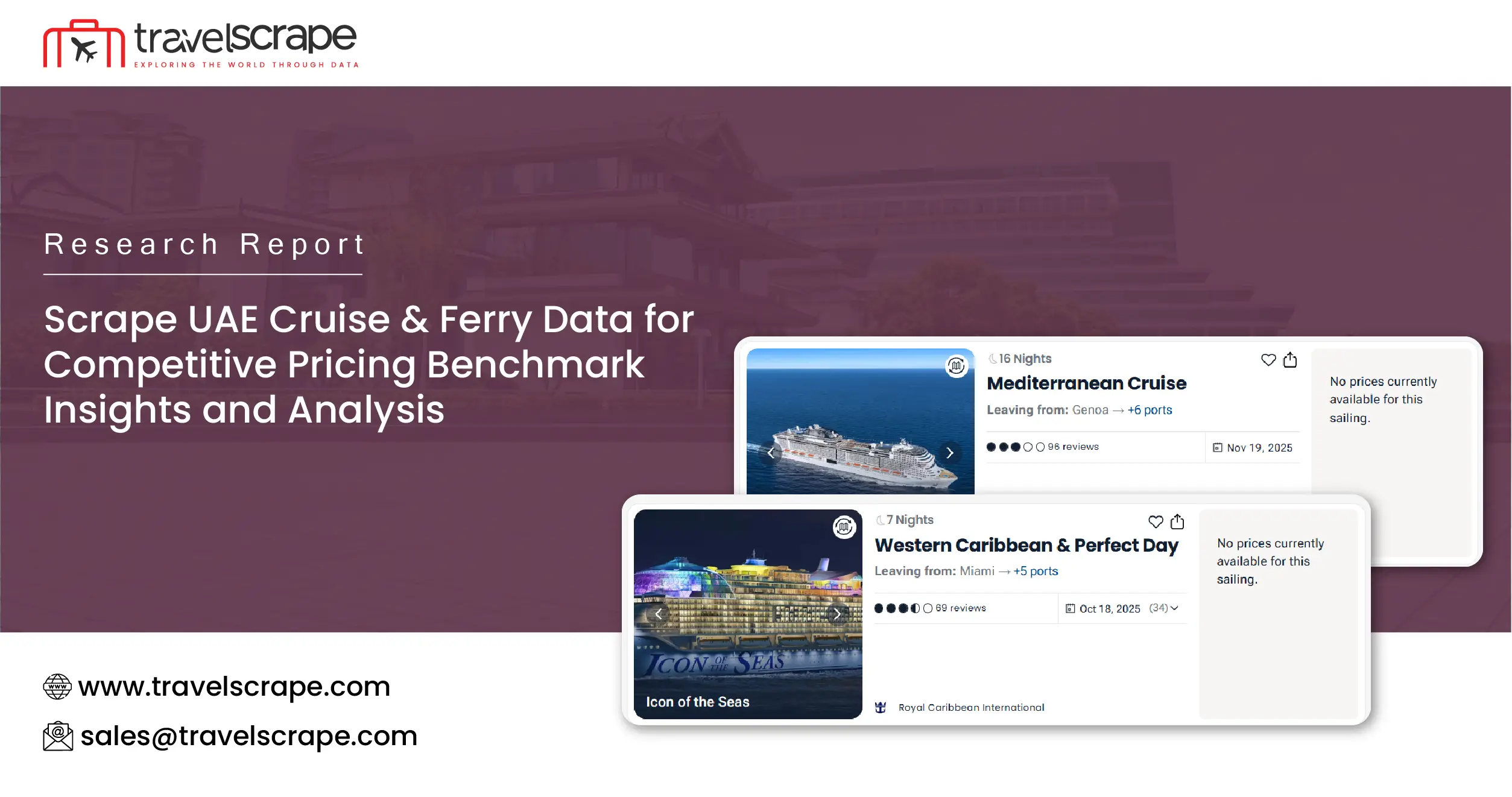

Scrape UAE Cruise & Ferry Data for Competitive Pricing Benchmark: Insights and Analysis

Introduction

The maritime travel and tourism sector in the United Arab Emirates (UAE) has witnessed a rapid transformation over the past decade, driven by rising demand for leisure cruises, inter-emirate ferries, and regional maritime connectivity. Travelers seek not only memorable experiences but also competitive ticket pricing that aligns with their budgets. In this environment, businesses and policymakers increasingly turn to data-driven strategies for understanding pricing dynamics. Leveraging advanced web scraping methodologies has emerged as a critical tool for market intelligence in this sector. The ability to Scrape UAE Cruise & Ferry Data for Competitive Pricing Benchmark enables operators, analysts, and regulators to derive valuable insights into price variability, market positioning, and consumer trends.

With the rise in digital booking platforms and online aggregators, comprehensive Cruise & Ferry Data Scraping Services provide stakeholders with accurate, real-time snapshots of pricing fluctuations across routes and providers. Moreover, the necessity of Scraping UAE cruise & ferry rates for Competitive Pricing Benchmark is not merely academic—it has practical implications for pricing optimization, operational strategy, and traveler satisfaction. This report examines competitive pricing benchmarks for UAE cruises and ferries using scraped data, presenting empirical insights, comparative analysis, and strategic recommendations.

Market Overview of UAE Cruises and Ferries

Growth Drivers

- UAE’s position as a luxury tourism hub attracts international cruise lines and ferry operators.

- Strong inter-emirate and regional demand for marine travel between Dubai, Abu Dhabi, Sharjah, and beyond.

- Increased adoption of online booking systems is making pricing data more accessible for analysis.

Market Challenges

- Pricing competition between established cruise operators and smaller ferry services.

- Volatility due to seasonal tourism peaks, particularly during winter and major events like Expo and New Year celebrations.

- Lack of transparency in bundled packages, where inclusions vary widely.

Role of Scraped Data in Pricing Benchmarking

Scraped data enables the development of a Global Cruise Route Dataset that aggregates information on ticket costs, onboard facilities, seasonal discounts, and competitor trends. For UAE-specific benchmarking, this dataset provides the context necessary to evaluate pricing strategies.

Data scraping captures price listings in real time, allowing operators to Benchmark UAE ferry and cruise pricing with data scraping rather than relying on outdated reports or averages. Moreover, integrating a Global Ferry Route Dataset into UAE analyses helps compare regional competitiveness, giving insight into how UAE pricing aligns or diverges from global averages.

Methodology

The research methodology involved:

- Identifying primary booking platforms, cruise operator websites, and third-party aggregators.

- Deploying customized scraping pipelines for structured extraction of ticket prices, travel classes, package inclusions, and availability.

- Cleaning datasets to ensure consistency and eliminate duplicates.

- Segmenting data by provider, route, time of year, and package type.

- Applying benchmarking frameworks to compare UAE ferry and cruise pricing with regional and global standards.

The dataset spans six months of scraped entries across prominent UAE-based cruise lines and ferry providers.

Key Findings

- Seasonal Price Variability

Scraped results indicated significant price hikes during December–February, coinciding with peak tourism season in Dubai and Abu Dhabi. Off-peak months like June–August displayed up to 40% lower ticket costs. - Package Complexity

Luxury cruise operators frequently bundle amenities such as fine dining, spa services, and shore excursions. This bundling often obscured base ticket comparisons, underscoring the need for normalized benchmarking metrics. - Route-Specific Differences

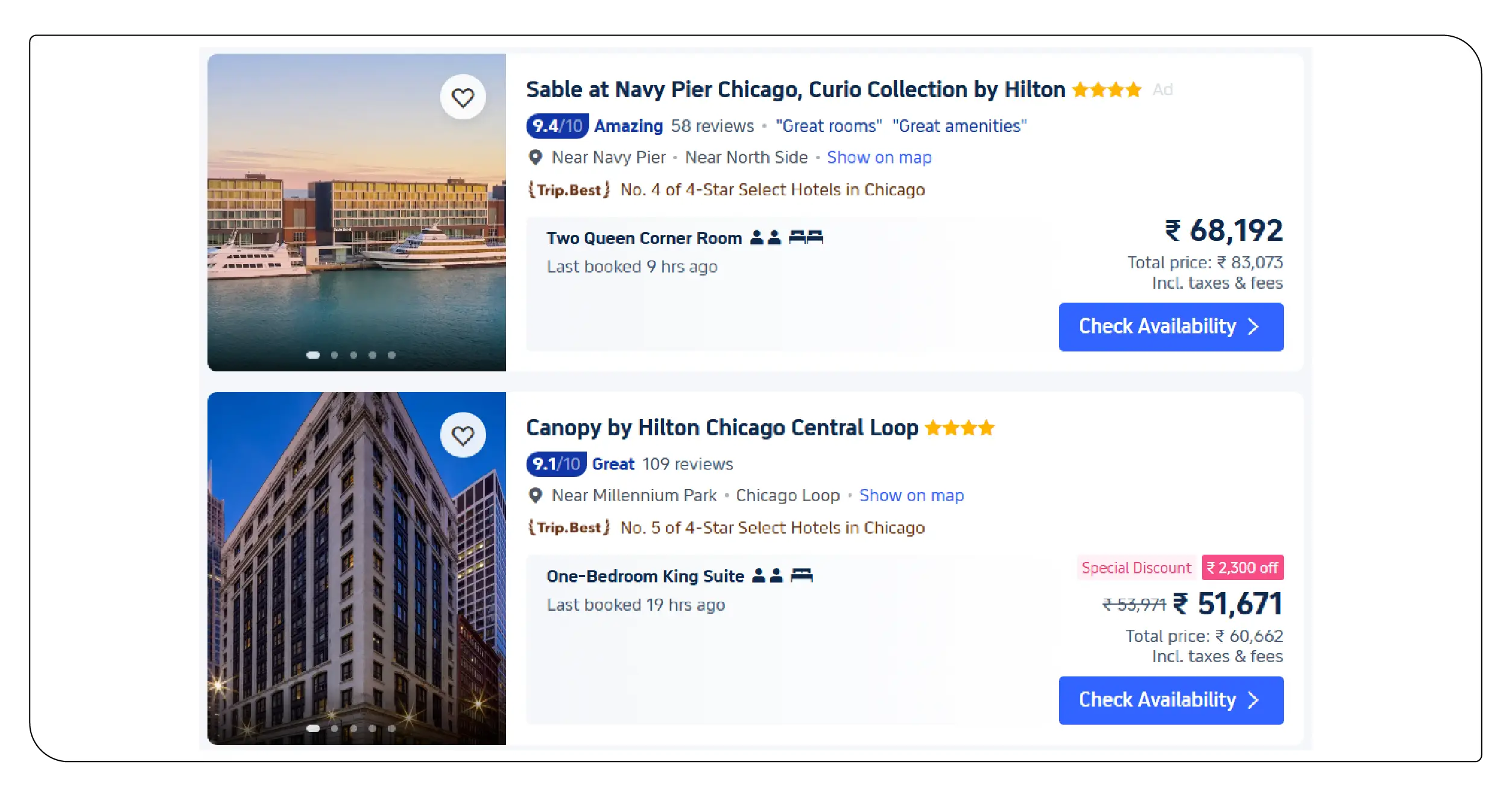

Inter-emirate ferries displayed consistent, low variability pricing, while international cruise routes showed wide-ranging costs based on cabin categories and package upgrades. - Digital Transparency

Scraping exposed discrepancies between aggregator prices and official operator websites, with differences as high as 12% for identical journeys.

Pricing Benchmark Table 1: UAE Ferry Routes

| Ferry Route (UAE) | Economy Fare (AED) | Business Fare (AED) | Avg. Seasonal Fluctuation | Notes |

|---|---|---|---|---|

| Dubai – Sharjah | 35 | 70 | 10% | Stable commuter demand |

| Abu Dhabi – Dubai | 55 | 110 | 15% | Weekend leisure surge |

| Ras Al Khaimah – Dubai | 65 | 120 | 12% | Higher demand during public holidays |

| Fujairah – Sharjah | 50 | 95 | 14% | Limited frequency increases price |

| Abu Dhabi – Sir Bani Yas | 75 | 150 | 20% | Eco-tourism routes with higher peaks |

Pricing Benchmark Table 2: UAE Cruise Packages

| Cruise Line / Route | Interior Cabin (AED) | Balcony Cabin (AED) | Suite (AED) | Avg. Seasonal Price Change | Key Add-ons |

|---|---|---|---|---|---|

| Dubai – Muscat (4 Nights) | 1,800 | 2,900 | 4,500 | 25% | Meals + excursions |

| Abu Dhabi – Doha (3 Nights) | 1,600 | 2,600 | 4,000 | 20% | Inclusive beverages |

| Dubai – Bahrain – Kuwait (7 Nights) | 3,200 | 5,000 | 8,200 | 30% | Entertainment + premium dining |

| Gulf Circle Cruise (5 Nights) | 2,200 | 3,800 | 6,200 | 28% | Spa & wellness packages |

| Dubai – India (10 Nights) | 4,000 | 6,800 | 11,500 | 35% | Multi-country excursion bundles |

Strategic Implications

The ability of Scraping UAE cruise & ferry pricing to monitor travel market trends is not just limited to tracking ticket fluctuations. Operators can integrate Cruise and Ferry Data Intelligence into their strategic decisions:

- Dynamic Pricing Optimization – Aligning ticket costs with demand elasticity and competitor benchmarks.

- Product Differentiation – Highlighting value-added services that justify higher price bands.

- Consumer Trust Enhancement – Ensuring consistency across direct booking and aggregator platforms.

- Revenue Forecasting – Using predictive analytics powered by scraped data to model seasonal revenue expectations.

- Market Expansion – Comparing UAE prices with regional routes using global datasets to identify competitive opportunities.

Future Outlook

The UAE maritime travel sector is positioned for robust growth as operators adopt technology-driven models. Real-time extraction of UAE cruise and ferry pricing for market insights will increasingly define how companies compete. Integration of AI with scraped data pipelines can provide predictive forecasts, automate competitor monitoring, and refine dynamic pricing systems.

Global operators are also showing interest in UAE as a cruise hub, meaning competitive pressures will intensify. Leveraging scraped datasets for rapid adaptation will be the key to market sustainability.

Conclusion

This research demonstrates that competitive benchmarking of UAE cruises and ferries is best achieved through structured, technology-driven approaches using real-time scraped datasets. The integration of digital insights into pricing strategies ensures operational agility, improved consumer trust, and stronger profitability. As new routes and operators enter the UAE market, the scope for competitive analysis will only expand. Businesses that embrace advanced scraping frameworks and analytical models will lead this transformation.

Ultimately, Competitive UAE cruise and ferry price analysis using scraped data delivers actionable intelligence for operators, policymakers, and travelers alike. Moreover, the capacity of Extracting real-time UAE cruise and ferry rates via API for benchmarking extends beyond pricing into forecasting and personalization. Future developments may also include the ability to Scrape Cruise Lines Personalized Packages via API, allowing unprecedented levels of customization, transparency, and competitiveness in the UAE’s maritime tourism industry.

Ready to elevate your travel business with cutting-edge data insights? Scrape Aggregated Flight Fares to identify competitive rates and optimize your revenue strategies efficiently. Discover emerging opportunities with tools to Extract Travel Website Data, leveraging comprehensive data to forecast market shifts and enhance your service offerings. Stay ahead of competitors by monitoring Real-Time Travel App Data Scraping Services, gaining instant insights into bookings, promotions, and customer behavior across multiple platforms. Get in touch with Travel Scrape today to explore how our end-to-end data solutions can uncover new revenue streams, enhance your offerings, and strengthen your competitive edge in the travel market.