Extract Hilton Hotel Chains Locations in UK 2026 to Enhance Market Intelligence

This report highlights how extracting Hilton Hotel chains locations in the UK provides actionable insights for strategic planning and market intelligence.

Introduction

The UK hospitality industry in 2026 is increasingly shaped by data-driven insights that enable precise market evaluation and strategic expansion. One of the most valuable intelligence assets for hotel operators, travel platforms, and investors is the ability to Extract Hilton Hotel chains Locations in UK, providing visibility into brand distribution, regional performance, pricing behavior, and guest demand across the country.

By leveraging advanced solutions such as the Real-Time Hotel Data Scraping API, businesses can continuously monitor hotel availability, rate movements, and occupancy signals across Hilton’s UK portfolio. Through systematic Scraping Hilton hotel chain locations UK, organizations gain structured datasets that support competitive benchmarking, location-based planning, and revenue optimization across England, Scotland, Wales, and Northern Ireland.

Hilton operates a diversified brand portfolio in the UK, including Hilton Hotels & Resorts, DoubleTree by Hilton, Hampton by Hilton, Hilton Garden Inn, Curio Collection, and Conrad Hotels. These brands are strategically positioned in business hubs, tourist destinations, and transport-linked cities. Extracting and analyzing Hilton’s UK location data enables deeper insights into hotel density, regional demand patterns, and brand-level performance trends.

280+

Hotels

30+

Major Cities

All

UK Regions

Covered

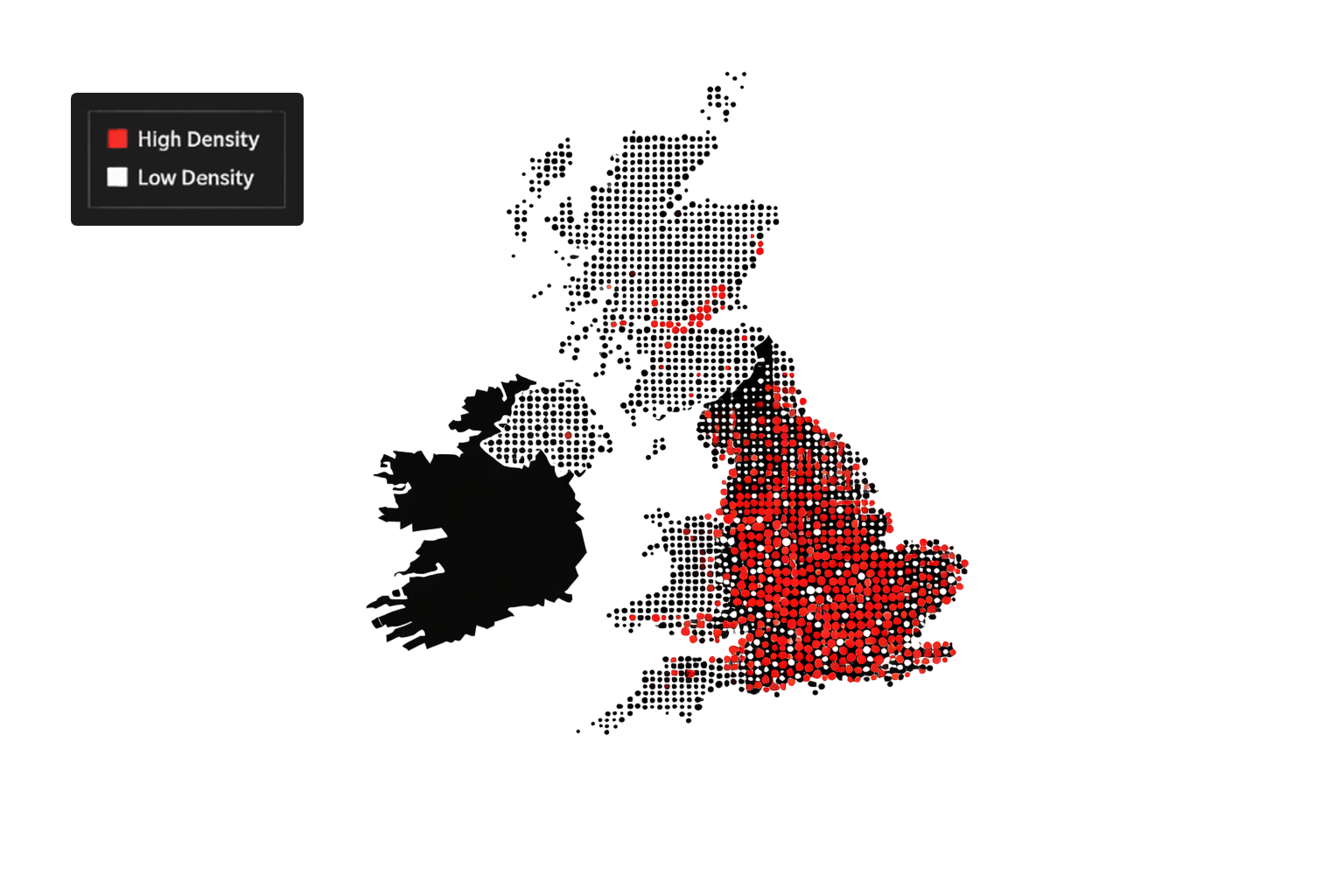

Top Regions by Number of Hilton Hotels

Regions with the highest concentration of Hilton hotels in the United Kingdom.

GREATER LONDON

75+

SOUTH EAST ENGLAND

45+

MIDLANDS

35+

NORTH WEST ENGLAND

30+

SCOTLAND

28+

WALES

12+

City Level Granularity

Total Cities Covered: 30+ major cities including London, Manchester, Birmingham, Edinburgh, Glasgow, Liverpool, Leeds, Bristol, Cardiff, Oxford, Cambridge, Reading, and Nottingham.

High Occupancy Hubs :

Top States with Most Hilton Hotels in the UK

Based on available data, the states with the highest number of Hilton properties include:

| Rank | State Name | Total Hotels | Key Cities |

|---|---|---|---|

| 01 | England – Greater London | 75+ | London, Westminster, Canary Wharf |

| 02 | England – South East | 45+ | Reading, Oxford, Gatwick |

| 03 | England – West Midlands | 35+ | Birmingham, Coventry |

| 04 | England – North West | 30+ | Manchester, Liverpool |

| 05 | Scotland | 28+ | Edinburgh, Glasgow |

| 06 | Wales | 12+ | Cardiff, Newport |

These states account for the majority of Hilton hotels across the UK and attract a mix of corporate, leisure, and international travelers, supported by the Hilton hotel chain location dataset UK. Hilton’s concentration in economically active and tourism-oriented states reflects a deliberate location strategy, supporting market analysis, expansion planning, and competitive intelligence initiatives through the method Extract API for Hilton Hotel Chains UK.

Hilton Hotels in Key UK Cities

| Rank | City Name | Hotels | Avg Review | Star Rating | Starting Price |

|---|---|---|---|---|---|

| 01 | London | 12 | 8.4 | 4★–5★ | £210 |

| 02 | Manchester | 10 | 8.2 | 3★–4★ | £165 |

| 03 | Birmingham | 9 | 8.1 | 3★–4★ | £150 |

| 04 | Edinburgh | 8 | 8.5 | 4★–5★ | £195 |

| 05 | Glasgow | 7 | 8.0 | 3★–4★ | £155 |

This table illustrates Hilton’s concentration of hotels and corresponding guest satisfaction across major UK cities using Web scraping Hilton hotel location data UK.

The insights support comparative performance benchmarking, enable demand forecasting at the city level, and help analysts evaluate market strength, competitive positioning, and future growth opportunities with greater accuracy through Hilton.com Travel Datasets.

Hilton Hotels with High Occupancy Rates

| Rank | Hotel Name | City | Star Rating | Review Score | Total Rooms | Occupancy Rate (%) |

|---|---|---|---|---|---|---|

| 01 | Hilton London Metropole | London | 4★ | 8.3 | 1,100 | 91% |

| 02 | DoubleTree by Hilton Manchester Piccadilly | Manchester | 4★ | 8.5 | 285 | 89% |

| 03 | Hilton Edinburgh Carlton | Edinburgh | 4★ | 8.6 | 211 | 92% |

| 04 | Hampton by Hilton Birmingham Broad Street | Birmingham | 3★ | 8.2 | 285 | 87% |

High-occupancy Hilton properties highlight strong, location-driven demand patterns across key markets using Hilton property location data UK. Analyzing these performance indicators helps refine pricing strategies, optimize revenue management, and guide future expansion decisions by identifying cities and locations with sustained booking momentum and growth potential.

Distribution of Hilton Hotels Across Major UK Cities

| Rank | City | Number of Hotels | Total Rooms | Avg Review Score | Starting Price (GBP) |

|---|---|---|---|---|---|

| 01 | London | 12 | 4,850 | 8.4 | 210 |

| 02 | Manchester | 10 | 2,100 | 8.2 | 165 |

| 03 | Birmingham | 9 | 1,980 | 8.1 | 150 |

| 04 | Edinburgh | 8 | 1,650 | 8.5 | 195 |

| 05 | Glasgow | 7 | 1,420 | 8.0 | 155 |

This city-level breakdown delivers a clear, data-driven view of Hilton’s operational presence across key UK markets. By highlighting hotel density, room capacity, pricing levels, and guest performance at the city scale, it enables accurate hotel analytics, supports informed investment evaluation, and helps identify high-growth locations with strong revenue potential.

Looking to Give Your Hotel Business an Edge?

“Harness powerful web scraping tools to gather hotel data efficiently and transform it into actionable business insights.”

Advantages of Hilton Hotel Location Data Over Generic Hotel Datasets

Hilton-focused location datasets transform raw hotel information into strategic intelligence, enabling stakeholders to interpret market behavior, spatial demand, and brand performance with precision across the UK hospitality landscape.

- Market Intelligence & Strategy Teams: Gain visibility into regional hotel concentration, competitive pressure, and demand corridors, supporting market entry evaluation, portfolio restructuring, and long-term brand positioning decisions.

- Urban Planners & Infrastructure Analysts: Utilize location-linked hotel density data to understand tourism flow, transport connectivity impact, and hospitality demand near commercial districts and transit hubs.

- Revenue Management & Pricing Teams: Access location-based rate patterns and occupancy signals to fine-tune dynamic pricing models, improve yield management, and respond effectively to city-level demand shifts.

- Travel Technology & Booking Platforms: Enhance search accuracy, recommendation engines, and location relevance by integrating brand-specific hotel coordinates, availability signals, and performance indicators.

- Corporate Travel & Mobility Managers: Identify strategically located Hilton properties aligned with business travel routes, conference venues, and corporate hubs to optimize travel planning and accommodation efficiency.

| Field Name | Description |

|---|---|

| Property Identifier | Unique Hilton hotel name linked with brand tier |

| Geographic Coordinates | Latitude, longitude, and regional classification |

| Market Classification | Business district, airport zone, city center, or leisure area |

| Capacity Indicators | Room count, room-type mix, and capacity utilization |

| Pricing Signals | Base rates, demand-led price shifts, and rate dispersion |

| Guest Experience Metrics | Satisfaction scores, review velocity, and sentiment trends |

This data framework is designed for direct compatibility with method to Extract Hilton.com Hotel API Data, enabling scalable ingestion into analytics platforms, forecasting models, and decision-support systems.

Insights and Analysis

Strategic Urban Coverage

Hilton’s strongest hotel clusters align with the UK’s highest business travel and tourism demand, particularly London, Manchester, Birmingham, and Edinburgh, ensuring consistent year-round occupancy and strong brand visibility.

Transport-Driven Location Strategy

A significant share of Hilton properties are positioned near airports, rail terminals, and convention centers, allowing the brand to capture corporate, transit, and event-driven demand efficiently.

Demand-Responsive Pricing Patterns

City-level pricing variations reflect Hilton’s ability to adjust room rates based on regional demand intensity, seasonal travel trends, and city-specific occupancy performance.

Balanced Portfolio Deployment

Hilton’s UK footprint demonstrates a deliberate balance between full-service city hotels and focused-service properties, enabling revenue stability across different traveler segments and economic cycles.

High-Performing City Clusters

Cities with multiple Hilton hotels show higher average review scores and occupancy rates, indicating operational efficiencies and strong customer trust in markets with dense brand presence.

Expansion Opportunity Identification

Mid-tier cities with rising tourism and limited Hilton penetration present clear opportunities for future development, supported by existing performance benchmarks from comparable urban markets.

Brand-Led Guest Satisfaction

Consistently strong review scores across locations highlight Hilton’s standardized service delivery, reinforcing brand loyalty and repeat bookings in competitive UK hospitality markets.

Data-Backed Investment Confidence

Granular location, occupancy, and pricing insights enable investors and operators to assess risk accurately, forecast revenue potential, and prioritize high-yield UK markets with confidence.

Conclusion

By leveraging structured hotel intelligence to analyze Hilton’s UK footprint, hospitality businesses can unlock actionable insights into location performance, pricing dynamics, and occupancy behavior. Advanced analytics powered by UK Hilton Hotel chains Locations data analytics enable informed investment decisions and operational optimization.

Direct integration through UK Hilton Hotel chains Locations data API supports real-time monitoring and predictive modeling, while Web Scraping Hilton.com Hotels Data ensures continuous access to market signals across availability, pricing, and guest sentiment.

As Hilton continues to expand across the UK, data-driven location intelligence will remain essential for maintaining competitiveness, improving guest experiences, and maximizing long-term revenue growth.