Bundle Deals During Monsoon Season: Price Monitoring of Vacation Packages from MakeMyTrip & Thomas Cook

Introduction

Monsoon season in India brings more than just rain—it triggers a surge in demand for affordable getaways. To tap into this trend, leading travel portals like MakeMyTrip (MMT) and Thomas Cook offer attractively priced bundle vacation packages that include flights, accommodations, sightseeing, and transfers.

These packages, however, don’t maintain static pricing. Their rates fluctuate based on factors such as demand patterns, weather events, long weekends, and internal promotions. This makes vacation package price monitoring an essential strategy for travel businesses and consumers alike.

This case study from Travel Scrape, a leader in Travel Data Intelligence, explores how these portals deploy dynamic bundle pricing, providing real-time pricing insights, data snapshots, and comparative analysis across top Indian destinations during the 2025 monsoon season.

Objectives

- Track bundle vacation price fluctuations on MMT and Thomas Cook.

- Compare bundle structures, pricing tactics, and promotional behaviors.

- Detect real-time changes in price and availability using automated scraping.

- Provide actionable insights for travel businesses and pricing analysts.

- Introduce use cases for vacation package price monitoring and Travel Data Intelligence.

Scraping Methodology by Travel Scrape

Our team used proprietary scraping technology for Travel Data Intelligence to extract bundle pricing across platforms.

Tools Deployed:

- Selenium & Puppeteer for rendering JavaScript-heavy travel portals.

- Headless Browsers simulating desktop and mobile behavior.

- Real-time price monitoring bots running every 6 hours.

- Geo-fencing simulation for origin-specific pricing.

- Structured JSON data storage for downstream analytics.

Destinations and Origin Cities Analyzed

Top Monsoon Destinations Scraped:

- Goa

- Munnar & Alleppey (Kerala)

- Coorg (Karnataka)

- Darjeeling

- Udaipur

Departure Cities:

- Delhi

- Mumbai

- Bangalore

Date range tracked: June 1 – July 15, 2025

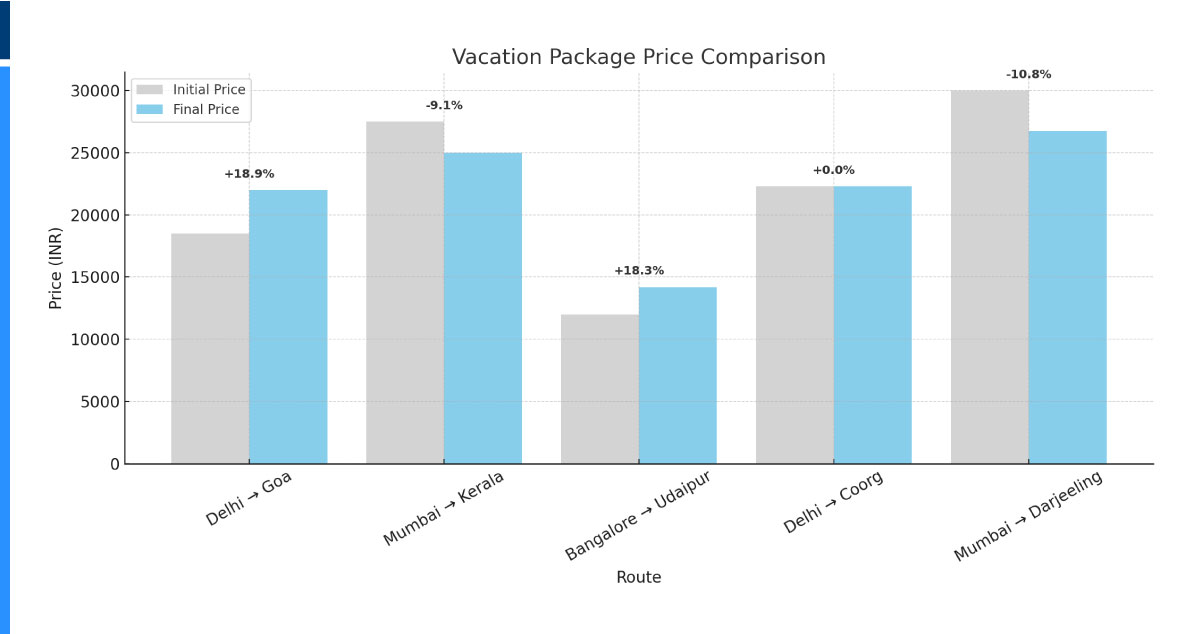

Sample Vacation Bundle Data

| Platform | Origin | Destination | Package Type | Date Range | Initial Price | Final Price | % Change |

|---|---|---|---|---|---|---|---|

| MakeMyTrip | Delhi | Goa | 3N/4D Flight+Hotel | 01-04 July 2025 | ₹18,499 | ₹21,999 | +18.9% |

| Thomas Cook | Mumbai | Kerala | 4N/5D Group Tour | 10-15 June 2025 | ₹27,500 | ₹24,999 | -9.1% |

| MakeMyTrip | Bangalore | Udaipur | Hotel+Cab Only | 20-23 June 2025 | ₹12,000 | ₹14,200 | +18.3% |

| Thomas Cook | Delhi | Coorg | 3N Resort Package | 05-08 July 2025 | ₹22,300 | ₹22,300 | 0% |

| MakeMyTrip | Mumbai | Darjeeling | 5N/6D Package | 25-30 June 2025 | ₹29,999 | ₹26,750 | -10.8% |

MakeMyTrip’s Dynamic Pricing Tactics

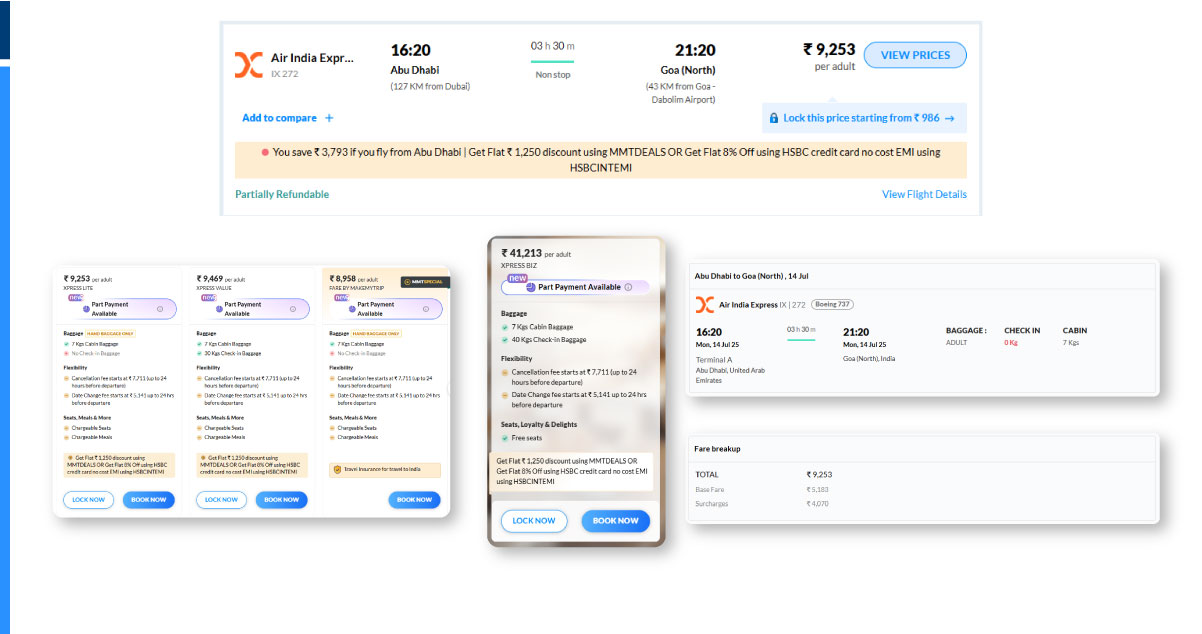

1. Flash Discounts & Countdown Timers

MakeMyTrip heavily uses flash sales, often with 24-hour countdowns. On June 28, a 3N Goa package dropped from ₹20,499 to ₹18,499, only to rise again by July 1.

Triggers:

- Long weekends

- Heavy rainfall in competing destinations

- Limited inventory thresholds

2. Device-Specific Discounts

Users checking prices via the mobile app received exclusive discounts of ₹500–₹1000. A Darjeeling package, for instance, cost ₹27,999 on desktop but ₹26,499 in-app.

Reasoning:

- MMT pushes app adoption via promo codes.

- Mobile behavior is more deal-driven.

3. User Behavior–Driven Pricing

Users returning to the same package within 48 hours saw “price lock” suggestions or slight increases—a behavioral upsell tactic.

Thomas Cook’s Hybrid Strategy

1. Base Package + Modular Add-Ons

Thomas Cook uses a fixed base package rate and dynamically prices add-ons like sightseeing, hotel upgrades, or premium transfers.

Example: A ₹25,000 Kerala package increased to ₹28,400 with three add-ons selected at checkout.

2. Agent Channel Pricing Variation

Offline quotes from Thomas Cook agents showed price variations of 5-10% from online rates—highlighting a dual pricing engine.

This mix of digital and human-led pricing demonstrates hybrid Travel Data Intelligence in action.

What Influences Dynamic Pricing?

| Variable | Influence Level | Observed Behavior |

|---|---|---|

| Booking Lead Time | High | Shorter lead = Higher price |

| Travel Window (Weekend) | High | Long weekends = Surge pricing |

| Weather Forecast | Medium | Kerala floods = Discount triggers |

| Portal Promotions | High | Campaigns create sudden 15-20% dips |

| Origin City Demand | Medium | Delhi-GOA high demand = steep fluctuations |

| Inventory Remaining | High | Lower rooms = Auto-surge on final 5 slots |

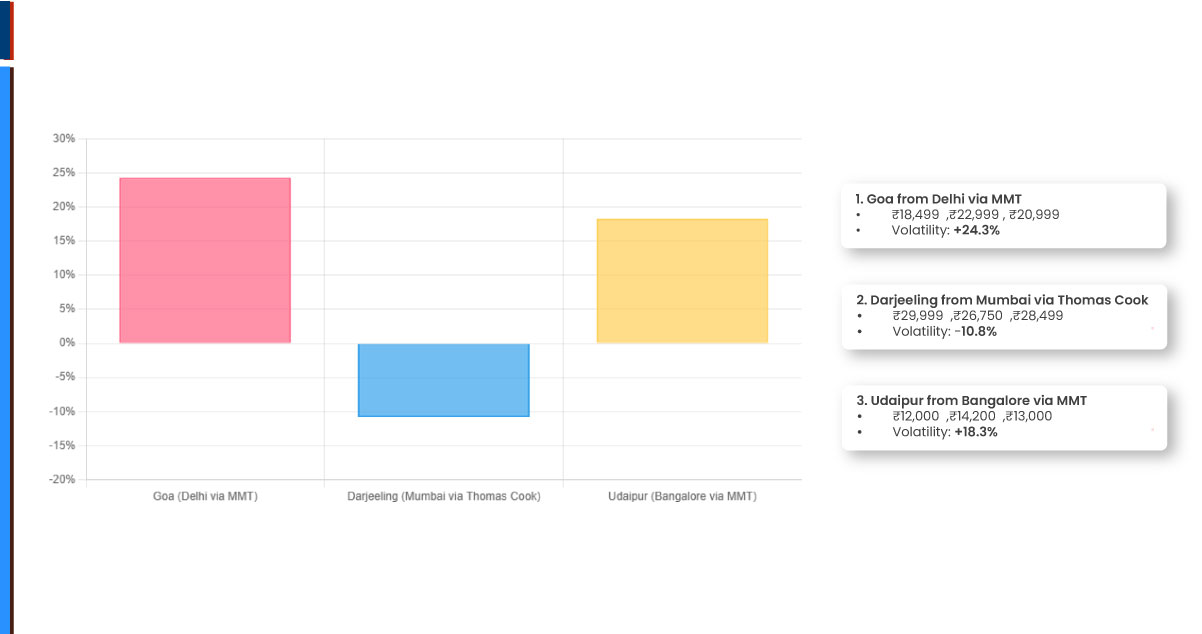

Most Volatile Packages Tracked

1. Goa from Delhi via MMT

- ₹18,499 → ₹22,999 → ₹20,999

- Volatility: +24.3%

2. Darjeeling from Mumbai via Thomas Cook

- ₹29,999 → ₹26,750 → ₹28,499

- Volatility: -10.8%

3. Udaipur from Bangalore via MMT

- ₹12,000 → ₹14,200 → ₹13,000

- Volatility: +18.3%

City-Wise Trends

Delhi

- Flash sales were rare; prices surged closer to travel date.

- Goa bundles saw the highest dynamic pricing swings.

Mumbai

- Most competitive Kerala rates.

- Frequent monsoon flash offers across all destinations.

Bangalore

- Steady pricing for hill stations like Coorg.

- Lower volatility, but more up-sell behavior during checkout.

Impact on Consumers

- Early birds saved up to 20%.

- Mobile users benefited more via exclusive discounts.

- Group travelers faced more fluctuation due to limited multi-room availability.

Role of Travel Scrape in Price Monitoring

As a leading provider of Travel Data Intelligence, Travel Scrape enables travel brands, aggregators, and tech startups to:

- Track competitor bundle pricing in real time.

- Optimize their own dynamic pricing engines using scraped insights.

- Integrate bundle price monitoring into AI-based travel platforms.

- Benchmark offers city-wise and date-wise.

- Provide dashboards or alerts to end users about falling/rising prices.

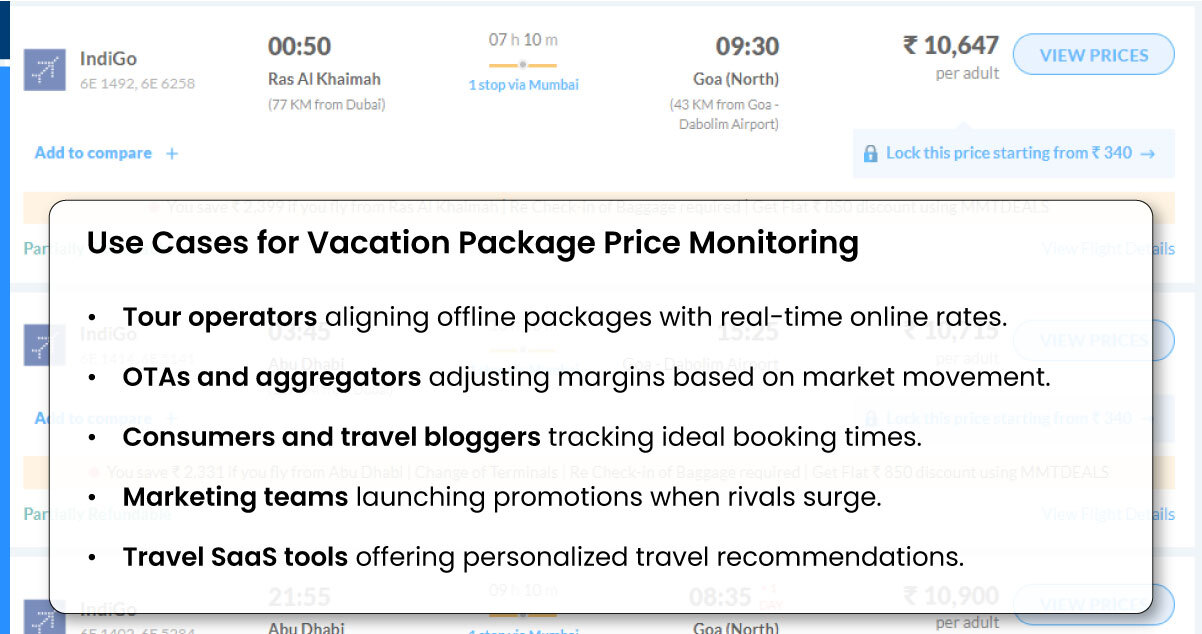

Use Cases for Vacation Package Price Monitoring

- Tour operators aligning offline packages with real-time online rates.

- OTAs and aggregators adjusting margins based on market movement.

- Consumers and travel bloggers tracking ideal booking times.

- Marketing teams launching promotions when rivals surge.

- Travel SaaS tools offering personalized travel recommendations.

Recommendations for Travel Brands

- Adopt real-time competitor monitoring to stay ahead during seasonal peaks.

- Leverage app-exclusive deals to drive downloads and engagement.

- Use monsoon-specific triggers like weather APIs to adjust pricing dynamically.

- Clearly disclose add-ons to improve trust and reduce abandonment.

- Provide real-time price alerts to potential customers.

What’s Next for Travel Scrape

- Expand monitoring to Thailand, Sri Lanka, and Vietnam monsoon travel deals.

- Add chatbot integration for real-time deal suggestions.

- Offer dynamic PDF reports and dashboards for tour operators.

- Train AI models to predict pricing 7–15 days in advance using historical volatility.

- Introduce WhatsApp deal scraping and alerting.

Conclusion

This case study shows that vacation package price monitoring is no longer optional for travel players—it’s essential. Both MakeMyTrip and Thomas Cook use dynamic bundle pricing strategies that respond to user behavior, travel seasons, weather, and platform usage.

With tools like Travel Scrape, businesses can now tap into rich Travel Data Intelligence to build competitive packages, optimize pricing, and drive conversions. As monsoon travel continues to gain traction, understanding the science behind dynamic pricing is a powerful asset.