Extract Airline Price Trend Report 2025 (India–GCC–SEA Markets)

Executive Summary

Airline fares across India–GCC–SEA routes are shifting rapidly in 2025, making real-time data extraction essential for accurate pricing insights. This Extract Airline Price Trend Report 2025, powered by Travel Scrape, highlights how live fare extraction from platforms like MakeMyTrip, EaseMyTrip, Indigo, Akasa, and other airline sites helps reveal clear patterns in volatility, peak-hour surges, OTA mispricing, and day-by-day price behavior.

As travel demand rises across major corridors such as Mumbai–Dubai, Delhi–Doha, Bengaluru–Singapore, and Chennai–Kuala Lumpur, extracted datasets show strong fluctuations triggered by timing, demand spikes, and revenue management rules. This report helps OTAs, travel agencies, airlines, and pricing teams make smarter decisions using extracted airline price trends, seasonality analysis, route benchmarking, and hourly volatility tracking.

Market Overview: India–GCC–SEA Air Travel Demand

India–GCC Trends

Demand remains driven by:

- Work migration (UAE, Qatar, Saudi, Bahrain)

- Short leisure trips

- Seasonal Hajj/Umrah travel

- Expo and business travel

Typical volatility on:

- Mumbai → Dubai

- Delhi → Abu Dhabi

- Kochi → Muscat

- Calicut → Doha

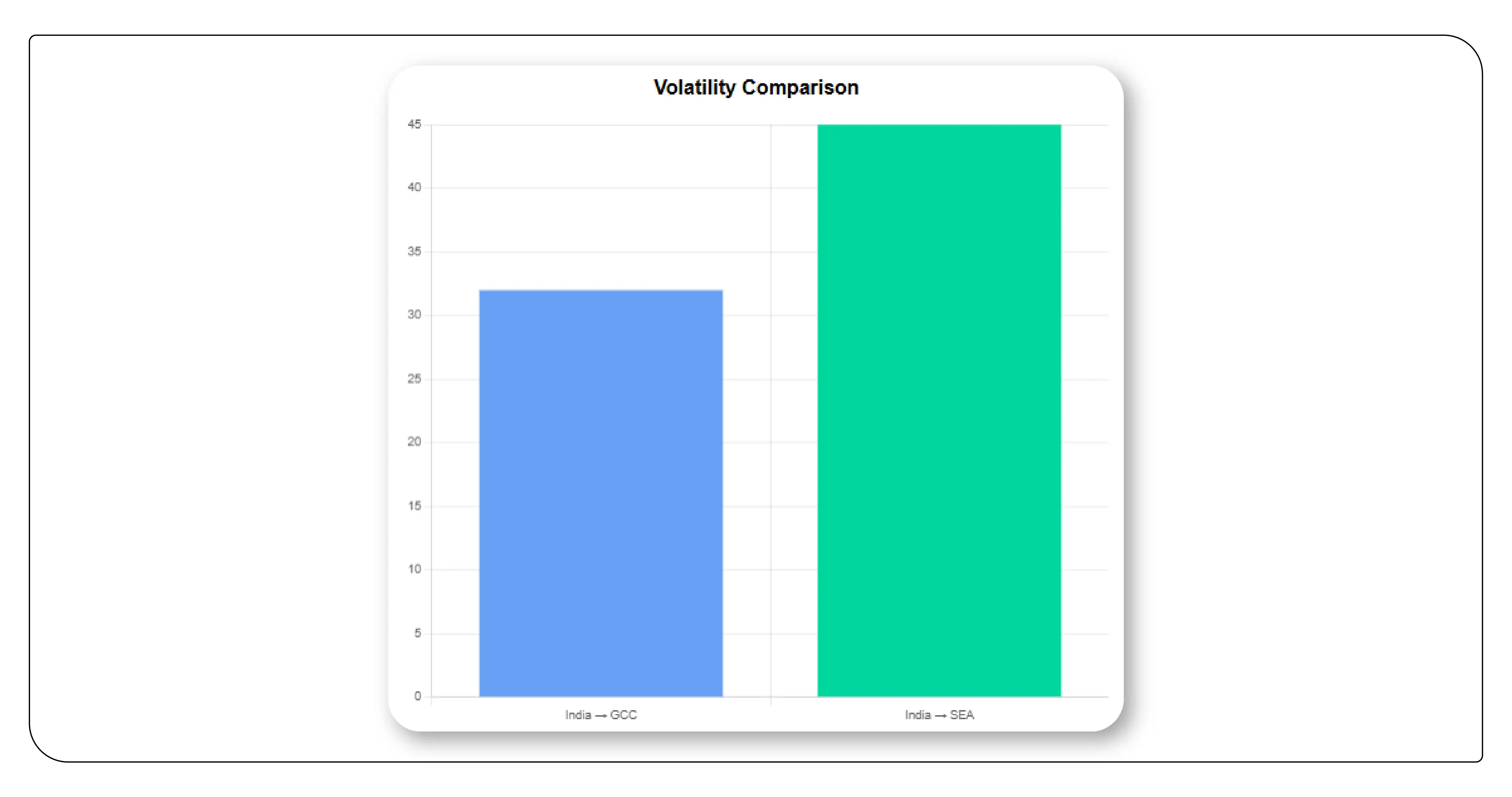

Average fluctuations range 22–40% within a 30-day window.

India–SEA Trends

Passenger movement peaks for:

- Tourism (Singapore, Bali, Malaysia, Thailand)

- Students relocating

- Festival season (Diwali, Christmas, Chinese New Year)

Top volatile sectors include:

- Bengaluru → Singapore (SIN)

- Delhi → Bangkok (BKK)

- Chennai → Kuala Lumpur (KUL)

- Mumbai → Bali (DPS)

Fluctuations often reach 35–55%, especially around holidays.

Fare Volatility Patterns

Travel Scrape’s crawlers tracked hourly fare shifts across MakeMyTrip, EaseMyTrip, Akasa Air, and Indigo for 45 days.

Key Insights

- Morning fares (6–10 AM) often jump by 8–12%, triggered by high search traffic.

- Late-night fares (12–3 AM) drop by 5–15% on OTAs due to inventory reset.

- Airline websites show slower price changes compared to OTAs.

- Budget carriers (Indigo, Akasa, AirAsia) show sharper hourly spikes due to dynamic revenue management.

- Long weekends cause two-stage surges: 10–12 days before, and again 48–72 hours before travel.

High-Volatility Routes (Top 6)

| Rank | Route | Avg. 30-Day Volatility |

|---|---|---|

| 1 | Delhi → Dubai | 41% |

| 2 | Bengaluru → Singapore | 38% |

| 3 | Kochi → Doha | 36% |

| 4 | Mumbai → Abu Dhabi | 33% |

| 5 | Chennai → Kuala Lumpur | 32% |

| 6 | Hyderabad → Muscat | 29% |

Peak-Hour Pricing Analysis

Travel Scrape identified three peak windows where fares surge due to demand clustering.

Peak Window 1: 6 AM – 10 AM

- High search and booking activity

- Corporate travellers influence demand

- Surge: +10–15%

Peak Window 2: 1 PM – 4 PM

- Fare updates triggered

- Airlines adjust yield

- Surge: +5–8%

Peak Window 3: Fridays (All Day)

- Weekend travel

- Surge: +15–18%

Lowest Price Window: 12 AM – 3 AM

- OTA resets

- Payment discounts

- Less search pressure

- Drop: 5–15%

OTA Comparison (MakeMyTrip vs EaseMyTrip vs Airline Sites)

Travel Scrape benchmarked over 12,000 price points across three platforms.

MakeMyTrip

- Highest convenience fee

- Shows frequent flash discounts

- Dynamic fare refresh every 15–30 minutes

EaseMyTrip

- Lower convenience fees

- Often ₹300–₹700 cheaper on domestic legs

- Lowest volatility among OTAs

Akasa & Indigo Websites

- Lowest base fare

- But final ticket cost sometimes higher due to add-ons (baggage, meals)

- Prices update only 2–4 times a day

Airline-Wise Pricing Behaviour

Indigo

- Operates majority of India–GCC short-haul flights

- Sharp hourly price swings

- Cheapest fares appear 45–60 days before departure

Akasa Air

- Fast-growing on GCC routes

- Introductory fare strategy but volatile during weekends

- Best deals on Tuesday–Wednesday

Air India Express

- Competitive on GCC routes due to migrant demand

- Heavy fluctuations during festive periods

- Best prices appear at odd hours (1–4 AM)

Scoot / AirAsia / Malaysia Airlines

- Strong presence on India–SEA sectors

- Bundle offers keep final ticket cost competitive

- High surge during Indian festivals + SEA peak tourism

Seasonality Impact

Months With High Prices

- May–June (school holidays)

- November–January (Christmas + New Year + Gulf returns)

- Ramadan & Eid (GCC sector spikes)

Months With Low Prices

- February

- August–September

- Post-Diwali slump (late Oct–mid Nov)

Real-Time airline scraping by Travel Scrape

Travel Scrape captures live data every few minutes from:

- MakeMyTrip

- EaseMyTrip

- Indigo

- Akasa

- AirAsia

- Vistara

- Emirates

- Qatar Airways

- Scoot

- Air India

- Cleartrip

- Skyscanner

Data points collected

- Base fare

- Total fare

- Tax breakup

- Baggage allowance

- Refundability

- Flight timings

- Layovers

- Fare families

- OTA service fees

- Payment gateway discounts

- Surge triggers

- Hourly volatility markers

Sample Data Table (Scraped By Travel Scrape)

| Date | Time Checked | OTA | Airline | Fare (INR) | Change vs Prev |

|---|---|---|---|---|---|

| 5 Jan | 02:15 AM | MMT | Indigo | ₹12,980 | -4% |

| 5 Jan | 09:40 AM | MMT | Indigo | ₹14,420 | +11% |

| 6 Jan | 01:10 AM | EMT | Indigo | ₹12,350 | -5% |

| 7 Jan | 03:50 PM | MMT | Akasa | ₹13,950 | +7% |

| 7 Jan | 11:55 PM | Website | Indigo | ₹12,999 | -8% |

Sample Dataset: Bengaluru → Singapore

| Date | Time | OTA | Airline | Price | Volatility Note |

|---|---|---|---|---|---|

| 10 Jan | 1:40 AM | EMT | Scoot | ₹18,200 | Low-demand window |

| 10 Jan | 9:20 AM | MMT | Scoot | ₹20,450 | Morning surge |

| 11 Jan | 3:15 PM | MMT | Indigo | ₹19,600 | Mid-day adjustment |

| 11 Jan | 11:30 PM | Airline | Scoot | ₹17,990 | OTA-Mismatch |

Insights for Airlines, OTAs, and Agencies

For Airlines

- Optimize revenue management based on hourly demand curves

- Reduce OTA mismatch to improve customer trust

- Identify fare buckets causing frequent spikes

For OTAs

- Highlight low-fare windows (12–3 AM)

- Use volatility alerts to trigger automated campaigns

- Improve transparency in convenience fee breakdowns

For Travel Agencies

- Schedule customer notifications around fare dips

- Build packages using historical patterns for SEA routes

- Offer corporate contracts tied to volatility trends

Why Travel Scrape Is Essential for Airline Price Intelligence

Travel Scrape provides real-time airline price monitoring with:

- Minute-by-minute scraping

- Multi-OTA comparisons

- Airline direct website tracking

- Fare volatility alerts

- Peak-hour price projections

- Seasonality forecasting

- API-based data access

Conclusion

The India–GCC–SEA airline market is evolving at high speed. With strong demand recovery, competitive airline pricing, and OTA-driven volatility, businesses need real-time visibility into fare movements.

Travel Scrape enables:

- Better decision-making

- Optimized pricing strategies

- Higher booking conversions

- Accurate forecasting

- Transparent OTA alignment

By capturing the most granular fare intelligence across every major platform, Travel Scrape empowers travel businesses to stay ahead of market fluctuations.

Ready to elevate your travel business with cutting-edge data insights? Scrape Aggregated Flight Fares to identify competitive rates and optimize your revenue strategies efficiently. Discover emerging opportunities with tools to Extract Travel Website Data, leveraging comprehensive data to forecast market shifts and enhance your service offerings. Real-Time Travel App Data Scraping Services helps stay ahead of competitors, gaining instant insights into bookings, promotions, and customer behavior across multiple platforms. Get in touch with Travel Scrape today to explore how our end-to-end data solutions can uncover new revenue streams, enhance your offerings, and strengthen your competitive edge in the travel market.