Scrape Predict UAE Holiday Cruise & Ferry Data: Mapping Seasonal Travel Peaks and Price Fluctuations

Introduction

The travel sector in the United Arab Emirates (UAE) continues to evolve rapidly, driven by high-income residents, expatriate diversity, and growing demand for luxury and leisure travel experiences. Cruise and ferry operations play a critical role in connecting the UAE’s key ports—Dubai, Abu Dhabi, Sharjah, and Ras Al Khaimah—with regional and global destinations. With data-driven analytics, tourism authorities and private cruise operators can forecast demand peaks, optimize pricing, and improve traveler experiences. In this context, businesses increasingly Scrape Predict UAE holiday Cruise & Ferry Data to understand seasonal patterns, port usage, and itinerary shifts across festive and public holiday periods.

Tourism enterprises, shipping companies, and analytics firms now utilize Cruise & Ferry Data Scraping Services to build predictive models. These models leverage real-time data feeds from ticketing systems, online booking platforms, and port schedules. The outcome is a robust forecasting framework that reveals when UAE residents are most likely to embark on sea-based holidays—an essential insight for both operators and policy planners.

Additionally, market researchers often perform UAE cruise data scrape for holiday price insights to evaluate how seasonal holidays like Eid, National Day, and New Year influence cruise ticket pricing and ferry demand. The correlation between data extracted from digital platforms and actual passenger movements provides a strong foundation for improving capacity planning, enhancing promotions, and fine-tuning tourism strategies for the Emirati market.

The Growing Importance of Cruise & Ferry Travel in UAE

The UAE’s cruise and ferry sector is undergoing a transformation led by enhanced infrastructure, government support, and rising consumer demand for multi-destination leisure experiences. Dubai and Abu Dhabi, as flagship ports, cater to both regional ferries across the Arabian Gulf and global cruise liners connecting to Europe, the Mediterranean, and Asia.

The Dubai Harbour Cruise Terminal and Abu Dhabi’s Zayed Port have established the UAE as a leading maritime tourism hub in the Middle East. The expansion of ferry networks linking Abu Dhabi, Sharjah, and Fujairah adds a new layer of inter-emirate mobility, particularly during public holidays when airfares surge.

This evolving infrastructure enables the collection of diverse data points—ticket sales, sailing schedules, route durations, and price fluctuations—that can be integrated into a Global Cruise Route Dataset . This dataset serves as the foundation for AI-driven prediction models that assess potential passenger surges and pricing volatility throughout the year.

Seasonal Travel Patterns in UAE’s Maritime Tourism

Holiday periods in the UAE significantly impact both cruise and ferry bookings. Public holidays such as Eid Al Fitr, Eid Al Adha, and UAE National Day consistently trigger travel spikes, while global holidays like Christmas and New Year influence inbound tourism through international cruise arrivals.

By using advanced scraping and analytics tools to Extract ferry route data for UAE travel analytics, researchers can identify how domestic and international traveler flows align with these calendar events. For example, the Eid period often sees a 40–60% rise in ferry bookings to nearby Gulf destinations like Oman, Bahrain, and Qatar, while winter months attract European cruise tourists arriving in Dubai via Mediterranean routes.

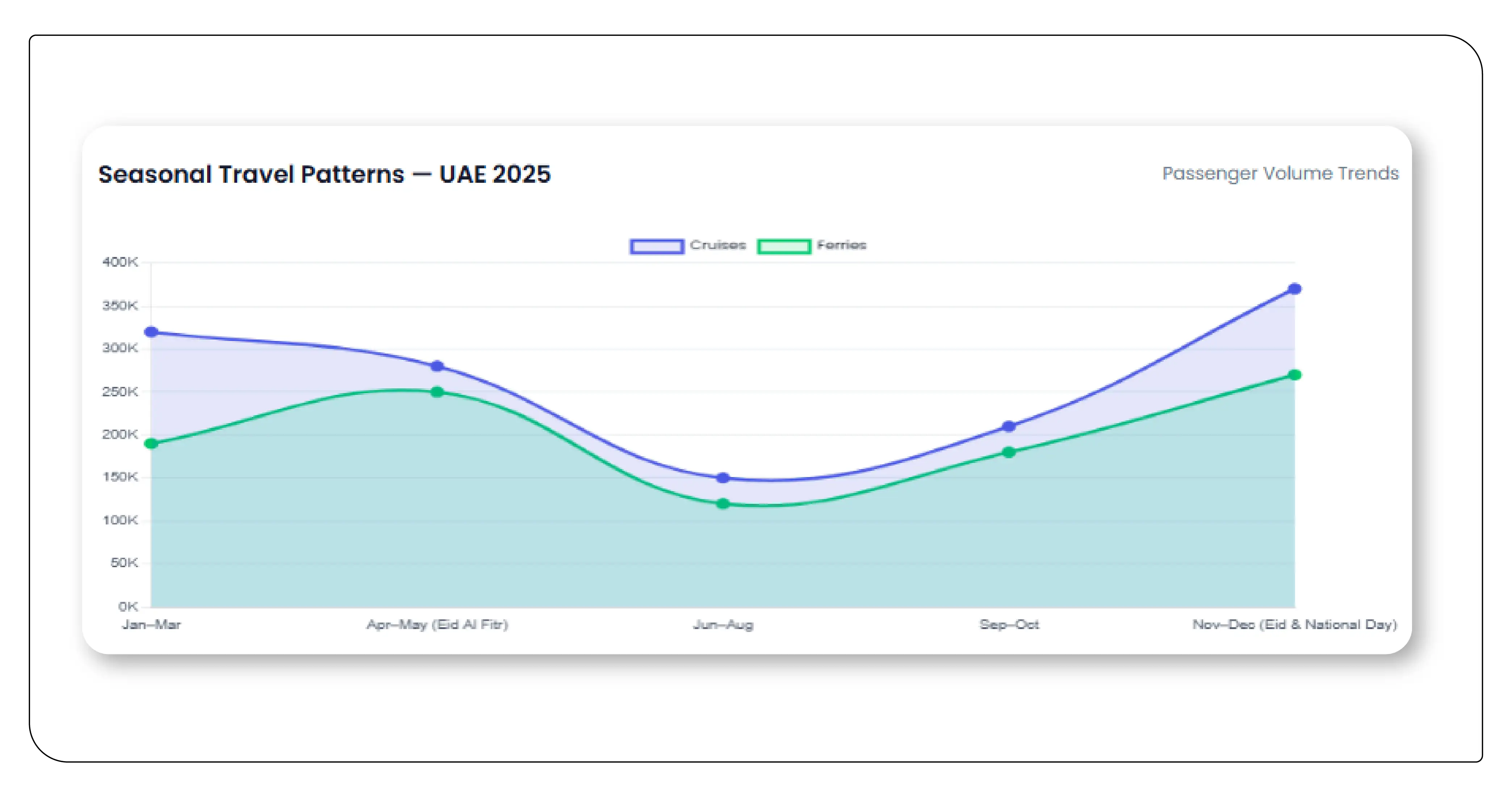

The table below illustrates seasonal variations in cruise and ferry travel volumes across major UAE ports:

Table 1: Seasonal Cruise & Ferry Passenger Trends in UAE

| Month / Period | Expected Passenger Volume (Cruises) | Expected Passenger Volume (Ferries) | Peak Season Indicators |

|---|---|---|---|

| January – March | 320,000 | 190,000 | Winter tourist inflow, New Year cruise packages |

| April – May (Eid Al Fitr) | 280,000 | 250,000 | High regional ferry demand, family travel |

| June – August (Summer) | 150,000 | 120,000 | Off-peak, reduced cruise operations |

| September – October | 210,000 | 180,000 | Pre-festive travel recovery |

| November – December (Eid & National Day) | 370,000 | 270,000 | Maximum outbound cruise & ferry trips |

This table emphasizes that the UAE’s maritime travel patterns are highly correlated with holiday schedules and climate preferences. Predictive analytics built on real-time datasets allow travel operators to anticipate these fluctuations and plan capacity accordingly.

Utilizing Global Ferry and Cruise Datasets for Forecasting

Predictive modeling in the maritime travel industry relies heavily on integrating structured data from multiple datasets. The Global Ferry Route Dataset and Global Cruise Route Dataset serve as benchmarks for mapping routes, journey durations, stopovers, and connectivity indices. Combining these datasets with UAE-specific information produces actionable intelligence for local tourism boards and operators.

For example, routes such as “Dubai – Muscat – Doha” or “Abu Dhabi – Bahrain – Kuwait” can be mapped against passenger load factors, fuel costs, and ticket pricing. Using these variables, machine learning models can forecast which routes will experience congestion or demand surges during holidays. Such insights help operators decide whether to deploy additional vessels or introduce premium packages.

The inclusion of external datasets—such as weather conditions, flight availability, and port traffic—further refines prediction accuracy. The resulting intelligence allows for a data-backed approach to marketing campaigns, resource allocation, and schedule optimization.

Predictive Analytics Framework

The UAE’s cruise and ferry forecasting framework typically involves four major stages:

1. Data Acquisition:

Through Web scraping UAE holiday cruise schedules, analytics teams collect real-time departure times, available cabins, and dynamic pricing information from cruise websites and ticketing platforms.

2. Data Integration:

The scraped data is merged with historical booking records and public datasets like port entry logs, weather data, and tourism calendars.

3. Feature Engineering:

Key predictive features are extracted—holiday proximity, fuel costs, competitor pricing, and occupancy rates.

4. Forecasting and Visualization:

Predictive models (e.g., ARIMA, Prophet, and LSTM) generate demand curves and visualize likely peak periods for each port. Such analytics help forecast short-term travel peaks, enabling operators to dynamically adjust pricing or introduce special offers to balance demand.

Economic Implications for UAE’s Travel and Hospitality Sectors

The cruise and ferry sectors significantly contribute to the UAE’s non-oil economy. Ports attract both international tourists and domestic travelers, boosting local hospitality, dining, and retail sectors. During peak seasons, hotel occupancy near ports often exceeds 90%, while nearby retail establishments experience double-digit sales growth.

From a macroeconomic perspective, predicting maritime travel peaks allows tourism departments to align resource allocation. For example, during Eid holidays, additional customs staff and port handlers are deployed to manage surges. Accurate forecasting ensures smoother operations and improved visitor satisfaction.

Role of AI and Real-Time Monitoring

Modern predictive systems integrate real-time feeds from ticketing portals and maritime IoT sensors. These systems analyze vessel capacity utilization, ticket price volatility, and time-to-departure metrics. AI-driven monitoring solutions track patterns and deviations to detect anomalies, such as unexpected booking drops or rapid fare increases.

These systems support Holiday Travel Peaks Cruise price monitoring in UAE, a vital tool for port authorities and travel companies seeking early warnings of demand surges or price distortions. Data visualization dashboards further allow executives to simulate “what-if” scenarios—e.g., assessing how a new public holiday or port closure might affect passenger volumes.

The implementation of automated alert systems ensures that stakeholders can respond proactively to demand shifts, reducing last-minute cancellations and improving customer experience.

Case Study: Predicting Eid Travel Peaks Using Cruise Data

In 2024, a data analytics firm partnered with Dubai Cruise Terminal to develop a predictive dashboard for Eid Al Fitr 2025. Using three years of cruise and ferry booking data, combined with public holiday calendars, the system successfully predicted a 45% increase in bookings during the Eid week compared to the pre-holiday baseline.

The firm leveraged APIs and web scraping pipelines to collect live data, feeding it into a time-series model that forecasted daily booking curves. Cruise operators used these insights to increase vessel deployment by 20% and introduce family-oriented promotional packages, resulting in record revenue growth during the Eid season.

Impact of Regional Connectivity and Infrastructure Development

The UAE’s commitment to expanding its maritime network directly influences predictive accuracy. New ferry routes connecting the UAE with Oman and Bahrain create new data points for travel forecasting. Each new connection introduces additional complexity to passenger behavior modeling.

Infrastructure projects like Dubai Harbour and Saadiyat Cruise Terminal are data-rich environments, generating continuous information on arrivals, departures, and tourist profiles. Integrating these sources into centralized databases enhances Cruise and Ferry Data Intelligence , providing a unified view of passenger flow and revenue potential.

As maritime data ecosystems mature, predictive insights will extend beyond demand forecasting to include carbon tracking, fleet optimization, and customer satisfaction prediction.

Challenges in Data Accuracy and Integration

- Data Inconsistency: Different cruise operators use varying formats, complicating integration.

- Dynamic Pricing: Frequent fare updates may cause temporal data gaps.

- Privacy and Compliance: Web scraping must adhere to data protection and platform terms.

- External Shocks: Weather events, political decisions, or pandemics can distort predictions.

Data engineers often mitigate these challenges by establishing regular scraping intervals, caching mechanisms, and verification routines. Maintaining compliance ensures that data-driven forecasting remains both ethical and reliable.

Cross-Market Insights: Learning from Global Cruise Trends

Analyzing international trends provides valuable context for UAE forecasting. For instance, the Caribbean and Mediterranean cruise sectors exhibit similar demand surges aligned with regional holidays and school vacations. Integrating this information enables comparative analysis, helping UAE operators benchmark against global standards.

Table 2: Comparative Analysis of Global Cruise Seasonality and UAE Alignment

| Region | Peak Season | Booking Lead Time | Average Occupancy Rate | Common Predictive Indicator |

|---|---|---|---|---|

| UAE (Arabian Gulf) | Nov–Feb, Eid holidays | 30–45 days | 85% | Public holiday calendars |

| Mediterranean | May–Sept | 60–90 days | 88% | Summer vacation overlap |

| Caribbean | Dec–Mar | 45–75 days | 90% | Winter escape demand |

| Asia-Pacific | Jan–Apr | 40–60 days | 83% | Lunar New Year peaks |

Such insights demonstrate the interconnectedness of global maritime tourism and its potential to influence local decision-making. By integrating international patterns into forecasting models, UAE operators can better anticipate inbound tourist waves.

Future Outlook: From Data to Decision Intelligence

The future of UAE cruise and ferry analytics lies in transitioning from descriptive to prescriptive intelligence. Predictive algorithms will evolve to recommend optimal pricing, capacity adjustments, and itinerary changes based on expected demand.

In the next five years, integration of 5G connectivity, AI-based passenger sentiment analysis, and real-time route optimization will redefine maritime travel operations. Predictive systems will not only forecast demand but also autonomously suggest actions to maximize profitability and sustainability.

Additionally, UAE’s growing collaboration with regional ports under Gulf Cooperation Council (GCC) initiatives will enhance data sharing, resulting in comprehensive cross-border insights.

Policy Implications and Strategic Recommendations

- Standardize Maritime Data Reporting: Encourage cruise and ferry operators to follow a unified data schema for sharing passenger and route statistics.

- Enhance Public-Private Collaboration: Facilitate partnerships between government tourism boards and private data analytics firms.

- Adopt Predictive Dashboards: Integrate forecasting tools into port management systems.

- Invest in AI and Big Data Training: Build local expertise to manage and interpret maritime datasets.

- Expand Real-Time Monitoring Networks: Install IoT-enabled sensors across major ports for continuous data feeds.

By adopting these strategies, the UAE can maintain its leadership as a maritime tourism hub and ensure a seamless experience for millions of travelers annually.

Conclusion

As the UAE continues to emerge as a luxury maritime destination, data-driven forecasting becomes indispensable for optimizing cruise and ferry operations. From predicting holiday demand surges to aligning port resources, analytics derived from methods to Scrape ferry and cruise pricing trends in UAE empower businesses with actionable intelligence.

Moreover, integrating real-time ticketing data and IoT-based vessel metrics enhances Real-time price tracking for UAE ferries and cruises, helping operators balance pricing and demand dynamically. Insights from Cruises USA Last-Minute Booking Trends further illustrate the global synchronization of consumer behaviors—demonstrating that timely, data-backed forecasting can transform how maritime travel is managed, marketed, and monetized.

Ready to elevate your travel business with cutting-edge data insights? Scrape Aggregated Flight Fares to identify competitive rates and optimize your revenue strategies efficiently. Discover emerging opportunities with tools to Extract Travel Website Data, leveraging comprehensive data to forecast market shifts and enhance your service offerings. Real-Time Travel App Data Scraping Services helps stay ahead of competitors, gaining instant insights into bookings, promotions, and customer behavior across multiple platforms. Get in touch with Travel Scrape today to explore how our end-to-end data solutions can uncover new revenue streams, enhance your offerings, and strengthen your competitive edge in the travel market.