How U.S. Cruise Ports (Miami, New York, LA) Compete: Data Insights from Cruise.com, Expedia Cruises & Royal Caribbean

Introduction

The U.S. cruise industry is one of the world’s most competitive travel markets, with Miami, New York, and Los Angeles serving as the major gateways for millions of passengers annually. Each port competes on pricing, itineraries, onboard experiences, and partnerships with leading cruise lines.

But with the dynamic nature of cruise fares, seasonal discounts, and shifting traveler preferences, traditional research methods fall short. That’s where web scraping becomes a game-changer. By collecting real-time data from platforms like Cruise.com, Expedia Cruises, and Royal Caribbean, businesses can understand port competitiveness, traveler demand, and pricing strategies in unparalleled detail.

At Travel Scrape, we specialize in cruise data scraping solutions that deliver actionable insights to travel agencies, cruise operators, and tourism boards. This blog explores how scraping cruise portals reveals competitive intelligence between Miami, New York, and Los Angeles ports.

Why Scraping Cruise Data is Essential

Cruise pricing isn’t static. Factors like seasonality, promotions, itineraries, and cabin availability make pricing fluctuate daily. Without automated scraping, businesses face:

- Missed opportunities in detecting discounts or premium demand spikes

- Slow competitor benchmarking, leading to poor revenue optimization

- Inaccurate insights due to outdated manual tracking

By leveraging Travel Scrape’s automated pipelines, stakeholders can access:

- Real-time cruise pricing intelligence

- Competitor itinerary comparisons

- Port-specific demand trends

- Customer sentiment analysis from reviews

This empowers businesses to react quickly, optimize pricing, and design better marketing strategies.

Key Sources to Scrape

1. Cruise.com

Cruise.com lists multi-line itineraries, cabin classes, and exclusive deals. Scraping this site helps track:

- Cabin pricing by category (inside, oceanview, balcony, suite)

- Seasonal promotions & flash sales

- Port departure comparisons

2. Expedia Cruises

Expedia Cruises aggregates cruise options across operators, making it a prime source for:

- Cross-operator price benchmarking

- Package deals with flights & hotels

- User review sentiment

3. Royal Caribbean

As a leading cruise operator, Royal Caribbean provides:

- Real-time direct operator pricing

- Exclusive onboard offers

- Loyalty program discounts

Scraping these three sources ensures broad + deep insights into the U.S. cruise market.

Data Points Extracted (with Examples)

To analyze port competitiveness, Travel Scrape captures:

- Cruise line name

- Departure port

- Destination & duration

- Cabin type & pricing

- Seasonal promotions

- Customer ratings & reviews

Sample Scraped Dataset (Synthetic Example)

| Departure Port | Cruise Line | Destination | Duration | Cabin Type | Price (USD) | Rating |

|---|---|---|---|---|---|---|

| Miami | Royal Caribbean | Caribbean 7N | 7 Nights | Balcony | $1,150 | 4.7 |

| New York | Norwegian | Bermuda 5N | 5 Nights | Oceanview | $899 | 4.3 |

| Los Angeles | Carnival | Mexico 4N | 4 Nights | Inside | $599 | 4.1 |

| Miami | MSC Cruises | Bahamas 3N | 3 Nights | Suite | $1,400 | 4.5 |

| New York | Royal Caribbean | Canada 9N | 9 Nights | Balcony | $1,650 | 4.6 |

This sample illustrates how scraped data can reveal price competitiveness, destination variety, and customer satisfaction across ports.

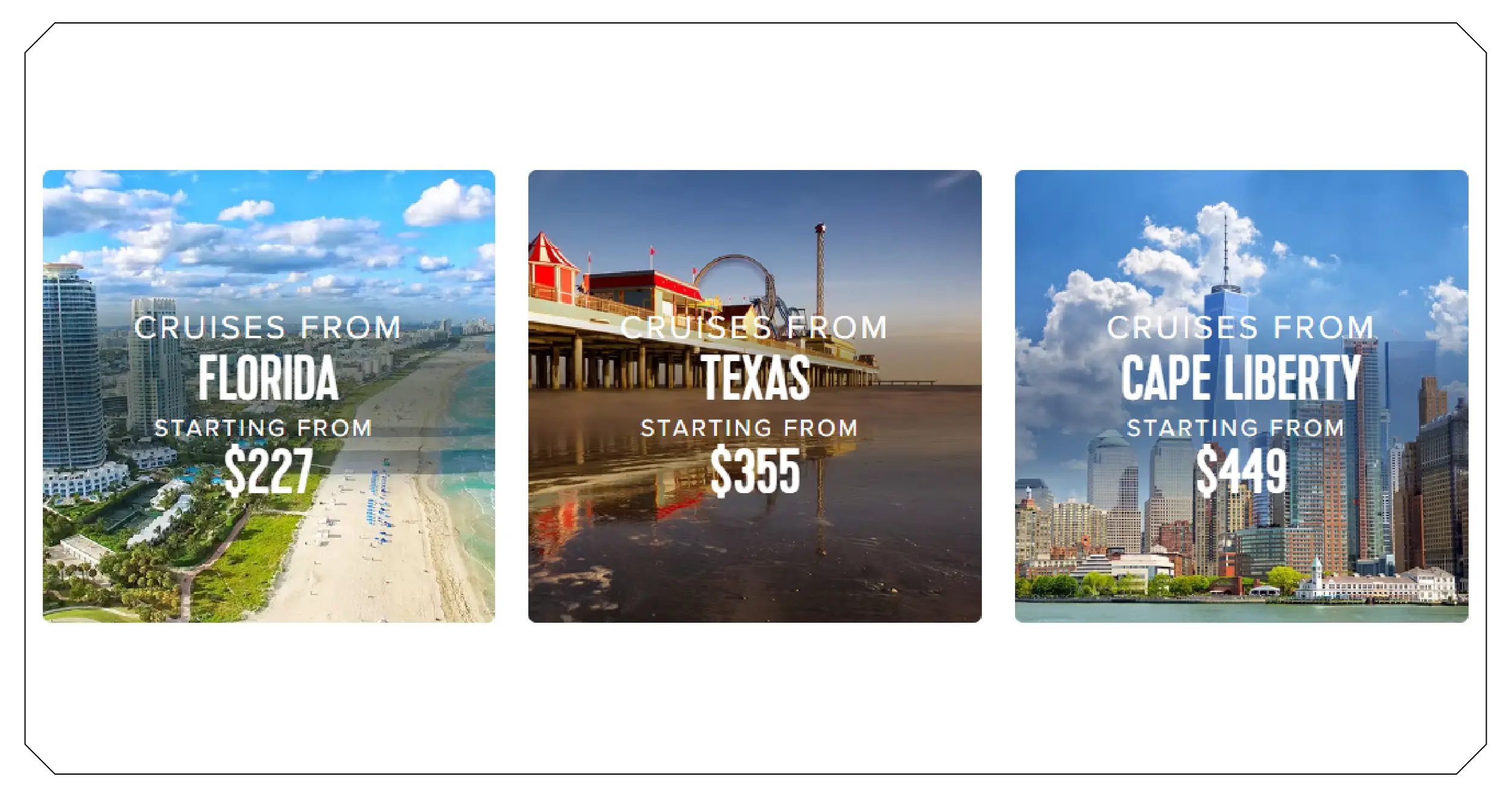

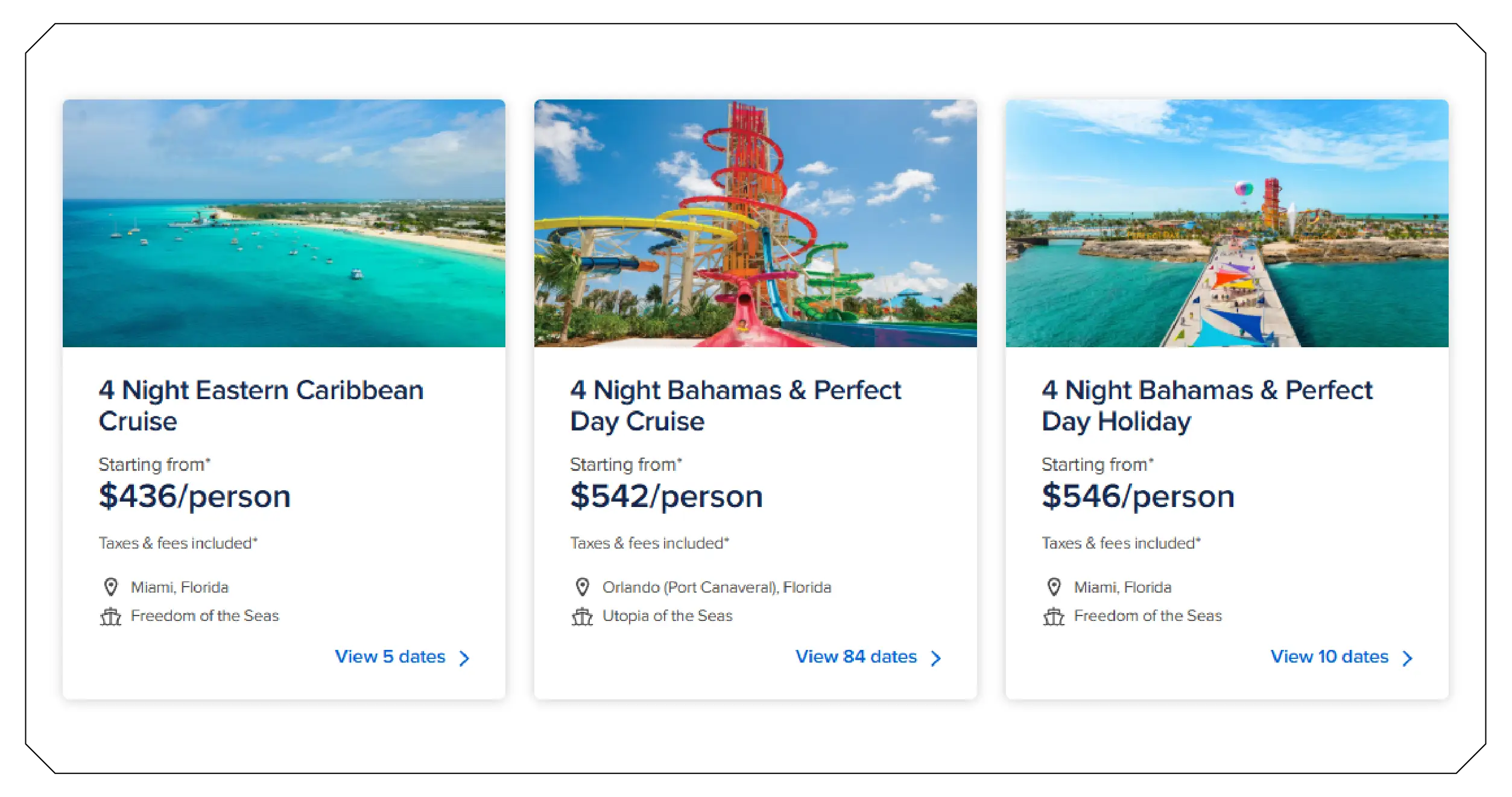

Miami Cruise Port: Scraped Insights

As the “Cruise Capital of the World,” Miami benefits from:

- Year-round warm weather attracting Caribbean itineraries

- Partnerships with Royal Caribbean, MSC, and Carnival

- Frequent short-duration cruises (3–5 nights)

Scraped insights show:

- Lower entry prices on shorter itineraries ($350–$600)

- High competition in balcony/suite segments

- Seasonal spikes during December holidays and spring break

New York Cruise Port: Scraped Insights

New York caters to a diverse audience—from luxury travelers to budget cruisers—departing to Bermuda, Canada, and the Caribbean.

Scraping reveals:

- Higher average prices due to longer itineraries (7–10 nights)

- Strong demand for fall foliage cruises to Canada

- Premium pricing on Royal Caribbean and Norwegian

Average balcony cabins often cost $1,200–$1,800, making New York more premium-heavy than Miami.

Los Angeles Cruise Port: Scraped Insights

Los Angeles is the gateway to Mexican Riviera and Pacific itineraries.

Scraped findings include:

- Strong demand for short trips (3–4 nights) to Baja Mexico

- Carnival and Princess dominate the port departures

- Pricing often 20–25% lower than Miami for similar categories

L.A. also sees growing popularity of Alaska repositioning cruises, offering variety for travelers.

Comparative Analysis: Miami vs New York vs LA

Using scraped data across ports, we see distinct competitive positioning:

| Metric | Miami | New York | Los Angeles |

|---|---|---|---|

| Avg. Entry Price | $450 – $650 | $900 – $1,400 | $500 – $700 |

| Popular Itineraries | Caribbean, Bahamas | Bermuda, Canada | Mexico, Alaska |

| Avg. Duration | 3–5 Nights | 7–10 Nights | 3–7 Nights |

| Market Position | Budget-friendly | Premium-heavy | Mid-range value |

This helps cruise operators align strategies—e.g., Miami for volume, New York for luxury, L.A. for affordable west-coast escapes.

How Travel Scrape Builds Cruise Data Pipelines

At Travel Scrape, we design scalable scraping pipelines for the cruise industry.

Steps in Our Process:

- Source Identification – Cruise.com, Expedia Cruises, Royal Caribbean

- Data Extraction – Pricing, itineraries, reviews, promos

- Anti-Bot Handling – Rotating proxies, headless browsing, CAPTCHA bypass

- Data Structuring – Cleaned into CSV/JSON/Database format

- Integration – API delivery for real-time dashboards

Example Data Output Format

{

"port": "Miami",

"cruise_line": "Royal Caribbean",

"itinerary": "Caribbean 7N",

"duration": 7,

"cabin": "Balcony",

"price": 1150,

"rating": 4.7

}

Business Benefits of Cruise Scraping

Scraping cruise data delivers strategic advantages:

- Dynamic Pricing Intelligence – Monitor competitor fares to adjust in real time

- Marketing Optimization – Identify demand surges for targeted campaigns

- Port Performance Tracking – Compare occupancy, popularity, and pricing

- Customer Sentiment Analysis – Track review trends for brand perception

- Forecasting – Predict seasonal demand patterns

Future of Cruise Data Scraping

With AI and machine learning, the future holds:

- Predictive pricing models to forecast fare changes

- Personalized travel recommendations based on past behavior

- Hyperlocal demand mapping for port-specific promotions

Cruise lines adopting scraping + AI insights will win in a highly competitive industry.

Conclusion

Miami, New York, and Los Angeles each bring unique strengths to the U.S. cruise market. But without data scraping, businesses miss the nuances of price shifts, itinerary preferences, and customer sentiment.

At Travel Scrape, we empower the cruise industry with end-to-end scraping solutions, turning raw travel data into actionable intelligence. Whether you’re a travel agency, cruise operator, or tourism board, our tools ensure you stay ahead of competition.

Ready to harness cruise scraping for smarter decisions?

Contact Travel Scrape today to unlock the power of real-time cruise intelligence.