Extract Hotel Chain Data in UAE to Optimize Hospitality Investments and Expansion Strategies

This report analyzes UAE hotel chains, covering property distribution, emirate-level presence, brand segmentation, market trends, and expansion strategies for 2026.

Introduction

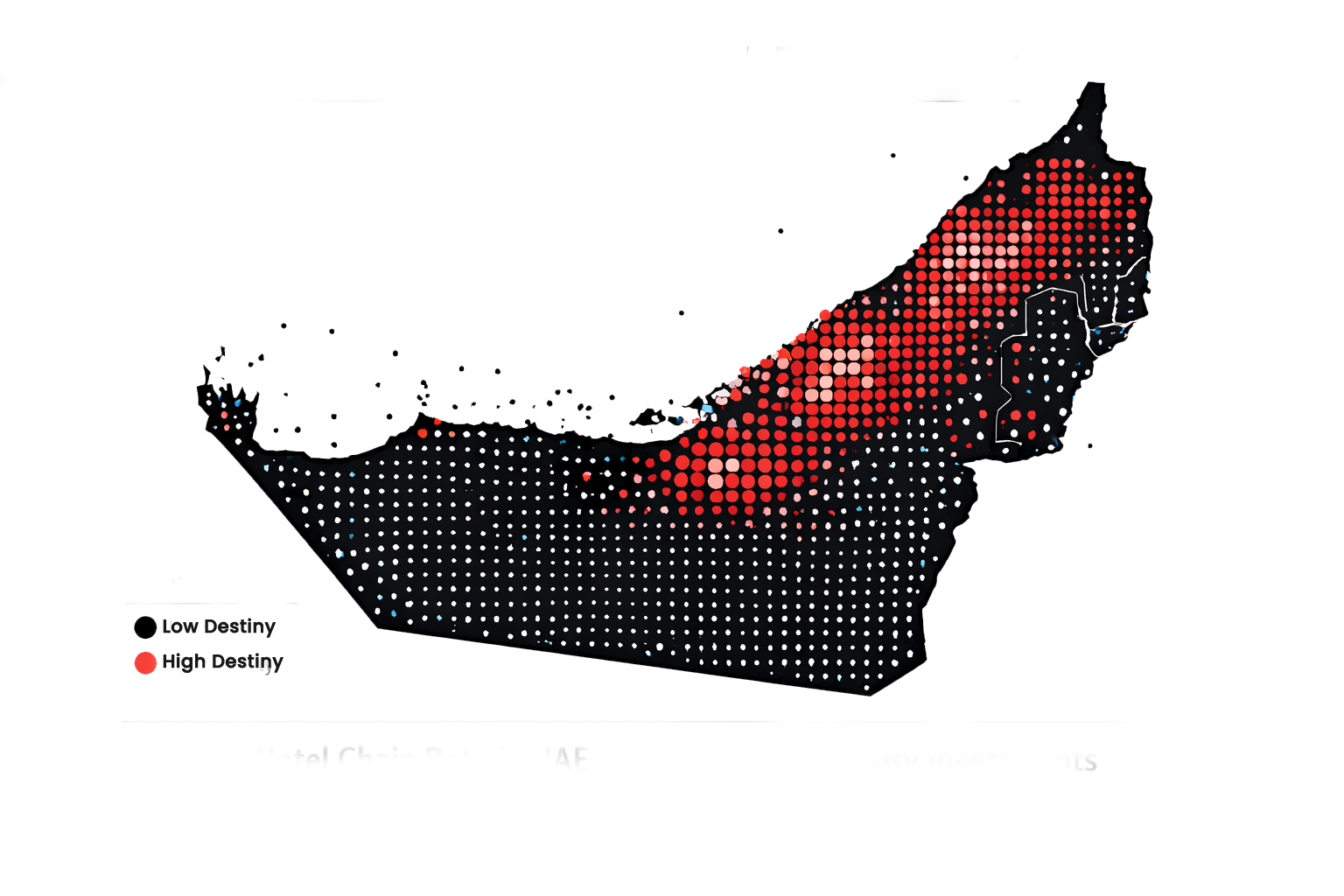

The UAE hotel industry is moving into a high-intensity growth cycle in 2026, driven by tourism diversification, branded real-estate integration, and large-scale hospitality investments across core and emerging emirates. To decode this competitive environment, this research draws on how enterprises increasingly Extract hotel chain data in UAE to evaluate property spread, brand clustering, and city-level expansion behavior.

Advanced platforms such as a Real-Time Hotel Data Scraping API now provide continuous visibility into hotel openings, refurbishments, rebrandings, and management changes, while Hotel chain locations scraping UAE enables precise geographic intelligence across emirates. These capabilities collectively strengthen market visibility for investors, travel aggregators, and hospitality consultants seeking forward-looking UAE hotel insights.

This report examines tracked hotel chain activity across 95+ UAE cities and tourism zones, covering more than 1,450 hotels operated by 10 major international and regional hotel groups. The analysis emphasizes emirate concentration, urban versus resort dominance, operational footprint, and expansion signals shaping the UAE hotel market in 2026.

1,450+

Hotels Tracked

10+

Hotel Chains

95+

Cities Covered

Top Emirates by Number of Hotels

Emirates with the Highest Concentration of Branded Hotel Chains in UAE

DUBAI

720+

Powered by global tourism inflows, luxury retail corridors, mega-events, and dense hospitality clusters across Downtown, Marina, Palm Jumeirah, and Business Bay.

ABU DHABI

380+

Supported by government-backed tourism, cultural attractions, convention demand, and large-scale resort developments on Yas and Saadiyat Islands.

SHARJAH

140+

Driven by cultural tourism, education travel, and value-focused accommodation demand adjacent to Dubai’s overflow market.

RAS AL KHAIMAH

110+

Resort-led expansion supported by adventure tourism, beachfront developments, and rising international leisure interest.

AJMAN

60+

Mid-scale and coastal properties serving regional tourism and extended-stay travelers.

FUJAIRAH

40+

East-coast growth focused on beach resorts, cruise tourism, and niche leisure demand.

What are the largest hotel chains in the UAE in 2026?

Insights derived from hotel network monitoring show that Marriott International, Hilton Worldwide, and Accor rank as the largest hotel chains in the UAE in 2026 based on property count and geographic reach.

Marriott International

PROPERTIES

Emirates

7

Cities

55+

Largest hotel chain operating across all major UAE emirates and more than 55 urban and resort destinations

Hilton Worldwide

PROPERTIES

Emirates

7

Cities

50+

Extensive footprint across Dubai, Abu Dhabi, and fast-growing leisure corridors

Accor

PROPERTIES

Emirates

6

Cities

48+

Strong multi-brand presence across luxury, lifestyle, and economy segments

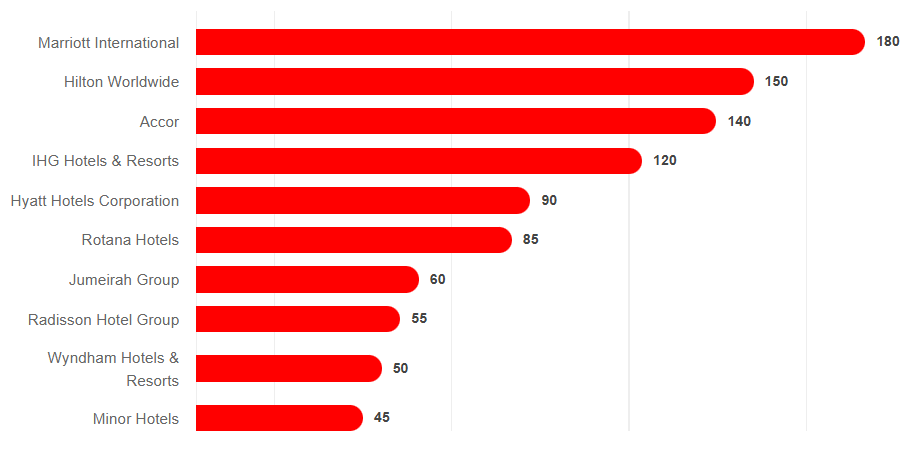

Top 10 Hotel Chains in the UAE by Property Count and Geographic Presence – 2026

The table below outlines the leading hotel chains in the UAE for 2026, highlighting total properties, emirate coverage, and city presence, supported by structured insights from the UAE hotel chain dataset.

Luxury brands dominate Dubai and Abu Dhabi, while mid-scale and serviced apartment operators expand across Sharjah, Ajman, and Ras Al Khaimah. Regional and international brands continue to scale through management contracts and franchising models.

| Hotel Chain | Total Properties | Availability (No. of Emirates) | Availability (No. of Cities) | Download Dataset |

|---|---|---|---|---|

| Marriott International | 180 | 7 emirates | 55+ cities | Download |

| Hilton Worldwide | 150 | 7 emirates | 50+ cities | Download |

| Accor | 140 | 6 emirates | 48+ cities | Download |

| IHG Hotels & Resorts | 120 | 6 emirates | 42+ cities | Download |

| Hyatt Hotels Corporation | 90 | 5 emirates | 35+ cities | Download |

| Rotana Hotels | 85 | 7 emirates | 40+ cities | Download |

| Jumeirah Group | 60 | 4 emirates | 22+ cities | Download |

| Radisson Hotel Group | 55 | 5 emirates | 28+ cities | Download |

| Wyndham Hotels & Resorts | 50 | 5 emirates | 30+ cities | Download |

| Minor Hotels | 45 | 4 emirates | 24+ cities | Download |

Top 10 Hotel Chains in the UAE – 2026

In 2026, the UAE hospitality landscape reflects a premium-heavy structure balanced by rapid mid-scale and long-stay expansion. Marriott, Hilton, and Accor lead in scale, while IHG and Hyatt deepen lifestyle-oriented developments. Regional leaders such as Rotana and Jumeirah anchor domestic brand identity alongside global operators.

Insights supported by Hotel Data Intelligence confirm that the UAE remains one of the most brand-dense hotel markets globally, with strong clustering around transport hubs, tourism districts, and mixed-use developments.

Chain-Level Market Insights

Marriott International

Luxury / PremiumMarriott leads the UAE hotel market with strong concentrations in Dubai and Abu Dhabi. Brands such as St. Regis, JW Marriott, W Hotels, and Courtyard serve leisure and corporate demand across diversified locations.

Hilton Worldwide

Luxury / PremiumHilton operates extensively across metro centers, resorts, and airport-adjacent zones, with Hilton, Conrad, DoubleTree, and Hampton driving growth.

Accor

Multi-SegmentAccor’s brand diversity enables penetration across luxury, lifestyle, and economy tiers, strengthening its footprint in both urban and resort markets.

IHG Hotels & Resorts

Mid-Scale / LuxuryIHG maintains strong coverage across business districts and tourism hubs through InterContinental, Crowne Plaza, and Holiday Inn brands.

Hyatt Hotels Corporation

Premium / LifestyleHyatt focuses on selective expansion through mixed-use developments and high-end leisure destinations.

Rotana Hotels

Upper Mid-Scale / PremiumRotana is a leading regional operator in the UAE, with a strong presence across Abu Dhabi and Dubai. Brands such as Rotana Hotels & Resorts, Centro, and Arjaan cater to business and long-stay travelers.

Jumeirah Group

LuxuryJumeirah represents the UAE’s flagship luxury hospitality brand, operating iconic beachfront and landmark properties focused on high-end leisure and experiential travel.

Radisson Hotel Group

Upper Mid-ScaleRadisson focuses on business districts and secondary urban markets, with Radisson Blu and Park Inn supporting corporate and transit-driven demand.

Wyndham Hotels & Resorts

Economy / Mid-ScaleWyndham expands primarily through franchised economy and mid-scale brands, targeting regional cities, highway corridors, and value-focused leisure travelers.

Minor Hotels

Premium / LifestyleMinor Hotels operates upscale and lifestyle-oriented properties, with brands such as Anantara, Avani, and NH Collection strengthening resort and mixed-use developments.

Advantages of Chain-Focused Hotel Location Data

Our Hotel Data Scraping Services provide actionable intelligence, enabling identification of high-potential markets, revenue optimization, strategic expansion planning, travel demand monitoring, and competitive benchmarking. These insights support informed investment, franchise growth, pricing strategies, and operational efficiency across emirates.

- Identifying High-Impact Markets: City-wise hotel mapping highlights underserved districts, emerging tourism zones, and expansion opportunities.

- Optimizing Revenue Streams: Rate benchmarking and occupancy insights enhance pricing strategies using guest behavior signals from the Hotel Guest Review Dataset.

- Informed Expansion Planning: Developers assess brand saturation and white-space opportunities using web scraping UAE hotel chain data.

- Tracking Travel Demand Shifts: Seasonal, event-driven, and infrastructure-led demand changes are continuously monitored.

- Enhancing Competitive Intelligence: Performance benchmarking improves positioning using structured insights from the UAE Hotel Chain Data Scraping API.

| Field Name | Description |

|---|---|

| Property Identity | Hotel name, brand affiliation, chain type, and service classification |

| Address & Geo-Coordinates | Full address, emirate, city, and GPS location |

| Room Inventory & Utilization | Room count, mix, occupancy patterns, and booking behavior |

| Rate Structure & Pricing Trends | Average rates, seasonal pricing, and competitor benchmarks |

| Guest Sentiment & Ratings | Aggregated reviews, ratings, and satisfaction metrics |

| Market Intelligence Insights | Location performance, demand signals, and investment indicators |

Insights and Analysis

The UAE hotel market in 2026 is shaped by luxury clustering, rapid brand diversification, and data-driven expansion strategies. Premium hotels dominate prime districts, while mid-scale and serviced accommodation accelerate in secondary markets. Continuous tracking of new openings, refurbishments, and repositioning activity highlights the sector’s dynamic nature.

Conclusion

In 2026, hospitality competition across the UAE demands precise, location-level intelligence. By Scraping top hotel chains in UAE, stakeholders gain clarity on expansion velocity, emirate penetration, and brand dominance. Access to a structured UAE Hotel chain locations dataset enables confident decisions around acquisitions, franchising, and market entry. When combined with insights from the Hotel Room Price Trends Dataset, these datasets support pricing optimization, occupancy growth, and long-term portfolio strategy across urban, resort, and emerging destinations nationwide.