How Can Hertz U.S. Pricing Intelligence Help Optimize Your Car Rental Strategy?

.webp)

Introduction

The car rental industry in the United States has seen remarkable transformations over the past decade, driven by technological innovations, customer-centric strategies, and dynamic pricing mechanisms. Among the leading players, Hertz stands out as a benchmark for rental pricing intelligence. Leveraging Hertz U.S. Pricing Intelligence has become critical for fleet managers, travel agencies, and data analysts seeking to gain a competitive edge in understanding market trends, optimizing revenue strategies, and predicting customer behavior.

The integration of Car Rental Data Intelligence allows operators to access granular insights into pricing fluctuations, vehicle class demand, and hold policy dynamics, which are essential for informed decision-making. With the help of Hertz U.S. car rental price monitoring, businesses can track price variations across different locations, vehicle types, and booking windows in real time. This not only improves operational efficiency but also enables proactive pricing adjustments to maximize revenue.

Through meticulous Hertz car rental data scraping , analysts can collect comprehensive datasets covering vehicle class mapping, weekend versus weekday pricing dynamics, and hold policy rules. These datasets form the foundation for predictive modeling, revenue forecasting, and competitive benchmarking, offering actionable insights that drive strategic growth in the U.S. car rental market.

Understanding Hertz Vehicle Class Mapping

Hertz categorizes its rental fleet into multiple vehicle classes, each designed to cater to specific customer needs and travel patterns. Understanding this classification is crucial for pricing analysis, demand forecasting, and revenue optimization. Hertz U.S. vehicle class mapping for pricing insights allows analysts to track how different segments perform under varying market conditions.

Key Vehicle Classes

- Compact Vehicles: Economical options for city and short-distance travel. They are popular among budget-conscious customers and first-time renters. Pricing for compact vehicles tends to be highly elastic, responding quickly to market competition and seasonal demand.

- Intermediate Vehicles: Offering slightly more space and comfort than compacts, intermediate cars are often preferred for business trips or family outings. Their pricing reflects a balance between affordability and comfort.

- SUVs: SUVs are in high demand during peak travel seasons, family vacations, and in regions requiring rugged transportation. These vehicles often carry higher weekend rates and seasonal pricing spikes.

- Luxury Vehicles: These premium vehicles cater to high-income travelers, business executives, and special occasions. Their pricing is significantly influenced by location, seasonality, and local events.

- Premium Vehicles: Positioned between standard and luxury, these vehicles attract travelers seeking additional comfort without the high price tag of luxury cars.

Sample Table: Hertz U.S. Vehicle Pricing Data

| Vehicle Class | Average Weekday Rate (USD) | Average Weekend Rate (USD) | Hold Policy Details |

|---|---|---|---|

| Compact | 45 | 55 | 24-hour hold before pickup |

| Intermediate | 50 | 65 | Prepaid, non-refundable options available |

| SUV | 70 | 85 | 48-hour hold, cancellation fee applies |

| Luxury | 120 | 150 | Flexible hold, subject to availability |

| Premium | 100 | 130 | Prepayment recommended, limited availability |

The above dataset represents a simplified overview of Hertz’s vehicle pricing structure. Real-world scraping can capture thousands of entries per city, enabling a detailed Car Rental Price Trends Dataset that facilitates granular insights into vehicle utilization, demand spikes, and price optimization opportunities.

Weekend vs. Weekday Pricing Dynamics

One of the most critical aspects of Hertz U.S. Pricing Intelligence is understanding how rental prices fluctuate between weekdays and weekends. The behavior of corporate and leisure travelers significantly impacts pricing, making it imperative for analysts to monitor these variations.

- Weekday Rentals: Corporate travelers dominate weekday bookings. Cities with high business activity, such as New York, Chicago, and Houston, see steady weekday demand. Weekday rates are typically stable but can be influenced by local events, holidays, or sudden business travel surges.

- Weekend Rentals: Leisure travel drives weekend demand, leading to higher pricing for SUVs, luxury, and premium vehicles. Weekend rentals are more sensitive to location, with tourist-heavy cities like Orlando, Las Vegas, and Miami showing significant spikes in weekend rates.

Real-Time Car Rental Price Tracking enables businesses to monitor these fluctuations dynamically. Analysts can detect early-week dips, Friday spikes, and weekend peaks, allowing for strategic price adjustments to capture maximum revenue.

By scraping Hertz pricing data across different cities and vehicle classes, businesses can map out a predictive model of demand cycles. This information not only helps in pricing optimization but also informs fleet allocation, ensuring high-demand vehicles are available in peak locations.

Hold Policies and Customer Behavior Analysis

Hertz U.S. hold policies directly influence booking behavior, cancellations, and overall revenue. Scraping this information provides valuable insights into how customers interact with pricing and flexibility options.

Types of Hold Policies

Understanding the distribution of hold policies helps businesses identify customer preferences and predict booking behavior. By integrating Travel Scraping API Services, analysts can continuously monitor hold policies across multiple locations, providing real-time insights into cancellation risks and potential revenue loss.

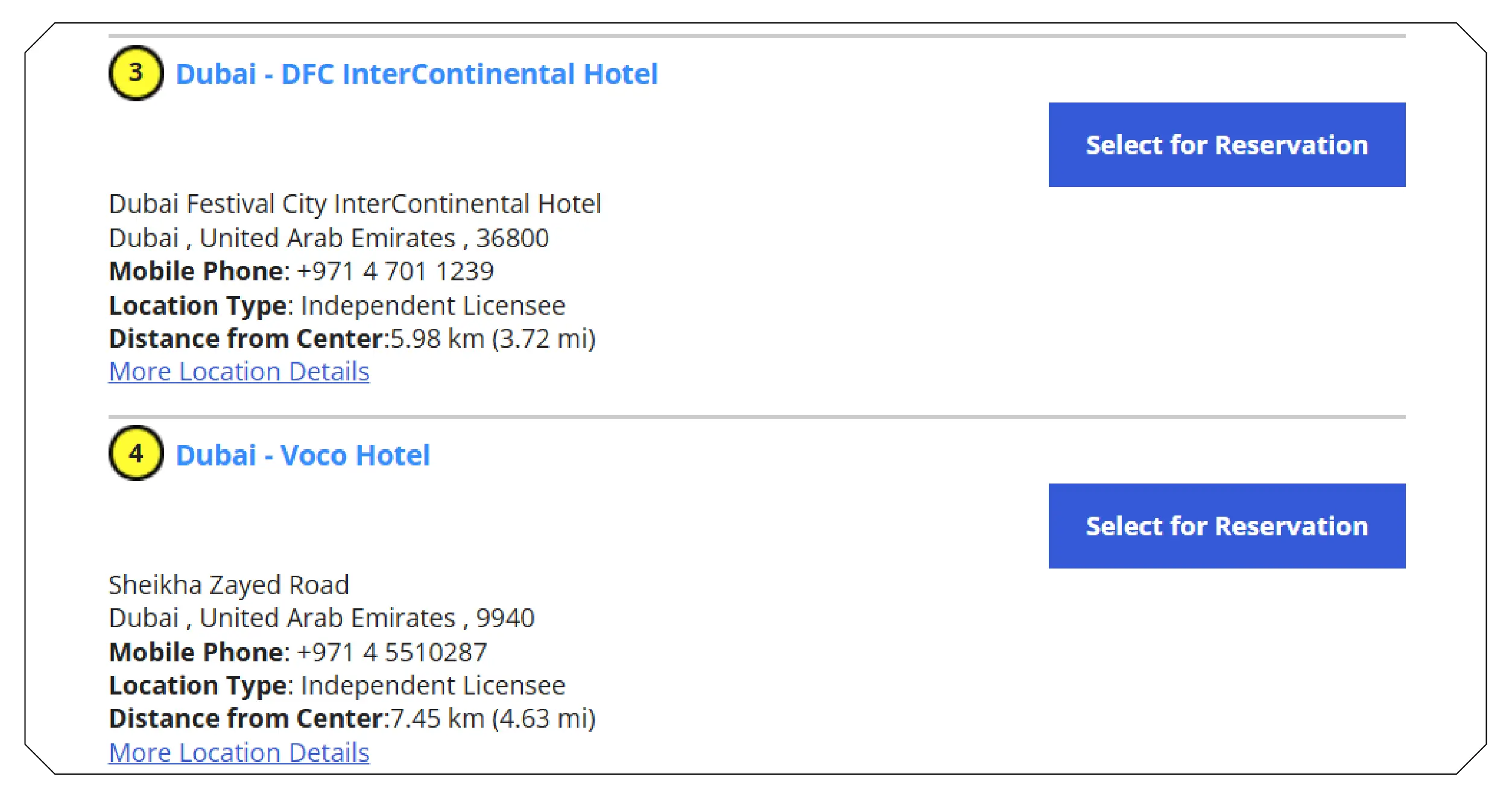

City-Specific Pricing Insights

U.S. cities exhibit varied rental demand patterns due to local economic conditions, tourism influx, and business activity. Scraping Hertz data on a city-by-city basis provides actionable intelligence for fleet managers and travel platforms.

High-Demand Business Cities

- New York & Los Angeles: Predominantly high weekday demand, with compact and intermediate vehicles being most popular. Luxury and premium vehicles see increased rates during special events or conventions.

- Chicago & Houston: Weekday corporate travel dominates, with moderate weekend demand. Vehicle pricing reflects consistent business needs rather than leisure-driven spikes.

Tourism-Heavy Cities

- Orlando & Las Vegas: SUV and family vehicle demand surges on weekends due to leisure travelers. Weekend rates are often 20–30% higher than weekday rates.

- Miami & San Francisco: Luxury and premium vehicles experience higher weekend bookings, influenced by tourist activities and seasonal peaks.

City-specific pricing insights enable businesses to develop targeted strategies, ensuring vehicles are available where demand is highest while avoiding underutilization in low-demand markets.

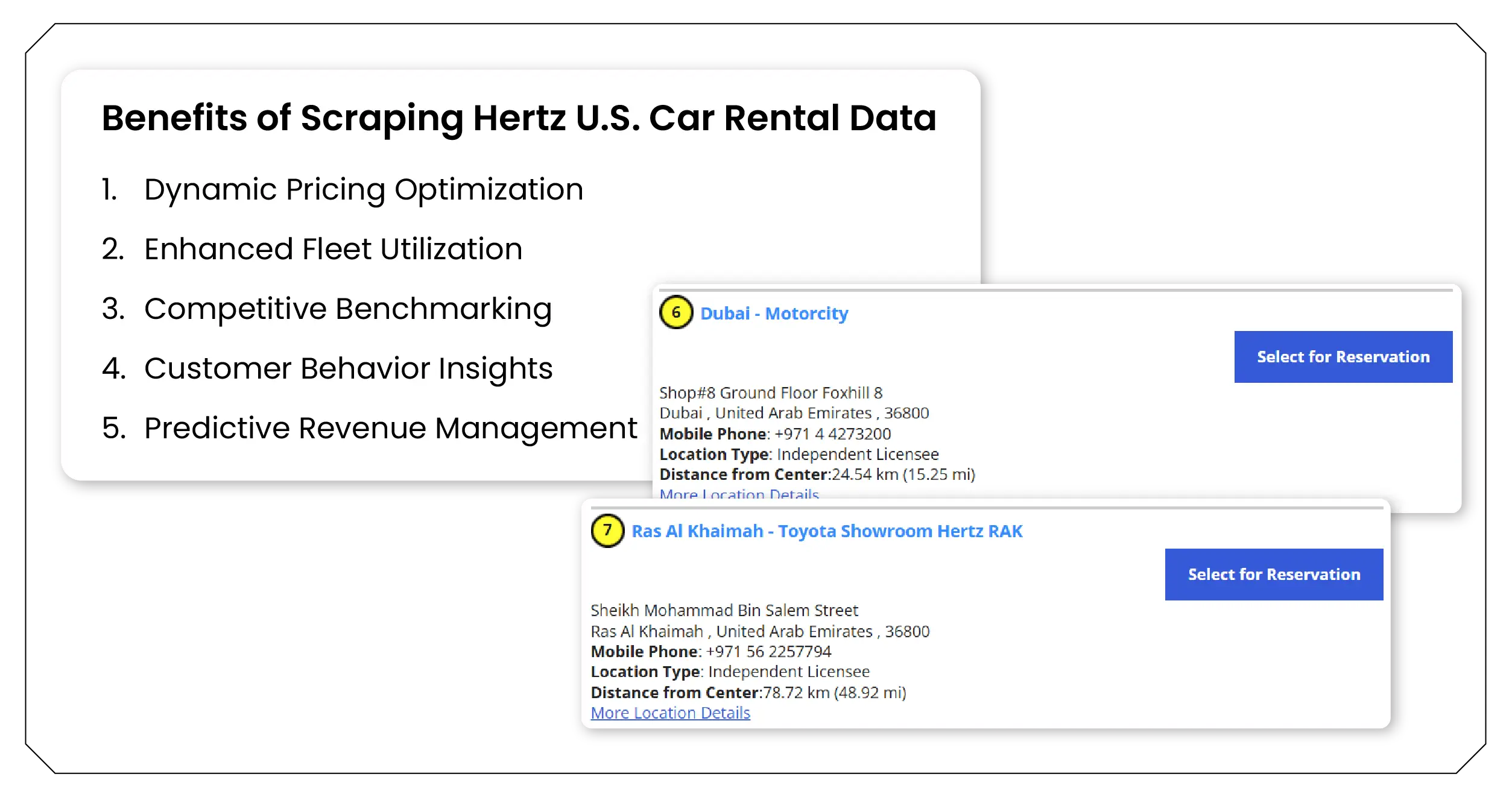

Benefits of Scraping Hertz U.S. Car Rental Data

- Dynamic Pricing Optimization: By monitoring price trends in real-time, businesses can adjust rates for different vehicle classes and locations, maximizing revenue during high-demand periods.

- Enhanced Fleet Utilization: Accurate demand forecasting ensures vehicles are allocated efficiently across cities, reducing idle inventory and improving profitability.

- Competitive Benchmarking: Scraped data enables comparison with competitor pricing, helping businesses position their fleet effectively in the market.

- Customer Behavior Insights: Analysis of hold policies and weekend vs. weekday patterns informs marketing campaigns and improves customer targeting.

- Predictive Revenue Management: With historical and real-time datasets, predictive models can anticipate price spikes, demand surges, and vehicle shortages, enabling proactive decision-making.

Integrating Car Rental Data Intelligence into Operations

Businesses leveraging Car Rental Price Trends Dataset can create advanced dashboards for monitoring pricing fluctuations, demand trends, and booking behavior. Integrating these insights into operational systems allows for automated alerts, predictive fleet allocation, and data-driven marketing strategies.

Practical Use Cases

- Travel Agencies: Adjust package rates and promotions based on real-time vehicle availability and pricing trends.

- Fleet Operators: Optimize vehicle deployment to high-demand locations during weekends or peak travel seasons.

- Corporate Travel Managers: Ensure cost-effective bookings by analyzing weekday and weekend rate differences for specific vehicle classes.

- Dynamic Marketing Campaigns: Target weekend travelers with promotions for SUVs, premium, and luxury vehicles, leveraging weekend pricing insights.

Leveraging Advanced Tools for Hertz Pricing Scraping

- Real-Time Monitoring: Continuously track price changes, hold policies, and booking trends across multiple locations.

- Historical Data Analysis: Build robust datasets for trend forecasting, seasonal analysis, and demand prediction.

- Automation & Scalability: Deploy scalable scraping solutions to monitor hundreds of cities and thousands of vehicle entries simultaneously.

- Integration with Analytics Platforms: Seamlessly feed scraped data into BI tools, dashboards, and predictive analytics models for actionable insights.

How Travel Scrape Can Help You?

- Accurate Rental Price Capture: Our services extract up-to-date pricing data from Hertz and other rental platforms, ensuring businesses have reliable and precise rate information.

- Detailed Class-Wise Analysis: We map prices across all vehicle categories, from compact to luxury, helping identify which segments drive the most revenue.

- Trend Insights Across Time: By comparing weekday and weekend rates, our scraping helps detect patterns in demand and optimize pricing strategies accordingly.

- Booking Flexibility & Policy Insights: We gather information on hold durations, prepayment requirements, and cancellation rules to understand how policies affect customer choices.

- Enhanced Strategic Planning: The scraped data feeds into analytics and forecasting tools, enabling smarter fleet management, competitive benchmarking, and targeted marketing campaigns.

Conclusion

In today’s competitive car rental industry, leveraging Weekend vs weekday Hertz rental price comparison U.S. is crucial for strategic decision-making. By employing Hertz U.S. booking hold rules and customer behavior analysis, businesses can obtain a comprehensive understanding of pricing dynamics, customer preferences, and vehicle class performance.

The insights derived from Analyzing Hertz U.S. car rental pricing fluctuations enable informed pricing strategies, optimized fleet allocation, and improved revenue management. With continuous monitoring and predictive analytics, operators can stay ahead of market trends, ensuring operational efficiency, competitive pricing, and superior customer experience across the U.S. car rental landscape.

Ready to elevate your travel business with cutting-edge data insights? Get in touch with Travel Scrape today to explore how our end-to-end data solutions can uncover new revenue streams, enhance your offerings, and strengthen your competitive edge in the travel market.