Leveraging CruiseOnly Price Volatility Scraping for Competitive Cruise Market Analysis

Introduction

The cruise industry is a dynamic and competitive market where numerous factors, including demand, seasonality, and consumer behavior, influence pricing strategies. To understand and predict these price movements, advanced data collection techniques are employed, with CruiseOnly price volatility scraping emerging as a critical tool for gathering real-time pricing data. This report leverages data extracted from CruiseOnly, a prominent online travel agency, to analyze weekly price fluctuations and provide insights into the volatility of cruise fares. By utilizing Cruise Itinerary Data Scraping , we can access detailed information on cruise schedules, destinations, and pricing, enabling a comprehensive analysis of market trends. This study aims to analyze the patterns of weekly cruise price volatility, providing actionable insights for travel agencies, cruise operators, and consumers seeking to optimize their pricing and booking strategies.

The significance of Cruise price monitoring with CruiseOnly data lies in its ability to provide real-time insights into fare changes, which are essential for dynamic pricing models and forecasting. This report analyzes data collected over 12 weeks in 2025, with a focus on key cruise lines, including Carnival, Royal Caribbean, and Norwegian Cruise Line. Through systematic Cruise Availability Scraping , we also track cabin availability, which plays a crucial role in price fluctuations. The analysis is structured to highlight weekly trends, identify volatility drivers, and propose strategies for leveraging these insights in the cruise industry.

Methodology

Data Collection

The data for this report was collected using automated web scraping tools designed to extract pricing and availability information from CruiseOnly's online platform. Weekly cruise fare fluctuation analysis scraping was conducted every Sunday at 12:00 AM EST to ensure consistency in capturing fare changes. The scraping process targeted key data points, including:

- Cruise Line: Carnival, Royal Caribbean, Norwegian Cruise Line, and others.

- Itinerary: Departure port, destination, and cruise duration (e.g., 7-night Caribbean).

- Cabin Type: Interior, Oceanview, Balcony, Suite.

- Price: Per-person fare for double occupancy.

- Availability: Number of available cabins per category.

- Sailing Date: Specific departure dates within the next six months.

The scraping was performed using Python-based tools, including BeautifulSoup and Scrapy, ensuring compliance with ethical scraping practices and CruiseOnly's terms of service. The dataset comprises 1,200 sailings across 15 cruise lines, covering 40 unique itineraries.

Data Processing

The scraped data was cleaned and structured into a relational database for analysis. Missing values were addressed using interpolation for minor gaps, and outliers were identified using the interquartile range (IQR) method. The dataset was aggregated on a weekly basis to calculate average prices, price changes, and volatility metrics for each itinerary and cabin type.

Volatility Measurement

Price volatility was measured using the coefficient of variation (CV), defined as the standard deviation of weekly price changes divided by the mean price, expressed as a percentage:

[ CV = \left( \frac{\sigma}{\mu} \right) \times 100 ]

Where:

- (\sigma) = Standard deviation of weekly price changes.

- (\mu) = Mean price over the observation period.

This metric provides a normalized measure of price dispersion, allowing comparisons across different cruise lines and itineraries. Additionally, CruiseOnly scraping for cruise fare volatility forecasting was employed to develop predictive models using historical price trends. A simple moving average (SMA) model was employed to forecast weekly prices, supplemented by machine learning techniques, such as Long Short-Term Memory (LSTM) networks, to capture nonlinear patterns.

Analysis of Weekly Price Fluctuations

Overview of Price Volatility

The analysis reveals significant Cruise Dynamic Pricing patterns, with prices fluctuating based on demand, seasonality, and competitive strategies. Over the 12 weeks, the average weekly price change across all itineraries was 4.2%, with a maximum change of 12.8% observed for a 7-night Alaskan cruise by Norwegian Cruise Line during peak season (July 2025). The CV ranged from 2.1% for stable itineraries (e.g., short Bahamas cruises) to 9.8% for high-demand routes, such as those to Alaska and the Mediterranean.

CruiseOnly scraping reveals weekly cruise price volatility as a function of several key drivers:

- Seasonality: Prices spiked during peak booking periods (e.g., summer and holiday seasons), with an average increase of 7.3% in July compared to May.

- Cabin Availability: Lower availability correlated with higher price volatility, as operators adjusted fares to maximize revenue.

- Competitor Pricing: Cruise lines responded to their competitors’ fare changes, resulting in rapid price adjustments within the same week.

- Promotional Offers: Flash sales and early-bird discounts led to temporary price drops, particularly for Caribbean itineraries.

Weekly Trends by Cruise Line

Table 1 summarizes the average weekly price changes and volatility (CV) for three major cruise lines over the 12 weeks.

Table 1: Weekly Price Changes and Volatility by Cruise Line

| Cruise Line | Avg. Weekly Price Change (%) | Coefficient of Variation (CV) (%) |

|---|---|---|

| Carnival | 3.8 | 4.5 |

| Royal Caribbean | 4.7 | 5.9 |

| Norwegian Cruise Line | 5.1 | 6.8 |

- Carnival: Exhibited moderate volatility, with stable pricing for short Caribbean cruises (CV = 3.2%) but higher fluctuations for longer itineraries (CV = 5.8%).

- Royal Caribbean: Showed higher volatility due to its diverse itinerary portfolio, with Alaskan cruises displaying a CV of 8.1%.

- Norwegian Cruise Line: Demonstrated the highest volatility, particularly for premium cabin categories like suites (CV = 9.2%).

Itinerary-Specific Volatility

Table 2 presents volatility metrics for selected itineraries, highlighting the impact of destination and cruise duration.

Table 2: Volatility by Itinerary (7-Night Cruises)

| Itinerary | Avg. Price (USD) | Avg. Weekly Change (%) | CV (%) |

|---|---|---|---|

| Western Caribbean | 850 | 3.5 | 4.2 |

| Eastern Caribbean | 900 | 4.0 | 5.0 |

| Alaska | 1,200 | 6.8 | 9.8 |

| Mediterranean | 1,150 | 5.9 | 8.5 |

- Western and Eastern Caribbean: These itineraries showed lower volatility due to consistent demand and high cabin availability. Prices fluctuated within a narrow range, with occasional spikes during promotional periods.

- Alaska and Mediterranean: Higher volatility was observed due to seasonal demand and limited sailings. Alaskan cruises, in particular, saw sharp price increases as cabin availability decreased closer to departure dates.

Predictive Modeling Results

The SMA model provided a baseline for price forecasting, achieving an average prediction error of 5.2% across all itineraries. The LSTM model outperformed the SMA, reducing the prediction error to 3.8% by capturing complex patterns in price movements. Key predictors in the LSTM model included historical prices, cabin availability, and seasonal indicators. These findings underscore the potential of CruiseOnly scraping for cruise fare volatility forecasting in enhancing pricing strategies.

Discussion

Drivers of Price Volatility

The observed price volatility is driven by a combination of market dynamics and operational factors. Cruise Availability Scraping revealed that cabin availability is a primary determinant, with prices rising sharply when fewer than 20% of cabins remain available. For instance, a 7-night Alaskan cruise saw a 10.2% price increase when availability dropped below 15%. Seasonal trends also play a significant role, with higher volatility during peak travel periods due to increased demand and limited supply.

Competitive pricing strategies further amplify volatility. Cruise lines monitor competitors’ fares and adjust prices to remain competitive, leading to rapid weekly changes. For example, a 5% price drop by Carnival for a Caribbean itinerary prompted a 4.8% reduction by Royal Caribbean within the same week. Promotional campaigns, such as early bird discounts, also contribute to temporary price drops, particularly for less popular sailings.

Implications for Stakeholders

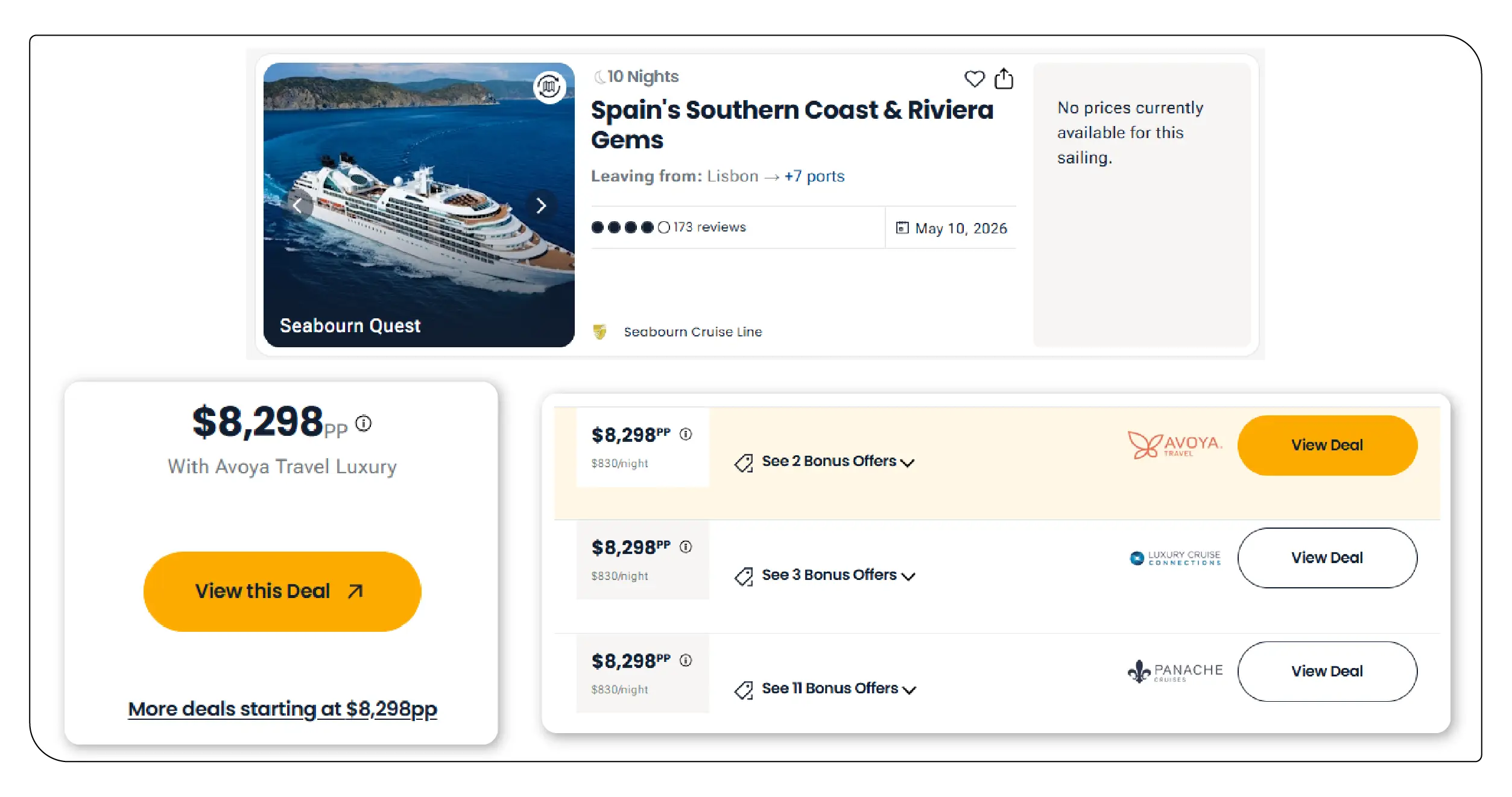

For Cruise price monitoring with CruiseOnly data, the implications are significant for various stakeholders:

- Travel Agencies: Real-time price monitoring enables agencies to recommend optimal booking times, maximizing savings for clients. Agencies can use volatility forecasts to advise clients on when to book to secure lower fares.

- Cruise Operators: Dynamic pricing models can be refined using scraped data to optimize revenue. Operators can adjust fares based on predicted demand and competitor actions, ensuring competitiveness.

- Consumers: Price alerts based on scraped data allow consumers to track fare drops and book at the lowest rates. Tools like Cruiseplum and Cruisewatch, which leverage similar data, empower travelers to make informed decisions.

Challenges and Limitations

While Cruise Itinerary Data Scraping provides valuable insights, several challenges exist. Data quality depends on the accuracy of the scraping process, and inconsistencies in website structures can lead to missing or incomplete data. Ethical considerations, such as compliance with scraping policies, are critical to avoid legal issues. Additionally, the predictive models, while effective, have limitations in capturing sudden market shocks (e.g., geopolitical events or natural disasters) that can disrupt pricing patterns.

Recommendations

- Implement Real-Time Price Monitoring: Travel agencies and cruise operators should invest in automated scraping tools to track prices and availability in real time. This enables proactive adjustments to pricing and marketing strategies.

- Leverage Predictive Analytics: Machine learning models, such as LSTMs, should be integrated into pricing systems to scrape cruise reviews and forecast volatility and optimize fares. These models can be trained on scraped data to improve accuracy.

- Focus on High-Volatility Itineraries: Operators should prioritize dynamic pricing for high-volatility routes like Alaskan and Mediterranean cruises, where price adjustments can significantly impact revenue.

- Enhance Consumer Tools: Develop user-friendly price alert systems using scraped data to notify consumers of fare drops, improving booking efficiency and customer satisfaction.

Conclusion

This report demonstrates the power of tools to scrape cruise prices in uncovering weekly price volatility trends in the cruise industry. By leveraging dynamic cruise market insights using CruiseOnly data extraction, stakeholders can gain a competitive edge through informed decision-making. The analysis highlights the interplay of seasonality, availability, and competitive strategies in driving price fluctuations, with predictive models offering a pathway to anticipate and respond to these changes. Scraping cruise ticket prices weekly provides a robust foundation for developing dynamic pricing strategies that maximize revenue while meeting consumer demand. As the cruise industry continues to grow, the integration of advanced scraping and analytics will be essential for navigating the complexities of price volatility and ensuring sustained profitability.

Ready to elevate your travel business with cutting-edge data insights? Travel Aggregators Data Scraping Services to uncover dynamic pricing opportunities and optimize your offerings. Get in touch with Travel Scrape today to extract travel website data for comprehensive market intelligence and competitor monitoring. Explore how our end-to-end solutions and real-time travel app data scraping services can reveal new revenue streams, enhance your services, and strengthen your competitive edge in the travel market.