How Is the Car Rental Dataset 2025 Transforming Global Travel Pricing Insights?

Introduction

The travel and mobility sector is rapidly transforming, driven by data-driven insights and automation. One of the most compelling developments is the emergence of Car Rental Dataset 2025, which enables businesses and analysts to uncover how car rental prices evolve globally. With thousands of vehicle listings updated daily across multiple providers, this dataset offers a real-time reflection of rental market dynamics. Leveraging structured data from scraping APIs, analysts can decode fluctuations in rental prices, availability, and consumer preferences.

Complementing this trend, the Car Rental Price Trends Dataset provides the foundation for comparing short-term and long-term vehicle hire costs across regions and seasons. By scraping platforms such as Discover Cars, Hertz, Europcar, and Avis, travel data engineers create comprehensive datasets that reflect live pricing movements, demand surges, and discount structures.

At the heart of this evolution lies the Car Rental Price Analytics Dataset, which allows businesses to measure the elasticity of car rental demand. Companies use these datasets to visualize how fuel prices, tourism activity, and economic shifts affect rental affordability in different markets. The ability to process these changes in real time marks a new era in travel data intelligence.

The Power of Real-Time Data: How Car Rental APIs Reshape Pricing Intelligence

Travel data scraping APIs collect structured information directly from car rental platforms every few minutes. These APIs aggregate essential details such as rental prices, car categories, pick-up locations, insurance costs, mileage limits, and customer ratings. Through Car Rental Data Scraping Services, data engineers can extract and standardize this vast pool of information into machine-readable formats suitable for dashboards, BI tools, and analytical models.

This automation not only reduces manual data collection but also ensures accuracy and consistency in tracking market behavior. For instance, during high-demand periods such as summer holidays in the USA or winter tourism peaks in the UAE, scraping APIs reveal how dynamic pricing strategies adjust rates in real time. This enables companies to forecast demand surges and optimize their offerings accordingly.

Moreover, for travel aggregators and metasearch engines, integrating these APIs helps create transparent pricing systems for end users. Businesses can benchmark competitors’ rates, identify promotional trends, and even forecast future rental demand based on historical and predictive datasets.

Key Providers Analyzed: Discover Cars, Hertz, Europcar, and Avis

The 2025 market analysis highlights four dominant players shaping the car rental ecosystem: Discover Cars, Hertz, Europcar, and Avis. The Discover Cars Dataset Analysis reveals how this aggregator optimizes cross-platform visibility by listing thousands of vehicle options sourced from multiple local and global partners. Its pricing algorithm dynamically adjusts according to currency exchange rates, booking durations, and insurance add-ons.

Hertz, a global leader, showcases how corporate rentals differ from tourism-focused rentals in pricing behavior. Their dynamic rate systems adjust to local economic indicators, fuel prices, and seasonal holidays. Europcar’s data, meanwhile, reflects a strong presence in the UK and Europe, with pricing models influenced heavily by electric vehicle adoption rates and cross-border demand. Avis stands out with premium segmentation insights, where brand loyalty programs influence pricing and customer retention.

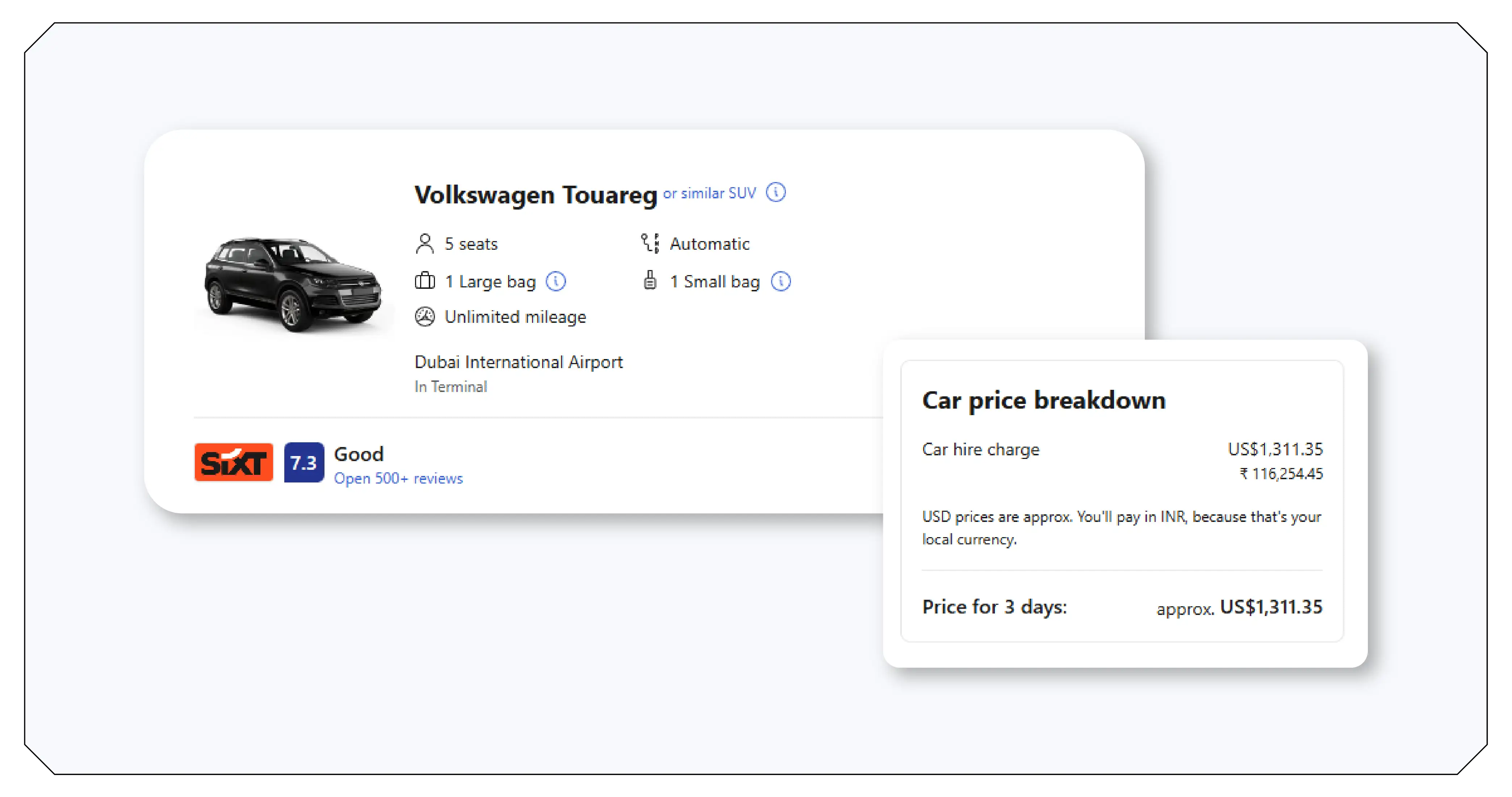

Through continuous scraping and aggregation, the Car Rental Location Dataset captures these variations geographically—helping analysts study rental costs across different airports, city centers, and tourist destinations. Businesses use this data to understand how proximity to airports or city landmarks affects pricing strategies and booking patterns.

Decoding Global Car Rental Pricing Trends: USA, UK, and UAE

One of the most valuable insights derived from Global Car Rental Pricing Trends is the identification of regional behavioral patterns. The United States demonstrates significant price flexibility, particularly during holiday weekends or major sports events. Scraped data reveals that SUVs and economy vehicles often show sharp rate fluctuations depending on urban demand density and travel seasonality.

In the United Kingdom, rental trends lean toward short-duration bookings driven by business travel and weekend leisure trips. Data from Europcar and Hertz show that electric and hybrid models are increasingly shaping mid-tier pricing structures. Analysts note that sustainability preferences and environmental regulations directly influence cost variations in key cities such as London, Manchester, and Edinburgh.

In the United Arab Emirates, particularly Dubai and Abu Dhabi, luxury and high-performance vehicles dominate demand. The Car Rental Data Intelligence collected from local providers reveals an emphasis on brand differentiation, with pricing influenced more by vehicle class than booking duration. Data scraping from UAE rental platforms highlights a strong correlation between tourism seasonality and price premiums for premium models.

These regional differences illustrate how real-time scraping enables global market mapping, ensuring that travel agencies, logistics companies, and financial analysts can identify where and when car rental services become more profitable.

Leveraging Car Rental Market Intelligence Dataset for Strategic Decisions

The Car Rental Market Intelligence Dataset acts as a foundation for strategic planning in both the B2B and B2C travel sectors. Businesses can compare rates across multiple platforms and identify underpriced or overpriced regions. For instance, an aggregator platform can use this dataset to design competitive pricing models, while a fleet management company can decide where to expand operations based on rental margins and utilization rates.

Moreover, data-driven analytics assist tourism boards and travel agencies in predicting seasonal booking patterns. For instance, scraping datasets from USA and UK markets during summer months may reveal opportunities to introduce targeted promotional campaigns for off-peak destinations. Similarly, insurance firms can integrate rental data analytics to evaluate risk and pricing models for coverage plans.

From a macroeconomic perspective, policymakers and analysts can use these insights to assess consumer spending behavior in the travel sector, linking it with GDP growth and mobility trends.

How Businesses Use Data for Rate Comparison and Transparency?

Data transparency is now a cornerstone of the car rental industry. Businesses use scraping tools to collect competitor pricing and availability in real time. This data empowers customers to make informed decisions, fostering healthy competition. Moreover, rate comparison engines rely on APIs that continuously update pricing feeds from platforms such as Discover Cars and Avis.

Through automation, businesses can detect anomalies in pricing and identify discount trends. Such intelligence supports dynamic pricing algorithms that adjust rates instantly in response to competitor activity. This transparency not only benefits consumers but also strengthens brand trust and market fairness.

The Car Rental Data Intelligence layer built on this ecosystem allows travel analytics platforms to visualize global trends—such as the most rented car types, regions with fastest-growing demand, or the correlation between tourism surges and pricing elasticity.

Future of Data-Driven Mobility: Predictive Pricing and AI Integration

As artificial intelligence becomes integral to travel analytics, predictive algorithms trained on car rental datasets will forecast future prices based on current and historical trends. Machine learning models can identify how weather, holidays, and flight bookings influence car rental demand.

Through integration with AI, scraping APIs can not only collect but also interpret data in real time. This paves the way for smarter rental systems that automatically suggest optimal pricing, improve fleet allocation, and enhance user experience. The growth of open data standards and structured APIs will further democratize access to global rental insights, ensuring that travel intelligence remains transparent and scalable.

How Travel Scrape Can Help You?

- Real-Time Price Tracking: Continuously monitor car rental rates, flight fares, and hotel prices across platforms to stay competitive and identify market fluctuations instantly.

- Comprehensive Market Insights: Access structured travel datasets covering vehicle categories, availability, locations, and seasonal trends for data-driven decision-making and market forecasting.

- Custom API Integration: Seamlessly integrate our scraping APIs into your systems to automate data collection from multiple travel portals in real time.

- Competitive Rate Analysis: Benchmark your pricing strategies against top competitors like Hertz, Europcar, and Discover Cars to enhance transparency and profitability.

- Global Coverage & Scalability: Collect travel data across multiple regions—USA, UK, UAE, and beyond—to uncover global patterns and optimize pricing strategies effectively.

Conclusion

The evolution of Car Rental Dataset 2025 marks a turning point in how travel businesses interpret market behavior. From price transparency to predictive analytics, car rental datasets empower companies to adapt quickly to changing market conditions.

With Scrape Car Rental Rate Comparison, businesses can ensure they stay ahead in a competitive market by monitoring prices dynamically and adjusting rates in real time. Similarly, Car Rental Price Monitoring Tools provide continuous visibility into market trends, enabling smarter decision-making for fleet managers, aggregators, and financial analysts.

Ultimately, the integration of travel scraping APIs and the Global Car Rental Pricing Extract 2025 allows the global car rental industry to operate with data precision—turning raw information into actionable intelligence that drives better business performance and enhances consumer transparency.

Ready to elevate your travel business with cutting-edge data insights? Scrape Aggregated Flight Fares to identify competitive rates and optimize your revenue strategies efficiently. Discover emerging opportunities with tools to Extract Travel Website Data, leveraging comprehensive data to forecast market shifts and enhance your service offerings. Real-Time Travel App Data Scraping Services Services helps stay ahead of competitors, gaining instant insights into bookings, promotions, and customer behavior across multiple platforms. Get in touch with Travel Scrape today to explore how our end-to-end data solutions can uncover new revenue streams, enhance your offerings, and strengthen your competitive edge in the travel market.