How Can Businesses Scrape European Hotel and Flight Price Data to Gain a Competitive Edge?

Introduction

In today’s dynamic travel ecosystem, data is the driving force behind pricing intelligence, user engagement, and competitive advantage. Online Travel Agencies (OTAs) and travel platforms rely heavily on accurate, time-sensitive information to tailor offerings, optimize revenue, and maintain their market share in an increasingly price-sensitive world. Among the most crucial forms of data for such platforms are real-time and historical price indices for hotels and flights, which empower travel providers to make informed strategic decisions.

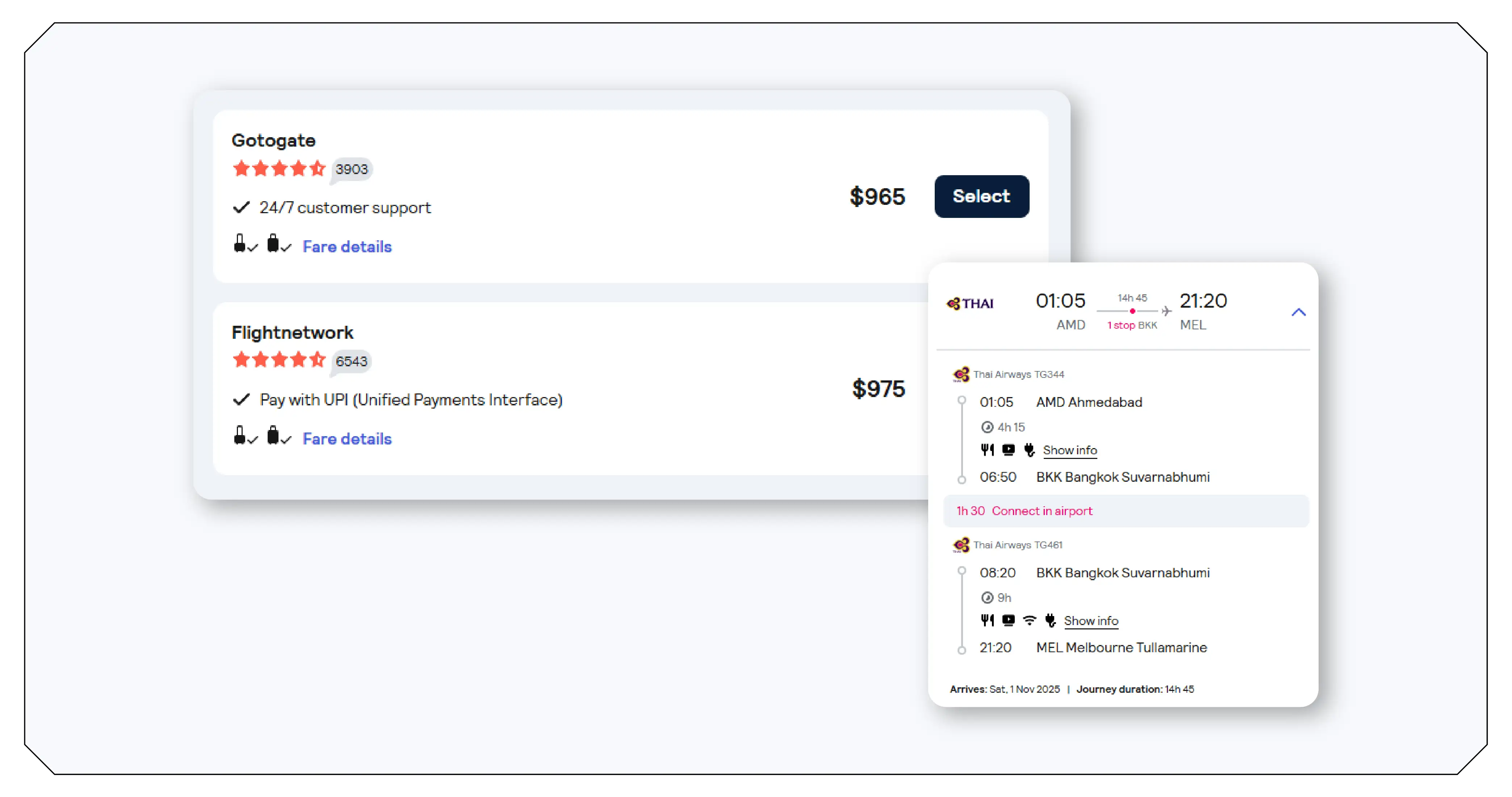

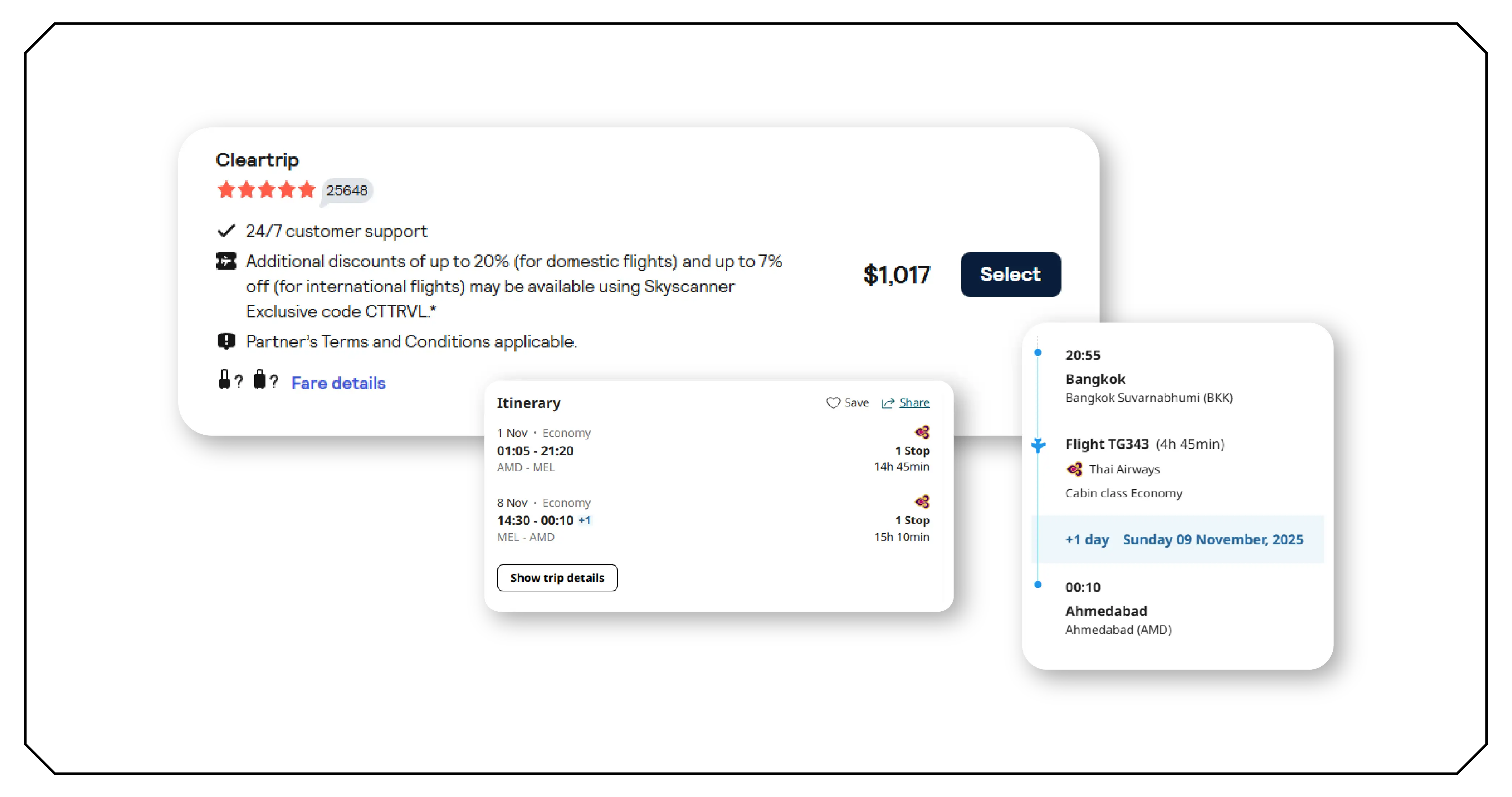

Modern scraping and analytics tools now make it possible to Scrape European Hotel and flight price data, enabling OTAs to understand both short-term market fluctuations and long-term pricing patterns. Combined with advanced Airline Data Scraping Services , this comprehensive data collection approach creates a transparent view of the competitive landscape across cities, airlines, and booking platforms. As global travel demand rebounds post-pandemic, access to these insights has become not just an advantage—but a necessity.

At the heart of this capability lies the need to Scrape European travel price indices effectively. These indices, derived from a vast array of travel data sources, measure fluctuations in average hotel room rates and flight ticket prices across destinations, time periods, and seasons. When analyzed in real-time or retrospectively, they empower OTAs and travel platforms to create intelligent, data-driven pricing strategies that match consumer demand, anticipate trends, and improve overall customer experience.

Understanding Real-Time and Historical Price Indices

Price indices are statistical tools used to measure the average change in prices of a particular set of goods or services over time. In the travel sector, these indices focus specifically on hotel accommodations and flight tickets—two of the largest cost components for travelers.

- Real-time indices provide instant insights into current market conditions. They help OTAs monitor how prices fluctuate daily or even hourly in response to changing demand, competitor actions, or external factors like holidays and major events.

- Historical indices, on the other hand, provide a long-term perspective. They reveal pricing trends across months or years, showcasing how seasonality, destination popularity, and economic shifts influence travel behavior.

Together, these indices form a powerful framework for competitive benchmarking, price optimization, and forecasting—enabling travel platforms to adapt quickly and effectively.

Collecting Hotel and Flight Pricing from Major European Cities

Europe remains one of the most competitive travel markets globally, with high traveler mobility, diverse accommodation options, and intense competition among airlines. For OTAs, collecting accurate pricing data from multiple European hubs—such as London, Paris, Rome, Madrid, Berlin, and Amsterdam—provides a strategic foundation for regional trend analysis.

Data collection involves aggregating live rates and availability from hotel booking engines, airline websites, and OTA aggregators. The goal is to create a robust, up-to-date dataset that reflects market realities. Key data points include:

- Hotel pricing per room type (standard, deluxe, suite, etc.) across various star categories.

- Airfare by route and airline, categorized by seat class (economy, business, first).

- Dynamic rate changes due to events, festivals, or tourism peaks.

- Availability data, showing the percentage of hotels or flights sold out in given periods.

- Geographic and temporal segmentation, allowing comparisons across regions and timeframes.

Through specialized scraping tools and Global Flight Price Trends Dataset integrations, OTAs can monitor these pricing parameters with near real-time accuracy. This capability allows platforms to adapt pricing strategies dynamically, keeping them competitive in both domestic and cross-border markets.

Benchmarking Rates to Monitor Market Trends and Seasonality

Price benchmarking is a cornerstone of strategic pricing management. By comparing their own pricing data against industry averages or competitor rates, OTAs can evaluate performance, identify outliers, and recalibrate strategies.

European travel markets are particularly influenced by seasonality. For instance:

- Summer brings a surge in leisure travel across Southern Europe (Spain, Italy, Greece).

- Winter sees demand rise for skiing destinations like Switzerland and Austria.

- Spring and fall typically attract city travelers seeking off-peak deals.

By leveraging European flight and hotel benchmarking , OTAs can map out these seasonal shifts with precision. This allows them to preemptively adjust marketing campaigns, flight packages, and hotel promotions to capture consumer attention at the right time.

Moreover, indices help identify price elasticity —the relationship between price changes and booking volume. For example, if average flight prices from London to Madrid rise by 15% during spring but bookings only drop by 5%, it signals strong market resilience. Such insights are invaluable for pricing strategists who aim to balance revenue optimization with customer retention.

Additionally, European market trend tracking for travel pricing enables platforms to spot emerging travel patterns such as budget airline dominance, post-pandemic business travel recovery, or the rising demand for eco-friendly accommodations. By tracking such metrics, OTAs can forecast traveler sentiment and design more appealing product bundles.

The Power of Real-Time Monitoring for Dynamic Decision-Making

Real-time monitoring transforms travel pricing from a static exercise into a dynamic, intelligence-driven process. OTAs that track minute-by-minute updates in flight and hotel rates can detect fluctuations and react faster than competitors.

For instance, during a sudden surge in bookings for Paris Fashion Week or Oktoberfest in Munich, hotel prices can spike by over 100% within days. Platforms equipped with automated data collection and analysis pipelines can identify these changes early, update their listings, and adjust promotions or discounts accordingly.

Furthermore, real-time insights help platforms manage rate parity, ensuring that hotel or airline prices listed on their site remain competitive with those on other channels. Maintaining rate parity is crucial not only for customer trust but also for regulatory compliance in many European countries.

Integrating real-time price monitoring also supports AI-driven dynamic pricing systems. These systems use live data to automatically recommend optimal price points based on availability, competition, and consumer demand, significantly improving revenue management efficiency.

Using Indices to Optimize OTA Offerings and Promotions

Price indices are not just analytical tools—they’re actionable assets that can directly influence an OTA’s operational decisions. By aligning offerings and promotions with insights drawn from both historical and live data, travel platforms can maximize their conversion rates and market share.

Optimizing OTA Offerings and Promotions with Data-Driven Insights

1. Customized Promotional Strategies: Using detailed

indices, OTAs can launch targeted promotions aligned with regional trends.

For example, if historical data shows a consistent drop in bookings to Rome during

November, the platform can design special flight-and-hotel bundles to attract travelers

during this lull.

2. Competitive Pricing Intelligence: Indices highlight

price gaps between different OTAs or between an OTA and direct supplier websites.

Platforms can then adjust their rates or value propositions—like offering free

cancellation or loyalty points—to maintain competitiveness.

3. Enhanced Customer Experience: By understanding how price

changes correlate with booking behaviors, OTAs can refine their user experience.

For instance, if users frequently abandon bookings when prices increase above a certain

threshold, platforms can send alerts for fare drops, encouraging them to complete the

transaction later.

4. Strategic Inventory Planning: Indices also support

data-backed negotiation with hotels and airlines.

If an OTA observes that certain destinations are experiencing rising demand and limited

supply, it can secure inventory earlier to lock in better deals.

5. Data-Driven Marketing: Travel brands can use insights

from benchmarking travel rates across European airports to craft

marketing messages that highlight value.

For instance, advertising campaigns can focus on “Best price guarantees” or “Seasonal

travel savings,” backed by reliable benchmark data.

Historical Insights: Learning from the Past

While real-time data informs immediate decisions, historical indices offer

the context needed for long-term strategy. These indices can show how the average flight

cost between major European hubs (like Frankfurt–Paris or Amsterdam–Rome) evolved over

years.

They also reveal how hotel pricing trends react to external shocks such as economic

downturns, regulatory changes, or geopolitical events.

For OTAs, historical data provides three main benefits:

1. Trend Prediction: By analyzing multi-year data, platforms can anticipate when and where demand is likely to rise or fall.

2. Performance Measurement: Historical benchmarking helps measure how effective past pricing strategies were, enabling better planning for future campaigns.

3. Demand Forecasting: Understanding historical occupancy rates and air traffic patterns helps forecast demand spikes—essential for optimizing promotions and revenue.

Such historical perspectives are especially useful when combined with macroeconomic data, tourism board statistics, or even weather data, creating a holistic pricing model.

European Market-Specific Insights

The European travel ecosystem has unique characteristics compared to other regions. Its fragmented geography, open borders, and variety of low-cost carriers create both opportunities and challenges for OTAs.

Western Europe: Characterized by business travel and

luxury accommodation markets, demanding granular price differentiation.

Eastern Europe: Emerging tourism markets like Poland and Hungary

offer affordable options but require price sensitivity to attract budget travelers.

Southern Europe: Driven by leisure and seasonal travel, where

real-time rate adjustments are critical to maintaining competitiveness.

Northern Europe: Stable year-round demand with high sustainability

standards affecting pricing models.

Collecting localized price indices across these zones allows OTAs to refine regional strategies and avoid one-size-fits-all pricing approaches.

The Role of Data Accuracy and Transparency

Data accuracy is fundamental to the reliability of price indices. Inaccurate data can lead to mispricing, revenue loss, or brand credibility issues. OTAs therefore rely on professional Hotel Data Scraping Services and airline data providers that ensure clean, verified, and up-to-date data streams.

Modern scraping systems use advanced anti-blocking measures, structured data

extraction techniques, and machine learning-based data validation.

This ensures the collection of only high-quality, deduplicated records that reflect the

actual market conditions.

Moreover, transparency in data sourcing allows OTAs to maintain trust with hotel partners and customers alike, especially when presenting benchmark comparisons.

Leveraging Indices for Strategic Advantage

OTAs equipped with accurate indices can leverage them for:

Dynamic pricing automation to maximize margins.

Forecasting models that align marketing spend with expected

demand.

Partnership negotiations, showcasing data-driven insights to hotel

and airline partners.

Traveler communication, using data insights to offer “best time to

book” recommendations.

By integrating these capabilities with robust dashboards and analytics systems, OTAs turn raw data into decision-making power.

Conversion Angle: Try Travel Scrape’s Price Index APIs

For OTAs and travel analysts seeking a reliable and scalable solution, Travel Scrape’s Price Index APIs offer a competitive edge. These APIs provide:

Real-time hotel and flight price data from multiple European cities.

Historical indices for long-term trend evaluation.

Custom benchmarking tools to compare rates across destinations and seasons.

Automated alerts for price changes, seasonal shifts, or competitor activity.

With easy API integration, it enables travel businesses to automate data

collection, monitor competitive pricing, and design smarter promotional strategies

without manual effort.

Whether you’re building a travel app, managing a booking engine, or analyzing market

dynamics, the company’s indices empower your team with actionable intelligence.

Now is the perfect time to test Travel Scrape’s Price Index APIs and transform your travel pricing strategy into a data-driven success story.

How Travel Scrape Can Help You?

Comprehensive Rate Monitoring: Collect real-time hotel prices, availability, and room categories across multiple booking platforms for accurate market insights.

Competitive Benchmarking: Compare hotel pricing and amenities with competitors to identify opportunities for better positioning and revenue optimization.

Trend and Seasonality Analysis: Track long-term pricing patterns to predict demand fluctuations and plan promotional strategies effectively.

Customizable Data Extraction: Access structured datasets tailored to specific regions, star ratings, or hotel brands for targeted decision-making.

Actionable Market Intelligence: Transform raw hotel data into insights that boost OTA performance, improve user experience, and enhance profitability.

Conclusion

As digital travel markets mature, the ability to analyze and respond to price fluctuations in real-time will determine who leads the industry. OTAs that effectively combine real-time indices with historical data will gain unparalleled insights into traveler behavior, competition, and market cycles.

By integrating advanced scraping technologies and analytical frameworks, travel platforms can make intelligent pricing decisions, refine marketing strategies, and deliver superior customer experiences.

Furthermore, the use of a Hotel Guest Review Dataset can enhance pricing insights by correlating rate changes with user satisfaction trends. When travel platforms analyze hotel and flight pricing trends in Europe, they unlock new opportunities for growth and innovation—driven by transparency, responsiveness, and consumer trust.

Ultimately, the key lies in leveraging Hotel Data Intelligence to interpret these massive datasets effectively. Through accurate benchmarking, consistent tracking, and data-powered decisions, OTAs can ensure their offerings remain competitive, profitable, and traveler-centric—no matter how dynamic the global travel landscape becomes.

Ready to elevate your travel business with cutting-edge data insights? Scrape Aggregated Flight Fares to identify competitive rates and optimize your revenue strategies efficiently. Discover emerging opportunities with tools to Extract Travel Website Data, leveraging comprehensive data to forecast market shifts and enhance your service offerings. Real-Time Travel App Data Scraping Services helps stay ahead of competitors, gaining instant insights into bookings, promotions, and customer behavior across multiple platforms. Get in touch with Travel Scrape today to explore how our end-to-end data solutions can uncover new revenue streams, enhance your offerings, and strengthen your competitive edge in the travel market.