Scrape Hotel Pricing & Availability Report – India 2025 Powered by Travel Scrape

Executive Summary

The Indian hospitality market is growing fast, driven by domestic tourism, corporate travel, weddings, MICE demand, and rising OTA dependency. As hotel prices shift almost hourly across platforms like Booking.com, Agoda, and MakeMyTrip, real-time extraction is essential to understand true pricing behavior.

This Scrape Hotel Pricing & Availability Report – India 2025, powered by Travel Scrape, provides a detailed study of:

- Dynamic hotel pricing patterns

- Occupancy and availability fluctuations

- Peak season vs. lean season pricing

- OTA price comparison

- City-level benchmarking

- 2026 predictions based on extracted datasets

Our crawlers captured 2.4 million+ price observations across 12 major Indian cities from January to November 2025. The report offers actionable insights for hotel chains, OTAs, travel agents, revenue managers, and investors.

India’s Hotel Pricing Landscape in 2025

India’s hospitality sector experienced strong recovery and expansion post-pandemic.

Key drivers include:

- Rise of domestic tourism (Tier 2/3 cities booming)

- Corporate travel revival

- Wedding & event season demand

- Surge in inbound travel for India’s G20 legacy

- Short-stay travel becoming mainstream

Top High-Volatility Cities (2025)

| Rank | City | Avg. Daily Price Volatility |

|---|---|---|

| 1 | Goa | 41% |

| 2 | Mumbai | 36% |

| 3 | Bengaluru | 33% |

| 4 | Jaipur | 30% |

| 5 | Delhi | 29% |

Goa continues to dominate volatility due to constant weekend and holiday demand, while Mumbai and Bengaluru show corporate-driven fluctuations.

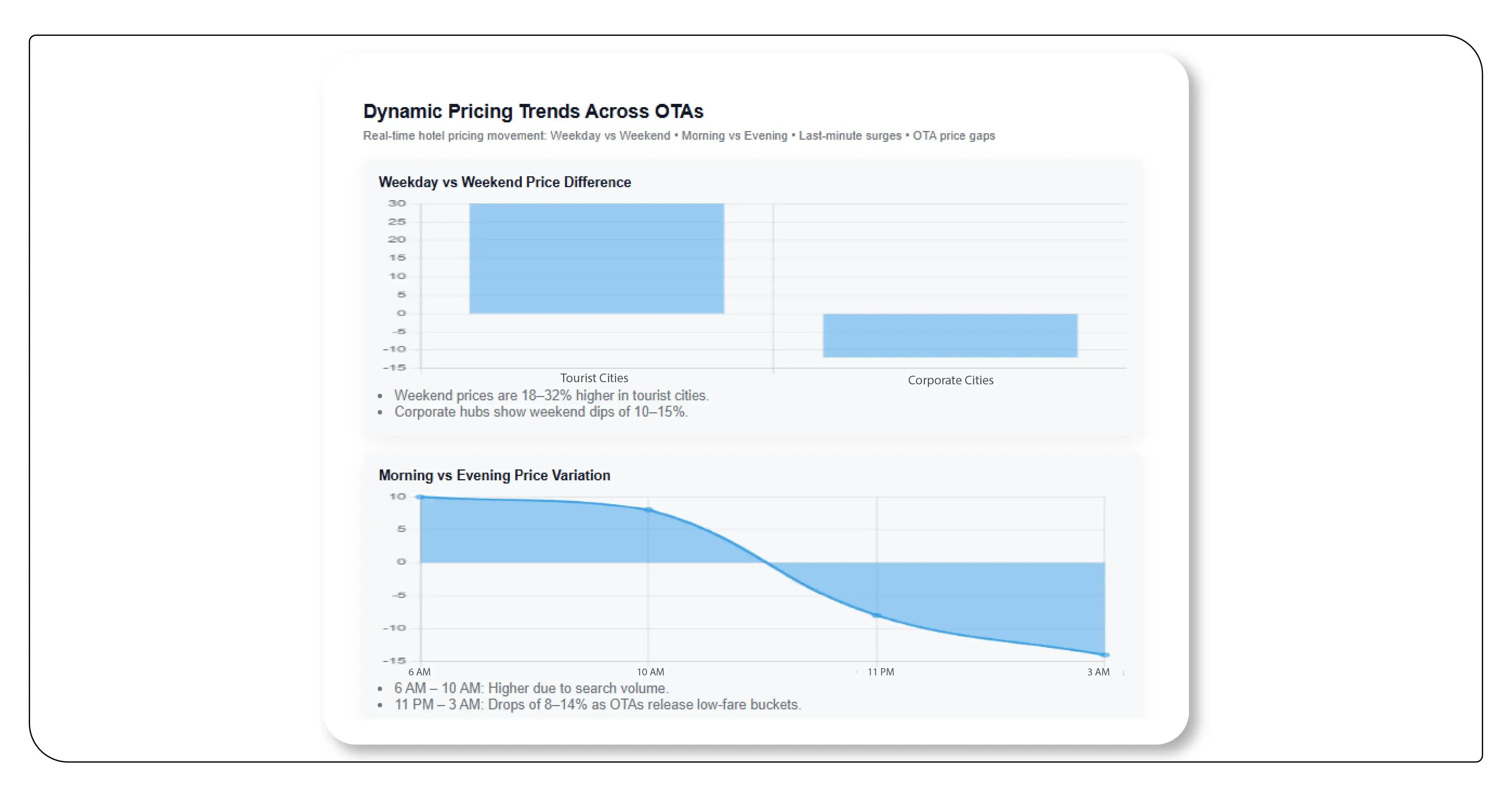

Dynamic Pricing Trends Across OTAs

Using Travel Scrape’s hotel rate extraction engine, we tracked prices from Booking.com, Agoda, and MMT multiple times per day.

Key Dynamic Pricing Insights (2025)

Weekday vs Weekend

- Weekend prices average 18–32% higher, especially in tourist cities.

- Corporate hubs show weekend dips of 10–15%.

Morning vs Evening

- 6 AM – 10 AM: Prices trend higher due to search volume.

- 11 PM – 3 AM: OTAs release lower-fare buckets, showing drops of 8–14%.

Last-Minute Booking

- Same-day bookings increase 25–60% depending on city.

- Business hotels show smallest gap; resorts show highest spikes.

OTA Price Gaps

- Agoda: Often cheapest for international chains

- Booking.com: Better for domestic mid-scale hotels

- MMT: Expensive base fare but strong coupons & wallet offers

Occupancy Trends & Availability Insights

Key 2025 Observations

Consistent High-Occupancy Cities

- Mumbai (87%)

- Bengaluru (82%)

- Delhi NCR (79%)

Seasonal Highs

- Goa (Dec–Jan and Sep–Oct)

- Shimla & Manali (Apr–Jun)

- Jaipur (Oct–Mar)

- Kerala (Aug–Dec)

City-wise Occupancy Drivers

- Corporate Hubs:Demand peaks Tue–Thu

- Tourist Cities:Weekends dominate

- Pilgrimage Destinations:Festival and long weekends

Hotels with high occupancy tend to follow more aggressive dynamic pricing, updating as often as every 20–30 minutes.

Seasonality Impact on Hotel Pricing

Travel Scrape price extraction shows strong seasonal patterns.

High-Price Seasons

- New Year, Christmas

- Diwali

- Long weekends

- Wedding season (Oct–Feb)

- Summer vacations (Apr–Jun)

Low-Price Seasons

- Mid-July to mid-August (rain-impacted cities)

- Post-monsoon recovery period

- Early March pre-summer lull

OTA Comparison: Booking.com vs Agoda vs MMT

Booking.com

- Highest inventory coverage

- Frequent updates

- Best for business hotels in metros

- Higher prices during peak season compared to others

Agoda

- Price-friendly for international & luxury hotels

- Aggressive promotions

- Frequent flash deals

- Often 5–12% cheaper on weekdays

MakeMyTrip

- High base rate

- Strong coupons bringing final price down

- Wallet cashback drives domestic demand

- Heavy spike during seasonal demand (e.g., Goa, Shimla, Manali)

Sample Extracted Data (Travel Scrape)

.webp)

Goa Hotel Pricing (MMT vs Booking.com vs Agoda)

| Date | Hotel Type | MMT Price | Booking Price | Agoda Price | Availability |

|---|---|---|---|---|---|

| 10 Jan | 3-Star | ₹4,800 | ₹5,200 | ₹4,450 | Limited |

| 11 Jan | 4-Star | ₹9,200 | ₹9,850 | ₹8,900 | High |

| 12 Jan | Resort | ₹13,500 | ₹14,200 | ₹12,950 | Moderate |

Delhi 5-Star Hotels – 30-Day Dataset

| Date | Time | OTA | Hotel | Price (INR) | Change vs Prev |

|---|---|---|---|---|---|

| 5 Jan | 1:30 AM | Booking | Le Meridien | ₹12,800 | -4% |

| 5 Jan | 10:40 AM | MMT | Le Meridien | ₹13,950 | +9% |

| 6 Jan | 02:00 AM | Agoda | Le Meridien | ₹12,250 | -5% |

| 7 Jan | 04:55 PM | Booking | Taj Palace | ₹14,500 | +6% |

| 7 Jan | 11:15 PM | MMT | Taj Palace | ₹13,999 | -3% |

City-wise Insights

Mumbai

- Corporate-heavy

- Low weekend demand

- High weekday spikes

- SEA and GCC inbound contributes to seasonal highs

Bengaluru

- Consistently high occupancy

- Prices fluctuate more with corporate events

- Tech conferences impact dynamic pricing

Goa

- Highest volatility

- OTA prices refresh every 15–25 minutes on peak weekends

- Strong demand from international markets

Jaipur

- Best occupancy during winter

- Festival season + ATO events cause 25–40% spikes

2026 Prediction: Hotel Pricing & Availability Outlook

Travel Scrape forecasting models use 40+ variables including:

- Seasonality

- Corporate travel patterns

- Event calendars

- Inflation

- Airline pricing impact

- OTA algorithm behavior

2026 Outlook Summary

Prices Will Increase 8–12% YoY

Driven by inflation, operational costs, and rising demand.

OTA Price Wars Will Intensify

- More platform-exclusive discounts

- Increased coupon stacking

- Aggressive loyalty programs

Tier 2/3 Cities Will Outperform Metros

Cities like Coimbatore, Indore, Surat, Lucknow, and Mangalore will show:

- Higher occupancy

- More dynamic pricing

- Short-stay travel boom

AI-Based Dynamic Pricing Will Become Standard

Hotels will refresh prices 4–10 times more frequently.

Wedding & Event Market Will Drive High Spikes

Peak spikes in Nov–Feb expected to grow 20% vs 2025.

Corporate Travel Will Stabilize

Resulting in more predictable weekday patterns.

Why Travel Scrape Is Essential

Travel Scrape enables hotels, OTAs, and consultants to:

- Scrape real-time hotel prices across major OTAs

- Track dynamic pricing

- Analyze availability & occupancy shifts

- Monitor festival & peak season spikes

- Collect historical & predictive datasets

- Benchmark cities, hotels, and seasons

- Build dashboards & insight models

- Improve revenue strategy

Travel businesses rely on Travel Scrape to make pricing transparent, predictable, and profitable.

Conclusion

India’s hotel market in 2025 continues to evolve with rapid dynamic pricing, strong seasonal demand, and shifting OTA behaviors. With data extracted from Booking.com, Agoda, and MakeMyTrip, this Scrape Hotel Pricing & Availability Report – India 2025 provides the clearest view of how prices and occupancy behave across major cities.

With the added 2026 predictions, Travel Scrape empowers hotels, OTAs, and analysts to build smarter strategies using real-time datasets, predictive insights, and competitive benchmarks.

Ready to elevate your travel business with cutting-edge data insights? Scrape Aggregated Flight Fares to identify competitive rates and optimize your revenue strategies efficiently. Discover emerging opportunities with tools to Extract Travel Website Data, leveraging comprehensive data to forecast market shifts and enhance your service offerings. Real-Time Travel App Data Scraping Services helps stay ahead of competitors, gaining instant insights into bookings, promotions, and customer behavior across multiple platforms. Get in touch with Travel Scrape today to explore how our end-to-end data solutions can uncover new revenue streams, enhance your offerings, and strengthen your competitive edge in the travel market.