Transforming Travel Intelligence via European Coastal Towns Holiday Rental Scraping

Introduction

The European coastal towns holiday rental scraping market has witnessed significant growth in recent years, driven by the increasing popularity of vacation rentals in picturesque coastal regions. This report focuses on tourist spot data scraping to analyze holiday rental trends in the coastal towns of Italy, Spain, and Portugal during the summer season (June to August). By leveraging techniques for scraping European vacation rentals, this study aims to provide insights into rental demand, pricing patterns, and regulatory challenges. The analysis draws on data from various sources, including web platforms and industry reports, to offer a comprehensive overview of the vacation rental landscape in these Mediterranean countries. The report also examines the implications of overtourism and regulatory changes on the rental market, providing actionable insights for stakeholders.

Methodology

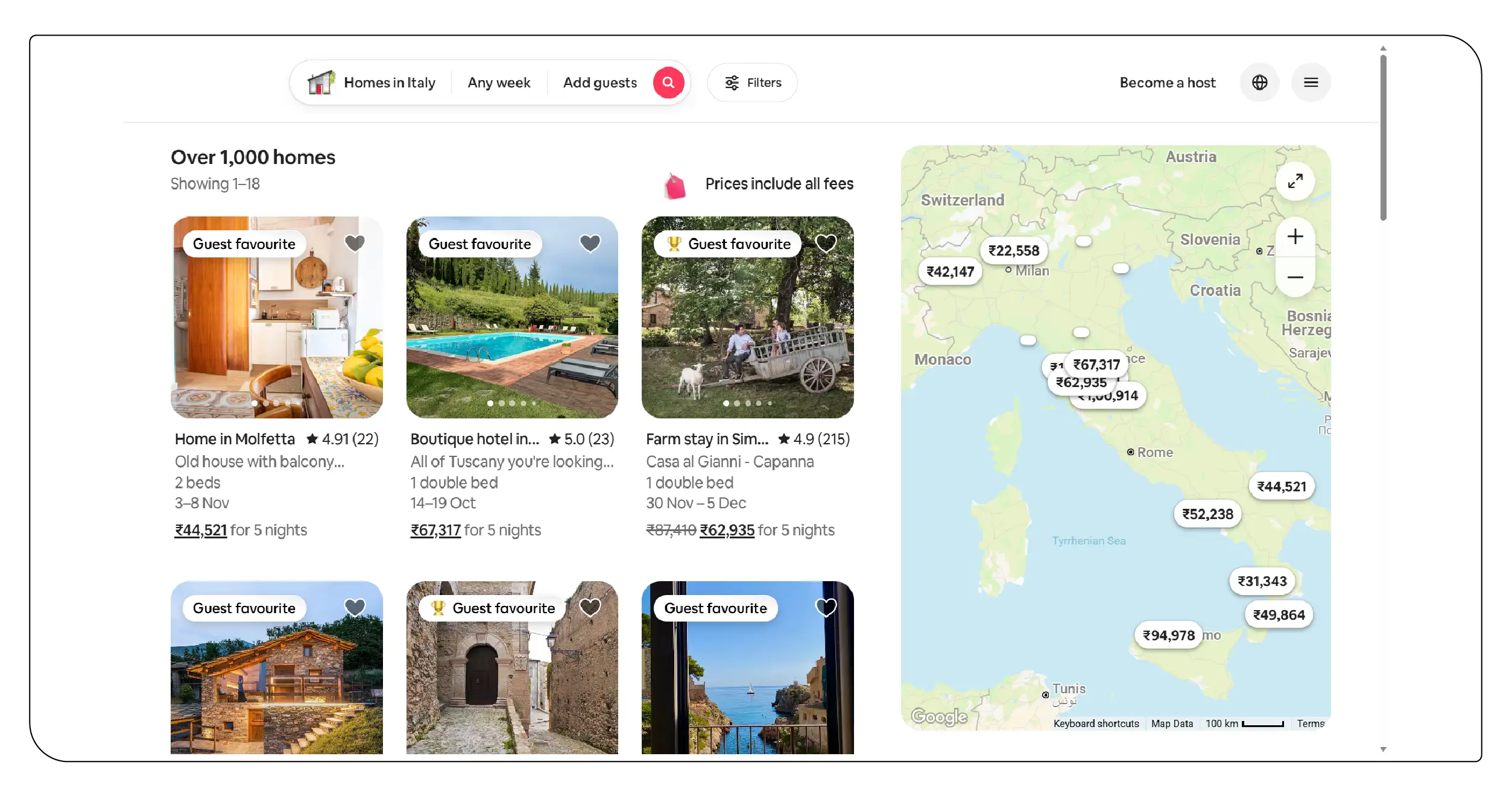

This report analyzes vacation home booking patterns in Europe using data scraping techniques to collect information from online platforms such as Airbnb, Booking.com, and Vrbo. Data was gathered on rental listings, pricing, occupancy rates, and guest reviews in key coastal towns across Italy (e.g., Amalfi, Cinque Terre, Sorrento), Spain (e.g., Costa del Sol, Mallorca, Barcelona), and Portugal (e.g., Algarve, Porto Covo, Albufeira) during the summer season of 2025. Vacation rental data scraping services were utilized to extract structured data, including property types, nightly rates, and availability. Additional data on tourism trends and regulations was sourced from industry reports and news articles. The scraped data was cleaned, aggregated, and analyzed to identify patterns and trends. Two tables are included to summarize key findings on pricing and occupancy rates.

Market Overview

The summer season is a peak period for tourism, as evidenced by seasonal rental data scraping for holiday homes in Italy, Spain, and Portugal, driven by their warm climates, scenic beaches, and rich cultural heritage. These countries collectively attract millions of tourists annually, with Spain expecting 100 million foreign visitors in 2025, followed by Italy and Portugal, which also experience significant tourist inflows. Coastal towns, in particular, are hotspots for vacation rentals due to their proximity to beaches and tourist attractions. However, the surge in demand has led to challenges, including rising housing costs and local backlash against overtourism, which has prompted stricter regulations on short-term rentals.

Italy

In Italy, coastal towns such as Amalfi, Cinque Terre, and Sorrento are renowned for their stunning landscapes and rich cultural significance. Scrape aggregated travel deals to reveal that these destinations command high nightly rates, often ranging from €150 to €400 for apartments and villas during the summer season. The demand for vacation rentals is driven by international tourists, particularly those from the UK and the US, who seek authentic experiences in historic towns. However, cities like Venice and Portofino have introduced measures to curb overtourism, such as day-tripper fees (€5–€10) and restrictions on short-term rentals, impacting availability. Data scraping indicates that listings in these towns are highly seasonal, with occupancy rates peaking at 80–90% in July and August.

Spain

Spain’s coastal regions, including the Costa del Sol, Mallorca, and Barcelona, are among the most popular destinations for summer rental demand, alongside Italy, Spain, and Portugal. Scraped data shows that nightly rates in these areas range from €100 to €350, with luxury villas in Mallorca reaching up to €600 per night. The Spanish government has cracked down on illegal rentals, delisting nearly 66,000 unlicensed Airbnb properties in 2025, which has reduced supply in some areas. Barcelona’s plan to phase out all 10,101 licensed short-term rentals by 2028 aims to address housing shortages, potentially shifting demand to nearby coastal towns like Malaga. Occupancy rates in these regions average 70–85% during the summer, with high demand from British and German tourists.

Portugal

Portugal’s Algarve region, including towns such as Albufeira, Faro, and Portimão, is a growing destination for vacation rentals. Vacation home booking patterns in Europe show that Portugal offers more affordable options, with nightly rates ranging from €80 to €250. The country’s focus on sustainable tourism, particularly in the Azores, has led to stable occupancy rates of around 64%. However, protests in Sintra and Lisbon highlight local concerns about housing affordability and overtourism, with fines of up to €36,000 for violations such as public drinking or the use of high-volume speakers on beaches. Scraped data indicates that family-friendly rentals and properties near natural parks are particularly popular.

Data Analysis

The following tables present key findings from the scraped data, focusing on pricing and occupancy rates in selected coastal towns during the summer season of 2025.

Table 1: Average Nightly Rates for Vacation Rentals (June–August 2025)

| Country | Town | Average Nightly Rate (€) | Property Type |

|---|---|---|---|

| Italy | Amalfi | €250 | Apartment |

| Italy | Cinque Terre | €200 | House |

| Italy | Sorrento | €300 | Villa |

| Spain | Costa del Sol | €180 | Apartment |

| Spain | Mallorca | €350 | Villa |

| Spain | Barcelona | €220 | Apartment |

| Portugal | Albufeira | €150 | House |

| Portugal | Faro | €120 | Apartment |

| Portugal | Porto Covo | €100 | Cottage |

Table 2: Occupancy Rates for Vacation Rentals (June–August 2025)

| Country | Town | Occupancy Rate (%) | Peak Month |

|---|---|---|---|

| Italy | Amalfi | 88% | July |

| Italy | Cinque Terre | 85% | August |

| Italy | Sorrento | 90% | July |

| Spain | Costa del Sol | 80% | August |

| Spain | Mallorca | 82% | July |

| Spain | Barcelona | 75% | June |

| Portugal | Albufeira | 70% | August |

| Portugal | Faro | 68% | July |

| Portugal | Porto Covo | 65% | August |

Trends and Insights

- Pricing Dynamics: The data highlights significant price variations across the three countries. Italy’s coastal towns, particularly Sorrento and Amalfi, command premium rates due to their exclusivity and limited supply. Spain’s Mallorca offers high-end villas at higher prices, while Portugal’s rentals remain more affordable, appealing to budget-conscious travelers.

- Occupancy Patterns: Seasonal rental data scraping for holiday homes shows that occupancy rates peak in July and August, driven by school holidays and favorable weather. Italy’s towns exhibit the highest occupancy rates, reflecting their status as bucket-list destinations. Portugal’s lower rates suggest untapped potential for growth in less-touristed areas like Porto Covo.

- Regulatory Impact: Stricter regulations, particularly in Spain and Italy, are reshaping the vacation rental market. Barcelona’s planned ban on short-term rentals by 2028 and Italy’s increased tourist taxes (up to €25 per night in top hotels) may drive demand to smaller coastal towns with fewer restrictions.

- Overtourism Concerns: Protests in Barcelona, Malaga, and Lisbon reflect growing local frustration with overtourism, which is exacerbated by short-term rentals. Scrape aggregated travel deals indicates that platforms are responding by offering filters for licensed rentals, helping tourists comply with local regulations.

Challenges and Opportunities

Challenges

- Regulatory Restrictions: The crackdown on unlicensed rentals and plans to eliminate short-term rentals in cities like Barcelona pose challenges for hosts and platforms. Compliance with local regulations, such as Spain’s requirement for 60% neighbor approval for rentals in multi-unit complexes, adds complexity.

- Overtourism Backlash: Local protests and measures like Venice’s day-tripper fees and Malaga’s ban on new rentals in certain neighborhoods highlight tensions between tourists and residents.

- Data Scraping Ethics: Vacation rental data scraping services must navigate legal and ethical considerations, as platforms like Airbnb may restrict scraping activities to protect user data.

Opportunities

- Emerging Destinations: Less-touristed towns like Huelva in Spain and Porto Covo in Portugal offer investment opportunities due to lower property prices and growing demand.

- Sustainable Tourism: Portugal’s focus on sustainable tourism in the Azores and Spain’s promotion of inland destinations could diversify rental demand, reducing pressure on coastal hotspots.

- Technology Integration: Advanced scraping tools can provide real-time insights into pricing and availability, enabling hosts to optimize listings and travelers to find better deals.

Conclusion

This report on comparing vacation home demand trends in Italy, Spain, and Portugal underscores the dynamic nature of the vacation rental market in analyzing summer season holiday rental demand. The coastal towns of these countries remain highly sought-after during the summer season, with Italy commanding premium prices, Spain facing regulatory shifts, and Portugal offering affordable alternatives. Vacation rental market scraping has revealed key insights into pricing, occupancy, and emerging trends, highlighting both challenges and opportunities. As overtourism and regulatory pressures reshape the landscape, stakeholders must adapt to ensure sustainable growth. By leveraging data scraping and focusing on emerging destinations, the vacation rental industry can continue to thrive while addressing local concerns.

Ready to elevate your travel business with cutting-edge data insights? Get in touch with Travel Scrape today to explore how our end-to-end data solutions can uncover new revenue streams, enhance your offerings, and strengthen your competitive edge in the travel market.