Hotel Price Trend Analysis 2026: Global Pricing Intelligence and Data-Driven Insights

Introduction

Hotel pricing is no longer a static output of seasonal demand; it has evolved into a real-time strategic lever shaped by data, automation, and competitive intelligence. In 2026, as global travel stabilizes after years of volatility, hotels are operating in a market where demand is steady, but pricing power is constrained. Margins are thin, competition is intense, and success depends on understanding micro-level price movements across channels and regions.

Hotel price trend analysis 2026 shows that global average daily rates (ADR) are expected to rise only 1–2%, well below inflation in most markets. This modest growth means hotels can no longer rely on demand surges to drive revenue. Instead, they must optimize pricing continuously using granular, competitor-level data.

Hotel Data Scraping Services have become central to this transformation, enabling hotels, OTAs, and travel intelligence platforms to collect, normalize, and analyze pricing data across thousands of properties and booking channels.

However, the need to scrape Hotel Pricing Trends data is now essential for forecasting demand, benchmarking competitors, optimizing revenue strategies, and responding quickly to regional or event-driven market shifts.

This research report explores how scraped hotel pricing data shapes decision-making in 2026, covering global trends, regional variations, business versus leisure pricing dynamics, and the growing role of AI-driven revenue management.

The Shift Toward Data-First Hotel Pricing

In 2026, nearly 90% of hotels globally use automated or AI-assisted revenue management systems. These platforms rely heavily on continuously refreshed pricing inputs sourced from OTAs, brand websites, metasearch platforms, and competitor listings. Static rate cards are fading, replaced by dynamic models that recalibrate prices multiple times per day.

Hotels that leverage scraped pricing data report revenue uplifts of 12–18%, primarily through better rate timing rather than higher occupancy. This highlights a critical industry shift: pricing intelligence now determines performance more than raw demand growth.

Global Hotel Pricing Growth Outlook (2026)

| Region | Expected ADR Growth | Primary Drivers | Pricing Pressure Factors |

|---|---|---|---|

| North America | 1.1% – 4% | 2026 FIFA World Cup, Luxury resilience | Softening economy demand, new supply (1.8%) |

| Europe | 2% – 4.2% | Strong inbound leisure, UK supply growth | Labor costs, Dutch/French tax hikes |

| Asia-Pacific | 1% – 5% | India (6.4%+), Japan/Vietnam recovery | Slowing China recovery, regional competition |

| Latin America | 5% – 6% | Experiential travel, festival "Live Tourism" | Inflation volatility, brand expansion wars |

| Middle East & Africa | 1% – 5% | Riyadh/Dubai expansion, Mega-events | Massive new supply (54k+ rooms in 2026) |

This fragmented growth pattern reinforces the need for localized, city-level pricing intelligence rather than broad regional averages.

Regional Pricing Variations and Competitive Dynamics

Scraped pricing data reveals that hotel rate movements in 2026 are highly uneven, even within the same country. In the U.S., cities like New York and San Francisco show moderate growth of 3–4%, while secondary markets remain flat due to new supply. In Europe, cities with short-term rental restrictions such as Amsterdam and Barcelona outperform neighboring markets.

Asia-Pacific is particularly polarized. India stands out as one of the fastest-growing pricing markets, driven by domestic business travel and limited high-quality supply in cities like Bengaluru and Hyderabad. Meanwhile, parts of East Asia show flat or declining ADRs as post-reopening momentum fades.

Sample City-Level Hotel Price Movement (2026 Projection)

| City | Segment Focus | Expected ADR Change | Key Insight |

|---|---|---|---|

| New York | Business & Bleisure | +3.5% to +4.0% | World Cup premiums pushing peak rates to $580+ |

| Paris | Leisure & Events | +4.0% | Notre Dame reopening and AI summits drive compression |

| Bengaluru | Business Travel | +6.0% to +7.0% | GCC expansion and 13% RevPAR growth outperforming luxury |

| Hong Kong | Corporate | 0% to -1% | Office leasing recovery offset by soft per-capita spend |

| Dubai | Mixed | +2.0% to +4.6% | High supply (152k rooms) caps aggressive hikes |

| Buenos Aires | Leisure | +5.6% to +6.5% | Peso weakness attracts high-volume inbound leisure |

These insights are typically derived from a continuously refreshed Hotel Room Price Trends Dataset, which aggregates daily rates across multiple OTAs and booking windows.

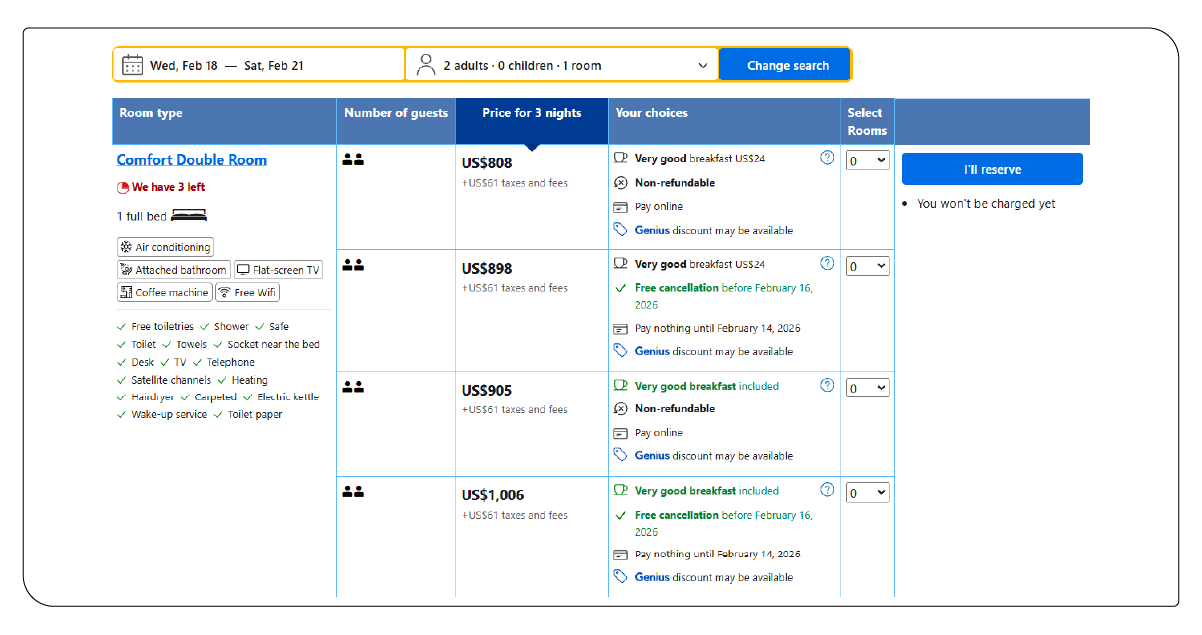

Business Travel Pricing: Stability Without Leverage

Business travel spending has fully recovered in volume, but pricing power has not. Corporate buyers are negotiating aggressively, using increased supply and slower economic growth to cap hotel rate increases. Most forecasts show corporate ADR growth staying below 2% globally in 2026.

Hotels now rely on blended strategies, offering negotiated weekday rates while capturing higher leisure pricing for weekend extensions. Scraped corporate and public rate data allows revenue teams to identify leakage, monitor compliance, and adjust pricing fences effectively.

Leisure, Family, and Group Travel Pricing Signals

Leisure demand remains strong but increasingly price-sensitive. Scraped pricing data shows travelers shifting toward midscale properties, shorter stays, and off-peak travel. At the same time, premium experiential hotels continue to command strong rates, revealing a bifurcated market.

Family and group travel further complicate pricing models. Larger rooms, suites, and connected inventory often show higher rate volatility, especially during school holidays. Hotels use historical comparisons and forward-looking pickup data to price these categories dynamically.

This is where a structured hotel pricing trend dataset becomes valuable, allowing analysts to compare room-type-level performance across seasons, traveler segments, and destinations.

AI, Automation, and Revenue Optimization

Modern pricing systems in 2026 ingest massive volumes of scraped data and apply machine learning models to forecast demand and recommend optimal prices. These systems increasingly extend beyond room rates, dynamically pricing add-ons such as meals, parking, spa services, and bundled packages.

AI models are only as good as their data inputs. That’s why many hotels and travel intelligence firms invest heavily in Hotel Data Intelligence, combining pricing, availability, reviews, and demand signals into a single analytical layer.

Key Data Inputs Used in Hotel Pricing Models (2026)

| Data Type | Source | Strategic Use |

|---|---|---|

| Competitor Room Rates | OTAs, brand sites | Rate benchmarking |

| Availability & Inventory | Booking platforms | Demand forecasting |

| Event Calendars | Local data feeds | Surge pricing |

| Reviews & Ratings | Travel platforms | Price-value calibration |

| Weather & Seasonality | Public data | Short-term adjustments |

Historical comparisons remain crucial. historical hotel price trend analysis helps revenue teams understand how markets behaved during similar economic conditions, avoiding reactive pricing decisions.

APIs and Real-Time Data Extraction

The speed of pricing decisions in 2026 demands instant data access. Many organizations now rely on APIs rather than batch data pulls to feed revenue systems and dashboards.

A real-time Extract hotel data API enables continuous monitoring of rate changes across competitors, ensuring pricing decisions reflect the latest market movements rather than outdated snapshots.

Similarly, a Real-Time Hotel Data Scraping API allows travel platforms, analysts, and hoteliers to track fluctuations at the city, property, or room-type level, supporting both strategic planning and tactical pricing actions.

Conclusion

Hotel pricing in 2026 is no longer about chasing growth; it’s about defending margin through intelligence, discipline, and speed. With global ADR growth capped at 1–2%, outperforming the market depends on how well hotels interpret and act on pricing data.

Success now requires continuous hotel rate price monitoring, not occasional benchmarking exercises. Hotels that invest in automation, analytics, and reliable data pipelines will react faster to demand shifts without eroding brand value.

At the same time, web scraping hotel prices Trends is becoming foundational for competitive intelligence, enabling visibility across channels, markets, and traveler segments.

Finally, pricing decisions are increasingly influenced by perception, not just numbers. Integrating datasets like the Hotel Guest Review Dataset alongside pricing data helps hotels understand how value perception impacts booking behavior, ensuring prices align with guest expectations.

As the industry moves deeper into a data-driven era, 2026 will reward hotels that price with precision, supported by robust scraping infrastructure and intelligent analytics.

Ready to elevate your travel business with cutting-edge data insights? Scrape Aggregated Flight Fares to identify competitive rates and optimize your revenue strategies efficiently. Discover emerging opportunities with tools to Extract Travel Website Data, leveraging comprehensive data to forecast market shifts and enhance your service offerings. Real-Time Travel App Data Scraping Services helps stay ahead of competitors, gaining instant insights into bookings, promotions, and customer behavior across multiple platforms. Get in touch with Travel Scrape today to explore how our end-to-end data solutions can uncover new revenue streams, enhance your offerings, and strengthen your competitive edge in the travel market.