France City-Wise Hotel Pricing Intelligence Enabling Smarter Hotel Rate Management

Introduction

France is among the world’s most visited countries, hosting a diverse hospitality ecosystem shaped by leisure tourism, business travel, cultural events, and seasonal migration. In this highly competitive environment, hotels increasingly rely on data-driven strategies to remain profitable and responsive to demand fluctuations. This research report examines city-level hotel pricing dynamics in France using OTA-derived datasets, focusing on Paris, Lyon, Nice, and Marseille as representative urban markets with distinct demand profiles.

The foundation of this study is France City-Wise Hotel Pricing Intelligence, which enables granular evaluation of how hotel prices vary by city, season, and traveler behavior. By combining this intelligence with structured extraction methods commonly associated with Hotel Data Scraping Services, the research captures real-world pricing signals that reflect live market conditions rather than static averages. Continuous OTA hotel price monitoring France further enhances accuracy by revealing competitive price movements, discount strategies, and demand-driven rate adjustments across major booking platforms.

Research Scope and Objectives

The primary objective of this report is to decode how city-specific characteristics influence hotel pricing across France. The research aims to:

- Compare pricing structures across major French cities

- Analyze seasonality and demand elasticity

- Assess the role of guest perception in pricing power

- Identify strategic pricing benchmarks for stakeholders

The analysis is designed for hotel chains, revenue managers, travel technology providers, investors, and tourism analysts seeking data-backed insights.

Data Collection Framework and OTA Intelligence

OTA platforms act as real-time mirrors of hotel market behavior. Prices listed on OTAs are dynamically adjusted based on occupancy forecasts, competitor actions, booking windows, and traveler demand. This study draws from aggregated OTA datasets that include daily room prices, availability signals, booking intensity indicators, and customer ratings.

Unlike traditional surveys or quarterly reports, OTA-driven intelligence provides high-frequency data, allowing detection of micro-trends such as weekend surges, event-driven spikes, and last-minute discounting patterns.

City-Level Market Characteristics and Pricing Logic

Paris: Global Hub with Structural Pricing Strength

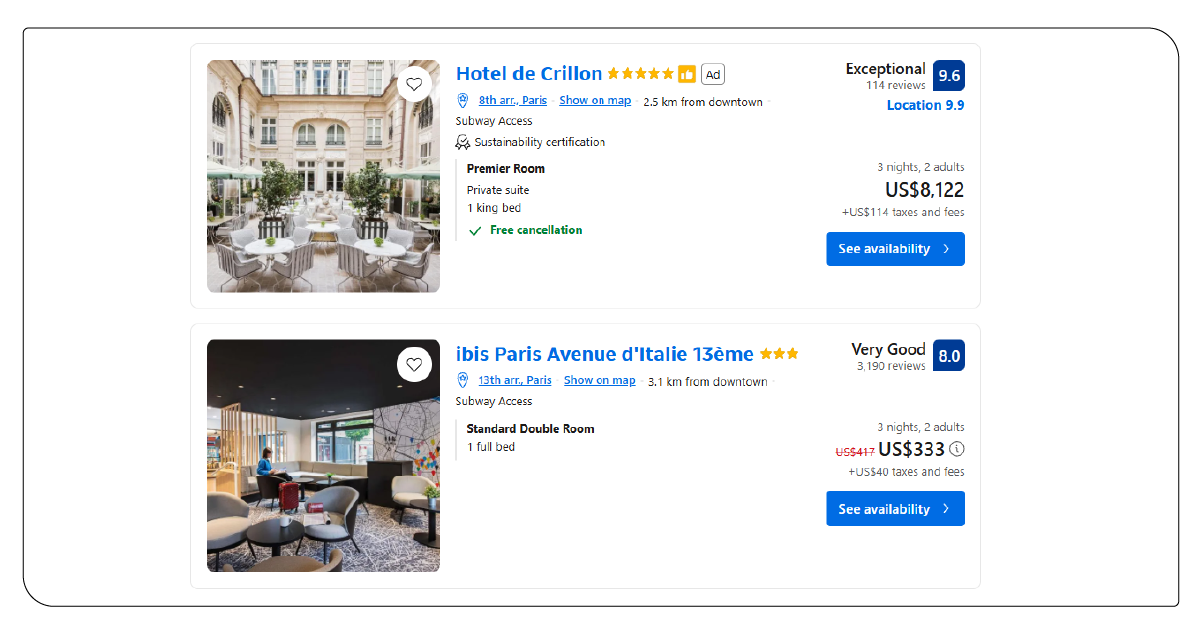

Paris stands as France’s most expensive hotel market, supported by consistent international demand and a dense calendar of global events. OTA data indicates that Paris hotels maintain higher pricing floors even during off-peak months, reflecting strong baseline demand.

Hotels in Paris show limited reliance on deep discounting. Instead, pricing strategies focus on early booking premiums, minimum stay rules, and value-added packages. Review reputation plays a significant role in sustaining higher average daily rates, particularly for centrally located properties.

Lyon: Stable Business Demand with Adaptive Leisure Pricing

Lyon represents a balanced hotel market where business travel stabilizes weekday demand while cultural tourism boosts weekend occupancy. OTA pricing patterns in Lyon reveal moderate volatility, with hotels frequently adjusting rates around exhibitions, trade fairs, and gastronomy events.

Unlike Paris, Lyon hotels are more flexible in promotional strategies, using short-term discounts and bundled offerings to optimize occupancy without eroding brand positioning.

Nice: Seasonal Demand Dominance and Yield Maximization

Nice demonstrates one of the strongest seasonal pricing curves in France. As a Mediterranean leisure destination, hotel prices surge sharply during summer months and taper significantly during winter.

OTA listings show aggressive yield maximization during peak season, followed by competitive repricing during shoulder periods. The city’s reliance on international leisure travelers makes pricing highly sensitive to holiday calendars, weather conditions, and airline capacity.

Marseille: Value-Oriented Pricing in an Emerging Market

Marseille’s hotel market operates at lower average price points but shows steady growth in demand. OTA data highlights increasing interest driven by urban regeneration, cruise tourism, and cultural branding.

Hotels in Marseille focus on competitive value rather than premium positioning, often using flexible pricing and extended-stay offers to attract cost-conscious travelers.

Comparative City-Wise Hotel Pricing and Demand Indicators

| City | Avg Daily Rate (€) | Peak Season ADR (€) | Low Season ADR (€) | Avg Annual Occupancy | Demand Elasticity | Typical Booking Window |

|---|---|---|---|---|---|---|

| Paris | 210 | 285 | 150 | 82% | Low | 30–45 days |

| Lyon | 135 | 180 | 100 | 75% | Medium | 20–30 days |

| Nice | 170 | 265 | 120 | 78% | High | 10–20 days |

| Marseille | 125 | 160 | 90 | 70% | Medium | 15–25 days |

Seasonality and Demand Cycles Explained

Seasonality exerts varying degrees of influence across French cities:

- Paris experiences multiple demand peaks rather than a single dominant season.

- Nice shows extreme seasonality with summer-driven revenue concentration.

- Lyon’s demand is event-based rather than climate-driven.

- Marseille displays gradual seasonal transitions, allowing smoother pricing adjustments.

Understanding these cycles allows hotels to align pricing models with realistic demand expectations rather than reactive discounting.

Guest Perception and Pricing Power

Guest satisfaction significantly affects a hotel’s ability to command premium pricing. OTA review data reveals that hotels with consistently strong ratings experience lower price sensitivity and higher booking conversion rates.

The inclusion of a Hotel Guest Review Dataset enables correlation analysis between review scores and pricing resilience, particularly in competitive urban markets such as Paris and Nice. High-rated hotels maintain stronger margins even during periods of increased competition.

Seasonal Pricing Trends and Review Impact

| City | Winter ADR (€) | Spring ADR (€) | Summer ADR (€) | Autumn ADR (€) | Avg Review Score | Review-Driven Price Uplift |

|---|---|---|---|---|---|---|

| Paris | 155 | 225 | 260 | 240 | 8.9 | High |

| Lyon | 105 | 145 | 165 | 155 | 8.5 | Moderate |

| Nice | 125 | 185 | 270 | 200 | 8.7 | High |

| Marseille | 95 | 130 | 155 | 140 | 8.3 | Low–Moderate |

Real-Time Pricing Intelligence and Automation

As hotel pricing becomes increasingly dynamic, real-time monitoring has emerged as a competitive necessity. A Real-Time Hotel Data Scraping API enables continuous tracking of price fluctuations, competitor movements, and sudden demand shifts.

Such systems allow revenue managers to react instantly to market changes, reducing revenue leakage during high-demand periods and improving occupancy during slower phases.

Competitive Benchmarking Across French Cities

Cross-city analysis provides actionable insights into relative pricing performance and market positioning. Through City-level hotel price comparison France, stakeholders can identify which cities offer stronger revenue potential, which markets are nearing saturation, and where pricing gaps exist.

This benchmarking approach is particularly valuable for multi-city hotel chains and investors evaluating expansion or repositioning strategies.

Long-Term Trends and Historical Pricing Behavior

Historical OTA data offers visibility into structural shifts within the hospitality market. Analysis of a Hotel Room Price Trends Dataset reveals long-term ADR growth patterns, recovery trajectories, and evolving traveler expectations around flexibility and value.

Such datasets are instrumental in forecasting future pricing ceilings and identifying sustainable growth opportunities.

Strategic Market Interpretation

From a strategic standpoint, France hotel market pricing analysis shows that successful pricing is shaped more by demand composition, seasonality exposure, and guest perception than by hotel category alone. Markets with diversified demand bases demonstrate greater pricing stability and resilience.

Forecasting and Revenue Planning

Predictive analytics built on OTA data enables forward-looking decision-making. Using advanced modeling techniques, stakeholders can anticipate high-demand windows, forecast occupancy levels, and simulate competitive responses.

These insights form the foundation of France hotel pricing trends analysis, supporting both short-term tactical pricing and long-term financial planning.

Conclusion

This research confirms that OTA-derived data is a critical asset for understanding hotel pricing behavior at the city level in France. Each market—Paris, Lyon, Nice, and Marseille—exhibits distinct pricing logic driven by demand structure, seasonality, and traveler expectations.

In conclusion, city-wise hotel pricing benchmarks for France provide hospitality stakeholders with a clear framework for competitive positioning and revenue optimization. By leveraging advanced analytics, hotels can respond proactively to market shifts and improve profitability.

The integration of robust datasets and predictive insights strengthens France hotel demand and pricing analytics, enabling more precise forecasting and strategic alignment. Ultimately, adopting a comprehensive Hotel Data Intelligence approach empowers the French hospitality sector to compete effectively in an increasingly data-driven global travel market.

Ready to elevate your travel business with cutting-edge data insights? Scrape Aggregated Flight Fares to identify competitive rates and optimize your revenue strategies efficiently. Discover emerging opportunities with tools to Extract Travel Website Data, leveraging comprehensive data to forecast market shifts and enhance your service offerings. Real-Time Travel App Data Scraping Services helps stay ahead of competitors, gaining instant insights into bookings, promotions, and customer behavior across multiple platforms. Get in touch with Travel Scrape today to explore how our end-to-end data solutions can uncover new revenue streams, enhance your offerings, and strengthen your competitive edge in the travel market.