Scrape Top Hotel Chains in India to Unlock Market Expansion Opportunities

This report analyzes Top Hotel Chains in India, their city-wise distribution, occupancy trends, and data-driven expansion opportunities for 2026.

Introduction

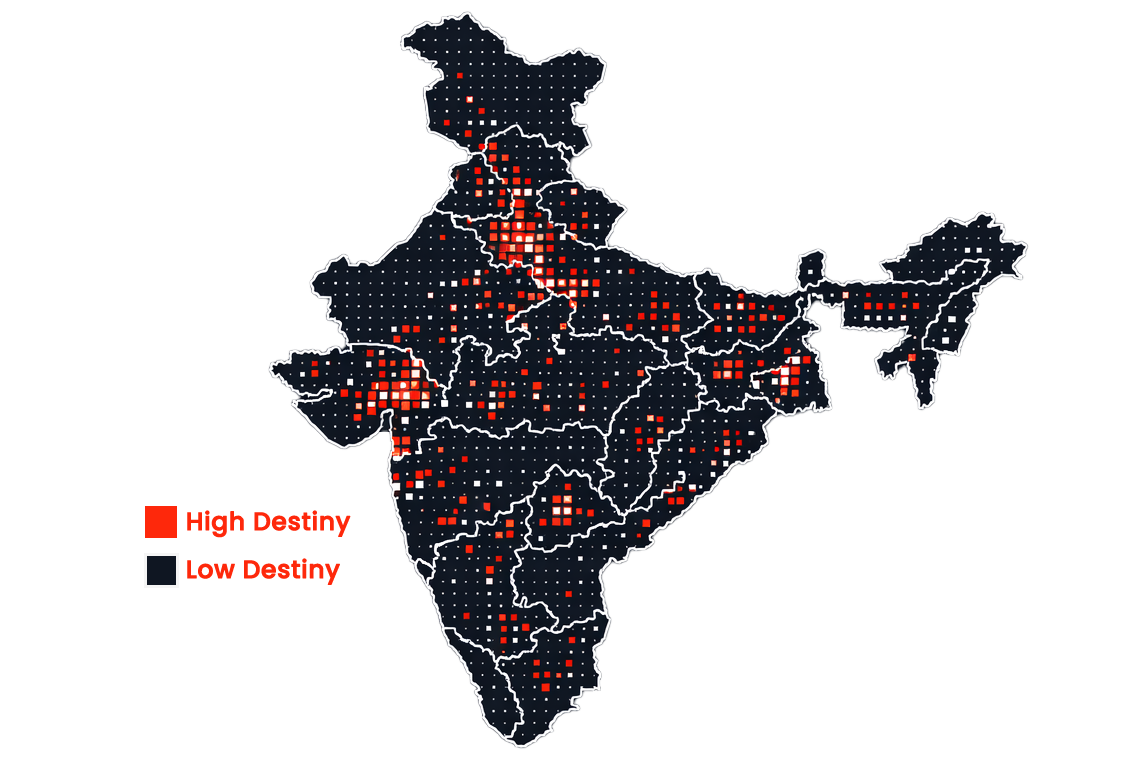

India’s hospitality sector is entering a transformative phase in 2026, driven by domestic tourism growth, business travel recovery, and rapid expansion of branded budget and mid-scale properties. To understand this evolving landscape, this research leverages insights derived as organizations increasingly Scrape Top Hotel chains in India to monitor expansion strategies, city-wise penetration, and competitive positioning. Advanced tools such as a Real-Time Hotel Data Scraping API now enable continuous visibility into hotel openings, closures, pricing signals, and occupancy trends, supporting stronger Indian hotel chains data intelligence for investors, travel platforms, and hospitality consultants.

This report analyzes monitored hotel chain activity across 435 Indian cities, covering 4,422 hotels and 101 hotel chains, including dominant players such as OYO Rooms, FabHotels, and The Indian Hotels Company Limited. The focus is on geographic concentration, urban dominance, operational scale, and future-ready insights for 2026.

4,422+

Hotels Tracked

101+

Hotel Chains

435+

Cities Covered

Top States by Number of Hotels

States with the Highest Concentration of Branded Hotel Chains in India

DELHI NCR

480+

Driven by government travel, corporate headquarters, international arrivals, and dense business districts across New Delhi, Gurgaon, and Noida.

KARNATAKA

420+

Led by Bangalore’s dominance as India’s IT and startup hub, with year-round business travel and strong budget-to-premium hotel mix.

MAHARASHTRA

360+

Anchored by Mumbai and Pune, supported by financial services, manufacturing, events, and expanding leisure destinations like Nashik.

TELANGANA

240+

Hyderabad’s technology parks, pharma corridor, and convention demand continue to attract aggressive hotel chain expansion.

TAMIL NADU

180+

Chennai and Coimbatore drive steady demand through industrial travel, healthcare tourism, and regional business movement.

RAJASTHAN

160+

Jaipur and Udaipur lead leisure-focused chain growth, combining heritage tourism with increasing mid-scale and branded budget supply.

What is the largest hotel chain in India?

OYO Rooms is the largest hotel chain in India in 2026.

OYO Rooms

PROPERTIES

States

30+

Cities

300+

Largest hotel chain across 30+ major states and 300+ cities

FabHotels

PROPERTIES

States

22+

Cities

120+

Largest hotel chain across 22+ key states and 120+ cities

Treebo Hotels

PROPERTIES

States

20+

Cities

110+

Largest hotel chain across 20 states and 110+ cities

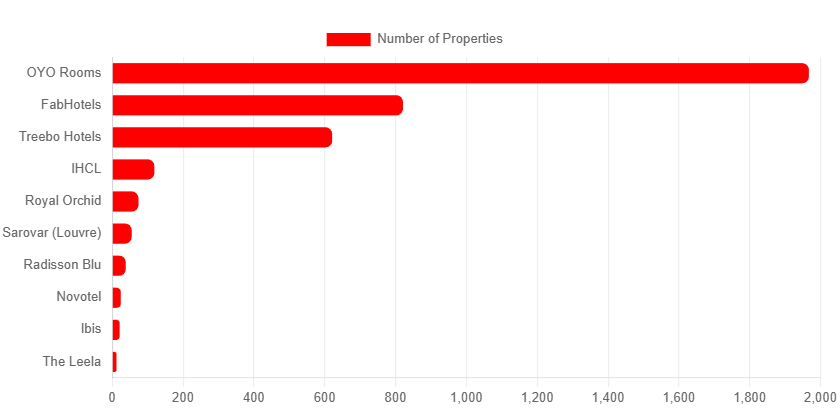

Top 10 Hotel Chains in India by Property Count and Geographic Presence – 2026

The table highlights the distribution and operational scale of leading hotel chains in India in 2026, reflecting varied expansion strategies. Budget and mid-scale brands like OYO Rooms, FabHotels, and Treebo Hotels dominate geographically, operating across more than 20 states and over 100 cities, ensuring deep market penetration. Luxury and upscale brands such as IHCL, The Leela, Radisson Blu, Novotel, and Ibis maintain a selective presence, focusing on key metro and tier-1 cities. Overall, the data illustrates how affordability-driven chains prioritize reach, while premium brands emphasize strategic, high-value locations.

| Hotel Chain | Total Properties | Availability (No. of States) | Availability (No. of Cities) | Download Dataset |

|---|---|---|---|---|

| OYO Rooms | 1,967 | 30+ states | 300+ cities | Download |

| FabHotels | 821 | 22+ states | 120+ cities | Download |

| Treebo Hotels | 621 | 20+ states | 110+ cities | Download |

| The Indian Hotels Co. Ltd (IHCL – Taj Group) | 119 | 18+ states | 70+ cities | Download |

| The Leela | 12 | 7 states | 10 cities | Download |

| Sarovar (Louvre) | 55 | 14 states | 45+ cities | Download |

| Radisson Blu | 38 | 16 states | 30+ cities | Download |

| Royal Orchid Hotels | 74 | 15 states | 50+ cities | Download |

| Novotel | 24 | 10 states | 20+ cities | Download |

| Ibis | 21 | 9 states | 18+ cities | Download |

What are the largest hotel chains in India in 2026?

Scraping hotel chain locations in India reveals that OYO Rooms, FabHotels, and Treebo Hotels are the largest hotel chains in India in 2026 based on the number of properties. OYO Rooms leads with 1,967 properties across Bangalore, Hyderabad, and New Delhi. FabHotels has 821 properties in New Delhi, Bangalore, and Pune. Treebo Hotels operates 621 properties in Bangalore, Pune, and Hyderabad. Combined, these three budget chains make up over 50% of the top 10 largest hotel chains in India.

Top 10 Hotel Chains in India – 2026

In 2026, India’s hotel landscape is dominated by a mix of budget, mid-scale, and luxury chains, reflecting diverse travel demand. OYO Rooms leads with 1,967 properties across Bangalore, Hyderabad, and New Delhi, catering primarily to budget and economy travelers. FabHotels and Treebo Hotels strengthen the mid-scale and budget segments, with strategic presence in major metros like Pune, Bangalore, and Hyderabad. Luxury and premium hospitality is led by IHCL and The Leela, operating in high-demand cities including Mumbai, Jaipur, and New Delhi. OPur Hotel chain data scraping API India showed that chains like Royal Orchid, Sarovar, Radisson Blu, Novotel, and Ibis provide a blend of upscale and mid-scale offerings. This distribution ensures comprehensive coverage across business, leisure, and transit-driven travel corridors.

OYO Rooms

Budget LeaderOYO Rooms is India’s largest hotel chain, focusing on budget travelers, tech-driven bookings, and wide city presence for business and leisure.

FabHotels

Luxury / HeritageFabHotels is a budget and mid-scale chain, offering standardized amenities, centralized bookings, and serving corporate and domestic travelers in key Indian cities.

Treebo Hotels

Upscale / BusinessTreebo Hotels is a budget hotel brand providing quality, tech-enabled management, targeting business and leisure travelers, ensuring consistent experiences across locations.

The Indian Hotels Co. Ltd (IHCL)

Mid-ScaleIHCL is a luxury chain offering heritage and modern experiences, targeting affluent and corporate travelers with selective city-focused expansion.

The Leela

Ultra-LuxuryThe Leela is a high-end luxury chain providing personalized services, gourmet dining, premium amenities, and business and leisure guest experiences.

Sarovar (Louvre)

Value Mid-ScaleSarovar is a mid-scale chain serving corporate, government, and leisure travelers, providing standardized, tech-enabled operations across urban and emerging cities.

Radisson Blu

Upper Mid-ScaleRadisson Blu is an upscale luxury chain targeting business and international travelers, emphasizing modern design, premium amenities, and strategic city locations.

Royal Orchid Hotels

Mid-Scale / EconomyRoyal Orchid Hotels is a mid-scale chain balancing business and leisure demand with quality rooms, banquet facilities, and operational efficiency.

Novotel

Premium / LifestyleNovotel is an upscale chain catering to business and leisure travelers, providing contemporary amenities, city-focused growth, and conference facilities.

Ibis

Upscale / BusinessIbis is a mid-scale chain offering affordable, standardized rooms for business, leisure, and transit guests with tech-enabled bookings and consistent service.

Advantages of Chain-Focused Hotel Location Data

Our Indian hotel chain market analysis datasets provide actionable intelligence that empowers organizations to make strategic, data-driven decisions across hospitality operations, investment, and expansion planning. Key benefits include:

- Optimizing Chain Performance: Detailed city-level insights into brand density and competitor activity allow consultants and operators to identify high-performing locations, under-served markets, and opportunities for operational improvement.

- Enhancing Pricing and Booking Strategies: Travel platforms and aggregators can leverage Hotel Data Scraping Services to dynamically adjust rates, forecast demand, and maximize occupancy across both metro and tier-2 cities.

- Supporting Investment and Expansion Decisions: Investors and hotel developers gain critical visibility into market saturation, occupancy trends, and revenue potential, enabling confident decisions on property acquisition, franchising, or portfolio diversification.

- Guiding Regional Market Insights: Tourism boards, analysts, and hospitality strategists can utilize Hotel Data Intelligence to pinpoint emerging travel corridors, forecast seasonal demand, and plan marketing initiatives beyond generic hotel listings.

| Field Name | Description |

|---|---|

| Hotel Name & Brand | Identifies the specific hotel and its chain, e.g., OYO Rooms, FabHotels, IHCL, or Treebo Hotels. |

| Location Details | Includes city, state, full address, and GPS coordinates for precise mapping and site analysis. |

| Room & Occupancy Data | Total number of rooms, occupancy rates, and booking trends for operational and revenue insights. |

| Pricing & Rate Information | Average room rates, seasonal pricing, dynamic rate trends, and competitor pricing intelligence. |

| Guest Ratings & Reviews | Aggregated guest feedback including review scores, number of reviews, and satisfaction metrics. |

Insights and Analysis

The 2026 Indian hotel chain landscape reflects a shift toward data-driven expansion, operational efficiency, and geographic diversification. Budget and mid-scale chains continue to dominate property counts, while premium brands strengthen their presence in high-value urban and leisure destinations.

Daily monitoring of new hotel additions, such as recent FabHotels and OYO properties added in August 2024, highlights how rapidly the market evolves. Chains that integrate continuous data intelligence into planning cycles demonstrate faster response times and more sustainable growth trajectories.

Conclusion

As competition intensifies and traveler expectations rise, the ability to act on accurate location and performance data has become a strategic necessity. By leveraging extraction hotel chain locations in India, stakeholders gain actionable visibility into expansion patterns, while Scraped India hotel chain data enables comparative benchmarking across cities and segments. Ultimately, structured datasets supporting Top 10 Hotel Chains Data Scraping will play a central role in shaping investment decisions, pricing strategies, and market entry planning across India’s hospitality sector in 2026.

Looking to gain deeper insights into India’s hotel chain ecosystem for analytics or investment?

Connect with our experts for continuously updated, city-level intelligence.