Scrape Top Hotel Chains in USA for Nationwide Location and Brand Expansion Insights

In-depth 2026 U.S. hotel industry report analyzing chain expansion, locations, pricing trends, guest reviews, and data-driven growth strategies nationwide.

Introduction

The U.S. hotel industry is entering a transformative phase in 2026, driven by franchising-led expansion, diversified brand portfolios, and increasing penetration into secondary and tertiary cities. To understand this evolving landscape, this research leverages insights derived as organizations increasingly Scrape Top Hotel chains in USA to monitor property distribution, brand saturation, and regional expansion strategies. Advanced tools such as a Real-Time Hotel Data Scraping API now enable continuous visibility into hotel openings, closures, renovations, and rebranding activity, supporting stronger U.S. hotel chains data intelligence for investors, travel platforms, and hospitality consultants.

This report analyzes monitored hotel chain activity across 1,250 U.S. cities, covering 6,200 hotels and 10 major hotel chains, including dominant players such as Marriott International, Hilton Worldwide, and Wyndham Hotels & Resorts. The focus is on geographic concentration, urban dominance, operational scale, and future-ready insights for 2026.

6,200+

Hotels Tracked

10+

Hotel Chains

1,250+

Cities Covered

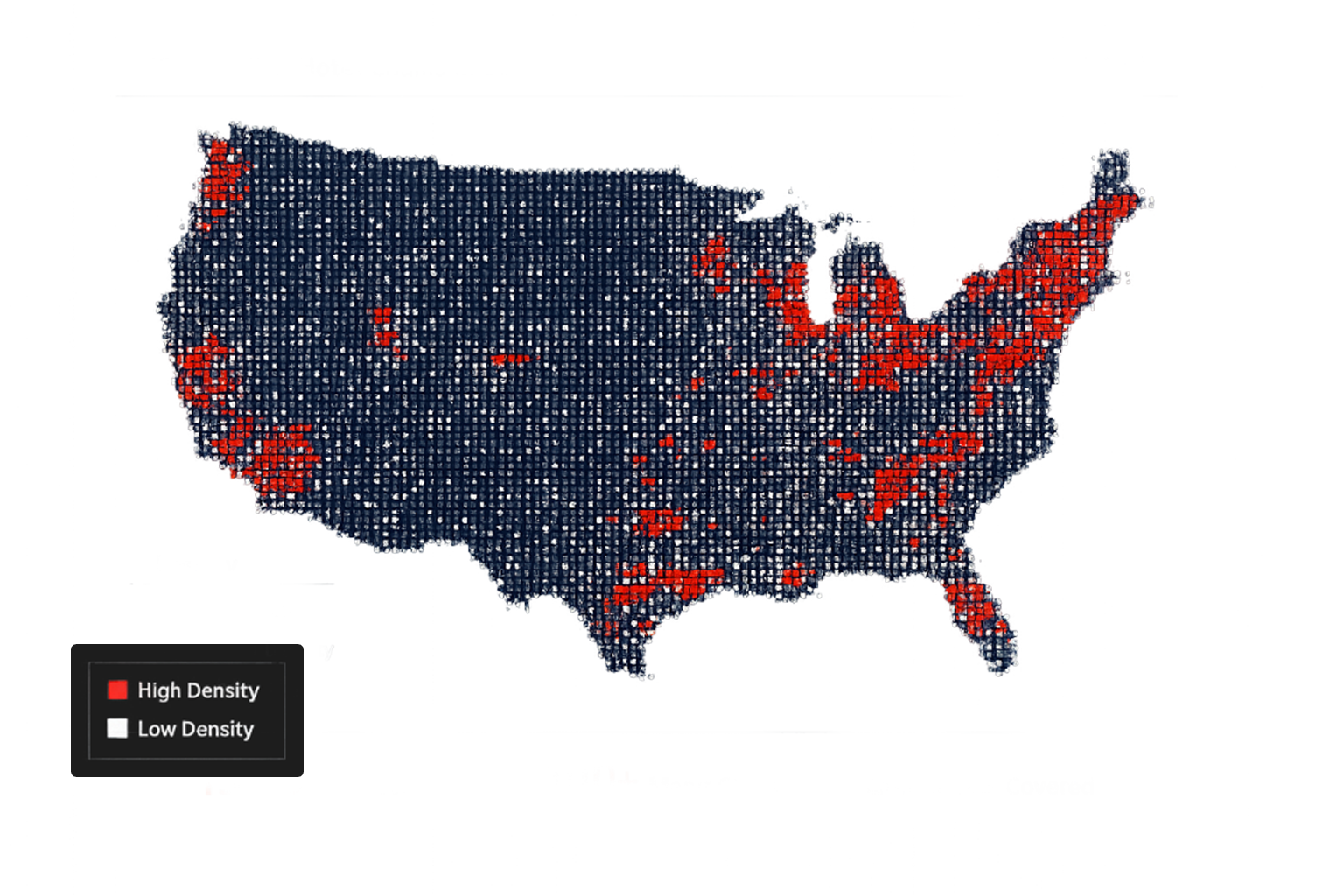

Top States by Number of Hotels

States with the Highest Concentration of Branded Hotel Chains in USA

CALIFORNIA

650+

Driven by strong coastal metros, leisure destinations, technology hubs, and international tourism across Los Angeles, San Francisco, and San Diego.

FLORIDA

520+

Led by Miami, Orlando, and Tampa’s high tourist demand, cruise ports, and convention centers driving business and leisure stays.

TEXAS

480+

Anchored by Dallas, Houston, and Austin, supported by corporate headquarters, suburban business parks, and growing leisure destinations.

NEW YORK

460+

New York City and Albany drive corporate, finance, and urban tourism demand, with heavy metro hotel concentration.

ILLINOIS

250+

Chicago-focused urban and airport-adjacent hotels cater to business travelers and convention traffic.

NEVADA

180+

Las Vegas and Reno lead leisure, entertainment, and convention-driven hotel expansion.

What are the largest hotel chains in the USA in 2026?

Scraping hotel chain locations in USA reveals that Marriott International, Hilton Worldwide, and Wyndham Hotels & Resorts are the largest hotel chains in the United States in 2026 based on the number of properties.

Marriott International

PROPERTIES

States

50+

Cities

1,250+

Largest hotel chain across 50+ major states and 1,250+ cities

Hilton Worldwide

PROPERTIES

States

50+

Cities

1,180+

Largest hotel chain across 50+ key states and 1,180+ cities

Wyndham Hotels & Resorts

PROPERTIES

States

45+

Cities

1,420+

Largest hotel chain across 45+ major states and 1,420+ cities

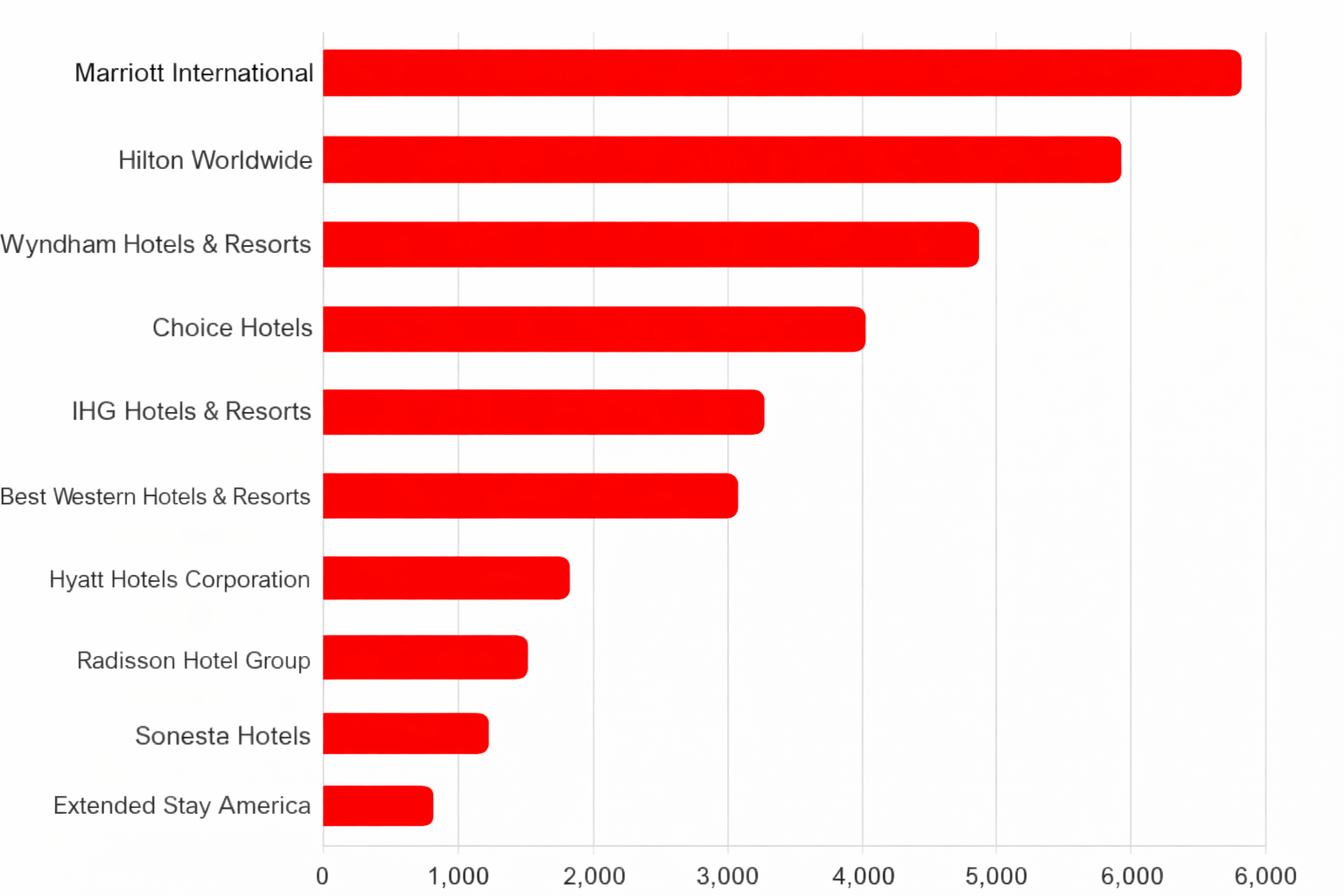

Top 10 Hotel Chains in the USA by Property Count and Geographic Presence – 2026

The table highlights the top 10 U.S. hotel chains in 2026, showing total properties, state and city coverage, and market reach, supported by insights from the Hotel Guest Review Dataset.

Marriott, Hilton, and Wyndham dominate, while mid-scale and economy chains expand across secondary cities and travel corridors nationwide.

Budget and economy chains like Wyndham, Choice, and Extended Stay America dominate geographically, operating along highways, secondary cities, and suburban commercial zones, guided by the Hotel Room Price Trends Dataset.

Luxury and premium brands like Marriott, Hilton, and Hyatt focus on metro and high-traffic leisure destinations.

| Hotel Chain | Total Properties | Availability (No. of States) | Availability (No. of Cities) | Download Dataset |

|---|---|---|---|---|

| Marriott International | 6,200 | 50+ states | 1,250+ cities | Download |

| Hilton Worldwide | 5,900 | 50+ states | 1,180+ cities | Download |

| Wyndham Hotels & Resorts | 5,400 | 45+ states | 1,420+ cities | Download |

| Choice Hotels | 4,900 | 45+ states | 1,360+ cities | Download |

| IHG Hotels & Resorts | 3,900 | 40+ states | 1,010+ cities | Download |

| Best Western Hotels & Resorts | 3,700 | 40+ states | 1,290+ cities | Download |

| Hyatt Hotels Corporation | 1,350 | 35+ states | 620+ cities | Download |

| Radisson Hotel Group | 1,150 | 30+ states | 540+ cities | Download |

| Sonesta Hotels | 1,000 | 25+ states | 480+ cities | Download |

| Extended Stay America | 700 | 20+ states | 410+ cities | Download |

Top 10 Hotel Chains in the USA – 2026

In 2026, the U.S. hotel industry reflects a balanced mix of economy, mid-scale, and luxury chains catering to varied traveler needs. Marriott, Hilton, and Wyndham lead in property numbers, while Choice, IHG, and Best Western expand mid-scale and budget options across secondary cities and suburban regions. Luxury and premium experiences are driven by Hyatt and Marriott’s upscale brands, concentrating on major metro centers and high-demand leisure destinations. Data from a Hotel chain data scraping API USA highlights Radisson, Sonesta, and Extended Stay America as key players offering extensive coverage for long-stay, business, and leisure travelers.

This configuration provides nationwide access across corporate, transit, and vacation-focused markets.

Chain-Level Market Insights

Marriott International

Luxury / PremiumMarriott International leads the U.S. hotel market with over 6,200 properties across New York, Los Angeles, and Chicago. Its diversified brand portfolio—including Courtyard, Residence Inn, Fairfield, and Ritz-Carlton—supports leisure and corporate travelers while maintaining strong regional balance.

Hilton Worldwide

Luxury / PremiumHilton Worldwide operates nearly 5,900 hotels across metro, airport-adjacent, and business-focused zones, with brands like Hilton Garden Inn, Hampton Inn, and Home2 Suites driving expansion.

Wyndham Hotels & Resorts

EconomyWyndham is the largest economy-focused chain in the U.S., operating 5,400 properties along highways, tourist routes, and regional towns. Brands include Super 8, Days Inn, and La Quinta.

Choice Hotels

Mid-Scale / EconomyChoice Hotels maintains nearly 4,900 locations nationwide, with Comfort Inn, Quality Inn, and Sleep Inn focusing on smaller cities and mid-scale accommodation.

IHG Hotels & Resorts

Mid-Scale / LuxuryIHG operates 3,900 hotels, including Holiday Inn, Crowne Plaza, and InterContinental, with strong coverage across business districts, airports, and interstate corridors.

Best Western Hotels & Resorts

Economy / Mid-ScaleBest Western operates approximately 3,700 properties, focusing on suburban, highway, and regional leisure destinations. Brands include Best Western, Best Western Plus, and SureStay.

Hyatt Hotels Corporation

Premium / LifestyleHyatt operates 1,350 properties in urban and mixed-use developments, with Hyatt Place, Hyatt House, and Andaz driving selective growth.

Radisson Hotel Group

Upper Mid-ScaleRadisson operates 1,150 hotels, with brands like Radisson, Country Inn & Suites, and Park Plaza targeting business hubs and secondary cities.

Sonesta Hotels

Economy to UpscaleSonesta operates 1,000 properties, growing via acquisitions and rebranding, spanning urban and suburban markets.

Extended Stay America

Long-Stay / EconomyExtended Stay America operates 700 hotels, catering to business travelers, healthcare workers, and project-based stays in commercial zones.

Looking to gain deeper insights into USA hotel chain ecosystem for analytics or investment?

“Connect with our experts for continuously updated, city-level intelligence.”

Advantages of Chain-Focused Hotel Location Data

Our U.S. hotel chain market analysis datasets provide actionable intelligence for investment, expansion, and operational strategy:

- Identifying High-Impact Markets: Analyze city-wise hotel distribution to uncover untapped opportunities, locate gaps in coverage, and pinpoint areas for targeted expansion or brand strengthening.

- Optimizing Revenue Streams: Leverage real-time occupancy, pricing, and booking patterns to dynamically adjust rates, boost profitability, and maximize returns across urban and suburban markets.

- Informed Expansion and Portfolio Planning: Gain insights into regional saturation, growth potential, and competitor positioning to support strategic investments, property acquisitions, and franchise expansion.

- Tracking Emerging Travel Patterns: Monitor shifts in traveler demand, seasonal trends, and high-growth corridors to guide marketing initiatives, location selection, and resource allocation for sustained growth.

- Enhancing Competitive Intelligence: Benchmark performance against leading hotel chains, analyze competitor strategies, and implement data-driven tactics to strengthen market positioning and operational efficiency.

| Field Name | Description |

|---|---|

| Property Identity | Name of the hotel and affiliated brand, including chain classification and service category. |

| Address & Geo-Coordinates | Full property address, city, state, postal code, and GPS coordinates for mapping and site analysis. |

| Room Inventory & Utilization | Total rooms, types, occupancy trends, and historical booking patterns for operational assessment. |

| Rate Structure & Pricing Trends | Standard rates, dynamic pricing, seasonal adjustments, and competitive pricing data for revenue optimization. |

| Guest Sentiment & Ratings | Aggregated customer reviews, star ratings, feedback summaries, and satisfaction scores for quality evaluation. |

| Market Intelligence Insights | Analysis of location performance, competitor activity, demand patterns, and investment potential. |

Insights and Analysis

The U.S. hotel industry in 2026 is marked by strategic growth fueled by analytics-driven expansion, franchise development, and balanced coverage across urban and suburban areas.

Economy and mid-scale brands lead in property numbers, while luxury and premium chains concentrate on high-demand metro and resort locations, supported by Hotel Data Scraping Services for competitive benchmarking.

Continuous tracking of new openings, renovations, and rebranding initiatives underscores the market’s dynamic nature.

Hotel chains that leverage Hotel Data Intelligence gain agility, enabling faster decision-making, optimized operations, and long-term sustainable growth.

Conclusion

In 2026, the U.S. hotel market is more competitive than ever, making precise location and performance intelligence a critical resource. By Scraping hotel chain locations in USA, investors, operators, and analysts gain a clear understanding of expansion trends, city-level penetration, and competitive positioning. Access to structured datasets detailing the Top 10 Hotel Chains Data Scraping USA enables stakeholders to make informed decisions on property acquisitions, franchise growth, and portfolio management. Furthermore, these insights support dynamic pricing strategies, occupancy optimization, and market-entry planning, providing a comprehensive view of opportunities and risks across urban, suburban, and leisure-focused destinations nationwide.