Corporate Flight Data Optimization Analytics for Smarter Corporate Travel Cost Control

Introduction

Corporate travel spending has rebounded sharply in recent years, making airfare optimization a top priority for finance leaders and travel managers. Rising fuel costs, fluctuating demand, and dynamic airline pricing models have increased the complexity of managing corporate flight bookings efficiently. To maintain control, enterprises are increasingly relying on advanced data-driven strategies supported by integrated analytics frameworks. These frameworks, often referred to as Corporate Flight Data Optimization Analytics, enable organizations to transform fragmented airfare information into structured intelligence that directly impacts cost control and policy enforcement.

At the foundation of this transformation lies large-scale data acquisition. Enterprises depend on Airline Data Scraping Services to collect structured pricing, availability, and fare rule data from airline portals, aggregators, and booking platforms. When this data is combined with Real-Time Corporate Flight Datasets, companies gain the ability to react instantly to market changes while retaining a long-term strategic view of travel costs.

The Growing Importance of Flight Data in Corporate Travel Strategy

Corporate travel decisions were once based on negotiated airline contracts and static booking policies. Today, pricing volatility demands more adaptive systems. Flight datasets allow organizations to evaluate airfare behavior across routes, airlines, booking windows, and cabin classes. Historical data provides context, while real-time feeds enable immediate action.

Enterprises that integrate these datasets into their travel ecosystems can forecast costs with higher accuracy, reduce last-minute premiums, and improve traveler satisfaction by offering optimal routes and fares at the right time.

Historical Flight Data as a Cost Benchmarking Tool

Historical airfare data plays a critical role in benchmarking and performance analysis. By examining years of pricing data, companies can identify baseline fare ranges for key business routes and detect abnormal price deviations. Datasets such as the Global Flight Price Trends Dataset reveal how fares respond to seasonality, holidays, fuel price changes, and regional demand shifts.

Sample Historical Corporate Flight Pricing Data (Annual Averages)

| Route | Avg Fare 2022 (USD) | Avg Fare 2023 (USD) | Avg Fare 2024 (USD) | YoY Change 2024 (%) |

|---|---|---|---|---|

| New York – London | 920 | 965 | 1,040 | +7.8% |

| San Francisco – Tokyo | 1,180 | 1,245 | 1,310 | +5.2% |

| Frankfurt – Dubai | 610 | 645 | 700 | +8.5% |

| Singapore – Sydney | 540 | 575 | 620 | +7.8% |

| Toronto – Chicago | 280 | 295 | 325 | +10.2% |

This data allows procurement teams to assess whether corporate-negotiated fares remain competitive compared to market averages.

Enhancing Predictive Accuracy with Historical Scraping

Accurate historical data is not always readily available through standard booking tools. Many enterprises therefore rely on Web Scraping Corporate Historical Flight data to capture fare changes over time across multiple airlines and booking channels. This approach ensures granular visibility into how prices evolve between 90, 60, 30, and 7 days before departure.

Such depth enables predictive modeling that supports smarter booking window recommendations and more realistic annual travel budgets.

Real-Time Flight Intelligence for Immediate Decision-Making

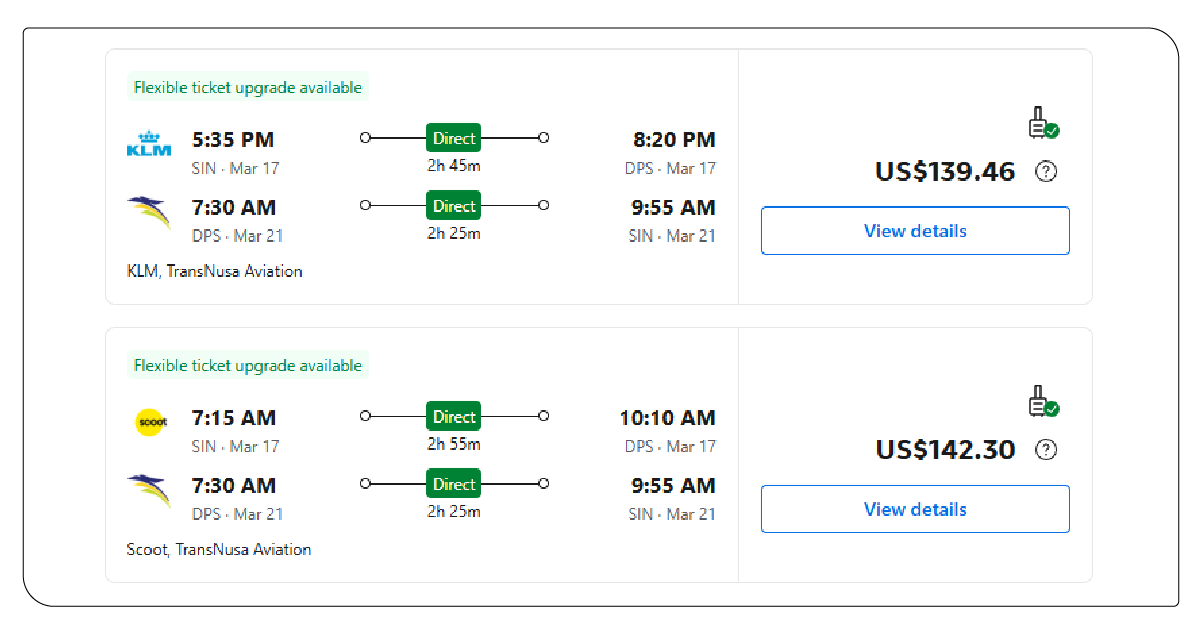

While historical data supports planning, real-time data drives execution. Live airfare intelligence allows companies to detect sudden price drops, flash sales, or capacity-driven fare spikes. Accessing this intelligence through a Real-Time Flight Data Scraping API ensures automated ingestion of pricing updates into corporate dashboards and booking platforms.

Real-Time Fare Fluctuations Observed Over 30 Days

| Route | Lowest Fare (USD) | Highest Fare (USD) | Avg Fare (USD) | Price Volatility (%) |

|---|---|---|---|---|

| Boston – Los Angeles | 310 | 540 | 425 | 74% |

| London – Paris | 120 | 260 | 185 | 117% |

| Mumbai – Singapore | 390 | 610 | 480 | 56% |

| Amsterdam – Rome | 145 | 310 | 215 | 114% |

| Chicago – Dallas | 160 | 295 | 210 | 84% |

This level of volatility highlights why static travel policies often fail to control costs effectively.

Airline Fare Intelligence and Supplier Strategy

To negotiate effectively with airlines, enterprises need transparency into pricing behavior across carriers. Airline Fare Intelligence for Corporate Travel enables organizations to compare contract fares against live market prices and identify airlines that consistently underperform.

This intelligence supports data-backed supplier negotiations, helping enterprises renegotiate contracts, diversify preferred carriers, or shift volume to more competitive airlines without compromising service quality.

Analytics-Driven Corporate Travel Optimization

When flight datasets are integrated with analytics platforms, organizations unlock a powerful optimization engine. Business Flight Optimization Using Analytics enables automated decision rules such as dynamic booking thresholds, route prioritization, and exception handling for urgent travel.

Impact of Analytics-Based Optimization on Corporate Travel Costs

| Optimization Metric | Before Analytics | After Analytics | Improvement (%) |

|---|---|---|---|

| Avg Ticket Cost (USD) | 680 | 575 | -15.4% |

| Out-of-Policy Bookings (%) | 22% | 9% | -59.1% |

| Last-Minute Booking Premium (%) | 34% | 18% | -47.1% |

| Avg Booking Lead Time (Days) | 12 | 21 | +75% |

| Annual Travel Spend (USD) | 18.5M | 15.9M | -14.1% |

These results demonstrate how analytics-driven travel programs outperform traditional booking approaches.

Monitoring Fare Movements with Price Intelligence

Effective optimization also depends on continuous visibility into fare changes. Flight Price Data Intelligence allows organizations to track airline pricing patterns at scale, identifying when fares deviate from expected ranges. This capability supports automated alerts, exception approvals, and smarter traveler guidance.

Price intelligence also helps enterprises identify routes where corporate discounts no longer deliver value compared to publicly available fares.

Operational and Financial Benefits for Enterprises

Organizations that adopt data-driven travel optimization report measurable improvements across finance, operations, and employee experience. Finance teams gain predictable budgets, procurement teams strengthen supplier leverage, and travelers benefit from better routes and reduced friction.

The integration of historical and real-time datasets ensures that decisions are grounded in both context and immediacy.

Conclusion

The future of corporate travel management lies in intelligent data utilization. Enterprises that invest in advanced flight data frameworks are better positioned to navigate pricing volatility, enforce policies fairly, and achieve sustainable cost savings.

By implementing Corporate Travel Flight Data Intelligence, organizations transform raw airfare data into strategic insight that aligns travel spend with business priorities. Continuous real-time airfare monitoring for corporate bookings ensures that every ticket purchased reflects current market conditions rather than outdated assumptions. Finally, maintaining a structured Airline Price Change Dataset empowers enterprises to anticipate trends, strengthen negotiations, and build resilient travel programs capable of adapting to an ever-changing airline marketplace.

Ready to elevate your travel business with cutting-edge data insights? Scrape Aggregated Flight Fares to identify competitive rates and optimize your revenue strategies efficiently. Discover emerging opportunities with tools to Extract Travel Website Data, leveraging comprehensive data to forecast market shifts and enhance your service offerings. Real-Time Travel App Data Scraping Services helps stay ahead of competitors, gaining instant insights into bookings, promotions, and customer behavior across multiple platforms. Get in touch with Travel Scrape today to explore how our end-to-end data solutions can uncover new revenue streams, enhance your offerings, and strengthen your competitive edge in the travel market.