scraping Autumn Escapes vs Pre-Diwali Travel Price Trends: Seasonal Shifts in Global Travel Costs

Introduction

The travel industry in 2025 is undergoing rapid transformations, with travelers prioritizing affordability, seasonal preferences, and creating memorable experiences. This report presents a comparative analysis of two significant travel periods: Scraping Autumn Escapes (September to November) and Pre-Diwali travel (mid-October to early November). These windows align with cultural festivals, favorable climates, and shoulder season advantages, all of which directly influence travel costs and demand. Using India Pre-Diwali travel price scraping, the report highlights price fluctuations, booking surges, and destination popularity during festive travel. Alongside, insights from Travel Review Analysis shed light on traveler expectations, satisfaction levels, and service benchmarks across the USA, India, and Japan. By combining data from online travel platforms, industry sources, and custom scraping tools, this research provides actionable intelligence. Scraping Autumn Escapes vs Pre-Diwali Travel Price Trends not only supports travelers in making informed decisions but also empowers stakeholders to design competitive strategies, adapt pricing models, and optimize customer engagement during these peak seasons.

Methodology

The data for this report was collected through Custom Travel Data Scraping from major online travel agencies (OTAs) such as MakeMyTrip, Skyscanner, Booking.com, and Expedia, alongside hotel and airline websites. Price data for flights, accommodations, and vacation rentals were scraped from September to November 2025, covering both Autumn Escapes and Pre-Diwali travel windows. Japan autumn tourism price monitoring was conducted using regional platforms like Rakuten Travel and JTB, while Scraping USA autumn escape price data relied on platforms like Airbnb, Expedia, and Kayak. For India, Scrape Travel Offers for Indian Destinations 2025 focused on domestic and international travel packages from tier 1 and tier 2 cities. Data was aggregated and analyzed to identify trends in pricing, demand, and booking behavior, ensuring a comprehensive comparison.

Autumn Escapes: A Global Perspective

Autumn Escapes, typically spanning September to November, are characterized by cooler weather, vibrant foliage, and lower travel costs due to the shoulder season. In the USA, destinations such as New England (Vermont, Maine) and the Pacific Northwest (Oregon, Washington) experience a surge in demand for autumn foliage tours. Scraping USA autumn escape price data reveals that average round-trip airfares from major US cities to these destinations range from $150 to $300, with accommodations (3-star hotels) averaging $100–$180 per night. Vacation rentals, tracked via Autumn escape vacation rental tracking USA vs Japan, show Airbnb listings in Vermont averaging $120–$200 per night, a 10% decrease from summer rates.

In Japan, autumn is a peak season for tourism due to the stunning fall foliage, particularly in Kyoto and Hokkaido. Japan autumn tourism price monitoring indicates that round-trip flights from India to Japan average $450–$700, while domestic flights within Japan (e.g., Tokyo to Sapporo) cost $80–$150. Hotel prices in Kyoto range from $90 to $220 per night for mid-range properties, with a 15% premium during late October due to foliage-related demand. Vacation rentals in Japan, which are less common than in the USA, typically average $100–$180 per night for traditional ryokans or modern apartments.

In India, Autumn Escapes align with cooler weather in hill stations like Manali and Darjeeling, attracting domestic travelers. Scrape Travel Offers for Indian Destinations 2025 to reveal domestic flight prices from Delhi to Manali averaging $60–$120 round-trip, with 3-star hotels costing $40–$80 per night. The shoulder season advantage keeps prices lower than summer or winter peaks, making autumn a cost-effective period for domestic travel.

Pre-Diwali Travel: India’s Festive Surge

Pre-Diwali travel, occurring in mid-October to early November, is a high-demand period in India due to the Diwali festival, a time when families reunite and travel for celebrations. India Pre-Diwali travel price scraping highlights a significant price surge, with domestic flight prices increasing by 20–30% compared to September. For instance, flights from Mumbai to Delhi average $80–$150 round-trip, while popular destinations like Goa see fares rise to $100–$180. Hotel prices in metro cities and tourist hotspots, such as Jaipur and Udaipur, range from $50 to $120 per night, with a 25% increase in the week leading up to Diwali.

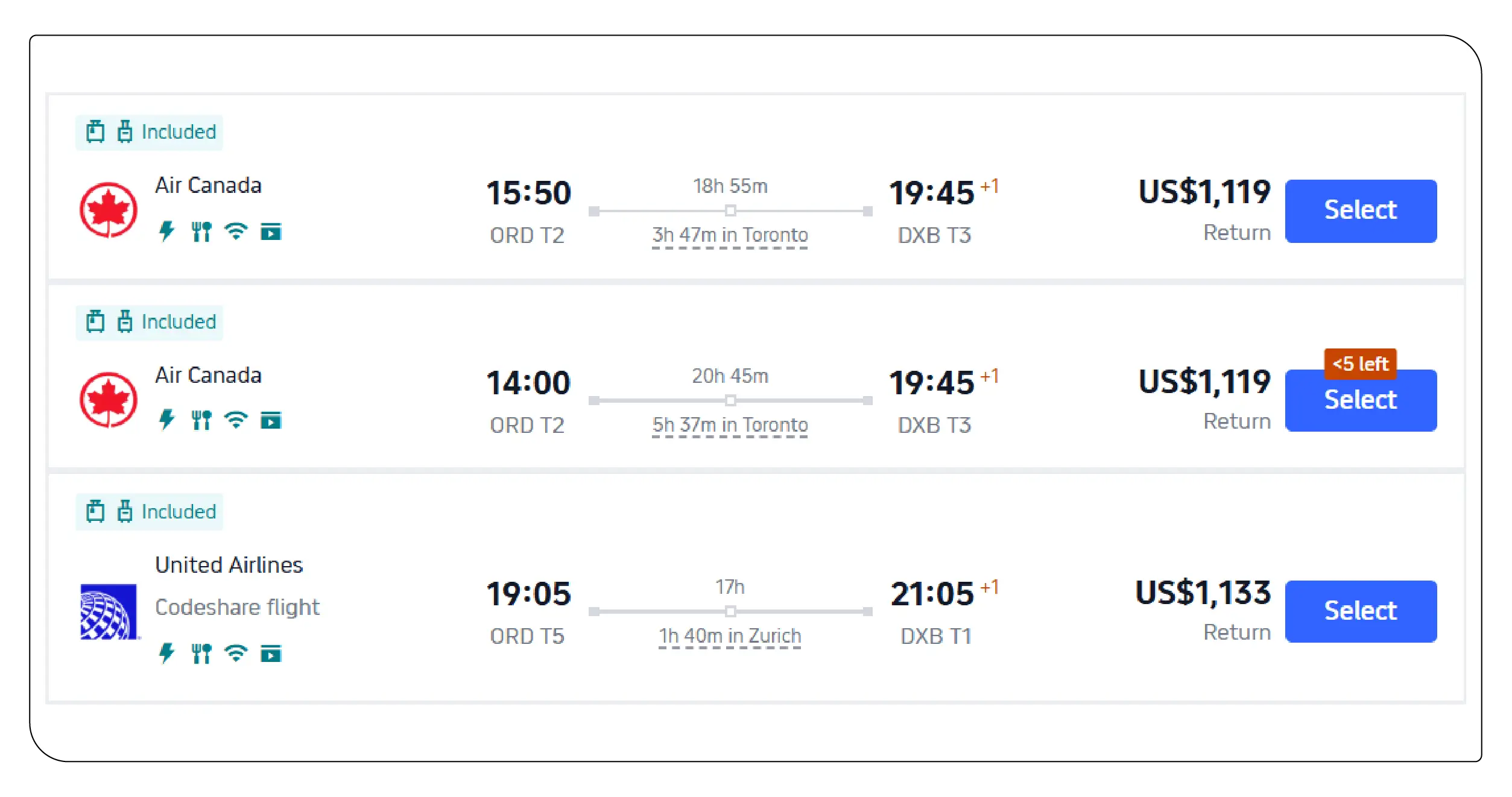

International travel during the pre-Diwali period also sees heightened demand, particularly to destinations such as the USA and Japan. Pre-Diwali travel prices compare using scraping insights show round-trip flights from India to the USA (e.g., Delhi to New York) costing $800–$1,200, a 15% increase from early September. Similarly, flights to Japan rise to $600–$900 due to overlapping autumn foliage demand. Accommodation prices in the USA during this period remain relatively stable, with 3-star hotels in New York averaging $150–$250 per night, while Japan sees a slight uptick in hotel rates (e.g., $100–$240 in Tokyo).

Comparative Price Analysis

The following table compares average prices for flights and accommodations during Autumn Escapes and Pre-Diwali travel across the USA, India, and Japan, based on data scraped in August 2025.

Table 1: Price Comparison for Autumn Escapes vs Pre-Diwali Travel (2025)

| Destination | Travel Period | Round-Trip Flight (USD) | 3-Star Hotel/Night (USD) | Vacation Rental/Night (USD) |

|---|---|---|---|---|

| USA (New York) | Autumn Escapes | 150–300 (domestic) | 100–180 | 120–200 |

| USA (New York) | Pre-Diwali | 800–1,200 (from India) | 150–250 | 140–220 |

| India (Delhi) | Autumn Escapes | 60–120 (domestic) | 40–80 | 50–100 |

| India (Delhi) | Pre-Diwali | 80–150 (domestic) | 50–120 | 60–120 |

| Japan (Tokyo) | Autumn Escapes | 450–700 (from India) | 90–220 | 100–180 |

| Japan (Tokyo) | Pre-Diwali | 600–900 (from India) | 100–240 | 120–200 |

Source: Data compiled using Travel Scraping API Services from OTAs and hotel booking platforms, August 2025.

The table illustrates that Pre-Diwali travel is consistently more expensive, particularly for flights, due to festival-driven demand in India and overlapping autumn tourism in Japan. The USA sees stable accommodation prices but higher international flight costs from India during Pre-Diwali.

Booking Trends and Traveler Preferences

Travel Review Analysis indicates that Indian travelers prioritize cost-effectiveness and flexibility during Autumn Escapes, often opting for shoulder season destinations to avoid crowds and save money. In contrast, Pre-Diwali travel is driven by cultural obligations, with 85% of Indian travelers planning to increase holiday frequency in 2025, and 84% raising travel budgets by 20–50%. Social media platforms like Instagram influence 42% of young travelers’ destination choices, amplifying demand for visually appealing locations like Japan’s autumn landscapes.

In the USA, Autumn escape vacation rental tracking USA vs Japan shows a preference for vacation rentals over hotels, with 62% of travelers seeking budget-friendly accommodations. Japan’s travelers, however, favor hotels and ryokans for cultural immersion, with 60% prioritizing wellness and relaxation. Travel Scraping API Services reveal that 66.67% of bookings in India are made via mobile apps, reflecting a mobile-first strategy.

Regional Insights

USA

Autumn Escapes in the USA benefit from lower hotel rates (down 4.8% year-over-year) and airfares slightly above 2024 levels (0.7% increase). Destinations like Asheville, North Carolina, and the Catskills, New York, are trending for their affordability and natural beauty.

India

Pre-Diwali travel dominates domestic tourism, with 40% of searches concentrated in top cities like Goa and Delhi. Offbeat destinations like Gokarna and Karwar gain traction for their authenticity, driven by DINK couples and remote workers.

Japan

Japan’s autumn season is a magnet for international tourists, with Kyoto and Hokkaido seeing high demand. Japan autumn tourism price monitoring highlights a 15% price premium in late October, but early booking can yield savings of up to 20%.

Cost-Saving Strategies

To maximize value, travelers can leverage the following insights from Custom Travel Data Scraping:

- Book Early for Pre-Diwali: Book flights and accommodations 2–3 months in advance to avoid festival surcharges.

- Opt for Shoulder Seasons: Travel in early September or late November for Autumn Escapes to secure lower rates.

- Use Loyalty Points: 79% of Indian travelers plan to use credit card rewards for flights and hotels, saving 15–20% on costs.

- Monitor Prices Dynamically: Utilize Travel Scraping API Services to track real-time price fluctuations and book during sales.

Price Trends by Category

Table 2: Price Trends by Category (Autumn Escapes vs Pre-Diwali, 2025)

| Category | Autumn Escapes (USD) | Pre-Diwali (USD) | Price Difference (%) |

|---|---|---|---|

| Domestic Flights (India) | 60–120 | 80–150 | +25% |

| Int’l Flights (to USA) | 700–1,000 | 800–1,200 | +15% |

| Int’l Flights (to Japan) | 450–700 | 600–900 | +20% |

| Hotels (USA) | 100–180 | 150–250 | +10% |

| Hotels (India) | 40–80 | 50–120 | +20% |

| Hotels (Japan) | 90–220 | 100–240 | +15% |

| Vacation Rentals (USA) | 120–200 | 140–220 | +10% |

| Vacation Rentals (Japan) | 100–180 | 120–200 | +12% |

Conclusion

The comparative analysis of Seasonal travel scrape data showing autumn vs festival trends reveals that Autumn Escapes offer cost advantages over Pre-Diwali travel, particularly for domestic travel in India and autumn tourism in the USA and Japan. Pre-Diwali travel, driven by cultural significance, commands a premium, with flight and hotel prices rising by 10–25% across regions. Festival vs seasonal travel scraping reports underscore the importance of early booking and leveraging loyalty programs to mitigate costs. The rise of Online Travel Booking Trends 2025, with 66.67% of bookings made via mobile apps and 35% of travelers using social media for inspiration, highlights the role of technology in shaping travel decisions. Travelers seeking value should prioritize Autumn Escapes for cost savings, while those traveling for Diwali should plan strategically to manage higher costs. This report provides a data-driven foundation for travelers and industry stakeholders to navigate the dynamic travel landscape of 2025.

Ready to elevate your travel business with cutting-edge data insights? Get in touch with Travel Scrape today to explore how our end-to-end data solutions can uncover new revenue streams, enhance your offerings, and strengthen your competitive edge in the travel market.