How Does Dynamic Pricing Benchmarking – Emirates vs Qatar vs Etihad vs Air India Impact Route-Level Fare Strategies?

Introduction

In today’s highly competitive airline industry, Dynamic Flight Pricing Benchmarking has become a crucial strategy for carriers aiming to maximize revenue while maintaining market competitiveness. Airlines constantly adjust fares based on demand, seasonality, and competitor pricing, making real-time insights essential. Using Emirates Flight Data Scraping Services, companies can now scrape airline competitor price data to understand pricing patterns, evaluate trends, and benchmark against rivals like Qatar Airways, Etihad, and Air India.

By leveraging these advanced tools, airline operators and travel agencies gain actionable intelligence to monitor competitor behavior, identify route-specific price fluctuations, and optimize their own fare strategies. This article explores the differences in dynamic pricing across Emirates, Qatar Airways, Etihad, and Air India, highlighting route-level disparities, price jumps, and class-wise splits.

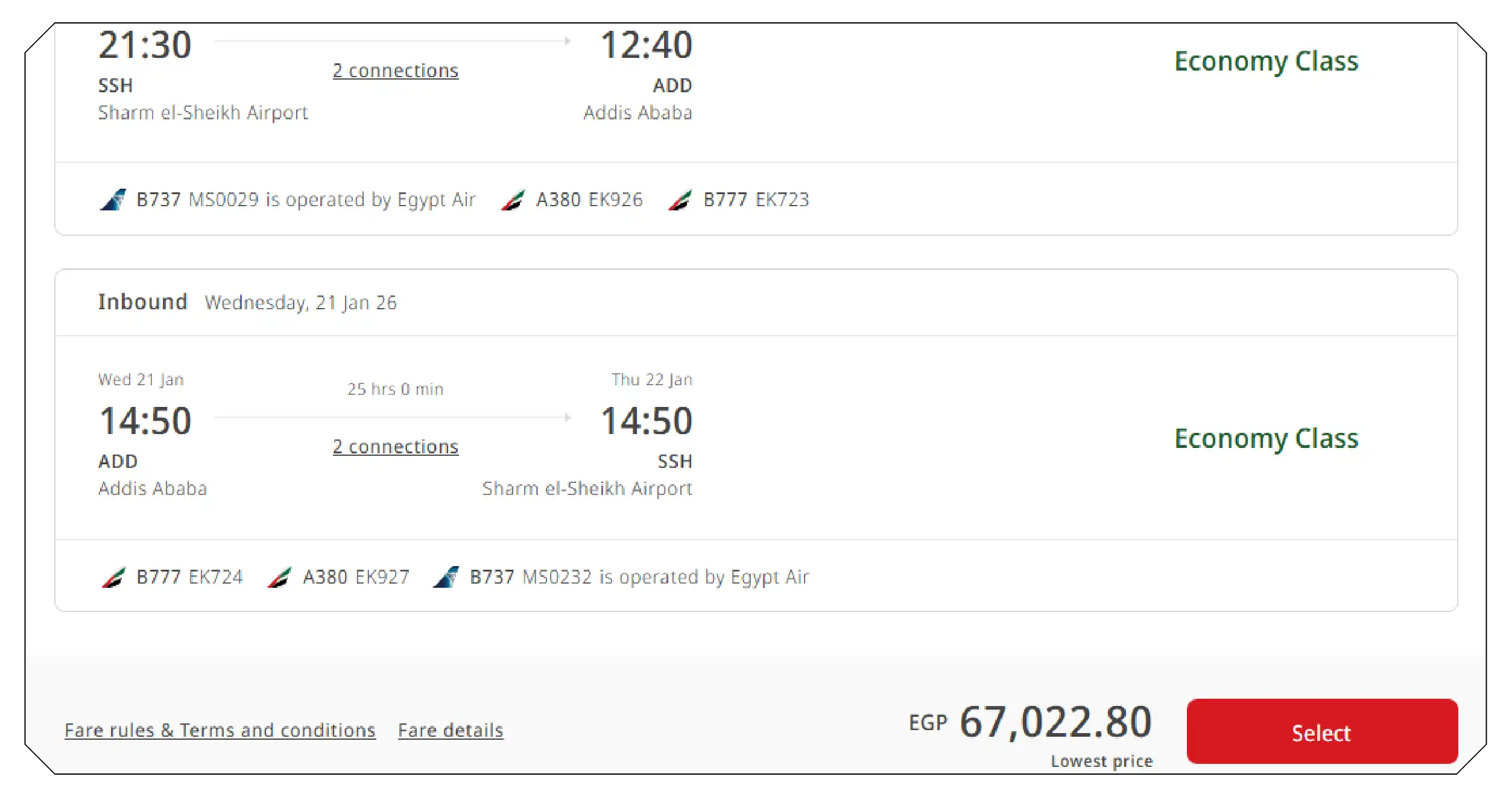

Emirates: Understanding Price Fluctuations Across Routes

Emirates Airlines has long been recognized for its premium services, extensive network, and innovative fare management strategies. Emirates dynamic pricing analysis reveals that fares fluctuate significantly across regions, with international routes experiencing sharper price variations compared to domestic routes.

Route-Level Differences

Emirates tends to increase ticket prices on high-demand routes, particularly those connecting the Middle East to Europe, North America, and Asia. For instance, flights from Dubai to London or New York frequently experience daily price shifts influenced by seasonal demand, competitor activity, and promotional offers.

Price Jumps

Price jumps are common during peak travel seasons such as Christmas, New Year, and summer holidays. Business class fares often spike more dramatically than economy, reflecting the higher elasticity of premium travelers willing to pay for flexibility and comfort.

Class-Wise Splits

Economy fares usually exhibit moderate volatility, whereas business and first-class tickets display more pronounced fluctuations. Emirates’ pricing models often bundle additional services in premium classes, allowing the airline to justify sudden fare hikes during periods of high occupancy.

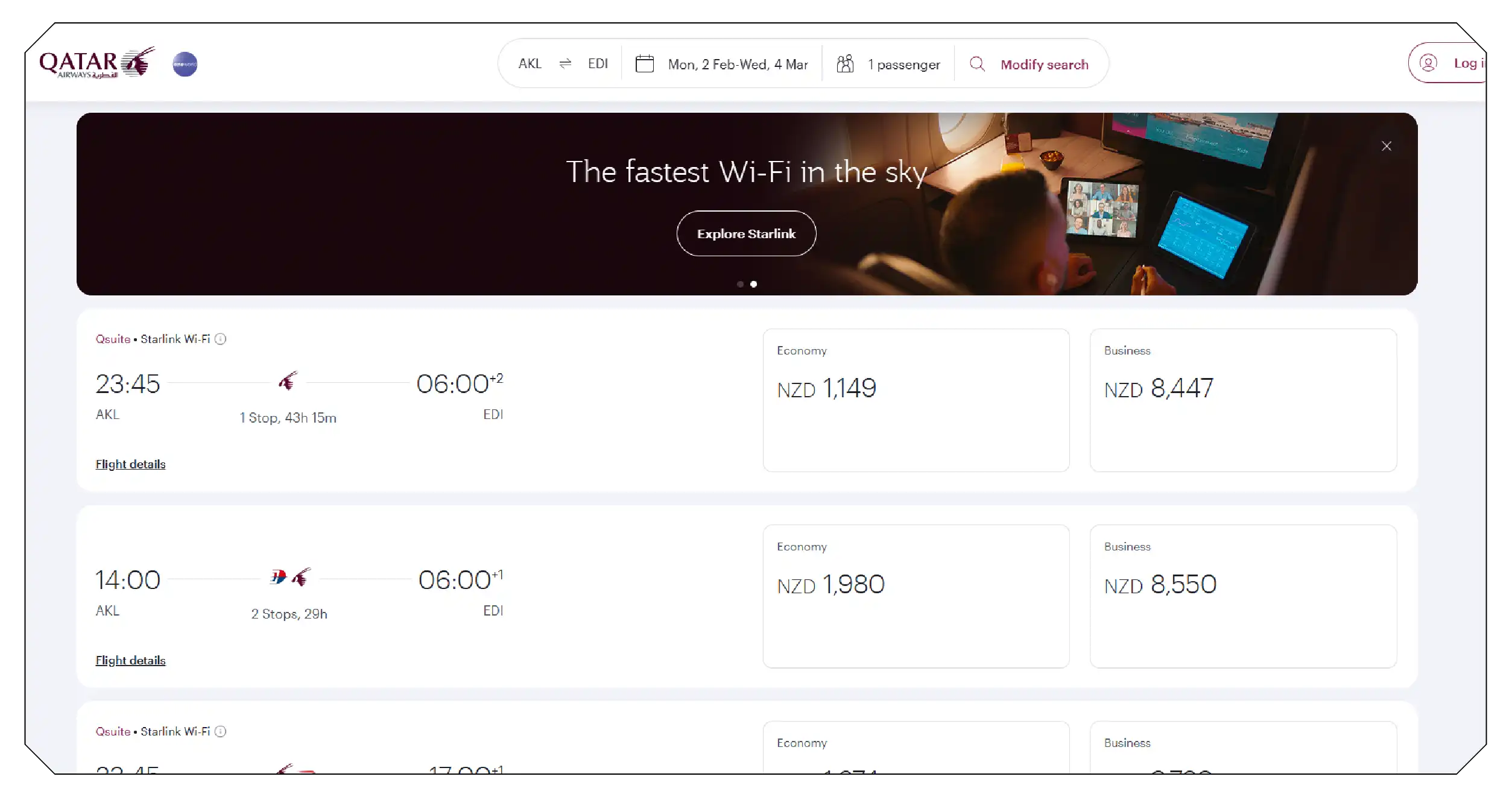

Qatar Airways: Pricing Insights for Long-Haul and Short-Haul Routes

Qatar Airways, renowned for its luxurious services and expansive route network, leverages dynamic pricing to maintain competitive advantage. Utilizing Qatar Airways Route Price Analysis, airlines and travel platforms can track competitor rates and implement strategic pricing adjustments.

Route-Level Differences

Qatar Airways shows significant pricing variation on long-haul routes, especially flights connecting Doha to North America, Europe, and Southeast Asia. Short-haul regional flights often display more stable pricing, with occasional spikes linked to special events or corporate demand.

Price Jumps

The airline frequently implements fare adjustments in response to competitors’ campaigns. For example, if Emirates releases promotional offers on Doha-London flights, Qatar Airways may adjust fares within hours to remain competitive, a trend that can be closely monitored through Qatar Airways Flight Data Scraping Services. Price jumps are particularly noticeable in business class during holiday seasons and major sporting events.

Class-Wise Splits

Economy class fares are relatively predictable, while business and first-class tickets can surge by 20-40% within a short period. Airlines leveraging competitor airline pricing intelligence gain an edge in anticipating these changes and optimizing yield management strategies.

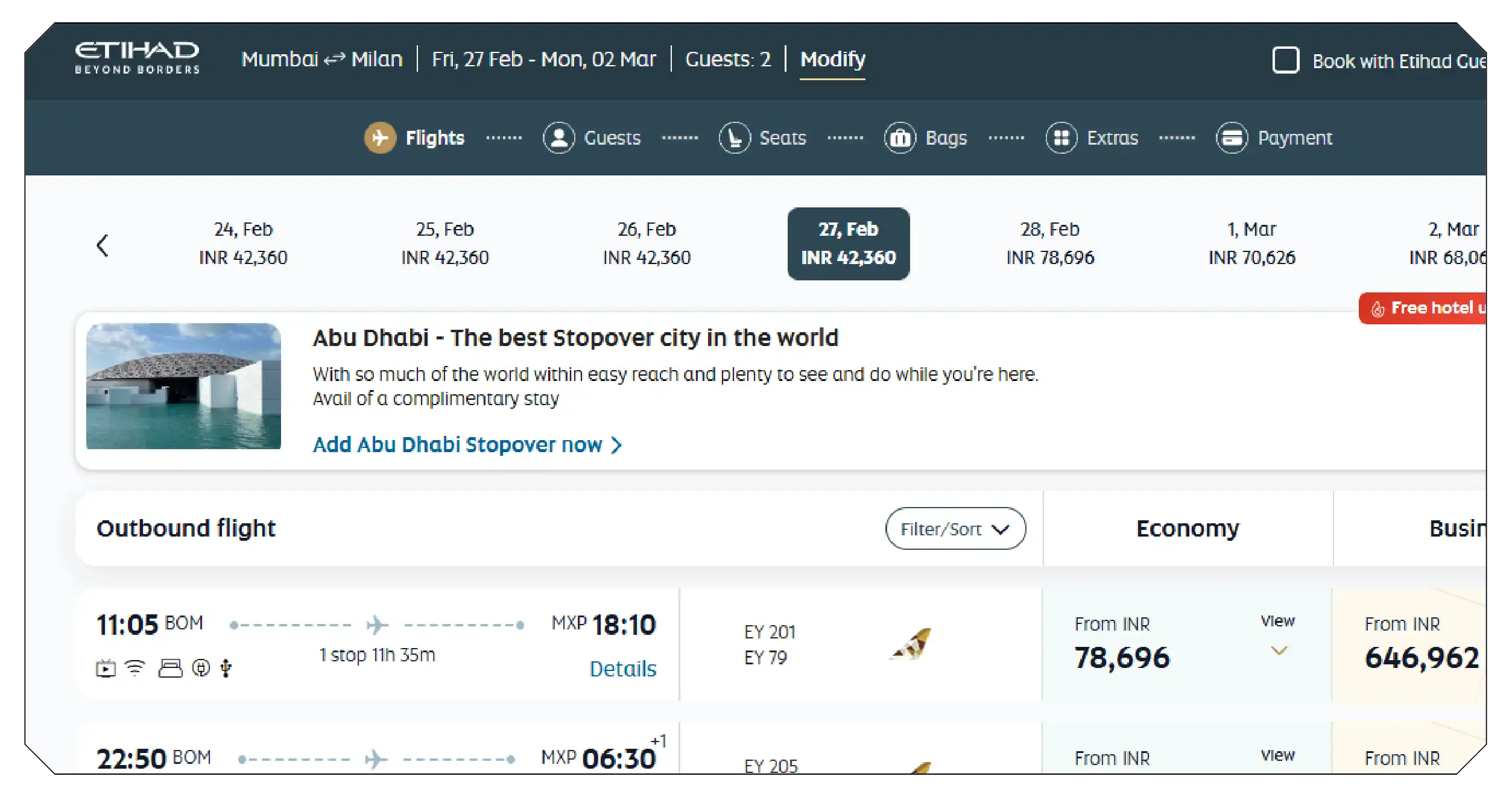

Etihad Airways: Balancing Affordability and Premium Services

Etihad Airways, the national carrier of the UAE, maintains a distinct pricing strategy focused on balancing affordability with premium offerings. Through Etihad Flight Data Scraping Services, travel businesses can monitor real-time fare movements and benchmark against rivals.

Route-Level Differences

Etihad’s pricing patterns vary depending on route popularity and competition. Routes connecting Abu Dhabi to European capitals and North American hubs exhibit higher volatility due to intense market competition. Conversely, routes to less competitive destinations show relatively stable fares.

Price Jumps

Price jumps are observed primarily during high-demand periods, such as festive seasons and major conferences. Etihad also applies strategic fare adjustments to undercut competitors on overlapping routes, especially against Emirates and Qatar Airways.

Class-Wise Splits

Similar to other carriers, economy fares fluctuate moderately, while business and first-class segments experience significant price jumps. Etihad often bundles additional amenities for premium tickets, influencing fare dynamics. Businesses using Etihad flight price monitoring tools can capture these variations to refine pricing strategies effectively.

Air India: Modernizing Fare Management

Air India, the flag carrier of India, has undergone a transformation in fare management with the adoption of modern dynamic pricing strategies. Through Air India Flight Data Scraping Services, operators can extract insights into competitor pricing, identify profitable routes, and understand customer behavior.

Route-Level Differences

Air India’s fare volatility is most prominent on international routes connecting India to Europe, North America, and the Middle East. Domestic routes exhibit lower price fluctuations, with exceptions during peak holiday seasons.

Price Jumps

Price jumps are common during Diwali, summer vacations, and the New Year period. Business class fares typically see larger increases than economy, reflecting a focus on high-yield passengers.

Class-Wise Splits

Economy class remains relatively accessible, whereas premium classes can show daily price variations. Using these insights, airlines and travel agencies can optimize fare allocation and implement competitive strategies effectively.

Comparative Insights Across All Four Airlines

When comparing the four carriers, several patterns emerge:

- International routes tend to show higher volatility across all airlines, with Emirates and Qatar Airways leading in dynamic fare adjustments.

- Business and first-class tickets are more sensitive to demand and competitor actions, often reflecting larger price jumps than economy.

- Seasonal and event-driven pricing affects all carriers, but the magnitude varies, with Etihad and Emirates demonstrating more aggressive dynamic pricing strategies.

- Route-specific pricing intelligence enables airlines to identify underserved routes, plan promotions, and react to competitor fare changes quickly.

- Tools like scrape airline competitor price data empower travel businesses to benchmark fares effectively, anticipate fluctuations, and optimize profitability.

How Travel Scrape Can Help You?

1. Real-Time Competitor Insights

Our services allow you to track live pricing trends across airlines like Emirates, Qatar Airways, Etihad, and Air India for informed decisions.

2. Route-Level Pricing Analysis

Extract detailed fare data for individual routes, enabling you to understand demand fluctuations, seasonal trends, and opportunities to optimize route-specific pricing strategies.

3. Class-Wise Fare Monitoring

Monitor economy, business, and first-class ticket prices separately to capture class-specific trends and adjust your pricing strategy for maximum revenue generation.

4. Seasonal and Event-Based Trends

Identify price jumps during holidays, festivals, or major events, helping you proactively adjust fares and remain competitive in highly dynamic markets.

5. Strategic Decision-Making

Leverage structured airline fare data to benchmark competitors, forecast demand, and implement dynamic pricing strategies that improve profitability and market positioning effectively.

Conclusion

Dynamic pricing in the airline industry is no longer optional—it is essential for revenue maximization and strategic positioning. Airlines like Emirates, Qatar Airways, Etihad, and Air India leverage advanced analytics and Flight Price Data Intelligence to track competitor behavior, optimize fares, and enhance customer satisfaction. By utilizing services like Etihad flight price monitoring, airlines can capture real-time fare fluctuations and optimize revenue management.

Air India flight price insights enable travel platforms to benchmark against competitors and identify profitable opportunities.

Monitoring Flight Price Data Intelligence helps carriers adjust pricing strategies according to demand and market trends. Analyzing route-level differences ensures airlines make informed decisions for high-demand routes and seasonal variations. Evaluating class-wise splits and seasonal price jumps allows operators to stay competitive in an ever-evolving market. Dynamic pricing benchmarking not only informs pricing decisions but also enhances strategic planning, market positioning, and customer engagement, making it a vital tool for modern airlines aiming to thrive in a competitive global landscape.

Ready to elevate your travel business with cutting-edge data insights? Scrape Aggregated Flight Fares to identify competitive rates and optimize your revenue strategies efficiently. Discover emerging opportunities with tools to Extract Travel Website Data, leveraging comprehensive data to forecast market shifts and enhance your service offerings. Real-Time Travel App Data Scraping Services helps stay ahead of competitors, gaining instant insights into bookings, promotions, and customer behavior across multiple platforms. Get in touch with Travel Scrape today to explore how our end-to-end data solutions can uncover new revenue streams, enhance your offerings, and strengthen your competitive edge in the travel market.