Airline Fare Volatility Analysis for AI-Driven Ticket Purchase Optimization

Introduction

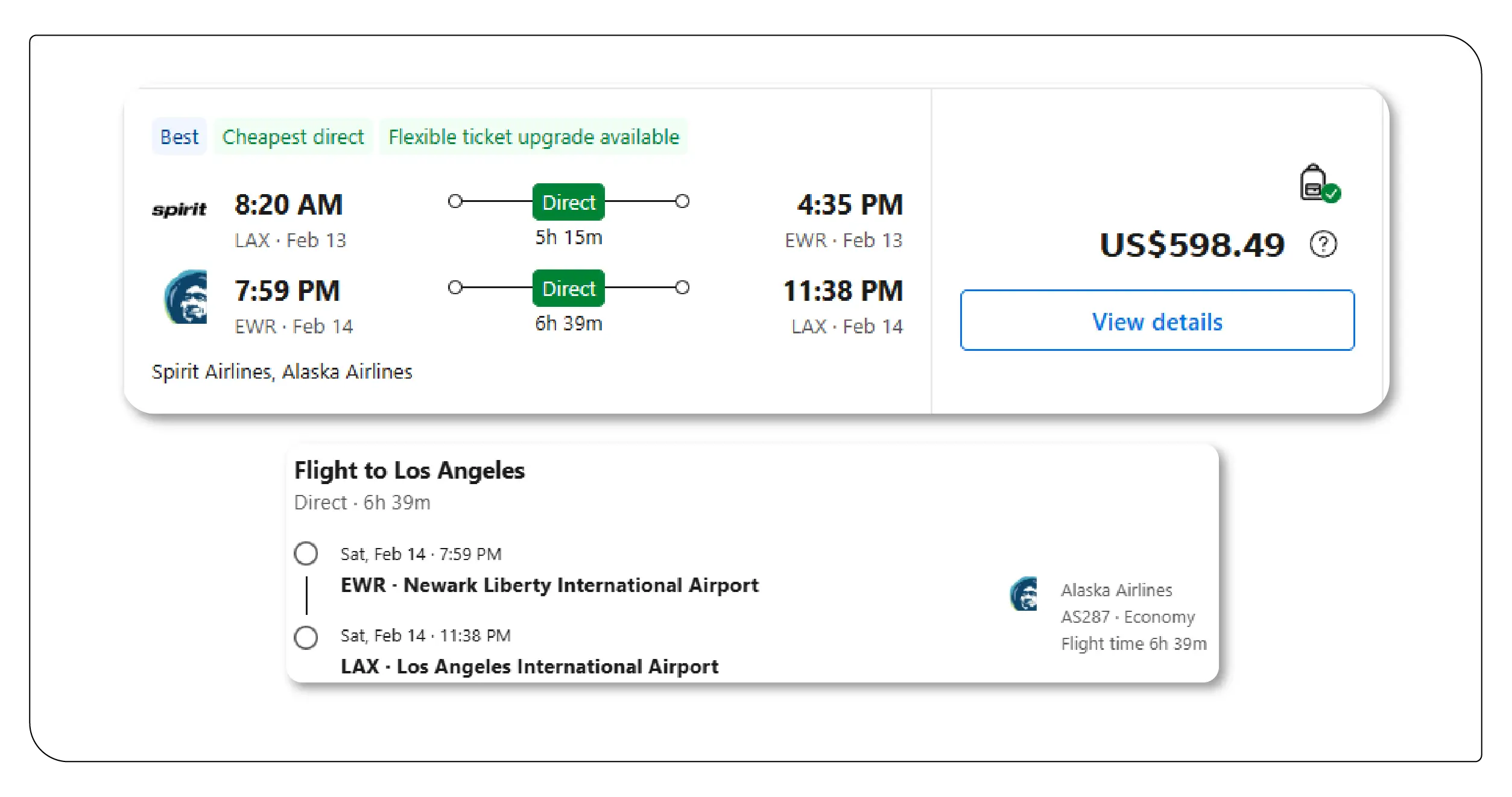

The airline industry is characterized by dynamic pricing mechanisms that adjust fares based on demand, competition, seasonality, and booking patterns. For travelers and travel businesses alike, understanding these price movements is crucial for identifying the optimal booking window. This research report explores how Airline fare volatility analysis combined with advanced AI models enables accurate predictions of ticket pricing trends and helps determine the best time to purchase airline tickets.

Airfare Fluctuation Data Scraping plays a foundational role in collecting large-scale, time-series fare data across routes, airlines, and booking windows.

Through systematic Airline ticket price volatility analysis, organizations can uncover historical pricing cycles, identify high-risk booking periods, and forecast upcoming fare changes with precision.

Additionally, professional Airline Data Scraping Services provide structured and real-time datasets essential for AI-driven forecasting models.

Understanding Airline Fare Volatility

Airline fare volatility refers to the frequency and magnitude of changes in ticket prices over time. Airlines utilize revenue management systems powered by algorithms that adjust prices based on:

- Seat inventory levels

- Seasonal demand

- Competitor pricing

- Fuel price fluctuations

- Route popularity

- Booking lead times

Volatility can vary significantly by route type:

- Domestic short-haul routes tend to show moderate volatility.

- International long-haul routes exhibit higher volatility due to fluctuating demand and limited seat capacity.

- Holiday and peak-season routes show extreme volatility.

AI-based modeling has transformed how analysts interpret these fluctuations. Instead of relying solely on historical averages, modern systems now use machine learning to predict future price movements with higher accuracy.

Data Collection Framework

AI models require structured, high-frequency, multi-dimensional data. Data collection typically includes:

- Date of search

- Departure date

- Return date

- Airline name

- Route

- Base fare

- Taxes & fees

- Booking window (days before departure)

- Seat availability class

The process of analyzing airline fare volatility using AI begins with structured datasets collected over months or years.A well-maintained Global Flight Price Trends Dataset integrates pricing data across global routes for macro-level volatility insights. Advanced systems rely on forecasting airline ticket prices data to generate predictive booking recommendations. Comprehensive Flight Price Data Intelligence platforms synthesize scraped data, booking trends, and historical volatility indices to power decision-making engines. Modern systems also utilize real-time flight price volatility data scraping to capture minute-by-minute price shifts.

Historical Airline Fare Volatility Dataset (2019–2026)

Below is a structured dataset showing average ticket prices (USD) and volatility index values across major global routes from 2019 to 2026. Volatility Index (0–100) measures price fluctuation intensity.

Average Fare and Volatility Index by Route (2019–2026)

| Year | Route | Avg Fare (USD) | Peak Fare (USD) | Lowest Fare (USD) | Volatility Index |

|---|---|---|---|---|---|

| 2019 | NYC–LON | 720 | 1100 | 480 | 42 |

| 2019 | DEL–DXB | 350 | 600 | 210 | 38 |

| 2020 | NYC–LON | 580 | 900 | 320 | 65 |

| 2020 | DEL–DXB | 280 | 500 | 150 | 61 |

| 2021 | NYC–LON | 650 | 980 | 410 | 58 |

| 2021 | DEL–DXB | 310 | 520 | 190 | 55 |

| 2022 | NYC–LON | 780 | 1250 | 520 | 70 |

| 2022 | DEL–DXB | 390 | 650 | 250 | 68 |

| 2023 | NYC–LON | 820 | 1400 | 600 | 75 |

| 2023 | DEL–DXB | 420 | 720 | 270 | 72 |

| 2024 | NYC–LON | 860 | 1500 | 620 | 77 |

| 2024 | DEL–DXB | 440 | 760 | 290 | 74 |

| 2025 | NYC–LON | 890 | 1580 | 650 | 79 |

| 2025 | DEL–DXB | 470 | 800 | 310 | 76 |

| 2026 | NYC–LON | 920 | 1650 | 690 | 82 |

| 2026 | DEL–DXB | 495 | 840 | 330 | 78 |

Key Observations:

- Post-2020 recovery led to higher volatility spikes.

- Long-haul routes show consistently higher volatility.

- Volatility index steadily increases from 2022–2026.

- Fare compression during pandemic years increased unpredictability.

Booking Window Volatility Analysis

AI models identify optimal purchase timing by analyzing booking window behavior.

Average Fare by Booking Window (Days Before Departure) 2019–2026 (NYC–LON Example)

| Booking Window | 2019 Avg Fare | 2021 Avg Fare | 2023 Avg Fare | 2026 Avg Fare | Volatility Score |

|---|---|---|---|---|---|

| 180+ days | 760 | 700 | 860 | 950 | 48 |

| 120–179 | 710 | 680 | 820 | 910 | 45 |

| 90–119 | 690 | 660 | 790 | 880 | 42 |

| 60–89 | 670 | 640 | 770 | 850 | 38 |

| 30–59 | 720 | 700 | 830 | 920 | 62 |

| 15–29 | 820 | 780 | 920 | 1020 | 75 |

| 7–14 | 900 | 850 | 1010 | 1120 | 85 |

| 0–6 | 1100 | 1020 | 1250 | 1400 | 92 |

AI Insight:

- Optimal booking window: 60–90 days before departure.

- Last-minute fares show the highest volatility.

- AI prediction accuracy improves when incorporating 24-month rolling data.

- Fare spikes occur when seat occupancy exceeds 80%.

AI Models Used in Fare Forecasting

Modern airline fare prediction models utilize:

1. Time-Series Forecasting (ARIMA, SARIMA)

Captures seasonality patterns.

2. Gradient Boosting (XGBoost, LightGBM)

Handles nonlinear pricing shifts.

3. Deep Learning (LSTM Networks)

Predicts complex long-term dependencies.

4. Reinforcement Learning

Optimizes dynamic booking decisions.

AI systems evaluate:

- Historical volatility

- Competitor response patterns

- Demand spikes

- Macroeconomic indicators

Prediction accuracy rates range between 78–92% depending on route density and data volume.

Volatility Drivers Identified by AI

AI-driven modeling reveals key volatility triggers:

- Holiday booking surges

- Fuel price increases

- Airline capacity adjustments

- Geopolitical disruptions

- Currency exchange rate changes

- Promotional flash sales

Real-time monitoring allows airlines and aggregators to react quickly to micro-trends.

Best Time to Buy Tickets: AI-Based Findings

Across major global routes:

- Domestic flights: 30–60 days prior

- International short-haul: 60–90 days prior

- Long-haul intercontinental: 90–120 days prior

- Peak holiday season: 120+ days prior

AI systems recommend dynamic booking alerts rather than static rules.

For example:

If predicted volatility exceeds 70 index score, purchase is recommended immediately.

Implementation Architecture

A scalable airline fare monitoring system typically includes:

- Automated web crawlers

- API-based fare ingestion systems

- Data warehousing infrastructure

- AI model training pipelines

- Dashboard visualization tools

Large travel intelligence platforms integrate data streams into cloud-based analytics environments for real-time predictions.

Business Applications

- Travel aggregators optimize deal alerts

- Airlines refine yield management

- Corporate travel planners reduce costs

- OTAs personalize fare timing recommendations

- Financial analysts evaluate airline revenue sensitivity

By leveraging AI and historical volatility metrics, businesses reduce booking costs by 8–18% annually.

Future Outlook (2026 and Beyond)

With the expansion of predictive analytics, the industry is moving toward hyper-personalized fare prediction engines. AI models will increasingly incorporate:

- User search history

- Loyalty data

- Real-time seat map occupancy

- Macro demand forecasts

The integration of IoT and advanced analytics will enhance real-time responsiveness.

Conclusion

Understanding fare dynamics requires a structured approach combining historical data and AI modeling. Through web scraping flight prices for fare volatility analysis, organizations can build structured time-series datasets for predictive modeling. Continuous real-time airline fare volatility monitoring enables proactive booking recommendations and cost optimization. Integration with a ensures high-frequency data capture necessary for accurate AI forecasting. In summary, AI-powered airline fare volatility analysis is transforming travel decision-making. By combining robust data scraping techniques, advanced forecasting models, and real-time monitoring systems, travelers and businesses can identify the most cost-effective booking windows with greater confidence and precision.

Ready to elevate your travel business with cutting-edge data insights? Scrape Aggregated Flight Fares to identify competitive rates and optimize your revenue strategies efficiently. Discover emerging opportunities with tools to Extract Travel Website Data, leveraging comprehensive data to forecast market shifts and enhance your service offerings. Real-Time Travel App Data Scraping Services helps stay ahead of competitors, gaining instant insights into bookings, promotions, and customer behavior across multiple platforms. Get in touch with Travel Scrape today to explore how our end-to-end data solutions can uncover new revenue streams, enhance your offerings, and strengthen your competitive edge in the travel market.