Scrape Car Rental Data from Travel Apps for Predictive Demand Modeling

Introduction

The global car rental industry has entered a period where predictive accuracy determines profitability. Operators must anticipate booking peaks, align fleet distribution, and price dynamically to compete in the app-based travel ecosystem. In this context, the ability to scrape car rental data from travel apps has transformed from an experimental practice into a strategic necessity.

Companies offering Car Rental Data Scraping Services now enable travel enterprises to access raw, granular data directly from consumer-facing platforms—insights that traditional booking systems cannot deliver. The integration of this real-time data into demand forecasting models empowers analysts to understand booking intentions, pricing elasticity, and destination preferences in near-instantaneous cycles.

To Extract Car Rentals data for demand forecasting, researchers employ automated pipelines that track available vehicles, hourly prices, pick-up zones, and drop-off frequencies across major travel apps. These structured datasets feed into predictive systems that forecast demand patterns at both temporal and spatial levels. In this evolving environment, Real-Time Travel App Data Scraping Services function as the backbone of data-driven decision-making in mobility operations.

Industry Context and Rationale

Car rental operations depend heavily on market timing. A car sitting idle represents opportunity cost, while inadequate availability results in lost revenue and diminished customer loyalty. Forecasting enables balance—ensuring that the right number of cars are available at the right place and time.

In the post-pandemic travel economy, consumer behaviour is volatile. Remote work, hybrid travel, and spontaneous short trips have created new demand curves. Historical data alone cannot capture these patterns. Hence, the industry’s shift toward Web scraping for car rental market analytics allows continuous observation of app-level activity. Scraped data captures hourly listing changes, price surges, and fleet adjustments, delivering a pulse of live market dynamics.

Traditional forecasting relied on limited variables—historical averages, seasonality, and economic indicators. The contemporary approach combines dynamic data with advanced algorithms. The result is a system that reacts, not just predicts.

Methodological Overview

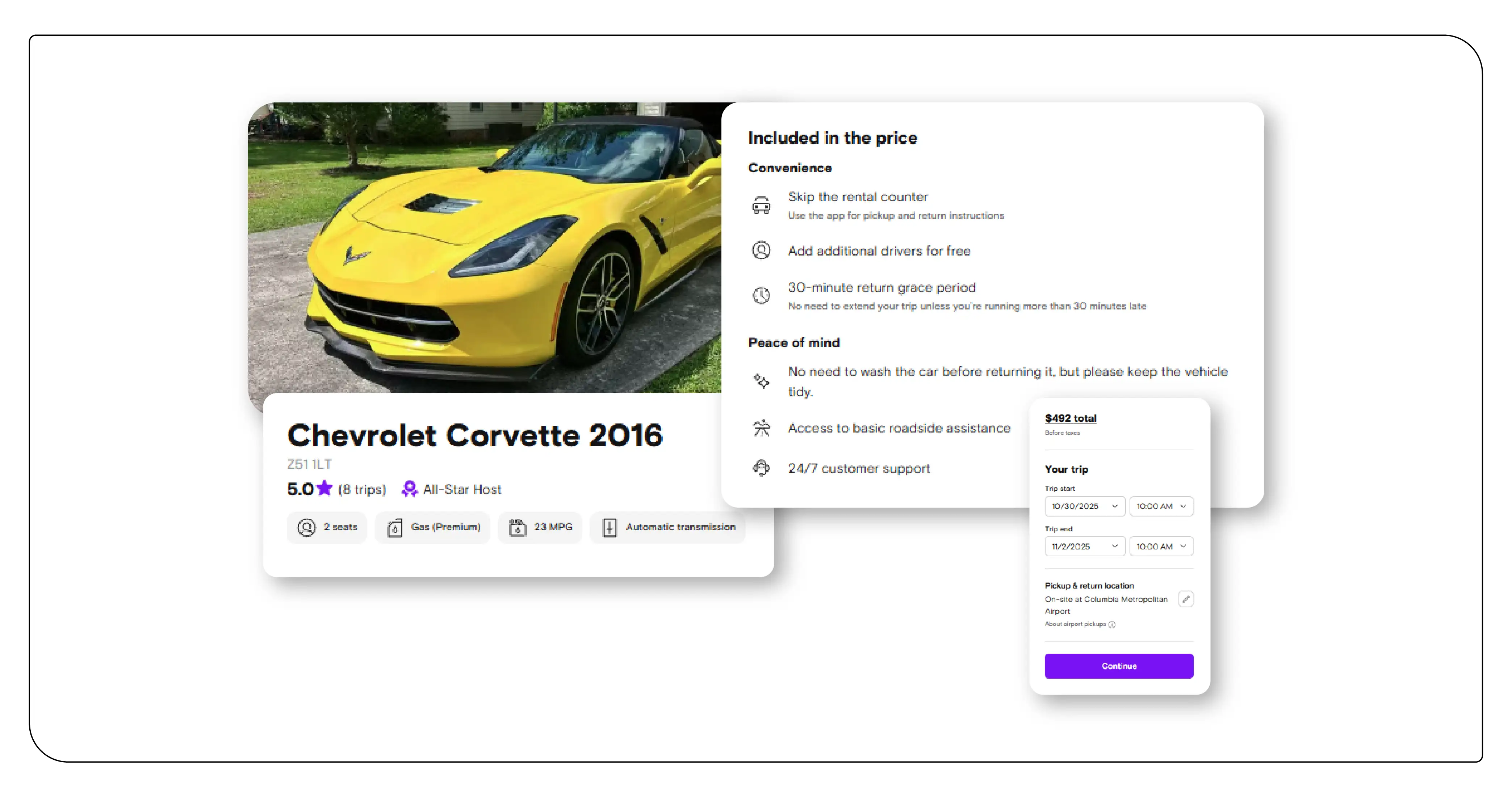

Data Acquisition

Real-time data acquisition forms the foundation. The process begins by identifying major travel apps aggregating car rentals—such as Expedia, Kayak, or local mobility apps. Automated crawlers collect offer-level information: pick-up city, car category, daily rate, availability, and booking window.

Over several weeks, these crawlers gather millions of observations, which are cleaned, timestamped, and standardised. The output becomes a Car Rental Price Trends Dataset , enriched with supplementary data such as weather, event schedules, and macro-economic indicators.

Feature Selection and Cleaning

- Temporal attributes: day of week, month, seasonality indicator, and lead-time before rental.

- Spatial variables: pick-up region, proximity to airports, and local tourism density.

- Price metrics: daily rate, discount percentage, competitor median price.

- Demand signals: active listings, sold-out flags, and search impressions (if available).

- External factors: weather category, holidays, or strikes affecting mobility.

All missing or corrupted entries are corrected through interpolation or eliminated if unreliable. This ensures that each record accurately represents market conditions for a specific time and place.

Data Visualization and Structure

Once cleaned, the data is arranged into structured time-series and panel formats. Below are sample illustrations:

Table 1 – Daily Aggregated Rental Data (Sample)

| Date | City | Vehicle Type | Average Price (£) | Total Rentals | Lead-Time (Days) |

|---|---|---|---|---|---|

| 2025-09-01 | London | Economy | 44.50 | 520 | 6.2 |

| 2025-09-01 | Manchester | Compact | 41.20 | 280 | 5.4 |

| 2025-09-01 | Edinburgh | SUV | 72.10 | 140 | 4.7 |

| 2025-09-02 | London | Economy | 45.00 | 560 | 5.9 |

| 2025-09-02 | Manchester | Compact | 40.80 | 295 | 5.3 |

These tables demonstrate how granular the collected information can be. Every hour adds a new layer of market insight, enabling the model to detect subtle shifts that signal rising or falling demand.

Table 2 – Hourly Travel App Listing Feed (Illustrative)

| Timestamp | App Source | City | Vehicle Type | Listed Cars | Price (£) | Availability (%) |

|---|---|---|---|---|---|---|

| 2025-09-10 08:00 | App A | London | Economy | 230 | 46.20 | 92 |

| 2025-09-10 08:00 | App B | London | SUV | 85 | 78.10 | 88 |

| 2025-09-10 08:00 | App A | Manchester | Compact | 190 | 41.80 | 95 |

| 2025-09-10 09:00 | App B | London | Economy | 215 | 45.70 | 90 |

| 2025-09-10 09:00 | App A | Edinburgh | SUV | 80 | 75.50 | 91 |

These tables demonstrate how granular the collected information can be. Every hour adds a new layer of market insight, enabling the model to detect subtle shifts that signal rising or falling demand.

Forecasting Framework

Defining the Problem

The central objective is to predict the number of rentals expected for a given city and vehicle type over the next few days. The second objective is price optimisation—estimating the expected rental rate that maximises occupancy without eroding margins.Model Architectures

1. Time-Series Models

- ARIMA/SARIMA: capture seasonality and trends.

- Exponential Smoothing: ideal for short-term operational forecasts.

2. Machine Learning Algorithms

- Gradient Boosting (XGBoost): identifies nonlinear relationships.

- Random Forest Regressor: handles noisy, categorical data effectively.

3. Deep Learning Approaches

- LSTM Networks: effective for sequential time-series forecasting using continuous input streams.

- Hybrid CNN-LSTM: combines spatial patterns (e.g., between cities) with time-based trends.

4. Hybrid Economic-Statistical Models<

These combine traditional econometric variables—GDP, tourism arrivals—with real-time app data to generate holistic predictions.

Model Inputs

Input features typically include historical rental volumes, real-time listings, competitor prices, availability, event indicators, and temporal variables. The target variable is forecasted daily rental count or average price.

Model Training

Training involves splitting the data into historical (training) and recent (testing) segments. Sliding window validation ensures that models generalise well. Model parameters are tuned through grid search or Bayesian optimisation.

Evaluation and Benchmarking

Forecast accuracy is measured using standard metrics:

| Metric | Description | Ideal Value |

|---|---|---|

| MAE | Mean Absolute Error – average difference between predicted and actual rentals | Lower |

| RMSE | Root Mean Squared Error – penalises large deviations | Lower |

| MAPE | Mean Absolute Percentage Error – percentage deviation | <10% desirable |

| R² | Coefficient of determination – explanatory power | Close to 1 |

A typical result might show LSTM achieving a MAPE of 8.5%, outperforming ARIMA (13.2%) and Random Forest (10.1%). Such precision can translate into millions in revenue optimisation for large rental networks.

Real-Time Model Integration

A production-level system continuously consumes scraped data from multiple sources. The incoming feed is processed every hour and stored in cloud-based pipelines. Models update forecasts dynamically, adjusting pricing dashboards and fleet recommendations.

For example, if the system detects a sudden spike in bookings near Heathrow Airport, it automatically notifies managers to redirect cars from nearby branches or revise prices upward for the next time block.

This adaptive forecasting capability represents the operational core of real-time car rental data scraping for pricing models, allowing dynamic market reactions instead of static planning.

Comparative Insight: Traditional vs Real-Time Forecasting

| Aspect | Traditional Approach | Real-Time Travel-App Approach |

|---|---|---|

| Data Frequency | Weekly or monthly aggregates | Hourly/daily live listings |

| Responsiveness | Slow; lagged by reporting cycles | Instant adaptation to market changes |

| Accuracy | Limited by sample size | Improved through volume and granularity |

| Cost | Lower upfront, higher inefficiency | Higher setup cost, better ROI |

| Use Case | Stable markets | Dynamic, volatile demand regions |

The evolution from historical batch forecasting to real-time intelligence represents a major leap for car rental operations. Instead of reacting to past trends, managers now act on live market conditions.

Case Analysis and Application Scenarios

Airport Zones: Airport-based locations experience extreme fluctuations tied to flight schedules. Incorporating live flight data along with scraped travel-app availability allows precise anticipation of pick-up surges. Predictive accuracy improves when combined with weather and airline delays.

Urban vs Rural Demand: Urban centres exhibit continuous flow but sharp price elasticity; rural branches show sparse bookings but high lead-time variability. Forecasting models calibrated for each segment ensure optimal fleet distribution.

Event-Driven Peaks: Large sporting or cultural events trigger sudden demand spikes. Integration of event calendars into machine learning models helps pre-position vehicles in advance. The synergy between app-based data and event prediction reduces lost sales from stock-outs.

Insights and Strategic Impact

Demand forecasting transforms the business mindset from reactive to proactive. Using Car Rental Data Intelligence, companies can make data-centric decisions about:

- Fleet Management: Allocate vehicles dynamically based on predicted demand hotspots.

- Revenue Optimisation: Align pricing strategies with real-time market elasticity.

- Customer Experience: Avoid overbookings and reduce wait times.

- Competitive Benchmarking: Track rival prices and offers across major apps daily.

This intelligence, drawn from continuous scraping and modelling, becomes a competitive differentiator. Firms that can accurately predict shifts even a few hours ahead gain a substantial operational advantage.

Ethical and Operational Considerations

Although scraping provides a wealth of insights, it must comply with data privacy and platform guidelines. Ethical scraping ensures transparent use, proper attribution, and respect for user data boundaries.

Operationally, the biggest challenge lies in maintaining scraper reliability amid frequent site changes. Automation frameworks must include error detection, proxy management, and data-validation loops to ensure consistent feed accuracy.

Another concern is computational expense—processing millions of hourly listings across hundreds of cities demands scalable infrastructure and efficient storage.

The Broader Role of Predictive Analytics

Car rental demand forecasting does not exist in isolation. It aligns with broader transport analytics, including ride-sharing, micromobility, and aviation. Real-time analytics can reveal correlations such as increased short-term rentals after public transport strikes or reduced bookings during extreme weather.

With scalable cloud systems, these insights can be shared across corporate departments—marketing, logistics, and pricing—to support unified decision-making. Predictive analytics thus become the engine of travel ecosystem synergy.

Limitations

1. Data Completeness: Travel apps may not list all inventory, introducing partial visibility.

2. Pricing Variability: Promotional rates and bundled offers complicate modelling consistency.

3. External Shocks: Sudden events (e.g., geopolitical disruptions) can invalidate short-term predictions.

4. Model Drift: Algorithms may degrade over time without retraining as user behaviour evolves.

5. Interpretability: Deep models like LSTM can be less transparent, complicating business justification.

Regular retraining, explainable-AI techniques, and ensemble models help mitigate these issues.

Future Directions

The next generation of forecasting will likely combine predictive modelling with prescriptive analytics—suggesting not only what will happen, but what should be done. Integrating reinforcement learning could enable fully autonomous pricing systems.

Furthermore, advancements in mobility data sharing and open APIs will facilitate seamless integration between travel platforms. Predictive signals from hotel or flight data could be merged with car rental forecasts to deliver holistic travel-planning insights.

As sustainability becomes a core theme, models may also incorporate vehicle type (EV vs petrol), carbon-footprint data, and charging-infrastructure availability.

Conclusion

The adoption of real-time, data-driven forecasting signifies a turning point for car rental operators worldwide. By combining statistical science with digital infrastructure, businesses can anticipate consumer movement instead of merely reacting to it.

When organisations conduct a Travel app scrape for car rental price intelligence, they transform the invisible pulse of consumer intent into measurable metrics. This predictive visibility empowers strategic fleet planning, pricing optimisation, and customer-centric services. Moreover, anticipating car rental demand using travel app data extract ensures efficient utilisation and revenue stability even in unpredictable markets.

Finally, integrating a Car Rental Location Dataset into the analytical pipeline enhances spatial awareness—linking micro-level trends across cities, airports, and tourist regions. As real-time intelligence becomes the new standard, those harnessing these models will define the next era of predictive mobility management.

Ready to elevate your travel business with cutting-edge data insights? Scrape Aggregated Flight Fares to identify competitive rates and optimize your revenue strategies efficiently. Discover emerging opportunities with tools to Extract Travel Website Data, leveraging comprehensive data to forecast market shifts and enhance your service offerings. Real-Time Travel App Data Scraping Services helps stay ahead of competitors, gaining instant insights into bookings, promotions, and customer behavior across multiple platforms. Get in touch with Travel Scrape today to explore how our end-to-end data solutions can uncover new revenue streams, enhance your offerings, and strengthen your competitive edge in the travel market.