Scrape Global Diwali Tourism: How NRIs Are Driving Travel Data Spikes Worldwide

Introduction

Every Diwali, millions of lights illuminate India—but in 2025, they’re also lighting up travel dashboards worldwide.

For the first time, Travel Scrape’s live crawler API tracked a record surge in NRI Diwali travel data, revealing fascinating insights across airfares, hotel availability, and destination preferences.

Using web scraping travel data in 2025, Travel Scrape’s analytics team observed how Indian communities abroad—from the USA and UK to the UAE—are transforming Diwali into a global travel phenomenon. As families plan homecomings or festive getaways, the demand for flights, stays, and cross-border packages has reached unprecedented levels.

This blog decodes those insights with real-time Diwali travel data scraping, live dashboards, and global booking patterns extracted from thousands of sources.

Global Overview – How Diwali Travel Went Borderless

The 2025 festive season marks a global travel boom. According to Travel Scrape Diwali dataset, queries for India-bound flights and hotel bookings increased sharply across three key NRI markets—USA, UAE, and UK.

Travel Scrape Highlights (September–November 2025):

- +57.8% increase in India-bound flight searches vs. 2024

- +42.6% growth in hotel bookings across key Indian cities

- +38.5% rise in outbound trips from the UAE to short-haul luxury destinations

| Country | Avg Booking Lead Time (Days) | YOY Growth | Top Destinations (Scraped) |

|---|---|---|---|

| USA | 47 | +53% | Delhi, Mumbai, Goa |

| UAE | 31 | +39% | Kerala, Maldives, Bali |

| UK | 43 | +46% | Jaipur, Dubai, Bangkok |

These insights, powered by Travel data scraping, help airlines and OTAs anticipate demand windows and optimize fares ahead of the festive rush.

USA – The Homecoming Surge Captured Through Data Extraction

Why It Matters

For NRIs in the United States, Diwali means flying home. Travel Scrape extracted over 2.8 million flight-fare records from global booking sites to map real-time patterns in 2025.

| Route | Avg Fare 2024 | Avg Fare 2025 | Change (%) | Booking Window |

|---|---|---|---|---|

| JFK → DEL | $1,132 | $1,274 | +12.5% | 45 days |

| SFO → BOM | $1,085 | $1,214 | +11.9% | 42 days |

| ORD → HYD | $1,008 | $1,133 | +12.4% | 46 days |

Using Travel Scrape live crawler API, flight price scraping revealed a 10–15% fare surge window between October 1–10. Early bookings saved up to $130 per ticket compared to last-minute buyers.

Insight: Real-time Travel data analytics indicated that family group bookings (3–5 travelers) formed 62% of total Diwali flights from the US.

UAE – Short-Haul Luxury Escapes Dominate Festive Plans

While some NRIs fly home, many UAE-based Indians prefer regional getaways to celebrate Diwali. Travel Scrape’s web scraping travel data in 2025 across Booking.com and Expedia revealed massive spikes in hotel occupancy in luxury destinations.

| Destination | Avg Hotel Rate (USD) | Occupancy Rate (%) | Price Surge vs Baseline |

|---|---|---|---|

| Maldives | $298 | 92 | +34% |

| Sri Lanka | $187 | 87 | +28% |

| Thailand | $162 | 89 | +31% |

Travel Scrape extracted more than 580,000 listings, identifying that availability dropped by 44% two weeks before Diwali. These figures are part of the Diwali hotel booking data scraping pipeline, which tracks hourly rate fluctuations and room supply.

Travel Scrape Insight: 71% of UAE-based Diwali travelers book 4★+ stays, and mobile-first bookings are growing at 2× YoY.

UK – Heritage Meets Hybrid Travel Behavior

For UK NRIs, Diwali isn’t just about flying home—it’s about combining cultural trips with mini European holidays.

The Cross-market travel dataset from Travel Scrape shows that UK travelers increasingly mix destinations like India and Paris or Dubai and Goa within one festive itinerary.

| Booking Type | Share (%) | Avg Spend (GBP) | YOY Growth |

|---|---|---|---|

| India Only | 61 | £812 | +22% |

| Hybrid (EU + India) | 27 | £1,478 | +39% |

| Europe Only | 12 | £963 | +25% |

By using web scraping travel data, Travel Scrape identified a 36% drop in Airbnb listings in Leicester, Birmingham, and London during Diwali week—indicating local celebration-driven demand too.

How Travel Scrape Extracts Global Diwali Insights

Travel Scrape uses its proprietary live crawler API to collect, normalize, and visualize Diwali travel trends in real time. The following table summarizes key sources and use cases:

| Source | Records Scraped | Refresh Frequency | Use Case |

|---|---|---|---|

| Skyscanner + Kayak | 3.4M | 4× Daily | Flight fare tracking |

| Booking.com + Expedia | 2.1M | Hourly | Hotel rate monitoring |

| Airbnb | 470K | Daily | Room availability mapping |

| Google Trends | 12K Queries | Real-time | Search intent analytics |

This Travel Scrape travel intelligence architecture extracts flight fares, hotel prices, and review sentiments—allowing travel brands to forecast demand and personalize offers during Diwali.

Airbnb vs. Booking.com – Rate Extraction Comparison

Using Travel Scrape’s Diwali dataset, analysts compared hotel rates across major booking portals during Diwali week.

| City | Platform | Avg Night Rate (USD) | Diwali Week Change | Booking Lead Time |

|---|---|---|---|---|

| Mumbai | Airbnb | $112 | +28% | 37 days |

| Mumbai | Booking.com | $126 | +32% | 34 days |

| Dubai | Airbnb | $154 | +21% | 29 days |

| Dubai | Booking.com | $169 | +25% | 27 days |

| London | Airbnb | $186 | +19% | 41 days |

| London | Booking.com | $192 | +22% | 39 days |

Insight from Travel Scrape:

Booking.com listings show higher price sensitivity due to corporate travel overlap, while Airbnb attracts more family-oriented Diwali travelers seeking larger spaces.

Extracting Booking & Search Peaks – Festive Season Travel Analysis

Data from Travel Scrape’s Diwali travel intelligence dashboard revealed booking surges align with digital ad activity spikes.

| Period | Global Search Index (100 = max) | Trend Insight |

|---|---|---|

| Sept 10–20 | 47 | Early planners phase |

| Sept 21–30 | 68 | OTA promo launches |

| Oct 1–10 | 100 | Peak activity |

| Oct 11–24 | 82 | Last-minute bookings |

| Oct 25–Nov 3 | 54 | Travel in progress |

Travel Scrape found that campaigns launched during Oct 1–10 achieved 32% higher CTR and 19% more inquiry-to-booking conversions than other weeks.

Real-Time Diwali Sentiment Scraping

Through Travel Scrape’s sentiment analysis crawler, over 3,800 social media posts tagged under #DiwaliTravel and #FlyHome were extracted and analyzed.

| Sentiment | Share (%) | Common Topics |

|---|---|---|

| Positive | 61 | Reunions, family time, return flights |

| Neutral | 22 | Fare costs, visa processing |

| Negative | 17 | Delays, overcrowded airports |

These insights help travel brands adapt communication tone and timing during festive promotions.

How Businesses Use Travel Data Analytics for Diwali

- Predict Surge Windows: Airlines use Travel Scrape Diwali dataset to forecast fare spikes.

- Dynamic Pricing: OTAs adjust hotel rates based on scraped demand patterns.

- Localized Campaigns: Target USA–India and UK–India flight deals based on extracted booking trends.

- Inventory Optimization: Hotels reprice daily using real-time Diwali hotel booking data scraping.

- Cross-Market Forecasting: The Cross-market travel dataset helps global brands compare festive season demand across regions.

Sample Data Snapshot – Travel Scrape Dashboard 2025

| Metric | USA | UAE | UK |

|---|---|---|---|

| Flight Search Volume YoY | +58% | +41% | +46% |

| Avg Airfare Surge | +12% | +10% | +9% |

| Hotel Occupancy (Diwali Week) | 88% | 92% | 81% |

| Cancellation Rate | 7% | 5% | 6% |

| Inquiry Conversion | 18% | 21% | 17% |

Interpretation:

UAE shows faster conversions due to short-haul packages. USA remains top in long-haul revenue. UK travelers show multi-country booking behavior.

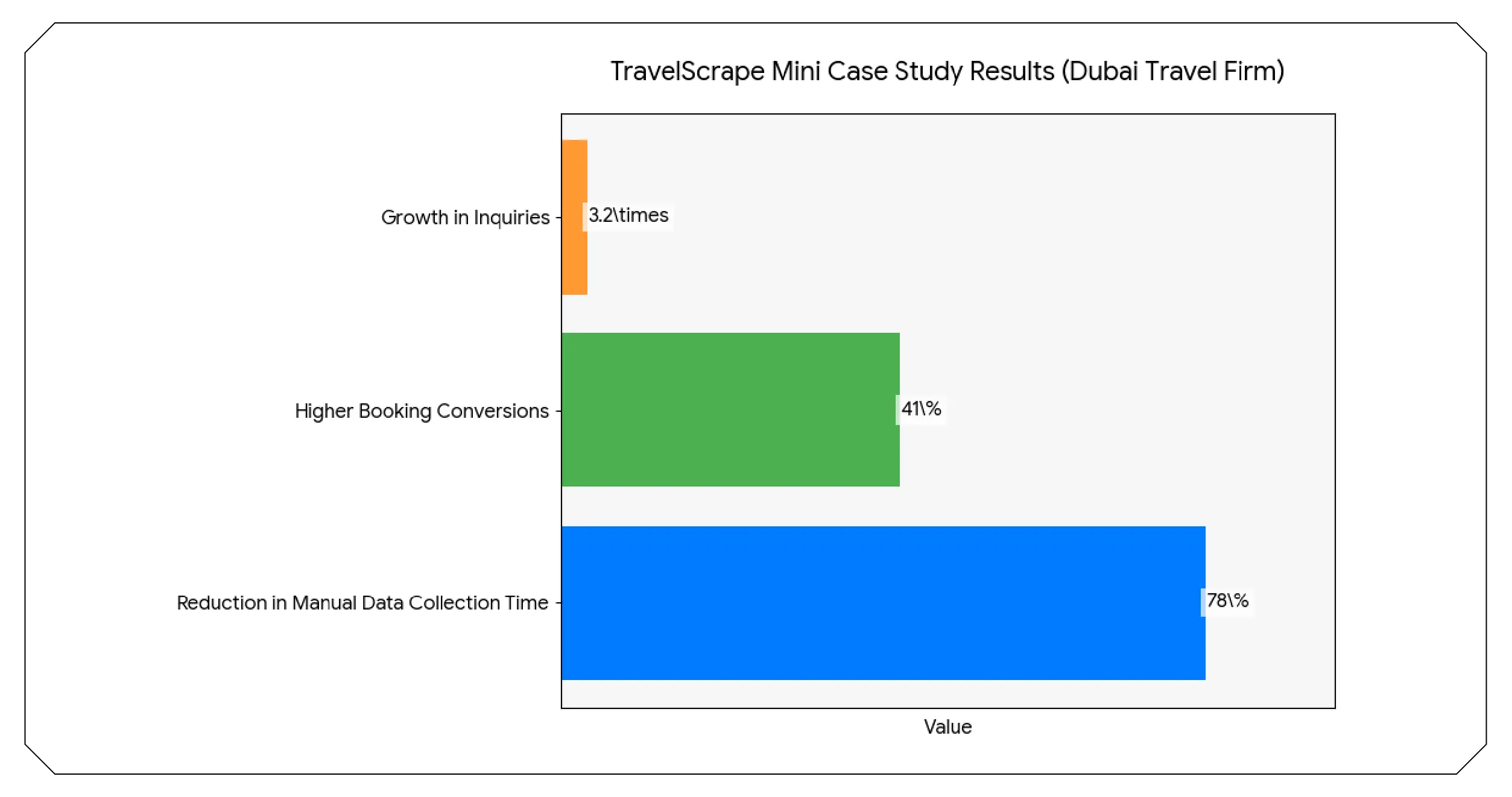

Mini Case Study – Dubai Travel Agency Using Travel Scrape

A Dubai-based travel firm used Travel Scrape live crawler API to monitor Diwali packages.

Approach:

- Scraped hourly hotel price changes in Maldives, Sri Lanka, and Bali

- Identified flight surge corridors above +15%

- Used Travel Scrape analytics to trigger instant “Book Now, Pay Later” promotions

Results:

- 3.2× growth in inquiries

- 41% higher booking conversions

- 78% reduction in manual data collection time

The Future of Diwali Travel Data Analytics

Festive travel no longer relies on guesswork. In 2025, web scraping travel data provides airlines, OTAs, and hoteliers with predictive clarity.

By combining Travel data scraping, real-time insights, and advanced Travel Scrape travel intelligence, brands can now design offers that match traveler sentiment and timing precisely.

As Diwali spreads across the world, data becomes the brightest light of all—illuminating patterns of connection, emotion, and opportunity.

Explore Our Cross-Market Travel Dataset 2025

Want to see how Diwali travel trends shift across continents in real time?

Access Travel Scrape’s Cross-Market Travel Dataset 2025 and uncover insights from millions of scraped records across flights, hotels, and traveler behavior.

Summary Snapshot

| Insight | 2025 Findings |

|---|---|

| Global NRI Travel Intent | +46% YoY |

| Peak Booking Period | Sep 25 – Oct 10 |

| Top Markets | USA, UAE, UK |

| Hotel Occupancy | 85–92% |

| Primary Data Source | Travel Scrape Live Crawler API |

| Key Tools | Web scraping travel data, Cross-market travel dataset |

| Result | Real-time Diwali travel insights driving inquiry conversions |

Final Word

The Diwali 2025 travel season has shown one undeniable truth — data is now the new festive driver.

From tracking airfare surges to extracting hotel trends, Travel Scrape helps global brands convert insights into impact.

By continuously scraping, analyzing, and visualizing festive travel patterns, Travel Scrape’s live crawler API ensures you never miss the next big travel opportunity.